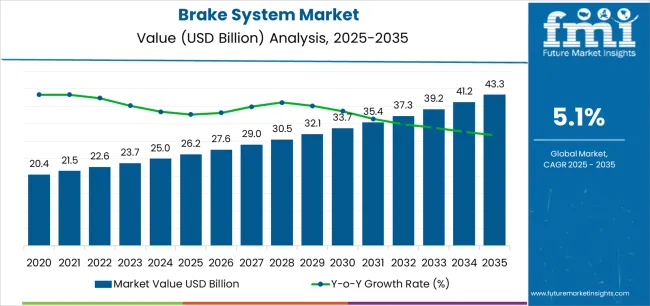

The Brake System Market is estimated to be valued at USD 26.2 billion in 2025 and is projected to reach USD 43.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The brake system market is witnessing robust growth, propelled by advancements in vehicle safety technologies, regulatory mandates, and the rapid electrification of automotive fleets. Rising demand for efficient braking mechanisms that enhance vehicle stability and reduce stopping distance has encouraged innovation in braking materials and system architecture.

The growing integration of electronic braking systems and regenerative braking in electric and hybrid vehicles is further shaping market evolution. Increasing global automotive production, coupled with consumer demand for improved safety performance, continues to drive the adoption of advanced brake technologies.

With the emphasis on lightweight components, improved heat dissipation, and predictive maintenance capabilities, the market is set for sustained growth as automakers strive for enhanced safety, comfort, and performance standards.

| Metric | Value |

|---|---|

| Brake System Market Estimated Value in (2025 E) | USD 26.2 billion |

| Brake System Market Forecast Value in (2035 F) | USD 43.3 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

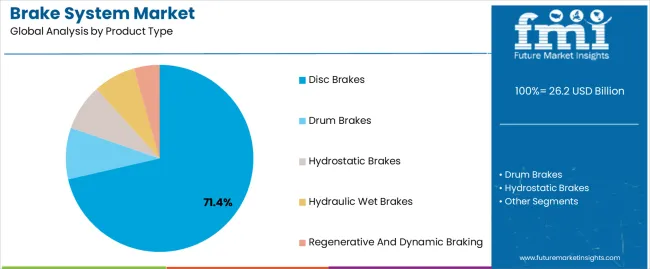

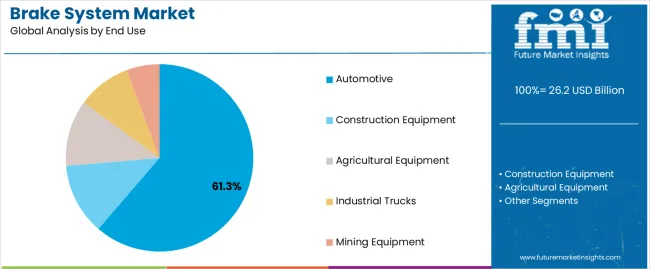

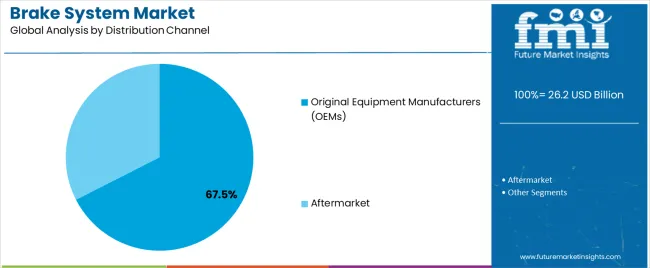

The market is segmented by Product Type, End Use, and Distribution Channel and region. By Product Type, the market is divided into Disc Brakes, Drum Brakes, Hydrostatic Brakes, Hydraulic Wet Brakes, and Regenerative And Dynamic Braking. In terms of End Use, the market is classified into Automotive, Construction Equipment, Agricultural Equipment, Industrial Trucks, and Mining Equipment. Based on Distribution Channel, the market is segmented into Original Equipment Manufacturers (OEMs) and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The disc brakes segment dominates the product type category with approximately 71.4% share, owing to its superior performance, heat management, and reliability under diverse driving conditions. This segment’s widespread adoption is driven by improved braking efficiency, faster response times, and lower maintenance requirements compared to drum brakes.

The transition toward high-speed and high-performance vehicles, including electric and hybrid models, has accelerated the shift to disc brake systems. Advances in rotor design and material engineering have enhanced thermal stability and durability, further reinforcing segment growth.

With increasing regulatory emphasis on braking performance and safety, disc brakes are expected to remain the preferred choice across passenger and commercial vehicle segments.

The automotive segment holds approximately 61.3% share within the end-use category, supported by growing global vehicle production and the mandatory integration of advanced braking systems in modern automobiles. The segment benefits from continuous technological development in ABS, EBD, and electronic stability control systems that rely on precise brake system coordination.

Increased demand for enhanced driver safety, fuel efficiency, and braking precision has spurred innovation in braking components tailored for electric and hybrid vehicles. The rise of autonomous driving technologies further underscores the importance of intelligent braking systems.

With ongoing automotive electrification and safety regulations, the automotive segment is expected to sustain its dominance in the brake system market.

The OEMs segment accounts for approximately 67.5% share in the distribution channel category, reflecting the dominance of integrated supply chains and the inclusion of advanced brake systems in new vehicle manufacturing. OEM partnerships with component suppliers enable customized solutions that align with evolving vehicle safety and efficiency standards.

The segment benefits from consistent demand from automakers seeking to enhance product differentiation and brand reputation through superior safety features. Additionally, the shift toward electric mobility has LED OEMs to collaborate on regenerative and electronic braking technologies, strengthening system integration capabilities.

With vehicle production volumes rising and OEMs prioritizing safety compliance, this segment is projected to maintain its leadership position.

The global brake system sales grew at a CAGR of 7.1% from 2020 to 2025. The growth of brake systems from 2020 to 2025 can be attributed to a convergence of factors:

The brake system market is expected to surge at a CAGR of 5.4% by 2035.

The table below shows the estimated growth rates of the top five countries. The United Kingdom, South Korea, and Japan are set to record high CAGRs of 6.6%, 7.0%, and 6.9%, respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

| United Kingdom | 6.6% |

| China | 5.9% |

| South Korea | 7.0% |

| Japan | 6.9% |

The table below explains the brake system market size of the leading five countries for 2035. Among them, the United States is anticipated to remain at the forefront by reaching a valuation of USD 43.3 billion. Japan is expected to reach around USD 4.7 billion by 2035, less than China's USD 6.6 billion.

| Countries | Market Values (2035) |

|---|---|

| United States | USD 43.3 billion |

| United Kingdom | USD 1.7 billion |

| China | USD 6.6 billion |

| South Korea | USD 2.7 billion |

| Japan | USD 4.7 billion |

The United States brake system industry is poised to exhibit a CAGR of 5.7% during the assessment period. By 2035, the United States market is expected to reach USD 43.3 billion. Key factors supporting the market growth are:

Brake system demand in China is anticipated to rise at a steady CAGR of 5.9% during the forecast period. This is attributable to a combination of factors, including:

Japan's brake system market is expected to reach a valuation of around USD 4.7 billion by 2035. Top factors supporting the market’s expansion in the country include:

The demand for brake systems is increasing in the United Kingdom, with a projected CAGR of 6.6% through 2035. Emerging patterns in the United Kingdom’s market are as follows:

The brake system market is projected to increase in South Korea at a CAGR of 7.0% through 2035. The factors driving the market’s growth are as follows:

The section below shows the disc brake segment dominated by product type. It is predicted to rise at a CAGR of 5.2% in 2035. The automotive segment is anticipated to generate a dominant share through 2025 based on end-use. It is set to surge at a CAGR of 5.0% in 2035.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Disc Brakes (Product Type) | 5.2% |

| Automotive (End-use) | 5.0% |

Based on product type, demand for disc brakes is expected to remain high during the evaluation period.

Based on end-use, the automotive segment is expected to surge at a CAGR of 5.0% through 2035.

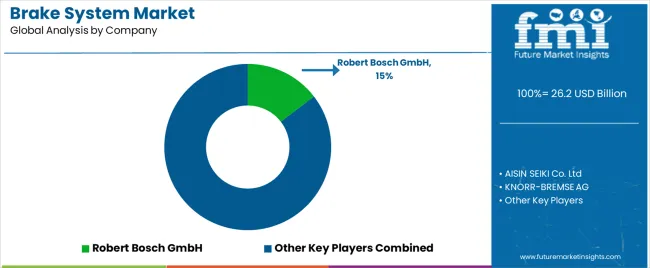

The brake system market is highly competitive due to the presence of several leading participants. Key companies and manufacturers in the industry include AISIN SEIKI Co. Ltd, KNORR-BREMSE AG, Nissin Kogyo Co., Ltd, CONTINENTAL AG, and BREMBO SPA.

Leading players are employing several growth strategies, such as new product launches and joint ventures, to increase their vehicle production capacity.

For instance

The global brake system market is estimated to be valued at USD 26.2 billion in 2025.

The market size for the brake system market is projected to reach USD 43.3 billion by 2035.

The brake system market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in brake system market are disc brakes, drum brakes, hydrostatic brakes, hydraulic wet brakes and regenerative and dynamic braking.

In terms of end use, automotive segment to command 61.3% share in the brake system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Brake Systems Market Growth & Demand 2025 to 2035

Brake Override System Market

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Aircraft Brake System Market

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

One-Box Electronic Hydraulic Brake (EHB)System Market Size and Share Forecast Outlook 2025 to 2035

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Brake Cables Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Brake Shoe Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA