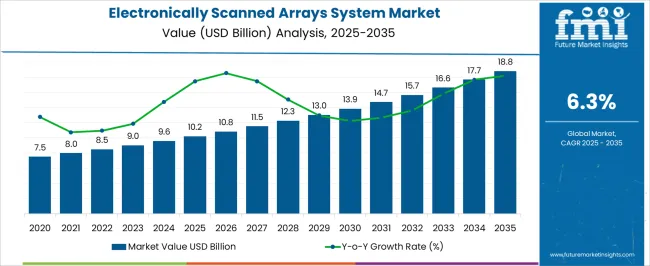

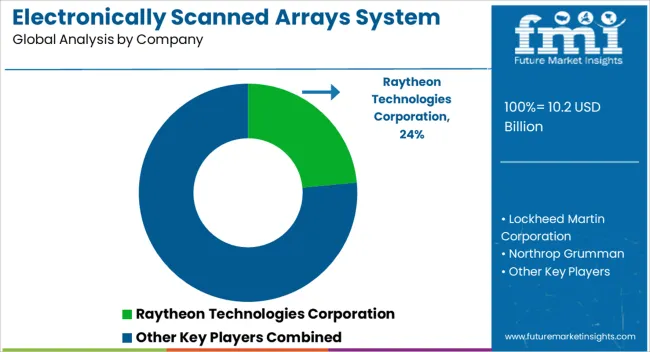

The Electronically Scanned Arrays System Market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 18.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Electronically Scanned Arrays System Market Estimated Value in (2025 E) | USD 10.2 billion |

| Electronically Scanned Arrays System Market Forecast Value in (2035 F) | USD 18.8 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Electronically Scanned Arrays (ESA) System market is experiencing strong growth, driven by increasing demand for advanced radar and communication systems across defense, aviation, and surveillance sectors. Adoption is being supported by the need for highly accurate, fast, and reliable detection capabilities in both military and commercial applications. The integration of active electronically scanned arrays enhances operational flexibility by allowing rapid beam steering without mechanical movement, improving tracking precision and response times.

Increasing investments in modern defense systems, situational awareness technologies, and autonomous platforms are further fueling market expansion. Continuous innovation in signal processing, software-defined platforms, and miniaturization of components is enabling scalable and cost-efficient deployment.

The market is also shaped by rising geopolitical tensions, defense modernization programs, and growing requirements for multi-mission radar systems As the focus on interoperability, network-centric operations, and threat detection grows, the ESA system market is expected to sustain long-term growth, driven by technological advancements and increased adoption across air, land, and sea platforms.

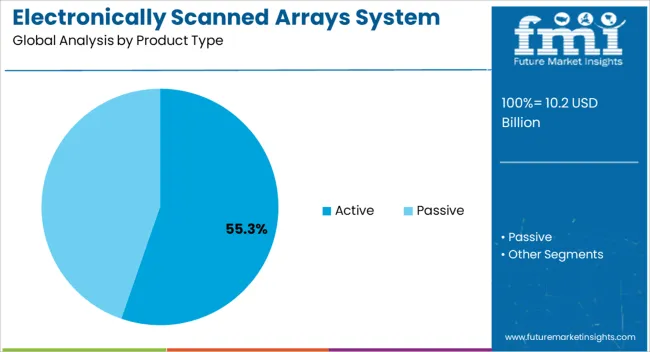

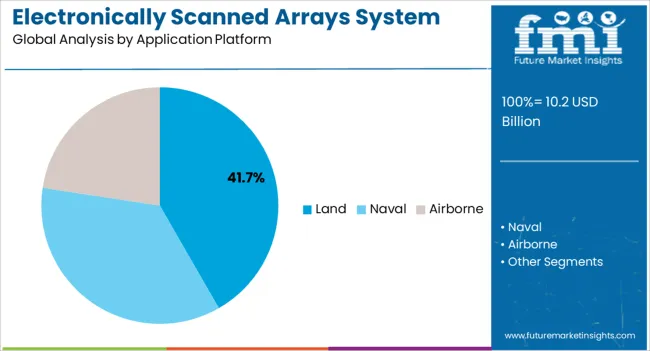

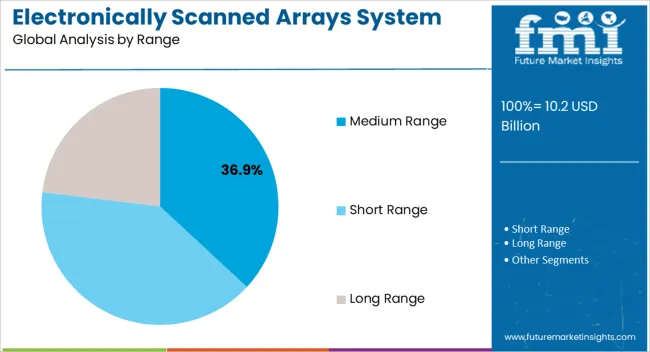

The electronically scanned arrays system market is segmented by product type, application platform, range, array geometry, components, and geographic regions. By product type, electronically scanned arrays system market is divided into Active and Passive. In terms of application platform, electronically scanned arrays system market is classified into Land, Naval, and Airborne. Based on range, electronically scanned arrays system market is segmented into Medium Range, Short Range, and Long Range. By array geometry, electronically scanned arrays system market is segmented into Linear, Planar, and Frequency Scanning. By components, electronically scanned arrays system market is segmented into Transmit Receive Module (TRM), Beam Forming Network (BFN), Phase Shifters, Signal Processing, Radar Data Processor, Power Supply Module, and Cooling System. Regionally, the electronically scanned arrays system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The active product type segment is projected to hold 55.3% of the ESA system market revenue in 2025, establishing it as the leading product category. Its dominance is being driven by the ability to deliver higher efficiency, longer operational life, and superior signal quality compared to passive arrays. Active ESA systems allow for precise control of power distribution and beam shaping, enabling enhanced detection, tracking, and multi-target engagement capabilities.

These systems also provide higher reliability and reduced maintenance requirements, making them the preferred choice in defense and critical surveillance applications. Continuous advancements in semiconductor technologies, including gallium nitride and other high-power components, are improving performance and operational flexibility.

Integration with software-defined control systems allows upgrades and enhancements without major hardware modifications With growing demand for scalable and high-performance radar solutions in modern military and security programs, active ESA systems are expected to maintain their market leadership, supported by their adaptability, precision, and operational efficiency.

The land application platform segment is anticipated to account for 41.7% of the ESA system market revenue in 2025, making it the leading application area. Growth is being driven by increasing deployment of radar systems for ground-based defense, border security, and tactical operations. ESA systems provide high-resolution imaging, rapid target acquisition, and long-range tracking capabilities critical for land surveillance and threat monitoring.

The ability to integrate these systems with command and control platforms enhances situational awareness and operational coordination. Investments in mobile radar units, unmanned ground vehicles, and border monitoring infrastructure are further accelerating adoption.

The segment benefits from the demand for reliable and rapid-response detection technologies that can operate under diverse environmental conditions As modernization of land-based defense networks and security infrastructure continues, the land application platform segment is expected to remain the primary driver of market growth, supported by technological advancements in array design, signal processing, and system interoperability.

The medium range segment is projected to hold 36.9% of the ESA system market revenue in 2025, establishing it as the leading range category. Its growth is driven by the balance it provides between detection distance, coverage, and cost-effectiveness, making it suitable for multi-mission applications including tactical operations, border monitoring, and mobile defense units.

Medium-range ESA systems are capable of providing rapid scanning, high resolution, and precise target identification, enabling real-time threat assessment and decision-making. Integration with advanced software-defined controls allows for dynamic adjustment of detection parameters without physical modifications, enhancing operational flexibility.

The ability to combine performance efficiency with cost optimization has strengthened adoption in both emerging and established defense markets With increasing investments in defense modernization programs, autonomous monitoring systems, and situational awareness solutions, the medium range segment is expected to continue leading, driven by demand for versatile and reliable radar capabilities that balance performance and affordability.

A key trend shaping the electronically scanned arrays system market is the integration of artificial intelligence and machine learning capabilities. Electronically scanned arrays systems are increasingly incorporating artificial intelligence algorithms to enhance their operational efficiency, accuracy, and responsiveness in dynamic environments.

Artificial intelligence enables electronically scanned arrays systems to autonomously adapt their radar scanning patterns, prioritize targets based on threat assessments, and optimize resource allocation in real time.

Machine learning algorithms analyze vast amounts of data collected by electronically scanned arrays system to identify patterns, predict behaviours, and improve decision making processes.

The above trend is driven by the need for electronically scanned arrays system to handle complex scenarios, such as electronic warfare, urban operations, and multiple target engagements, with greater precision and speed.

As artificial intelligence continues to advance, electronically scanned arrays system equipped with intelligent capabilities are expected to play a pivotal role in enhancing defense capabilities, improving situational awareness, and supporting critical missions across military, aerospace, and surveillance applications.

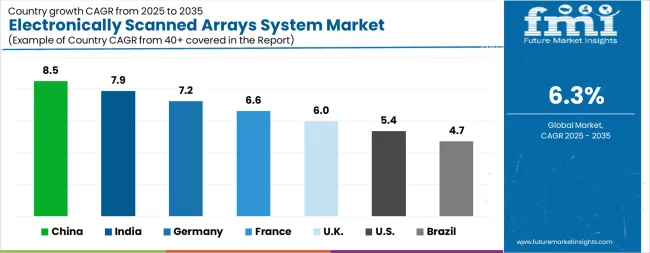

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The Electronically Scanned Arrays System Market is expected to register a CAGR of 6.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.5%, followed by India at 7.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Electronically Scanned Arrays System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.2%. The USA Electronically Scanned Arrays System Market is estimated to be valued at USD 3.6 billion in 2025 and is anticipated to reach a valuation of USD 6.1 billion by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 515.2 million and USD 258.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.2 Billion |

| Product Type | Active and Passive |

| Application Platform | Land, Naval, and Airborne |

| Range | Medium Range, Short Range, and Long Range |

| Array Geometry | Linear, Planar, and Frequency Scanning |

| Components | Transmit Receive Module (TRM), Beam Forming Network (BFN), Phase Shifters, Signal Processing, Radar Data Processor, Power Supply Module, and Cooling System |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies Corporation, Lockheed Martin Corporation, Northrop Grumman, Saab AB, Aselsan A.S., Hanwha Systems, and BAE Systems |

The global electronically scanned arrays system market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the electronically scanned arrays system market is projected to reach USD 18.8 billion by 2035.

The electronically scanned arrays system market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in electronically scanned arrays system market are active and passive.

In terms of application platform, land segment to command 41.7% share in the electronically scanned arrays system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA