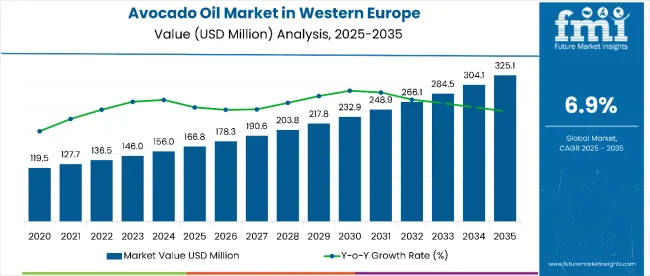

The Western Europe avocado oil market is estimated to be valued at USD 166.8 million in 2025 and is projected to reach USD 325.1 million by 2035, registering a CAGR of 6.9% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 158.4 million between 2025 and 2035, reflecting a 1.95 times growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 166.8 million |

| Forecast Value in (2035F) | USD 325.1 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The market's evolution is expected to be shaped by rising adoption of premium cold-pressed oils, increasing consumer preference for natural and minimally processed products, and expanding applications in both food and beverage and cosmetics sectors.

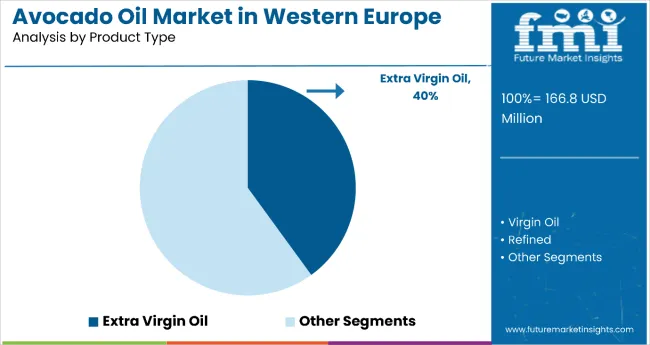

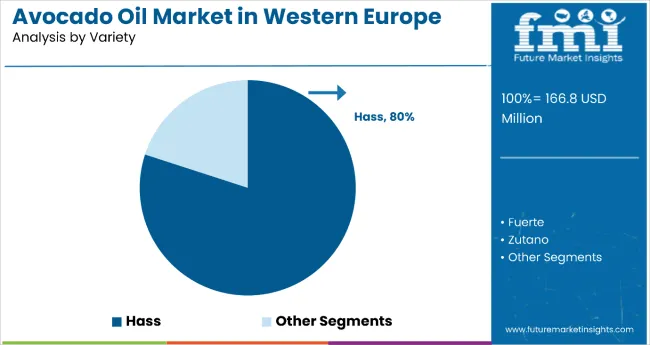

By 2030, the market is likely to reach approximately USD 232.9 million, accounting for USD 66.1 million in incremental value over the first half of the period. The remaining USD 92.2 million is expected during the second half, indicating a slightly back-loaded growth pattern. In absolute terms, this reflects a USD 66.1 million increase from the 2025 market size of USD 166.8 million. Extra virgin avocado oil will dominate with a 40.0% market share in 2025, while the Hass variety will account for 80.0% of production, supported by its flavor profile and oil yield advantages.

Companies such as Olivado Ltd., Grove Avocado Oil, and La Tourangelle, Inc. are advancing their competitive positions through eco-friendly sourcing partnerships, product innovation, and marketing efforts focused on health benefits. Market performance will remain anchored in organic certification, clean-label positioning, and expanding retail distribution channels across Western Europe.

The market holds approximately 38% of the premium edible oil segment, driven by its nutritional benefits, versatility in culinary applications, and strong appeal in the cosmetic and personal care industries. It accounts for around 34% of the health-focused oils market, supported by its high monounsaturated fat content, antioxidants, and vitamins that enhance both heart and skin health. The market contributes nearly 29% to the natural and organic products segment, particularly for clean-label food products, premium skincare formulations, and dietary supplements. It holds close to 21% of the specialty cooking oils market, where avocado oil is valued for its high smoke point, mild flavor, and premium positioning.

The market is undergoing structural transformation fueled by the demand for functional and ethically sourced oils across both food and non-food applications. Advanced cold-press extraction techniques and eco-friendly farming practices have enhanced oil quality, purity, and bioactive retention, positioning avocado oil as a premium alternative to conventional cooking oils and synthetic cosmetic ingredients. Producers are introducing refined, extra virgin, and organic variants tailored to specific market needs in Western Europe, expanding its appeal across retail, foodservice, and personal care sectors.

The market is expanding due to its high nutritional value, versatility in culinary applications, and growing use in premium cosmetic and personal care products. Rich in monounsaturated fats, antioxidants, and vitamins, avocado oil aligns with the region’s strong demand for health-focused, natural, and clean-label products.

Rising consumer awareness of heart health, skin wellness, and eco-friendly sourcing practices is driving adoption across both food and non-food sectors. Advancements in cold-press extraction and organic certification have enhanced oil purity, quality, and bioactive retention, increasing its appeal in retail, foodservice, and cosmetic formulations.

As Western Europe continues to prioritize premium, sustainably sourced, and multifunctional products, avocado oil is well-positioned to capture a larger share of the health-conscious consumer segment, supported by strong innovation pipelines and strategic collaborations between growers, processors, and brands.

The market is segmented by product type, variety, nature, end use, distribution channel, and country. By product type, the market is divided into extra virgin oil, virgin oil, and refined. Based on variety, the market is classified into Hass, Fuerte, Zutano, Bacon, Lamb Hass, Gwen, and others (Pinkerton, Reed, and Ettinger). In terms of nature, the market is segmented into conventional. By end use, the market is divided into personal care and cosmetics, food and beverage processing, functional food and dietary supplements, foodservice, and retail. Based on distribution channel, the market is bifurcated into direct sales and indirect sales. Based on country, the market is classified into UK, Germany, Italy, France, Spain, and the rest of Western Europe.

Extra virgin avocado oil, commanding a substantial 40% share of the Western Europe avocado oil market, is among the most lucrative product types due to its premium quality, superior nutritional profile, and versatility in both culinary and cosmetic applications. Produced through cold-press extraction without chemical solvents, it retains high levels of monounsaturated fats, vitamin E, and antioxidants, appealing to health-conscious consumers.

In Western Europe, where clean-label, minimally processed oils are in strong demand, extra virgin varieties benefit from their association with Mediterranean-style diets and gourmet cooking trends. The growing popularity of functional foods, plant-based diets, and high-quality cooking oils in countries like Germany, the UK, and France is driving steady consumption. Additionally, rising use in skincare formulations owing to its deep moisturizing and anti-inflammatory properties further boosts market penetration.

Hass avocados lead the Western European market, accounting for over 80% of total variety share, due to their superior taste, creamy texture, and year-round availability from global suppliers. The variety’s thick, pebbly skin and high oil content are advantages during transport, making it ideal for long-distance imports from Latin America and Africa. Western Europe’s retail and foodservice sectors prefer Hass for its consistent ripening profile and rich flavor, aligning with consumer demand for premium-quality produce.

In culinary applications, Hass pairs well with gourmet and health-focused recipes, contributing to its popularity in upscale restaurants, meal kits, and home cooking. Countries like the UK, Germany, and the Netherlands rely heavily on Hass imports to meet growing demand, especially in the health-conscious and plant-based segments. Its longer shelf life compared to other varieties further cements its dominance, enabling retailers to minimize waste and maintain supply chain efficiency.

From 2025 to 2035, Western Europe’s food and personal care sectors are witnessing a pronounced shift toward nutrient-rich, clean-label, and functional products. This transition positions avocado oil producers especially those offering extra virgin, cold-pressed varieties as prime partners for meeting consumer demand for premium-quality, multi-use oils.

Premiumization and Multi-Channel Availability Create Market Expansion Opportunity

In 2024, the market began experiencing wider availability across both specialty health food outlets and mainstream supermarket chains, enhancing consumer access and brand visibility. This expansion was further boosted by the oil’s crossover appeal, its ability to serve as a gourmet cooking ingredient and a functional cosmetic component.

By 2025, extra virgin avocado oil was being integrated into value-added food products such as salad dressings, marinades, and functional beverages, while also gaining traction in skincare and haircare formulations due to its deep moisturizing and anti-inflammatory properties. Brands investing in premium packaging, sustainability certifications, and consumer education are well-positioned to capture higher market share, capitalizing on the growing convergence of culinary and personal care demand.

Supply Chain Dependence on Imports Presents Key Market Restraint

While demand is growing, Western Europe remains heavily reliant on avocado imports from Latin America and Africa, making the market vulnerable to supply chain disruptions, weather-related crop losses, and fluctuating export prices. Hass avocados, accounting for over 60% of the regional variety share, are particularly dependent on long-distance shipping, which can impact costs and availability.

Seasonal price volatility, combined with sustainability concerns related to water usage in avocado cultivation, is prompting scrutiny from both consumers and regulatory bodies. These factors underscore the need for diversified sourcing strategies, investment in local processing capabilities, and transparent supply chain practices to mitigate risks and sustain market growth.

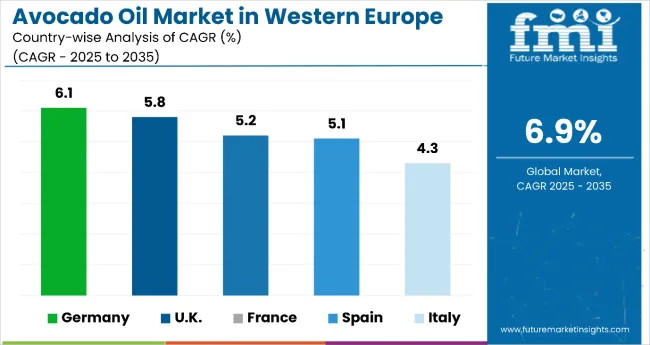

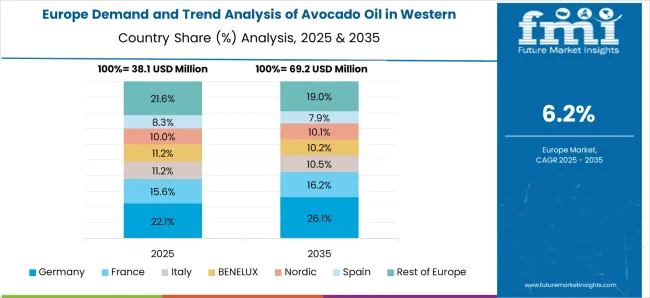

| Countries | CAGR |

|---|---|

| Germany | 6.1% |

| UK | 5.8% |

| France | 5.2% |

| Spain | 5.1% |

| Italy | 4.3% |

In the Western Europe avocado oil market, Germany leads with the highest CAGR of 6.1%, reflecting strong health-conscious consumer behavior, robust retail penetration, and premium product adoption. The UK, with a CAGR of 5.8%, benefits from premiumization trends, plant-based diet adoption, and expanding e-commerce channels. France follows at 5.2%, driven by gourmet culinary integration, a flourishing organic sector, and demand for traceable, ethically produced products. Spain registers 5.1%, supported by its dual role as producer and consumer, alignment with the Mediterranean diet, and rising export opportunities. Italy has the lowest CAGR at 4.3%, yet its growth is supported by gourmet positioning, fusion cuisine adoption, and beauty industry applications.

Revenue from avocado oil in Germany is projected to grow at a CAGR of 6.1% from 2025 to 2035. The market’s growth is driven by rising health-conscious consumer behavior, a shift toward natural cooking oils, and increasing imports from Latin American suppliers. Expanding retail penetration, both online and offline, has made avocado oil accessible across major cities. Germany’s strong emphasis on organic certifications and sustainability are encouraging premium product adoption. The increasing influence of global cuisines in household cooking is also boosting avocado oil’s popularity. Restaurants and food service outlets are integrating avocado oil in both cold and hot applications. Germany’s robust logistics network supports consistent supply, reducing import delays. The trend toward functional food ingredients continues to shape product innovation and marketing strategies.

The UK avocado oil market is anticipated to expand at a CAGR of 5.8% from 2025 to 2035. Avocado oil is increasingly featured in specialty stores, organic supermarkets, and e-commerce platforms. UK consumers are willing to pay a premium for organic and sustainably sourced oils. The growth of at-home cooking culture post-pandemic has boosted retail sales. Social media trends and celebrity endorsements are influencing awareness and consumption patterns. Partnerships between local distributors and global avocado oil producers are strengthening supply stability. Increased use of avocado oil in cosmetic and personal care products is also contributing to revenue. The UK’s multicultural food scene further supports product diversity and demand.

Demand for avocado oil in France is forecast to grow at a CAGR of 5.2% from 2025 to 2035. Chefs and home cooks are embracing avocado oil for salad dressings, marinades, and sautéing due to its health benefits and mild flavor. The organic segment is showing strong momentum, supported by France’s well-established organic retail infrastructure. The beauty and skincare sector is integrating avocado oil into premium product lines. French consumers value product traceability, pushing suppliers to enhance transparency in sourcing. The Mediterranean diet’s popularity is indirectly benefiting avocado oil demand. Collaborations with Michelin-star chefs are boosting brand credibility. France’s active participation in food innovation fairs also promotes new product launches in the segment.

Revenue from avocado oil in Spain is projected to register a CAGR of 5.1% from 2025 to 2035. Spain’s market benefits from being both a consumer and producer in the avocado value chain. The country’s Mediterranean diet culture aligns well with avocado oil’s health positioning. Local production in southern Spain reduces dependency on imports and supports fresher supply. Demand from restaurants, particularly in health-focused dining, is growing steadily. Export opportunities are expanding due to Spain’s competitive production costs. The increasing presence of avocado oil in food tourism experiences and cooking classes is also boosting domestic and international recognition. Spain’s government initiatives promoting healthier diets further contribute to market expansion.

Sales of avocado oil in Italy are expected to grow at a CAGR of 4.3% from 2025 to 2035. Italy’s demand is driven by the intersection of gourmet cooking and health trends. Italian consumers are showing increased interest in plant-based and organic oils as alternatives to traditional olive oil. The product is gaining popularity in high-end restaurants, especially in fusion cuisine. Online and specialty food retailers are expanding their avocado oil offerings. Imports from Spain and South America ensure steady supply despite limited domestic production. The beauty industry is incorporating avocado oil into luxury skincare ranges. Italy’s strong culinary heritage and export-oriented food manufacturing sector create opportunities for locally branded avocado oil products.

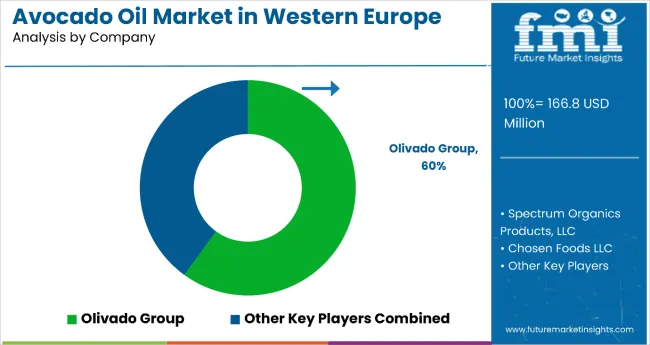

The market is moderately consolidated, with leadership held by Olivado Ltd., commanding an estimated 60% market share. The company leverages vertically integrated sourcing, premium cold-pressed product positioning, and a robust European distribution network to maintain its dominance.

Key players in the market include Grupo Industrial Batellero S.A. de C.V., Chosen Foods LLC, La Tourangelle Inc., Grove Avocado Oil, Primal Kitchen, and Ahuacatlan Avocado Oil, each offering a diverse portfolio of culinary-grade, cosmetic-grade, and organic avocado oils. Their strategies focus on eco-friendly sourcing, organic certification, and targeting both the retail and foodservice channels across Germany, the UK, France, Spain, and Italy.

Emerging participants are entering through private-label supply contracts with European supermarket chains, health store networks, and e-commerce platforms, often focusing on innovative packaging formats, infused flavors, and clean-label claims. While established players retain a competitive edge through quality consistency, brand reputation, and certified supply chains, new entrants are finding opportunities in niche health-conscious segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 166.8 Million |

| Product Type | Extra Virgin Oil, Virgin Oil, and Refined |

| Variety | Hass, Fuerte, Zutano, Bacon, Lamb Hass, Gwen, and Others (Pinkerton, Reed) |

| Nature | Conventional |

| End Use | Food & Beverages Processing, Cosmetics & Personal Care, Pharmaceuticals, and Functional Foods and Dietary Supplements, Foodservice, Retail |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | Western Europe |

| Country Covered | Germany, France, United Kingdom, Italy, Spain, Netherlands, Belgium |

| Key Companies Profiled | Spack BV, Gustav Heess Oleochemische Erzeugnisse GmbH, Henry Lamotte Oils GmbH, Hunter & Gather Foods Ltd, Sesajal S.A de C.V., Grupo Industrial Batellero, Grove, Cibaria International, Olivado USA, Spectrum Organics Products, LLC, Bella Vado Inc., The Village Press, La Tourangelle, Inc. |

| Additional Attributes | Dollar sales by source and application segment; demand driven by clean-label trends, premium positioning in culinary applications, expanding use in natural cosmetics; technological advances in cold-press extraction improving oil quality, nutrient retention, and sustainability |

The global demand and trend analysis of avocado oil in western europe is estimated to be valued at USD 166.8 million in 2025.

The market size for the demand and trend analysis of avocado oil in western europe is projected to reach USD 325.1 million by 2035.

The demand and trend analysis of avocado oil in western europe is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in demand and trend analysis of avocado oil in western europe are extra virgin oil, virgin oil and refined.

In terms of variety, hass segment to command 80.0% share in the demand and trend analysis of avocado oil in western europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA