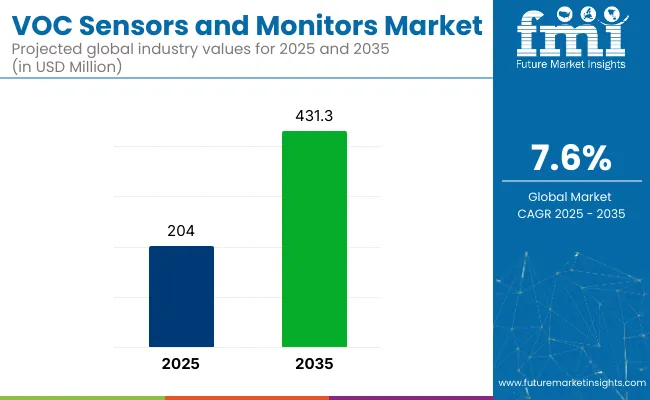

The global VOC sensors and monitors market is valued at USD 204.0 million in 2025 and is slated to reach USD 431.3 million by 2035, reflecting a CAGR of 7.6%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 204.0 million |

| Projected Value (2035) | USD 431.3 million |

| CAGR (2025 to 2035) | 7.6% |

This growth is expected to be fueled by rising environmental awareness, regulatory pressure, and an increasing focus on air quality monitoring in industrial and residential spaces. Demand is also being reinforced by stricter emission norms and the widespread adoption of smart sensor networks across developed and emerging economies.

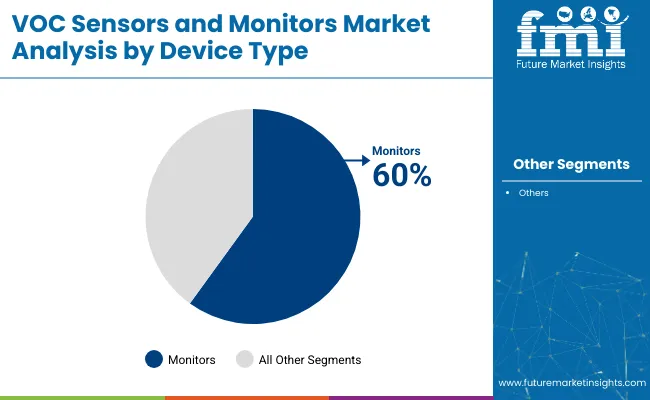

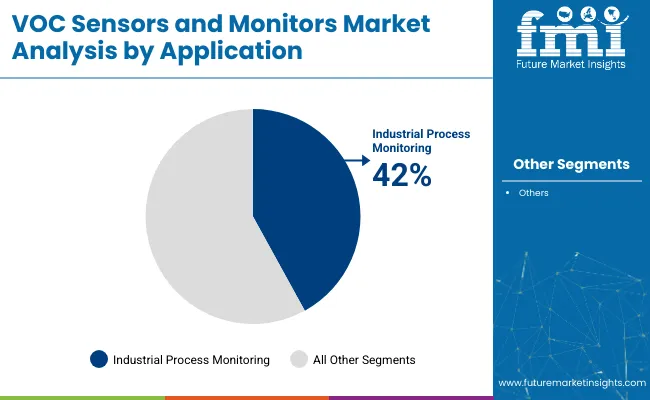

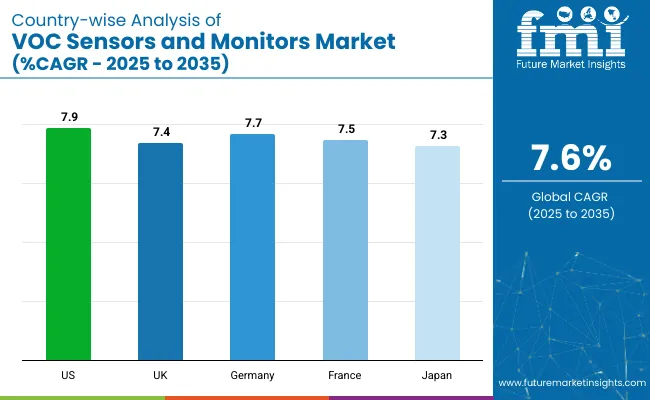

North America is projected to hold the largest market share by 2035 due to its advanced regulatory landscape, especially with the USA rapidly growing at a CAGR of 7.9%. Whereas Germany and France closely follow the fastest growth at CAGRs of 7.7% and 7.5% respectively.Monitors are likely to hold with over 60% share due to their widespread use in heavy industrial settings. Meanwhile, industrial process monitoring by application segment accounts for 42% of the market share.

In terms of the competitive landscape, companies such as Honeywell and Sensirion are witnessing strong profitability due to their IoT-enabled product lines and regulatory-ready solutions. Meanwhile, Japanese firms are facing slower adoption rates due to higher costs and lower penetration of smart systems. Europe is experiencing success in deploying sustainable sensor technologies aligned with its Green Deal initiatives. Government regulations such as the EU’s Industrial Emissions Directive and California’s air quality standards have been instrumental in driving the market forward.

The VOC sensors and monitors market holds varying but impactful shares across its parent markets. Within the indoor air quality monitoring market, it commands a strong 30-35% share, as VOC detection is central to IAQ compliance. In the air quality monitoring market, it contributes around 20-25%, particularly in smart building and urban monitoring applications.

It captures approximately 15% of the gas sensors market, given the diversity of gases measured. In the industrial safety equipment market, its share is about 10-12%, driven by workplace exposure limits. Overall, VOC sensors play a critical role in health, safety, and regulatory monitoring systems.

The global VOC sensors and monitors market is segmented into device type, application, and region. Under device type, the market includes sensors and monitors. By application, it is categorized into industrial process monitoring, environmental monitoring, air purification and monitoring, and leak detection. Regional segmentation covers North America, Latin America, Europe, Asia Pacific, and MEA.

Monitors are projected to hold more than 60% of the global market share through 2035, driven by rising installations in industrial and commercial facilities where real-time VOC tracking is critical. Their integration with IoT platforms enhances their value in regulatory compliance and safety assurance. The ability to continuously detect low-level VOC concentrations has further solidified their role in high-risk and quality-sensitive environments.

Industrial process monitoring is expected to command approximately 42% share of the total application base due to the need for strict compliance in sectors such as oil & gas, chemicals, and heavy manufacturing. Their deployment supports predictive maintenance and reduces exposure risks to hazardous compounds for workers. These systems are increasingly being standardized across production lines to meet emission norms.

Recent Trends in the VOC Sensors and Monitors Market

Key Challenges in the VOC Sensors and Monitors Market

The USA leads the market with a projected CAGR of 7.9%, driven by strict EPA and CARB regulations and advanced IoT integration. Germany follows at 7.7%, supported by EU directives and industrial automation. France and the UK are close behind, with 7.5% and 7.4% CAGRs respectively, fueled by smart infrastructure and emissions compliance.

Japan trails slightly at 7.3%, focusing on compact, efficient sensors under regulatory mandates. Overall, developed economies are showing consistent growth, with the USA and Germany standing out due to strong industrial bases and aggressive clean air policy implementation.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The VOC sensors and monitors revenue in the USA is projected to expand at a CAGR of 7.9% from 2025 to 2035. Growth is driven by stringent state-level regulations, especially in California, and strong demand from industrial sectors such as petrochemicals, manufacturing, and agriculture. High adoption of IoT-enabled monitoring systems and a well-established regulatory compliance infrastructure continue to enhance market penetration. Additionally, investments in smart buildings and indoor air quality improvements are accelerating the demand for advanced VOC sensors.

The demand for VOC sensors and monitors in the UK is forecasted to grow at a CAGR of 7.4% between 2025 and 2035. Growth is supported by ongoing environmental policy reforms and the country’s commitment to its net-zero emissions target by 2050. Industrial and urban monitoring needs are being addressed through smart infrastructure upgrades and air quality initiatives. Additionally, the integration of VOC sensors in public health and transportation projects supports consistent demand across commercial and government sectors.

The VOC sensors and monitors sales in Germany are expected to register a CAGR of 7.7% from 2025 to 2035 in the VOC sensors and monitors market. Its leadership in automation, strong manufacturing ecosystem, and alignment with the EU’s Industrial Emissions Directive contribute significantly to sensor deployment. Demand is particularly high in sectors like chemicals, automotive, and green energy. Germany’s carbon-neutral roadmap for 2045 and industrial digitalization strategies further enhance opportunities for sensor integration across automated and smart factories.

The VOC sensors and monitors market in France is anticipated to grow at a CAGR of 7.5% between 2025 and 2035. France’s adherence to the EU Green Deal and national industrial emission regulations is pushing industries to adopt real-time air quality monitoring systems. High adoption in the automotive and chemical sectors, alongside public infrastructure upgrades, is reinforcing sensor demand. Efforts toward sustainable manufacturing and smart factory rollouts also support long-term growth.

The VOC sensors and monitor revenue in Japan is expected to witness a CAGR of 7.3% through the forecast period of 2025 to 2035. The country’s regulatory policies on air pollution and its focus on reducing industrial emissions are leading factors. However, cost sensitivity and space constraints in factories push demand toward compact, efficient, and cost-effective sensors. Despite slower IoT adoption rates, Japan is investing steadily in sustainable technologies and emission monitoring systems to meet its 2050 carbon neutrality goals.

The VOC sensors and monitors market is moderately fragmented, with a mix of established players and emerging innovators. Leading companies such as Honeywell, Aeroqual, Extech, ams AG, and Figaro Engineering are actively competing through strategies focused on technological innovation, strategic partnerships, and expansion into emerging markets. These firms are leveraging advancements in sensor technology, integration with IoT platforms, and real-time data analytics to enhance product offerings and meet the growing demand for air quality monitoring solutions.

Top players are actively competing on technological innovation, pricing, and integration capabilities. IoT connectivity, miniaturization, and multi-sensor platforms are at the core of differentiation strategies. Firms are also leveraging strategic partnerships, acquisitions, and regional collaborations to strengthen their distribution networks and product portfolios.

Honeywell and Sensirion (via acquisition) are investing in high-accuracy, cloud-enabled VOC sensors, while others like Aeroqual are expanding in the government and environmental monitoring sectors. Focus is also shifting to eco-friendly designs, AI-enabled predictive analytics, and portable monitoring formats for emerging markets.

Recent VOC Sensors and Monitors Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 204.0 million |

| Projected Market Size (2035) | USD 431.3 million |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in units |

| By Device Type | Sensors, Monitors |

| By Application | Industrial Process Monitoring, Environmental Monitoring, Air Purification and Monitoring, Leak Detection |

| Regions Covered | North America, Latin America, Europe, Middle East & Africa, Asia Pacific |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, South Korea, Australia, Brazil |

| Key Players | Honeywell, Aeroqual , Extech , ams AG, Figaro Engineering, Nissha FIS, Inc , Winsen , Membrapor , Alphasense , ION Science |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The industry is bifurcated divided into sensors and monitors.

It is segmented into industrial process monitoring, environmental monitoring, air purification and monitoring, and leak detection.

The market is studied across North America, Europe, Asia Pacific, The Middle East and Africa, and Latin America.

The market is valued at USD 204.0 million in 2025.

The market is forecasted to reach USD 431.3 million by 2035, reflecting a CAGR of 7.6%.

Monitors are expected to lead the market with over 60% share in 2025.

Industrial process monitoring is expected to account for 42% of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 7.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VOC Minimization Packaging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Avocado Oil Market Size and Share Forecast Outlook 2025 to 2035

Levocarnitine Market Size and Share Forecast Outlook 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Online Advocacy Platform Market

Employee Advocacy Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Advocacy Software Market - Enhancing Brand Loyalty

Bio-based and Low VOC Paints Market Size and Share Forecast Outlook 2025 to 2035

Volatile Organic Compound (VOC) Detector Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Avocado Oil in Western europe Size and Share Forecast Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA