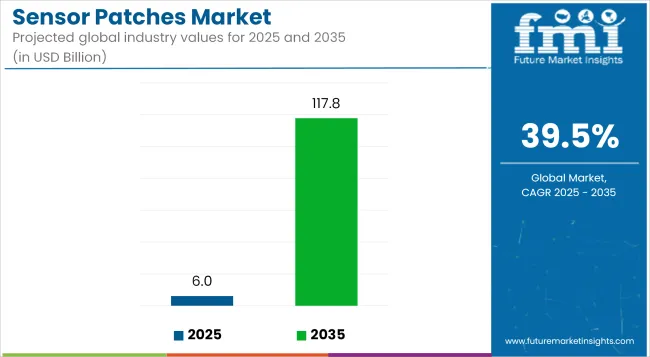

The sensor patches or wearable biosensors market is valued at USD 6.04 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 39.5% and reach USD 117.8 billion by 2035. The worldwide wearable biosensors industry experienced a significant turning point in 2024, as hospital systems, eldercare centers, and digital therapeutics companies significantly increased deployments of wearable biosensors.

FMI research identified that monitoring chronic diseases, particularly cardiovascular diseases and diabetes, was the major force behind growth in 2024. A major development was the introduction of reimbursement systems in OECD nations, allowing public and private payers to cover sensor-based remote monitoring. Moreover, high-performance wearable biosensors for elite sports and wellness use cases picked up speed in North America and select industries in Europe.

In 2024, top brands partnered with AI creators to integrate predictive analytics directly into wearable platforms, minimizing human intervention and increasing diagnostic reliability. FMI’s research indicates that the industry is expected to enter a long-term growth phase in 2025, represented by vertical expansion within clinical diagnostics, fitness tech, and aging care ecosystems.

Increased incorporation of wearable biosensors in telehealth platforms and AI-enabled alert systems will further enhance procurement at an enterprise level. Ahead, increased technology innovation, regulatory clarity, and behavioural change within preventive care are anticipated to accelerate, enabling the industry to hit USD 117.8 billion by 2035.

Market Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.04 billion |

| Industry Value (2035F) | USD 117.8 billion |

| CAGR (2025 to 2035) | 39.5% |

The sensor patch industry is experiencing a high-growth trajectory because of increasing demand for real-time, non-invasive monitoring of health in consumer and clinical industries. Advancements in wearable technology and growing acceptance of remote care are accelerating adoption across hospitals, eldercare centers, sports, and wellness sectors.AI-enabled, interoperable sensors will likely lead the market, while traditional device makers may face challenges if they do not evolve.

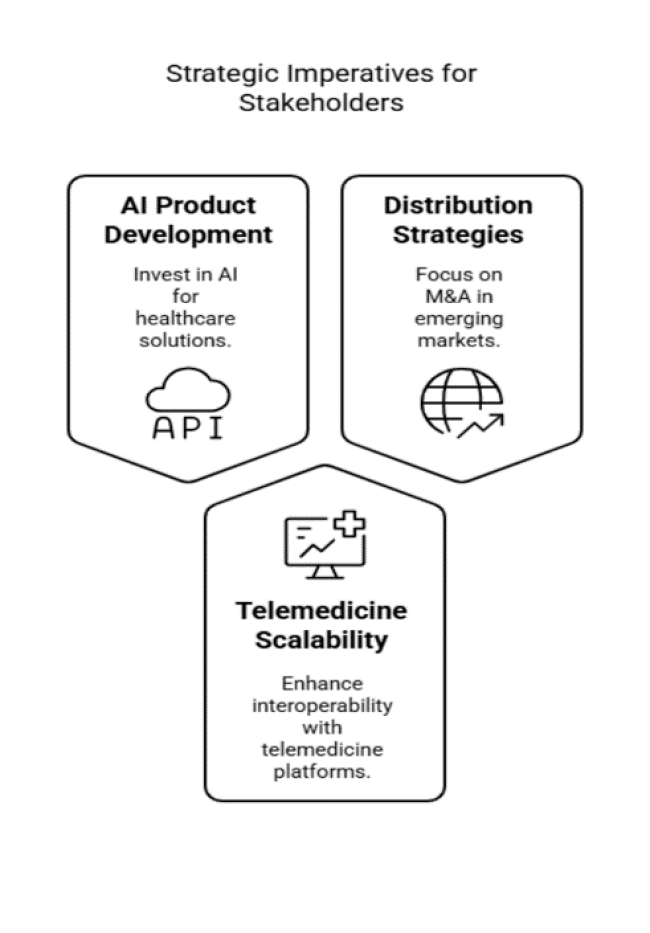

Powerful AI-enabled product development

Invest in sensor patch technology fusing AI with predictive analytics for raising diagnostic effectiveness, reducing the burden on clinicians, and building enhanced user experiences in healthcare and fitness use cases.

Leverage scalability with telemedicine and preventive care ecologies.

Extend products' interoperability with telemedicine platforms and prioritize use cases for chronic disease care in order to maximize shifting models of care and value-based models of healthcare.

Strengthen distribution and M&A strategies in emerging economies.

Pursue channel deals and acquisitions in Asia-Pacific and Latin America to rapidly increase industry presence. Strengthen R&D capabilities to localize sensor solutions for regional needs.

| Risk | Probability - Impact |

|---|---|

| Regulatory Delays in Clinical Approval | Medium - High |

| Data Privacy Breaches in Connected Devices | High - High |

| Supply Chain Disruptions for Semiconductor Components | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Sensor Accuracy Enhancement | Run feasibility on multi-biomarker sensor integration |

| Clinical Partnerships | Initiate OEM feedback loop with hospital networks and telehealth providers |

| Global Expansion Strategy | Launch channel partner incentive pilot in Asia-Pacific and LATAM |

To stay ahead, companies need to focus on speeding up the development of AI-based wearable biosensors at a fast pace and forging strategic alliances in telehealth and growth industries. Such insight emphasizes a structural transition from episodic to continuous care, requiring an active transition of R&D, product strategy, and commercial alignment.

By integrating real-time analytics and compatibility with remote patient monitoring ecosystems, leadership can future-proof the firm's position in preventive care. The next 12 months are key to securing clinical partnerships, obtaining regulatory clearances, and scaling distribution to secure outsized returns before the competitive environment matures.

Regional Variance

High Variance

Consensus

Variance

Shared Challenges

Regional Differences

Manufacturers

Distributors

End-Users (Hospitals & Clinics)

Alignment

Divergence

Variance vs. Consensus

Key Variances

Strategic Insight

| Countries | Regulatory & Policy Impact |

|---|---|

| United States | Sensor patches are Class II devices regulated by the FDA. Firms need to adhere to 21 CFR Part 820 (Quality System Regulation) and receive 510(k) clearance or De Novo classification. The Safer Technologies Program ( STeP ) of the FDA expedites innovative patch approvals, especially for chronic care. HIPAA compliance is required for data handling. |

| United Kingdom | Under the UKCA (UK Conformity Assessed) mark after Brexit, replacing CE. wearable biosensors are required to comply with MHRA and demonstrate clinical performance evidence. NHS is driving digital-first care approaches, encouraging adoption by offering reimbursement codes for remote patient monitoring (RPM). |

| France | The product is subject to CE certification under EU MDR (2017/745). ANSM ( Agence nationale de sécurité des produits de santé, or French Health Products Safety Agency) enforces further review for related medical devices. The French government finances digital health pilots, but cybersecurity compliance and hosting of health data in EU servers are firm requirements. |

| Germany | MDR conformity is required, with BfArM regulating approvals of digital health apps ( DiGA ) and patches eligible for public insurance coverage upon DiGA listing. GDPR enforcement leadership falls to Germany regarding wearable device data. Risk Class IIa and above patches face increased scrutiny. |

| Italy | All wearable biosensors need to bear the CE mark according to MDR. The Italian Ministry of Health regulates wearable health devices in accordance with national telemedicine guidelines published in 2022. Public hospitals, under strict regulation, centrally procure reimbursement, which varies by region. |

| South Korea | Guided by MFDS (Ministry of Food and Drug Safety). Digital health patches are classified as Class II or III devices depending on their functionality. The government actively encourages digital therapeutics and telehealth within its Health Innovation Strategy, although it requires domestic clinical performance testing on all devices. |

| Japan | Regulated by PMDA under the Pharmaceuticals and Medical Devices Act (PMD Act). Wearable biosensors with diagnostic applications need stringent clinical testing and GCP conformity. Regulation is stringent, but the government has initiated fast-track programs for geriatric-centric digital health devices. |

| China | Class II registration is generally required by NMPA for most wearable biosensors. Local clinical trials are usually required. Products have to conform to GB standards (ISO equivalents in China) and provisions of the law on cybersecurity. AI-based diagnostics are encouraged by the government, but data localization regulations are strict. |

| Australia and New Zealand | The product is subject to TGA (Australia) and Medsafe (NZ) regulations. wearable biosensors are Class IIa devices, according to medical device regulations. Both countries accept CE marks for transitional approvals but require full ARTG or WAND registration. Government digital health strategies facilitate patch uptake in home monitoring. |

| India | The CDSCO regulates wearable patches. Wearable patches are not yet fully regulated unless they purport to have diagnostic or therapeutic value and must register under the Medical Device Rules (2017) in that case. Data protection frameworks are changing, yet regulatory clarity is short. |

Between 2025 and 2035, patches for sensing blood glucose will be the most profitable product segment, led by the phenomenal growth in diabetes incidence, growing demand for continuous glucose monitoring (CGM), and the transition from invasive to minimally invasive wearable technology. The Blood Glucose Sensor Patches segment is anticipated to expand at a CAGR of around 43.6% between during the forecast period, surpassing the overall industry growth rate of 39.5%.

As type 2 diabetes prevalence skyrockets in developed and emerging economies alike, patients and clinicians are seeking round-the-clock monitoring of metabolic data. Recent FDA clearances and broader reimbursement schemes have further fueled adoption of glucose-monitoring patches in home and clinical environments.

Convergence with insulin pumps and artificial intelligence-based predictive models further gains traction. With this strong demand path and ubiquitous adoption in digital chronic disease platforms, the segment is expected to see sustained investment and clinical adoption.

The monitoring segment is anticipated to be the most profitable application segment during the assessment period. This is dueto intensified emphasis on preventive care, post-operative monitoring, and the management of chronic diseases. Monitoring is anticipated to expand at a CAGR of about 41.2% during 2025 to 2035.

Remote patient monitoring (RPM) programs are increasing worldwide-especially for cardiovascular, metabolic, and respiratory disorders-and are transforming the continuum of care through real-time intervention.

These patches enable providers to monitor patients in real-time, decreasing hospital readmission rates and enhancing long-term results. Employers and insurers are also integrating wearable health solutions into wellness plans, which is driving up demand. Moreover, AI and IoT integration into monitoring platforms guarantees quicker clinical decision-making.

From 2025 to 2035, healthcare will be the most profitable end-use segment for sensor patches, driven by rising hospital digitization, smart ICUs, and post-discharge telehealth infrastructure investments. The healthcare segment is set to register a CAGR of about 40.5% between forecast years. Wearable biosensors are increasingly becoming a part of hospital-grade diagnostics and treatment plans, particularly in cardiology, endocrinology, and geriatrics.

Their capacity to offer non-intrusive, real-time information is diminishing the demand for tethered systems and speeding up the delivery of care. Electronic health record (EHR)-compatible sensor platforms are also fueling system-wide integration. In addition, government regulations and payer incentives are aligning with these innovations, and wearable biosensors are becoming central to the development of future healthcare infrastructure.

FMI’s forecasts indicate that the sensor patch industry in the United States will grow at a CAGR of 40.9% between 2025 and 2035. The USA is a world leader in innovation in digital health, wearables, and remote monitoring technologies, with strong adoption fuelled by the prevalence of chronic diseases, aging populations, and technologically perceptive consumer bases.

Strong reimbursement systems and embedding sensor patches in clinical and telehealth workflows are driving early diagnosis and real-time management of patients. The presence of major industry players, research establishments, and digital startups also creates sustained innovation and aggressive industry expansion. The focus is on smart diagnostics and personalized medicine, which are driving the demand for sensor patches.

UK’s sales are expected to grow at a CAGR of 37.6%. The UK National Health Service (NHS) has increasingly integrated wearable biosensors in patient monitoring systems, particularly for cardiac and diabetic diseases. Public sector efforts for digital transformation in healthcare are fostering a positive context for the adoption of sensor patches.

The increasing need for remote diagnosis and AI-powered health monitoring underpins future growth. Furthermore, strong collaborations between academia, technology innovators, and the public sector have played a crucial role in mainstreaming these technologies in both primary and secondary care environments.

The industry of sensor patches in France is projected to grow at a CAGR of 36.2% from 2025 to 2035. France is increasingly making investments in digital healthcare infrastructure, including special emphasis on care for the aging population and remote patient monitoring. Clinics and hospitals are testing wearable biosensors for post-surgical monitoring, heart rate observation, and detection of chronic disease at an early stage.

Clarifying regulations for integrating digital therapeutics and mHealth tools' integration within national reimbursement infrastructure has paved the way for extensive adoption. Domestic startups and healthcare technology ecosystems of Paris and Lyon are driving rapid commercialization of sophisticated sensor-based therapeutic monitoring platforms.

During the assessment period, projections indicate a CAGR of 38.5% for the sensor patch industry in Germany. With a strong manufacturing ecosystem and high standards for healthcare, Germany is among the most likely locations for deploying sensor patches. Reimbursement for digital health technologies, such as biosensors, is covered under government schemes like the Digital Healthcare Act (DVG).

Large health systems and payers are collaborating with technology companies to implement continuous monitoring of vital signs for cardiovascular and metabolic disease patients. Germany is also emerging as a hub for clinical trials involving wearable therapeutics and diagnostics.

In Italy, the sensor patch industry is projected to grow at a CAGR of 34.4% during 2025 to 2035. Adoption in Italy is increasing across both public and private healthcare facilities, led by the requirement for minimizing hospital readmissions and for home-based care. Chronic disease management programs, especially among the elderly, are driving demand for continuous monitoring solutions such as sensor patches.

Though innovations in the industry is behind that of Germany or the UK, greater cooperation between public hospitals and med-tech firms is improving accessibility. Furthermore, EU-funded digitization initiatives are pushing local healthcare systems to mainstream wearable monitoring as part of normal care.

The projections indicate a CAGR of 41.1% for the sensor patch industry in South Korea from 2025 to 2035. South Korea's technological prowess in electronics and biotechnology, coupled with an aggressive movement to adopt digital health, puts it in the top destination for sensor patch technologies. The smart hospital programs of the government, the emphasis on preventive care, and the tech-savvy aging population provide the perfect environment for mass rollout.

Samsung and LG, domestic conglomerates, are driving biosensor technology, while authorities are streamlining approval processes for wearable diagnostics. Real-time monitoring for diabetes and hypertension is receiving broad acceptance.

From 2025 to 2035, projections indicate a CAGR of 35.3% for the industry in Japan. Japan's aging population and high healthcare expenditure drive the growth of remote monitoring and non-invasive diagnostics. However, cost sensitivity and prudent regulatory clearances moderate the growth to some extent.

Nevertheless, the demand is increasing for sensor patches in home care and residential eldercare for monitoring temperature, heart rate, and glucose. Local producers are emphasizing miniaturization and battery life to address an older population's needs. As clinical acceptance increases, opportunities for expansion in rural regions are increasing.

The industry in China is projected to grow at a 42.0% CAGR from 2025 to 2035. China is becoming one of the most promising regions with government-scale support for smart healthcare, artificial intelligence, and wearable diagnostics. China is actively digitizing public health infrastructure with significant investments in telehealth and chronic disease management solutions.

Local technology majors are getting into the biosensor industry, driving down cost solutions with volume scalability. With increasing awareness of individual health and a vast diabetic population, wearable biosensors for glucose and heart rate monitoring are seeing explosive growth.

Australia and New Zealand have the sensor patches industry growing at a CAGR of 36.8% from 2025 to 2035. The two nations are taking advantage of robust public healthcare infrastructure and increasing demand for remote patient monitoring in rural regions and underserved communities. Adoption of telemedicine and government-backed digitization strategies has provided favourable ground for biosensor technologies to grow.

Both nations are actively promoting clinical trials using smart patches, particularly for cardiovascular diseases and diabetes. Cross-border partnerships with American and Asian technology firms are further adding value to local innovation. The emphasis is on improving patient self-management through connected, real-time diagnostics.

The projections indicate a CAGR of 40.2% for the sensor patches industry in India from 2025 to 2035. Healthcare's quick digitalization, increasing incidence of chronic diseases, and growing middle class are fuelling adoption of economical sensor patch solutions. Local startups are developing low-cost, reusable sensor devices, and hospital chains are testing them in urban areas for glucose and ECG monitoring.

Government initiatives such as Ayushman Bharat and telemedicine policy are building broader awareness and infrastructure for digital diagnosis. India's efforts toward digital public health records and wearable integration have long-term scalability potential.

In the field of sensor patches, key players are engaging in fierce competition over innovation, alliances, and geographical expansion. Pricing remains competitive, especially in emerging industries where affordability drives faster adoption. Abbott, Medtronic, and Dexcom are investing heavily in research and development to design multi-parameter patches and develop AI systems for predictive analysis through these patches.

Mergers and collaborations with digital health start-ups are speeding up product development timetables. Additionally, domestic consumers in Asia are establishing their platforms to take advantage of minimum and maximum supply chain efficiencies. The combination of technological advancements and business strategies will drive the competitive strength of the sensor patch industry from 2025 to 2035.

In 2024, Abbott's FreeStyleLibre 2 Plus continuous glucose monitor (CGM) became compatible with Tandem Diabetes Care’s t:slim X2 insulin pump and Control-IQ algorithm in the USA, enhancing automated insulin delivery options for patients.

In the same year, Medtronic acquired Fortimedix, a developer of surgical instruments, aiming to expand its minimally invasive surgical offerings.

GE HealthCare also signed a deal in 2024 to acquire MIM Software, a provider of medical imaging analysis programs, aiming to enhance its imaging capabilities across various medical specialties. In addition, Dexcom, Inc. projected revenues exceeding USD 4 billion for 2024, fueled by the growth of the G7 sensor and the upcoming launch of Stelo, a tracker aimed at people with Type 2 diabetes not on insulin.

Abbott Laboratories (USA)

Share: ~25-30%

IDEAL leads the market with an edge inCGM wearable biosensors beyond its FreeStyleLibre platform. Abbott also leads in global CGM deployments beyond FreeStyleLibre, utilizing a strong international supply chain. Expanded usages across diabetes management

Dexcom, Inc. (United States)

Share: ~20-25%

Real-time GCM only; Dexcom G7 adoption picks up.Dexcom faces competition from insulin pump makers introducing similar initiatives and AI-based diabetes managers.

Medtronic plc (Ireland)

Share: ~15-20%

Among the best in diabetes control with its Guardian Connect system. With bleeding-edge skills in hybrid closed-loop systems and wearable sensors for chronic disease monitoring

GE Healthcare (USA)

Share: ~10-15%

Develops remote patient monitoring patches for cardiology and neonatology. Invests in AI-powered analytics of the data produced by wearable health devices.

Philips (Netherlands)

Share: 1-10%

Focuses on hospital-grade wearable sensors like patches for continuous monitoring of vital signs. Integrates care delivery with telehealth platform partners.

VitalConnect (USA)

Share: ~5-8%

Announced cardiac monitoring ECG and wearable biosensors. The new thing in post-surgery to remote patient monitoring industries.

The sensor patches market is fragmented into blood glucose, blood pressure / flow, heart rate, ECG, temperature and others.

The industry is categorized into diagnostics, monitoring and medical therapeutics.

The landscape is bifurcatedinto healthcare andfitness & sports.

The industry is studied across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa.

Growing chronic disease rates, remote monitoring demand, innovation in wearable technology, and heightened health consciousness are the key drivers.

The industry is projected to witness robust growth, underpinned by tech advancements, healthcare digitization, and active patient participation.

Major players are Cardiomo Care, Inc., Dexcom, Inc., Gentag, Inc., G-Tech Medical, Hivox Biotek, Inc., iRhythm Technologies, Inc., Isansys Lifecare Ltd., Leaf Healthcare Inc. It also includes Medtronic PLC, Nanosonic, Inc., Abbott Laboratories, GE HealthCare Technologies Inc., and VitalConnect, Inc.

The blood glucose segment is anticipated to dominate the global industry due to its vast application in diabetes management and continuous glucose monitoring.

By 2035, we expect the industry to reach around USD 117.8 billion.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Data Analytics Market Growth - Trends & Forecast through 2034

Sensor Testing Market Analysis – Growth & Forecast 2024-2034

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

NOx Sensor Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Microsensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA