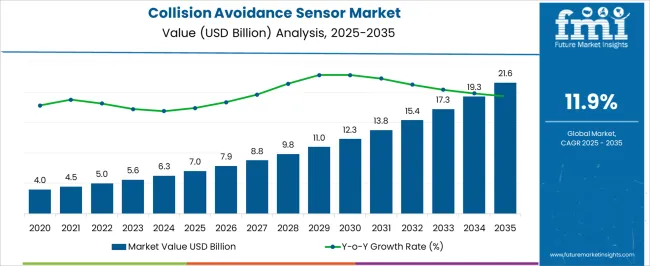

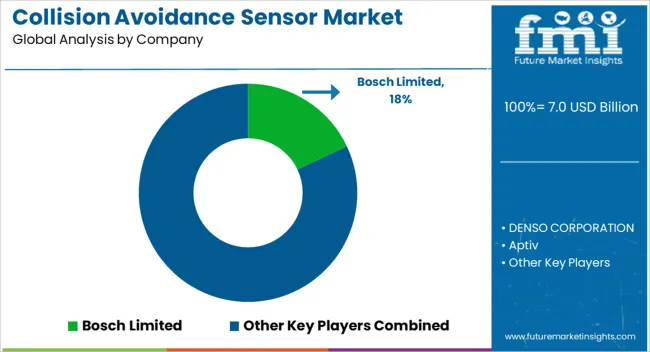

The Collision Avoidance Sensor Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 21.6 billion by 2035, registering a compound annual growth rate (CAGR) of 11.9% over the forecast period.

| Metric | Value |

|---|---|

| Collision Avoidance Sensor Market Estimated Value in (2025 E) | USD 7.0 billion |

| Collision Avoidance Sensor Market Forecast Value in (2035 F) | USD 21.6 billion |

| Forecast CAGR (2025 to 2035) | 11.9% |

The collision avoidance sensor market is expanding steadily due to rising adoption of advanced driver assistance systems (ADAS), automotive safety mandates, and growing investments in autonomous vehicle technologies. Regulatory frameworks across major automotive markets are driving the integration of sensors that support collision detection, lane assistance, and adaptive control functions.

Automotive OEMs are increasingly aligning product development with safety compliance benchmarks, leading to widespread deployment of sensor-enabled modules in both passenger and commercial vehicles. Enhancements in radar and camera-based systems, miniaturization of sensing hardware, and integration of AI for predictive response are fostering product innovation.

As electrification and autonomous mobility gain momentum, demand for collision avoidance sensors is expected to grow across not just transportation but also industrial automation, robotics, and logistics.

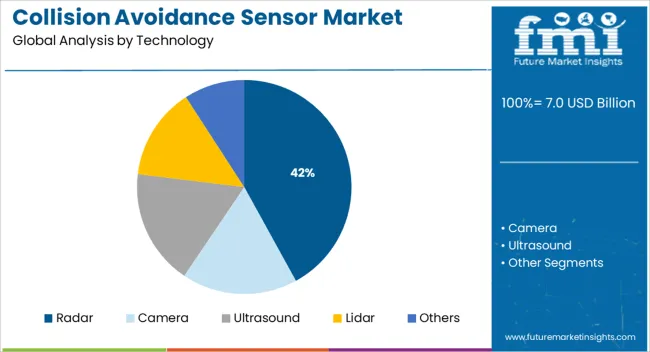

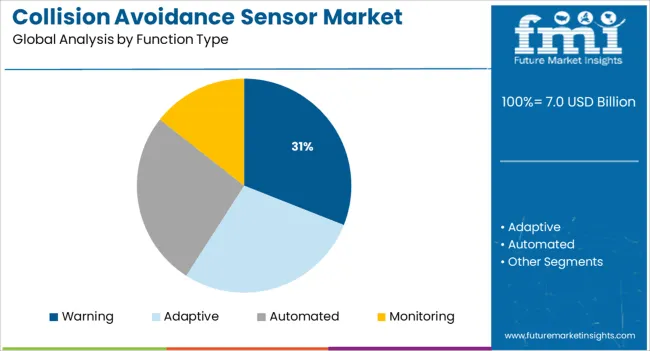

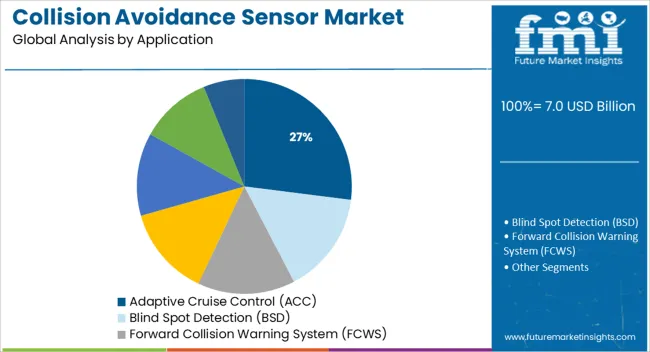

The market is segmented by Technology, Function Type, Application, and Industry Vertical and region. By Technology, the market is divided into Radar, Camera, Ultrasound, Lidar, and Others. In terms of Function Type, the market is classified into Warning, Adaptive, Automated, and Monitoring. Based on Application, the market is segmented into Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Lane Departure Warning System (LDWS), Parking Assistance, Night Vision (NV), Autonomous Emergency Braking, and Others. By Industry Vertical, the market is divided into Automotive, Rail, Marine, Aerospace & Defence, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Radar-based sensors are expected to hold 42.0% of the total revenue share in 2025, making them the dominant technology in the collision avoidance sensor market. Their leadership is being driven by high reliability in adverse weather conditions, long-range object detection capabilities, and cost-effectiveness in mass production.

Radar sensors have proven compatibility with high-speed environments and are less susceptible to visual obstructions, which enhances their value in safety-critical applications. Increased deployment in automotive and aerospace domains has strengthened manufacturing volumes, reducing unit costs and improving system integration.

Continuous advancements in millimeter-wave radar and chip-scale packaging have further improved radar precision, enabling robust real-time response across a wide range of mobility platforms.

The warning function segment is projected to contribute 31.0% of the market revenue by 2025, making it the leading functional deployment within collision avoidance systems. This dominance is driven by the wide implementation of pre-emptive safety mechanisms that alert drivers to potential hazards without interfering directly with vehicle control.

Warning systems offer cost advantages and faster regulatory approval compared to intervention-based alternatives, facilitating their adoption across mid-range vehicle models. The growth of semi-autonomous systems, where human control remains integral, has further reinforced demand for alert-based technologies.

Enhanced human-machine interface (HMI) designs and increased compatibility with dashboard visualization systems have also improved user responsiveness and system effectiveness.

Adaptive cruise control (ACC) is anticipated to account for 27.0% of the total revenue in the collision avoidance sensor market by 2025, establishing it as the leading application segment. The segment’s growth is being supported by growing demand for driver comfort, speed modulation, and safety consistency in congested traffic conditions.

ACC systems rely heavily on real-time data from collision avoidance sensors to automatically adjust vehicle speed based on proximity to surrounding traffic, thereby reducing human error. With increasing penetration of Level 2 and Level 3 autonomy features, ACC is becoming a standard offering across premium and mid-tier vehicle platforms.

Regulatory endorsements and inclusion in safety rating programs have further propelled OEM integration. As road safety expectations continue to rise, the ACC segment remains a key deployment area for collision avoidance technologies.

Different vehicles demand different types of sensors. This involves laser and GPS-based sensors that save any vehicle from colliding. FMI explains the latest developments in the collision avoidance sensor market that reflect higher sales of these sensors all around the world.

Millimeter Wavelength Radar: Senses objects within 200 meters millimeter wavelength, millimeter wavelength radar light speed and high energy enough to avoid most radio frequencies, and their interface provides support to the self-assistance driving cars.

Ultrasound

Ultrasound sensors detect sound waves at 20 kHz and are the most common type while being ideal for low speeds and short ranges. Applied in backup reversing systems, the technology is commonly used in ships and airplanes. The Doppler effect and external noises make this a poor choice for high-speed road use.

Laser

The laser sensor detects the Infrared emitting LEDs or light-emitting diodes at approx 880 nm wavelength. Similar to ultrasound sensors, these are used for short-range detection of fewer than 10 feet. LED laser sensors are pocket friendly, but they do have a lack while being used in areas with high-temperature sources. These are mainly used in industrial applications, but some reverse auto sensors use them.

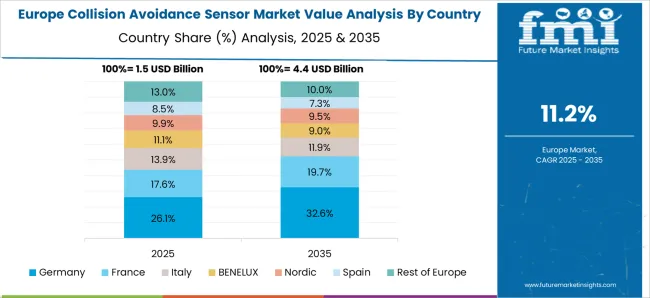

Europe is the market leader in terms of revenue and is making quick changes to revolutionize the automobile industry. With the rising number of accidents, governments in Europe have started taking serious actions such as ADAS systems, Sensory Systems, Advanced Airbags, etc.

On the other hand, newly developed automobile companies in Asia-Pacific countries like China and India have led to the higher application of collision avoidance sensors and other advanced safety solutions. India has reported over 472,606 accidents in the last five years, while 149,472 people died in these accidents, thriving with the adoption of collision avoidance sensors.

The increase in sales of sports utility vehicles (SUVs), high-end luxury vehicles, and utility vehicles is expected to drive the global collision avoidance sensor market size. Furthermore, advancements in the camera field boost the overall market growth. The cyclical nature of automotive sales and production, on the other hand, is a significant restraint on the collision avoidance sensor market.

On the contrary, an increase in automotive safety standards, as well as the installation of advanced driver assistance systems in passenger vehicles, is expected to create lucrative collision avoidance sensor market opportunities.

Demand in the Marketplace

There is a high risk of colliding when transporting goods applications. There are some undefined paths in this process that can pose a serious threat. Due to these factors, the collision avoidance sensor market is in high demand from industrial sectors. Sensors are widely used in mass-production regions.

Omnidirectional Vision Drones Show Promising Potential in Tracking People and Subjects

Drones are widely used in business. Many industrial units are increasing the use of drones. Another is the use of collision sensors. This product is in high demand among autonomous drones. These market demand drivers are likely to boost overall demand for collision avoidance sensors.

The Mandate in the Automotive Market

The automotive industry's demand is a key driver. Toyota, for example, is now utilizing advanced braking systems. This device is commonly found in many SUVs. These collision avoidance sensors are very useful. The number of accidents caused by vehicles equipped with this sensor is low.

As a result, the collision avoidance sensor market's installation activities are increasing. The support of automotive behemoths boosts demand for collision avoidance sensors. All of these factors contribute to a rapid collision avoidance sensor market expansion rate during the forecast period.

| INDUSTRY | OUTLOOK |

|---|---|

| Sport Utility Vehicles are a Growing Market |

|

| Investment Opportunities in the Luxury Vehicle Market |

|

| Myriad Perks for Marine Industry |

|

Exorbitant Installation Charges

The high cost of installation is a barrier to the market for collision avoidance sensor. High-end sensors are available on the market. There are numerous technologies and components available on the market.

These vehicles' manufacturing costs are already high. The addition of collision sensors will have an effect on the overall cost of these vehicles. As a result, adoption rates may fall in some areas. The collision avoidance sensor market may see an increase in the use of low-cost sensors.

Dearth of Cognizance

In the collision avoidance sensor market, there is a lack of awareness. Many parts of the world are unaware of this product. Epically, the developed regions are experiencing more options. They are the first to use this next-generation sensor. However, demand for collision avoidance sensor from developing countries is low.

Prominent Startups Holding a Sway over the Collision Avoidance Sensor Market

Honda acquires Drivemode, a developer of driver-focused smartphone apps. Honda is creating new value in the areas of digital and connected mobility products. Drivemode became a wholly-owned subsidiary of Honda Research and Development as a result of the acquisition.

Netradyne introduced Driver•iHubX, the latest generation of its Driver•i® accessory, which allows customers to add up to four external cameras to their existing installation for a complete 360-degree view of the vehicle. Along with the new hardware, the company announced a slew of enhancements and new features to its vision-based safety platform.

Smart Eye Aktiebolag (publ) announced an agreement to acquire iMotions A/S, a provider of multimodal software for human behavior research, on October 26, 2024. Smart Eye has completed its acquisition of all of iMotions' shares.

To attract more customers, key collision avoidance sensor providers such as Robert Bosch GmbH, Infineon Technologies AG, and Magna International Inc. are concentrating on the development of cost-effective collision avoidance sensors. To develop and offer differentiated and cost-effective vehicle safety solutions, key market players are heavily investing in Research and Development projects and establishing production infrastructure.

With five leading industry players accounting for 25% of the market stake, startups are increasing their efforts to develop drones with multiple-direction obstacle avoidance sensors.

Continental AG has a strong market presence as a result of its strong Research and Development and manufacturing facilities. The company's primary focus is on product innovation and effective distribution via a large network of partners in multiple countries.

Recent Development:

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 11.9% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Product type, end-use, material type, region |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia, and New Zealand |

| Country scope | USA; Canada; Mexico; Germany;United Kingdom; France; Italy; Spain; Russia; Belgium; Poland; Czech Republic; China; India; Japan; Australia; Brazil; Argentina; Colombia; Saudi Arabia; United Arab Emirates; Iran; South Africa |

| Key companies profiled | Alstom SA, Autoliv Inc., Delphi Automotive PLC (Aptiv), Denso Corporation, General Electric Company, Honeywell International Inc., Robert Bosch GmbH, Collins Aerospace, Siemens AG, Wabtec Corporation |

| Customization scope | Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global collision avoidance sensor market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the collision avoidance sensor market is projected to reach USD 21.6 billion by 2035.

The collision avoidance sensor market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in collision avoidance sensor market are radar, camera, ultrasound, lidar and others.

In terms of function type, warning segment to command 31.0% share in the collision avoidance sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Collision Sensor Market Size and Share Forecast Outlook 2025 to 2035

Front Collision Warning Market Growth – Trends & Forecast 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA