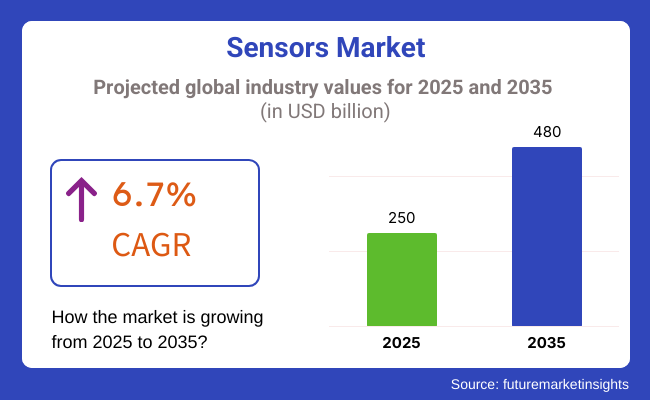

The sensors market is anticipated to grow to USD 250 billion by 2025 and spike at CAGR of 6.7% to USD 480 billion by 2035. Trends in the industry are fueled by innovation in sensor technologies, widespread use of IoT and AI-based applications, as well as government drives toward smart cities and Industry 4.0. Industry growth is also augmented further by growing demands for automation, real-time monitoring, and predictive maintenance in industries.

Miniaturization, wireless transmission, and low energy consumption have become trending characteristics of products today, revolutionizing industries by optimizing processes into more efficiency, accuracy, and cost savings. Indeed, these technologies are important across industries impacted by automotive, healthcare, manufacturing, and environment monitoring. Furthermore, technological improvements in MEMS, optical, and bio sensors are broadening the industry landscape, opening doors to innovation and growth.

Fast development of AI and IoT technologies, which are boosting the response of the sensors and enabling intelligent automation systems, are one of the key drivers for the growth in the industry. AI-powered sensors facilitate smarter industrial automation, smart homes, and autonomous vehicles edge computing elevates sensor performance by reducing latency in processing data, enhancing real-time decision-making.

Industry growth is further fueled by growing demand for sensors in smart health, such as wearable medical devices and remote monitoring solutions. The growing smart cities and smart infrastructure are driving the demand for smart products in traffic management, environmental monitoring, and public safety applications.

The industry, though potential growth has its hurdles. New sensor technologies' high production and deployment costs can limit the scaling growth of firms like small and medium enterprises. Data privacy and cyber security concerns in sensor based systems are also top priorities since these networked devices produce enormous amounts of sensitive information. Sensor calibration and standardization is also difficult, with respective industries demanding specialized sensor solutions, thus adding complexity to integration and maintenance.

Technological advancements and cross industry collaborations shape the industry of tomorrow. They will be enabled further by AI-driven analytics, blockchain for secure data exchanges, and the development of multi-function sensor systems. There is increased investment in sustainable and energy-efficient sensor technology such as self-powered and biodegradable products. Demand is anticipated to evolve and grow strongly in the coming decade with expanding sectors automating their operations, embracing smart infrastructure, and making sensible data-driven decisions.

Accelerometers & Speed account for a 46% share in 2025; this increasing demand for these types of they lead to higher growth in the industry as they help to enhance vehicle safety in automotive, aid industrial automation, and consumer electronics. They are critical for ADAS (Advanced Driver Assistance Systems), smartphones, wearables, aerospace, and robotics.

From stability control for transportation applications to smart motion detection for fitness wearables, many leading players such as Bosch, STMicroelectronics, and Honeywell invest vast amounts of money into MEMS-based accelerometers and high-precision speed products. The increasing adoption of autonomous vehicles and industrial IoT is further creating demand for the segment.

The global adoption of image sensors in smartphones, surveillance, healthcare, and automotive applications will help the Image Sensor segment capture a 54% industry share in 2025. This segment is led by CMOS image sensors, owing to their high resolution, energy efficiency, and cost-effectiveness.

Some of the major players in the development of high-resolution image sensors equipped with AI functions for applications in the areas of autonomous vehicles, facial recognition, and augmented reality technology include companies such as Sony, Samsung, and ON Semiconductor. The growth of smart cities, AI-powered security cameras and developments in medical imaging in particular are further fuelling demand.

The demand for both accelerometer & speed sensors and image sensors will continue to be driven across consumer, industrial, and automotive applications throughout the next decade by increasing automation, integration of AI/machine learning capabilities, and the proliferation of internet-connected products and devices.

The CMOS (Complementary Metal-Oxide-Semiconductor) sensor segment is significantly dominating the industry, contributing 58% of its total share by the year 2025. CMOS technology is the dominant imaging technology in mobile smartphones, automotive cameras, industrial imaging, and security surveillance areas because of its high resolution, low power, and other cost advantages.

Top manufacturers, like Sony, Samsung, and Omni Vision, are constantly refining CMOS sensors with AI imaging, low-light upgrades, and high-speed data processing. This segment is further extended with the adoption of autonomous vehicles, AR/VR applications, AI-driven security cameras, etc.

MEMS are expected to dominate the sensor industry, accounting for 42% of the industry share in 2025 due to their large application in motion sensing, industrial automation, medical devices, and consumer electronics. MEMS (Micro-Electro-Mechanical Systems) based accelerometers, gyroscopes, and pressure are vital components of smartphones, wearables, robotics, and automotive safety systems (examples are airbags and ADAS).

Bosch, STMicroelectronics, and Texas Instruments are some of the well-known American and International MEMS companies mastering the industry with a focus on trends of miniaturization, higher precision, and integration of AI and IoT. The increasing demand for smart manufacturing, IoT-enabled medical devices, and predictive maintenance solutions is anticipated to drive MEMS sensor adoption.

Between AI, automation, IoT, and more, the impending future is looking bright for both CMOS and MEMS, continuing to accelerate the enablement of smart electronics, industrial systems, and connected devices across the globe.

The industry is going through a process of rapid expansion, and the key drivers of its growth are automation, IoT adoption, and advanced AI-driven sensor technology. Automotive is one segment where they play a significant role for ADAS, electric vehicles, and self-driving cars, concentrating on high accuracy and long life.

Health care applications have the highest priority for precision and low power consumption; along with wearables, diagnostics, and patient monitoring systems they also use them. The industrial applications lay stress on cost-effectiveness and reliability to integrate them for process automation, robotics, and predictive maintenance.

The consumer electronics industry is significantly contributing to the growing demand for motion, biometric, and environmental sensors, with emphasis on integration and power efficiency. In aerospace & defence, they are utilized for navigation, surveillance, and safety, requiring high durability and accuracy.

Smart infrastructure reduces energy expenses and automates through environmental and occupancy sensors. The quick proliferation of connected smart solutions in return propels the sensor industry across various sectors.

Contracts and Deal Analysis

| Company | Contract Value (USD million) |

|---|---|

| Bosch Sensortec | Approximately USD 50 - USD 70 |

| STMicroelectronics | Approximately USD 80 - USD 100 |

| Honeywell International | Approximately USD 40 - USD 60 |

| Analog Devices | Approximately USD 30 - USD 50 |

The industry surged in 2024 and early 2025 with development partnerships and technological advancements. This is another indication of the need for better user experiences in consumer products (Bosch Sensortec intends to provide MEMS sensors for future smartphones). Much like STMicroelectronics’ supply contracts for image sensors in autonomous vehicles, which highlights the automotive sector's focus on safety and advanced navigation. Its deployment of green sensors as part of a smart city program provides evidence that the globe is headed toward green urbanization.

During the period 2020 to 2024, the industry expanded at a fast pace driven by growing application in industrial automation, healthcare, automotive, consumer electronics, and smart infrastructure. Growth in IoT-enabled devices, edge computing, and real-time monitoring of data increased demand for temperature, pressure, motion, proximity, and biosensors.

Miniaturization of sensor technology and MEMS and AI-driven sensor analytics improved precision and functionality. The healthcare sector witnessed huge growth in biosensors and wearable health monitors, more so during the COVID-19 outbreak when remote diagnostics driven by AI became at the forefront of patient care. The automotive industry saw increasing demand for ADAS, LiDAR, and radar sensors to improve automation and safety in electric and hybrid vehicles.

From 2025 to 2035, data analytics based on AI, nanosensor technologies, and quantum sensing will revolutionize the industry. Ultra-accurate measurement of medicine, environment, and cyber security will be enabled by quantum sensors. Sensor fusion through AI capability will strengthen real-time analysis of multi-sensor data, predictive diagnosis, and automated decision-making.

The healthcare field will witness nanotechnology-based biosensors, wearable intelligent patches, and bio-integrated sensors for real-time disease diagnosis and targeted treatment. The automotive industry will head towards autonomous mobility with the help of quantum LiDAR, computer vision-enabled smart sensors, and V2X communication for intelligent traffic and safety control.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments imposed environment and safety regulatory compliance, fueling the uptake of them in automotive, health, and industrial applications. | AI-driven sensor data privacy laws, sensor data governance using blockchain, and quantum-based sensor standards will define future policy. |

| Miniaturized MEMS sensors, image based on AI, LiDAR, and real-time biosensor analysis improved performance. | Quantum sensors, real-time AI-based sensor fusion, and nanotechnology-derived biodegradable sensors will transform smart monitoring and diagnostics. |

| They found applications in numerous applications of automotive safety, industrial automation, wearable health monitoring, and smart infrastructure. | AI-powered predictive maintenance, bio-integrated health, and quantum-enhanced smart with self-power will have broader industry uses. |

| AI-enabled sensor-based IoT devices boosted automation, predictive analytics, and real-time remote monitoring. | Next-gen smart industries will be driven by decentralized AI-backed sensor networks, blockchain-encrypted smart sensing, and real-time V2X communication. |

| MEMS-based low-power, AI-optimized, and energy-efficient sensor networks lowered costs. | Self-sustaining, biodegradable sensors, AI-optimized predictive energy optimization, and recyclable sensor materials will increase sustainability and affordability. |

| AI-driven sensor analytics enhanced industrial automation, healthcare monitoring, and autonomous vehicle navigation. | Quantum computing-based real-time sensor data analysis, AI-based predictive diagnostics, and decentralized smart sensor networks will revolutionize predictive analytics. |

| Industry challenges were semiconductor shortages, high cost of production, and supply chain interruptions. | AI-optimized sensor supply chains, decentralized production of sensors, and blockchain-secured sensor data logistics will make the industry more resilient. |

| IoT growth, growing adoption of AI, growing demand for real-time monitoring, and automation trends powered growth. | Future industry growth will be driven by the growth of AI-driven predictive maintenance, intelligent bio-integrated products, and eco-friendly sensor solutions. |

Industry growth is significantly fuelled by high demand in sectors like automotive, healthcare, consumer electronics, and industrial automation. Although, research and development (R&D) costs high and financial issues companies deal with, they need to work on cost-efficient production, strategic partnerships, and continuous innovations to be able to keep profitability and competitiveness in the industry.

Supply chain disruptions such as semiconductor shortages and reliance on rare materials, have a direct effect on production and pricing. The geopolitical tensions, trade restrictions, and raw material cost fluctuations further bring instability to the industry. Firms will have to resort to diversifying suppliers, greenfield manufacturing, and other alternative materials to stave off the issues and carry on with a steady production.

Cybersecurity is a growing concern with them being integrated into IoT networks and critical infrastructure. Breaches like hackers accessing secured data, and gains by third-party handlers, could affect the functionality of the software and the privacy of the customers. Hence, the integration of encryption techniques, artificial intelligence for threat recognization, and secure communication paths is the crux for the safeguarding of data and trust from consumers.

Regulation hurdles regarding the adherence to environmental, health, and data protections affect both the sensor manufacturers and the deployment of them. Companies should acknowledge both the evolving regulations and the initiation of these changes, while they will need certifications, and will have to ensure that all regulations are strictly followed to avoid the legal and operational disruption. Long-term sustainability in the sensor's sector will be through constant innovations, strong supply chains, and adopting rigorous cyber methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| France | 7.1% |

| Germany | 7.3% |

| Italy | 7% |

| South Korea | 7.6% |

| Japan | 7.4% |

| China | 8% |

| Australia | 6.9% |

| New Zealand | 6.8% |

The industry in the United States is likely to record 7.5% CAGR from 2025 to 2035. The USA industry evolves dynamically as industries adopt high-tech sensor technology. High-tech sensor technology is adopted by healthcare, automotive, and industrial automation industries. Greater utilization of AI and IoT-based product increases real-time monitoring and predictive maintenance capabilities. Industry leaders such as Texas Instruments, Honeywell, and Amphenol develop semiconductor-based products, leading industry competitiveness. Stringent regulatory requirements propel energy-efficient and safety-improving sensor solutions for the industrial and consumer industries.

The USA automotive industry uses high-end LiDAR, radar, and vision products for autonomous driving and enhanced car safety. The consumer electronics industry is assisted by rising demand for wearable products and smart home applications. Industry automation's rapid growth also assists smart manufacturing technology like sensors. Medical sensor innovations, like biosensors and remote patient monitoring, also drive the industry forward. There are also private investment and government programs available to drive innovation in sensor technology to make America a favorable place to innovate products.

The industry is likely to account for a CAGR of 7.2% through 2035. The UK industry continues to grow steadily on the heels of the growing adoption of smart manufacturing, digital healthcare, and IoT-based infrastructure technology. The growing demand for performance by aerospace and defense companies also provides a further boost to growth. Renishaw and BAE Systems dominate among precision measuring technologies and defense sensor technology. Government initiatives through smart city development and environment monitoring provide an impetus for further deployment of sensor-based solutions.

Healthcare and industrial automation industries lead the demand for them, with AI-driven diagnostic equipment and sophisticated robots in demand. The automotive sector perceives a growing demand for smart sensors in electric and autonomous cars. The UK is sustainability-conscious, meaning energy-efficient and low-power sensor solutions. Growth in 5G networks facilitates IoT-based sensor applications, further enhancing the country's competitiveness in the international industry.

The industry in France is projected to be around 7.1% during the forecast period. France's industry prospers on account of its dominance in aerospace, automotive, and industrial automation. Schneider Electric and Safran are the drivers of innovation for energy-efficient and aerospace-quality sensor technologies. Smart infrastructure and sustainability drivers drive increased adoption of sensor-based environmental monitoring and energy management systems.

The industry for car products grows with France shifting towards electric and autonomous cars, focusing on efficiency and safety. Healthcare is supported through biosensors and wearable healthcare technology development. Growth in intelligent production factories and automation technologies based on AI also starts sensor installations in production industries. Government initiatives toward Industry 4.0 and digitalization also contribute to industry growth.

The industry is set to record a CAGR of 7.3% during the forecast period. Germany's industry grows exponentially because the country is at the forefront of automotive engineering, industrial automation, and intelligent manufacturing. Bosch, Infineon, and Siemens lead technology development based on precision, efficiency, and energy conservation. Autonomous vehicles and Industry 4.0 growth drive demand for high-performance products.

Automotive products drive the trend to electric and autonomous vehicles in Germany. They are applied in production to optimize processes and perform preventive maintenance. The diagnostic sensor and medical imaging sensor form geometric growth in the health care industry. The need for sustainable energy solutions drives the demand for power-aware sensor technology in power generation and supply.

The industry is projected to register a CAGR of 7% through 2035. Italy's industry develops steadily because of its robust industrial automation and automotive industries. STMicroelectronics and Leonardo lead the development of semiconductor and defense sensor technology. AI-driven manufacturing platforms and IoT-based products' penetration enhance business efficiency across industries.

Car sensor demand rises as Italy accelerates shift towards electric mobility. Smart farming sees environment and precision agriculture sensors being used on a large scale to maximize resources. Healthcare and wearables technology segments also see rising investment in sensor-based diagnostics. Digital transformation policy initiated by governments also drives the growth of the industry.

The market in South Korea is likely to register 7.6% CAGR during the forecast period. South Korea's industry is already in high growth mode, and the country is leading in semiconductor technology, consumer electronics, and smart city programs. Samsung, LG, and SK Hynix are leading innovations in industrial and consumer sensor solutions for high-performance applications. Sensor solutions enabled by AI enhance automation, healthcare, and transport industries.

The government is investing in sensor-based infrastructure and security and deploying IoT-based smart city solutions. The automotive sector uses sophisticated sensors in electric and autonomous vehicles. Furthermore, 5G connectivity enables the increasing adoption of real-time monitoring solutions for healthcare, industrial automation, and environmental use.

In Japan, the industry is likely to record 7.4% CAGR during the forecast period. Robotics, automation, and precision manufacturing drive the Japanese industry. Sony, Panasonic, and Omron are at the forefront of innovations concerning imaging, motion, and industrial. Miniaturization and high-performance are committed to consumer electronics, car safety, and medicine.

The growth of autonomous mobility and the automation of factories accelerate industries' adoption of them. Smart home devices and IoT products gain traction and propel the demand for smart sensing solutions. Growth in AI and machine learning also increases the capability of them in real-time processing.

The market in China is projected to grow at a CAGR of 8% during the forecast period. China's industry grows exponentially as it dominates consumer electronics, automotive, and industrial automation. Huawei, Xiaomi, and BYD foster innovation in AI-based and IoT-based. Government initiatives that fuel smart cities and digitalization again drive the industry growth.

The automotive industry witnesses an expansion in demand for them as China invests in developing its electric vehicle industry. The health sector witnessed a boom in investments in remote health monitoring and wearable sensor technology. Leadership in semiconductors in the nation contributes to facilitating growth in sensor production capacity.

The industry in Australia is likely to record a CAGR of 6.9% during the forecast period. The industry in Australia expands with the growth in industries investing in automation, smart infrastructure, and environment monitoring technology. ResMed and Cochlear are some of the forces behind the innovation of healthcare and medical devices. Renewable energy projects drive demand for smart grid and energy management technology.

The agricultural sector is supported by precision agriculture technology, which improves efficiency and makes agriculture sustainable. Further, smart city plans enable the implementation of sensor-based traffic monitoring and environmental monitoring systems.

The industry in New Zealand is set to record a CAGR of 6.8% during the forecast period. The industry in New Zealand remains steady with applications that range from smart agriculture to healthcare and the environment. Medical technologies built on sensor technology are led by Fisher & Paykel Healthcare entities. The government advocates IoT-based technologies for building resource efficiency as well as sustainable outcomes.

More investment in renewable energy uses increases the need for smart grid. Investment in data analytics and AI also improves sensor-based decision-making in most sectors.

The industry is highly fragmented and competitive, and the continually increasing demand across industrial automation, consumer electronics, healthcare, automotive, and smart infrastructure sectors will drive growth in this area. The industry is being driven at a high rate by the increasing usage of AI-based data analytics, IoT-enabled smart sensors, and miniaturized components for innovation and industry growth. Other driving factors for industry growth are progress in the fields of biometrics, environmental monitoring, and autonomous systems, as well as rising applications in predictive maintenance and safety-critical solutions.

These include mature technology companies with advanced research & development capabilities, which also usually have an extensive distribution network and an emphasis on continued innovation (e.g., Texas Instruments, Bosch Sensortec, STMicroelectronics, Honeywell International Inc., and NXP Semiconductors) that dominate this industry. Moreover, niche players and startups have focused on energy-efficient, AI-integrated, and high-precision sensor solutions targeted for use in the new applications of IoT, smart cities, and wearables.

The growth of the industry is driven by many other real forces, such as the advancements in MEMS (Micro-Electro-Mechanical Systems) technology, AI integration for predictive sensing, and regulatory focus on the accuracy and reliability of them. For a long-term presence, companies focus on expansion of product line, development of new sensor technology and penetration in high-growth sectors including healthcare and automotive safety.

Key dynamics shaping competition include price pressures, supply chain resilience, and changing consumer preferences toward multi-function and connected sensing solutions. As the trend is to automate processes and get data in real-time, sensor manufacturers have to set themselves apart harder than before by providing precision, low power, and smart (AI-integrated) sensor modules that comply with extensive levels of safety standards.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Texas Instruments | 20-25% |

| Bosch Sensortec | 15-20% |

| STMicroelectronics | 12-17% |

| Honeywell International Inc. | 8-12% |

| NXP Semiconductors | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Texas Instruments | Leading in analog and digital sensors, including pressure, temperature, and motion sensing solutions. |

| Bosch Sensortec | Develops MEMS sensors for consumer electronics, automotive, and industrial applications. |

| STMicroelectronics | Specializes in advanced MEMS and environmental sensors for IoT and wearable devices. |

| Honeywell International Inc. | Provides high-precision industrial, aerospace, and safety-critical sensing technologies. |

| NXP Semiconductors | Focuses on automotive and IoT sensor solutions, including radar and biometric sensing. |

Key Company Insights

Texas Instruments (20-25%)

Texas Instruments is a dominant player in the sensor industry, offering a broad range of analog and digital sensing solutions for automotive, industrial, and consumer applications.

Bosch Sensortec (15-20%)

As a world leader in MEMS sensor technology, Bosch Sensortec offers MEMS solutions for smartphones, wearables, and automotive systems, focusing on miniaturization and power efficiency.

STMicroelectronics (12-17%)

STMicroelectronics leverages MEMS and environmental sensors, aligning with AI and IoT capabilities for predictive analytics and real-time monitoring.

Honeywell International Inc. (8-12%)

Honeywell is a leader in high-precision sensors for industrial automation, aerospace, and safety, with a focus on AI-driven data insights.

NXP Semiconductors (5-9%)

NXP Semiconductors offers innovative sensor solutions for automotive and IoT applications, such as radar-based safety systems and biometric authentication.

Other Important Players (30-40% Combined)

The industry covers accelerometer & speed sensor, image sensor, biosensors, optical, pressure sensor, temperature sensor, touch sensor, and others, with image leading due to their widespread use in consumer electronics and automotive applications.

The industry includes CMOS, MEMS, NEMS, and others, with CMOS dominating due to its cost-effectiveness and high efficiency in imaging and sensing applications.

The industry spans aerospace & defense, automotive, electronics, healthcare, industrial, IT & telecom, and others, with automotive holding the largest share due to the increasing demand for sensors in advanced driver assistance systems (ADAS) and autonomous vehicles.

The industry covers North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA), with Asia Pacific leading due to strong sensor manufacturing capabilities and high demand from the automotive and electronics sectors.

The industry is expected to generate USD 250 billion in revenue by 2025.

The industry is projected to reach USD 480 billion by 2035, growing at a CAGR of 6.7%.

Key players include Texas Instruments, Bosch Sensortec, STMicroelectronics, Honeywell International Inc., NXP Semiconductors, Infineon Technologies, Analog Devices Inc., TE Connectivity, Omron Corporation, and Sensirion AG.

Asia-Pacific and North America, driven by advancements in smart devices, automotive safety systems, and industrial automation.

Image and motion dominate due to their extensive applications in smartphones, automotive ADAS (Advanced Driver Assistance Systems), and industrial robotics.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2022 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2022 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2022 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2022 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2022 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2022 to 2033

Figure 21: Global Market Attractiveness by Type, 2022 to 2033

Figure 22: Global Market Attractiveness by Technology, 2022 to 2033

Figure 23: Global Market Attractiveness by End User, 2022 to 2033

Figure 24: Global Market Attractiveness by Region, 2022 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2022 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2022 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2022 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2022 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2022 to 2033

Figure 45: North America Market Attractiveness by Type, 2022 to 2033

Figure 46: North America Market Attractiveness by Technology, 2022 to 2033

Figure 47: North America Market Attractiveness by End User, 2022 to 2033

Figure 48: North America Market Attractiveness by Country, 2022 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2022 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2022 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2022 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2022 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2022 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2022 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2022 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2022 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2022 to 2033

Figure 74: Europe Market Value (US$ Million) by Technology, 2022 to 2033

Figure 75: Europe Market Value (US$ Million) by End User, 2022 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Technology, 2022 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User, 2022 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User, 2022 to 2033

Figure 93: Europe Market Attractiveness by Type, 2022 to 2033

Figure 94: Europe Market Attractiveness by Technology, 2022 to 2033

Figure 95: Europe Market Attractiveness by End User, 2022 to 2033

Figure 96: Europe Market Attractiveness by Country, 2022 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2022 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Technology, 2022 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End User, 2022 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2022 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2022 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2022 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2022 to 2033

Figure 118: Asia Pacific Market Attractiveness by Technology, 2022 to 2033

Figure 119: Asia Pacific Market Attractiveness by End User, 2022 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2022 to 2033

Figure 122: MEA Market Value (US$ Million) by Technology, 2022 to 2033

Figure 123: MEA Market Value (US$ Million) by End User, 2022 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2022 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Technology, 2022 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End User, 2022 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End User, 2022 to 2033

Figure 141: MEA Market Attractiveness by Type, 2022 to 2033

Figure 142: MEA Market Attractiveness by Technology, 2022 to 2033

Figure 143: MEA Market Attractiveness by End User, 2022 to 2033

Figure 144: MEA Market Attractiveness by Country, 2022 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Image Sensors Market Growth – Trends & Forecast through 2034

Chest Sensors Market

PPG Biosensors Market – Size, Share & Growth Forecast 2025 to 2035

Motion Sensors Market

EMG Biosensors Market

Airbag Sensors Market

Shutter Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Quantum Sensors Market Size and Share Forecast Outlook 2025 to 2035

Seismic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Tactile Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA