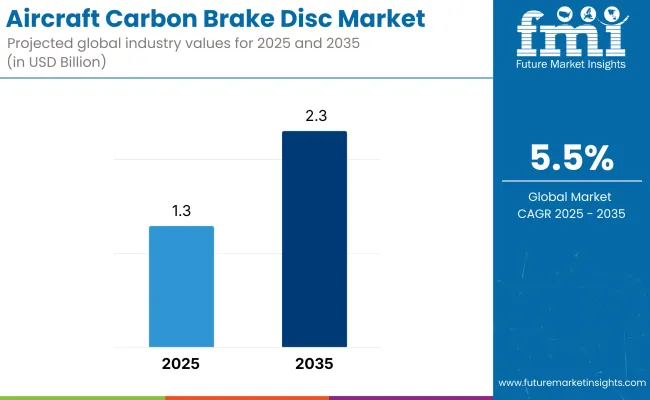

Aircraft carbon Brake Disc Market from 2025 to 2035 demand forecast market growth gas cycles. It is expected to grow from USD 1.3 Billion in 2025 to USD 2.3 Billion in 2035 at a CAGR of 5.5% over the forecasted period. Interestingly, carbon brake discs are also utilized in commercial, military, and business aviation because they dissipate heat better, are lighter and are more durable than traditional steel brakes.

Recently, an interesting trend has emerged, with airlines and aircraft manufacturers adopting carbon-based brakes instead of traditional metal-based brakes, in light of fuel efficiency regulations and improved performance. Global air travel continues to flourish, supported by strong deliveries of the latest aircraft models. And various defense agencies started to incorporate carbon composite brake discs in military aircraft to ensure efficient ground taxiing and operational performance after a hard landing.

Strong growth potential is countered by the high production costs, sophisticated manufacturing processes, and presence of alternative braking technologies. However, relentless investments in carbon composite research, nanomaterial integration, and AI-powered predictive maintenance systems for their potential benefits laying the groundwork for future market expansion.

North America is an important region for aircraft carbon brake discs, where the USA and Canada continue to witness aircraft modernization contracts in both commercial and military aviation. High-performance carbon braking systems used by manufacturers, such as Boeing and Lockheed Martin, influence demand.

The FAA and DoD are investing in fuel-efficient aircraft designs, contributing to the market's demand for lightweight carbon-based braking systems. Major carriers including American Airlines and Delta consider fleet modernization and operational efficiency as high priorities, bolstering the demand for carbon brake disc retrofits.

Europe continues to hold a significant share in the aircraft carbon brake disc market, as countries such as France, Germany, and the United Kingdom are paying growing attention to aviation sustainability and the development of next-generation aircraft. European aerospace industry players, such as Airbus and Safran, are also investing in lightweight materials like carbon composites to increase aircraft fuel efficiency.

The European Union Aviation Safety Agency (EASA) backs green aviation projects, redirecting airlines to embrace fuel-efficient and low-maintenance pieces of aircraft hardware. In addition, defense investments in fighter jets and military transport aircraft are gaining attention in the market for high-performance aircraft, demanding carbon braking systems.

Asia-Pacific will continue to be the region challenge the largest market for aircraft carbon brake discs, with fast expanding demand in countries such as China, Japan, India and South Korea due to a surge in fleet growth and increasing air passenger traffic. China's COMAC and India's HAL are investing in domestic aircraft production, which boosts the demand for carbon composite braking systems.

The region's defense modernization programs, including fighter jet and UAV development, also enhance the uptake of carbon-based braking solutions. And in Southeast Asia, low-cost carriers (LCCs) are fitting lightweight, durable brake systems to planes in a push to lower operational expenditure.

Market growth and adoption of carbon-carbon composite.

The massive cost associated in manufacturing is one of the big challenges, as the production process is complex which demands advanced technologies which in turn has a huge cost. Stringent certification and regulatory approvals established by aviation authorities like FAA and EASA also place strict safety and performance requirements, leading to long product certification cycles.

Other major drawback is limited production capacity, as the specialized nature of carbon brake disc manufacturing limits both scalability and flexibility within the supply chain. Moreover, the environmental issue of raw materials used in carbon composites is an ongoing concern due to high carbon emissions released during processing, emphasizing the need for sustainable production processes.

Finally, maintenance and turnaround time of carbon brakes are relatively high compared to metallic brakes, which could hinder net aircraft revenue driving demand towards metallic brake solutions as well.

Increasing demand for lightweight and fuel-efficient aircraft

Allowing airlines to minimize operational costs by reducing weight and improving fuel efficiency. Moreover, development in composite material technology has proven efficient and high durability high-temperature carbon composites, which ensure safety and effective braking than ever before.

Moreover, the growth of commercial and military aviation sectors is also a key driver of market growth; With the rise in global air traffic and military aircraft procurement, there is an increasing demand for high-performance braking systems. In addition, retrofitting of aircraft and growing demand for aftermarket creates a significant opportunity for this market as the airlines are aiming to upgrade ageing fleets with advanced braking solutions.

Finally, sustainability efforts and carbon footprint cutting activities of manufacturers are driving the manufacturers to use sustainable materials and moving towards recycling initiatives, promoting the integration of sustainable carbon based braking systems across the entire aviation industry.

During the years 2020 to 2024, the aircraft carbon brake disc market grew in response to a renewed emphasis on performance, weight reduction and energy efficiency in the airline and aircraft manufacturer sectors.

Carbon brake discs began to be used more often in commercial and military aircraft because they offered several benefits over metal designs: better thermal stability; longer life; and less weight on the landing gear (leading to a gap that lightweight solutions could fill, as carbon emissions and fuel efficiency became bigger issues); and. Moreover, the aerospace industry started implementing advanced manufacturing techniques like automated fibre placement and additive manufacturing in the brake disc manufacturing to enhance process efficiency.

While the rising rate of the airline increasing the required output of a carbon brake disc was factored, the significant increase in the cost of fuel called for more efficient carbon brake disc manufacturing to help reduce fuel effort. The carbon brake disc market, however, initially suffered in the wake of the COVID-19 pandemic as air traffic declines hurt aircraft production and disrupted the supply chain, and airline revenues plummeted.

Still, thanks to rekindled airline travel, the manufacturers were accelerated their production to overcome the backlog of aircraft orders, causing rapid insertion of newly manufactured aircraft into the fleet, which, in turn, generated an increase in disc replacements of the carbon brakes.

They will incorporate AI-powered diagnostic tools and IoT-based monitoring systems to enable real-time predictions of brake wear, optimizing maintenance cycles and increasing safety standards. The growth of aviation and aerospace sector powered by electric and hybrid-electric aircrafts will also create demand for lightweight and high-efficiency braking solutions, thus driving further innovation in carbon brake disc materials and technology.

Moreover, sustainability initiatives will inspire innovation in carbon composite recycling and allow manufacturers to pursue environmentally-friendly, low-carbon disposal methods. Governments and regulatory bodies will develop new aviation emission standards, which will cause aircraft operators to invest in lighter weight, fuel-efficient technologies like carbon brake disc systems

Ultra-high-performance braking systems incorporating high-strength carbon composites are needed to resist extreme speed and temperature conditions, which will be only exacerbated through next-generation supersonic and hypersonic aircrafts.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Aviation authorities updated safety regulations for carbon brake disc performance. |

| Technological Advancements | Advancements in carbon composite materials and automated manufacturing enhanced brake performance. |

| Industry Applications | Airlines and defense sectors increased adoption of carbon brake discs for fuel efficiency and durability. |

| Environmental Sustainability | Initial efforts to reduce carbon emissions in brake disc production and recycling emerged. |

| Market Growth Drivers | Rising demand for lightweight aircraft components and improved braking efficiency. |

| Production & Supply Chain Dynamics | Pandemic-induced supply chain disruptions impacted raw material availability and production. |

| End-User Trends | Airlines invested in carbon brake disc retrofits and aftermarket upgrades. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental regulations and sustainability mandates drive industry-wide material innovation. |

| Technological Advancements | AI-driven predictive maintenance, nanostructured carbon fibers, and self-healing composites dominate the market. |

| Industry Applications | Expansion into electric aircraft, supersonic travel, and sustainable aviation applications. |

| Environmental Sustainability | Widespread adoption of recyclable carbon composites and green manufacturing processes. |

| Market Growth Drivers | AI-enabled real-time wear monitoring, electrification of aviation, and next-gen aircraft designs fuel industry growth. |

| Production & Supply Chain Dynamics | Localized manufacturing, AI-driven supply chain management, and sustainability-driven procurement improve resilience. |

| End-User Trends | Autonomous aircraft, AI-optimized maintenance solutions, and electric aviation innovations define future trends. |

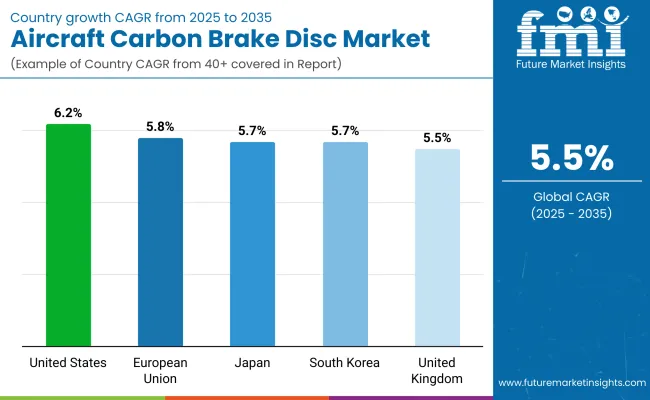

The USA aircraft carbon brake disc market is expanding due to the presence of major aerospace manufacturers, increasing defense budgets, and strong demand for commercial aircraft. Leading companies such as Honeywell and Collins Aerospace are investing in advanced carbon composite materials to enhance braking efficiency and reduce aircraft weight.

With the Federal Aviation Administration (FAA) supporting next-generation aircraft technologies, airlines are increasingly adopting carbon brake discs to improve fuel efficiency and reduce maintenance costs. Additionally, the growing focus on sustainable aviation and electric aircraft development is expected to drive further innovation in carbon brake disc technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

The steady growth of the UK aircraft carbon brake disc market is ascribed to robust aerospace industry, with comprehensive manufacturing expertise in the country, encompassing industry leaders such as Rolls-Royce and BAE Systems. The growth of commercial aviation and military aircraft programs is driving the demand for lightweight and high-performance braking systems.

Also, ongoing UK-based research efforts that focus on carbon composite materials as well as sustainability in aviation are developing technologies that can be applied towards aircraft braking systems. Additionally, the focus on electric & hybrid aircraft market is projected to have a positive impact in terms of market growth over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

Germany, France, and Italy dominate the European aircraft carbon brake disc market owing to well-established aerospace manufacturing activities and rising aircraft deliveries. Airbus has implemented advanced carbon brake disc systems into its commercial and military aircraft.

The push toward sustainable aviation and extreme emissions regulations from the European Union drive demand for lightweight, fuel-efficient braking systems. Also, investments in research and development in next-generation carbon composites are boosting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.8% |

Factors such as growing commercial aircraft production and increasing investment into new infrastructures are driving the growth of the gap carbon brake disc market in Japan. One of the major players, Mitsubishi Heavy Industries, has been making significant investments in aeronautical braking technics with the support of their respective domestic and global economic aviation markets.

The growth of Japan's low cost airline sector and a rise in international air travel is driving demand for durable lightweight brake disc solutions. Moreover, future developments in the market would be driven by innovations in carbon-carbon composites and in new materials research.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

Growing aerospace industry and increasing investments in defense aviation bolster the demand for aircraft carbon brake disc in South Korea. And, aided by the government initiatives, the country's push toward the development of its own aircraft manufacturing capabilities is bolstering demand for high-performance braking technologies.

The adoption of carbon brake discs is also being driven by South Korea's push for sustainable aviation and greener aircraft components. Moreover, collaborations with worldwide aerospace industries are leading in technology advancements and market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Carbon-carbon and carbon-composite segments occupy the majority of the share in the aircraft carbon brake disc market owing to the emphasis given by aircraft manufacturers, airline operators, and defense marketers towards lightweight, durable, and high-performance braking solutions.

The use of advanced brake disc materials is critical for commercial airlines, military fleets and general aviation aircraft due to their role in enhancing the efficiency of braking, lower aircraft mass, improved braking, and thus increased up time of the aircraft and improved overall flight safety.

Market Demand Fuelled By Performance-Oriented Aircraft Operators Seeking Superior High-Temperature Durability and Longevity

Carbon-carbon brake discs have become one of the most popular braking systems in the aviation sector due to their high thermal stability, light weight and high wear resistance. Carbon-carbon composites are particularly advantageous for use in high-performance aircraft, as they retain their structural integrity even when exposed to extreme braking applications, unlike conventional steel brake discs.

Consumers including airline companies, fleet operators in high-traffic life would have enhanced vision prospects among the usage of these products including wide-body jets, supersonic fighters, and defense agencies among others, thereby accounting as a result for the high market uptake of these products in accordance with component of carbon-carbon brake discs to offer better life service and minimum maintenance.

In fact, research indicates carbon-carbon brake disks last roughly twice as long as standard steel brakes, hence high demand in this sector. The growing adoption of next-generation aviation technologies, such as electrified aircraft braking systems, better performing carbon-carbon heat dissipation coatings, and AI-powered predictive maintenance for brake wear monitoring, has bolstered the market demand, boosting overall reliability and efficiency of the aircraft braking performance.

Advanced machine-learning models for wear prediction, real-time brake temperature optimization, and performance analytics for aircraft operators as part of AI-powered material science innovations have also spurred adoption, guaranteeing greater cost efficiency and operational safety.

The regenerative braking techniques that include energy recovery mechanisms in hybrid-electric aircraft along with A.I-optimized utilization of carbon-carbon brake disc has consequently contributed to overall market growth, facilitating better synchronization with the aviation sector's transition toward eco-friendly and fuel-efficient solutions.

Sustainable manufacturing practices, including the use of recyclable carbon-carbon composites, carbon-neutral production processes, and closed-loop material lifecycle management, have bolstered market growth while promoting improved fulfilment of global sustainability legislation.

Though carbon-carbon brake discs have the advantages of high-temperature resistance, long service life, and lightweight use, the cost of carbon-carbon brake discs is relatively high, with limited production scalability, as well as dependent on special process manufacturing.

But with innovations like AI-driven carbon-carbon material reinforcement, block chain-backed supply chain transparency, and advanced additive manufacturing for precision-engineered brake discs, the cost-effectiveness, production efficiencies, and overall accessibility of the market are improving, ensuring continued growth of the carbon-carbon market for brake discs across the globe.

As the demand for fuel-efficient, low-maintenance, and high-performance braking systems increases, carbon-composite brake discs have received a strong share of the commercial market, especially among commercial airlines, regional aircraft manufacturers, and next-generation urban air mobility (UAM) solutions.

Compared with pure carbon-carbon brake discs, the carbon composite discs provide a good trade-off between durability, cost and thermal management, making them more applicable to medium or larger(especially undercarriage) commercial aviation.

The growing demand for carbon-composite brake discs in commercial aviation, especially in narrow-body and regional jets, has propelled the acceptance of composite-based braking solutions on commercial and regional aircraft, as airlines look for more economical solutions that enhance aircraft fuel efficiency and operational performance. Over 60% of new-generation commercial aircraft models utilize carbon-composite brake discs which strongly positions this segment moving forward according to studies.

The proliferation of lightweight aircraft manufacturing trends, such as composite-based fuselages tables, aerodynamic efficiency improvements and reduced overall aircraft weight has further propelled the market demand over the forecast period, and has allowed for a more rested compatibility between carbon-composite braking technologies and next-generation aircraft designs.

The rise in adoption has also been complemented by the introduction of AI-driven performance optimization that includes real-time wear tracking, predictive maintenance for composite brakes, and automated brake pad life cycle assessments, which provides fleet operators with better reliability and maintenance management scheduling.

The efforts to develop eco-sustainable and economical composite material formulations such as low-friction composite brake linings, high-temperature resistant polymer blends, and AI optimized material density distribution have optimized the overall market growth to allow it finding greater affordability and operational longevity.

Due to their significant adaptability to diverse aviation applications, the integration of hybrid composite-carbon braking technologies, including multilayer composite structures with built-in cooling channels, advanced fibre-reinforced braking surfaces, and self-healing composite brake materials, have bolstered market growth.

Though possessing cost-efficiency, lightweight performance, and fuel-saving advantages, the carbon-composite brake disc segment is faced with challenges in the form of regulatory approval processes, long-term durability validation, and limited penetration in high performance military aircraft.

Nonetheless, breakthrough in artificial intelligence composite material engineering, block chain tracking of brake wear, and nanomaterial-enhanced composite brake structures are enabling efficiencies, maximized tenures and integration across the aviation industry, ensuring the sustained spread of carbon-composite brake discs in markets worldwide.

The commercial aircraft and military aircraft segments represent two major market drivers, as carbon brake discs increasingly play a critical role in improving fuel efficiency, operational safety, and braking performance in modern aviation.

Commercial Aircraft Segment Leads Market Demand as Airlines Seek Fuel-Efficient and Low-Maintenance Carbon Brake Solutions

Airline operators that fitted carbon brake discs to commercial aircraft have seen substantial fuel savings and reduced aircraft landing gear maintenance costs, making the commercial aircraft segment one of the largest consumers of carbon brake discs, while also extending brake life compared to traditional steel braking systems.

Traditionally, commercial airplanes have employed legacy braking technologies, but carbon brake discs introduced in the airline industry help optimize fuel consumption(increased amount of fuel required for the flight) due to their light weight and better braking power.

The adoption of carbon-based braking technologies is being fuelled due to the increasing demand for carbon brakes on in new-generation narrow-body and wide-body commercial aircraft, such as the Boeing 737 MAX, the Airbus A320neo, and the Boeing 787 Dreamliner, as airlines look for next-generation fuel-efficient solutions.

As advantages like cost savings, lightweight, and longer service life driving the market, the commercial aircraft segment is likely to see challenges owing to high initial investment costs, complex transition in airline fleets, and variation in aftermarket brake disc replacement.

Yet emerging innovations for AI-driven fleet-wide brake management, predictive analytics for carbon brake maintenance and next-gen hybrid braking technologies are improving the scalability, cost efficiency and airline adoption rates needed to sustain growth for the carbon brake discs market within the commercial aviation landscape.

The military aircraft sector has seen significant market penetration, especially among kindred manufacturers, defense contractors and tactical aircraft service providers, as new generation supersonic jets, unmanned aerial vehicles (UAVs) and military cargo planes more frequently utilize high performance carbon brake discs. Military aircraft differ from commercial aviation in that they fly under extreme conditions, necessitating durable, heat-resistant and maintenance-free braking solutions.

The increasing use of advanced braking systems in supersonic aircraft PMT has also contributed to carbon-carbon brake adoption in the market such as F-35 Lightning II, F-22 Raptor, and Eurofighter Typhoon, providing improved braking efficiency that reduce braking distance considerably at high speed and avoid braking failures due to extreme temperatures.

While the military aircraft segment can certainly benefit from the extreme temperature tolerance, high-performance applications, and tactical reliability advantages of the technology, it also has to contend with stringent defense procurement regulations, specialized maintenance requirements, and a limited aftermarket.

But recent innovations in AI-supported material resilience testing, block chain-enabled military supply chain integration, as well as next-generation Nano-coating technologies for carbon brake reinforcement are enhancing reliability, longevity, and total market competitiveness paving the way for continued growth of carbon brake discs for global military aviation.

According to a new report released by Kaplan Research, Global aircraft carbon brake disc market is growing, due to increasing demand for lightweight and high-performance braking systems for commercial, military and general aviation. Two solutions are particularly complex and require carbon brake discs that offer unique features: better durability, optimized heat resistance, and lower weight, which together result in greater fuel efficiency and the overall performance of the aircraft.

Market Key Players are targeting High-performing carbon-carbon composite materials, improved wear resistance and next-gen braking systems to support the ever-growing global fleet of fuel-efficient and electric aircraft. The growing penetration of more-electric aircraft (MEA) and new-generation urban air mobility (UAM) solutions additionally drives the market.

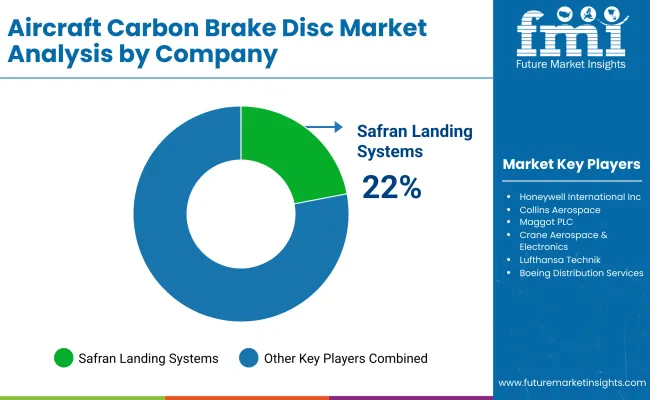

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Safran Landing Systems | 22-26% |

| Honeywell International Inc. | 16-20% |

| Collins Aerospace (RTX) | 12-16% |

| Maggot PLC | 8-12% |

| Crane Aerospace & Electronics | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Safran Landing Systems | Manufactures carbon brake discs for commercial and military aircraft, integrating proprietary carbon composite technology for extended lifespan. |

| Honeywell International Inc. | Develops lightweight, high-performance braking systems, focusing on wear-resistant carbon-carbon composites. |

| Collins Aerospace (RTX) | Innovates electrified and hybrid braking solutions, enhancing safety and fuel efficiency. |

| Maggot PLC | Produces advanced carbon brake disc solutions for regional and business jets, ensuring superior heat dissipation and longevity. |

| Crane Aerospace & Electronics | Specializes in integrated braking control systems and carbon disc technology for both fixed-wing and rotary aircraft. |

Key Company Insights & Competitive Strengths

Safran Landing Systems (22-26%)

Honeywell International Inc. (16-20%)

Collins Aerospace (RTX) (12-16%)

Crane Aerospace & Electronics (5-9%)

Other Key Players (30-40% Combined)

Several aerospace manufacturers and defense contractors contribute to aircraft carbon brake disc innovations, focusing on extended wear life, reduced maintenance, and high-temperature stability:

The overall market size for the Aircraft Carbon Brake Disc Market was USD 1.3 Billion in 2025.

The market is expected to reach USD 2.3 Billion in 2035.

The demand will be fuelled by rising air passenger traffic, increasing demand for fuel-efficient and lightweight aircraft components, growing adoption of carbon composite materials for enhanced durability and performance, and expanding commercial and military aircraft fleets.

The top five contributors are the United States, France, Germany, China, and the United Kingdom.

Commercial aircraft, particularly in narrow-body and wide-body categories, are anticipated to command a significant market share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Aircraft Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Fit Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Fit Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Fit Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Fit Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Fit Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Fit Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Fit Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Fit Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Fit Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Fit Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Aircraft Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Fit Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Fit Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Fit Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Fit Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Fit Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA