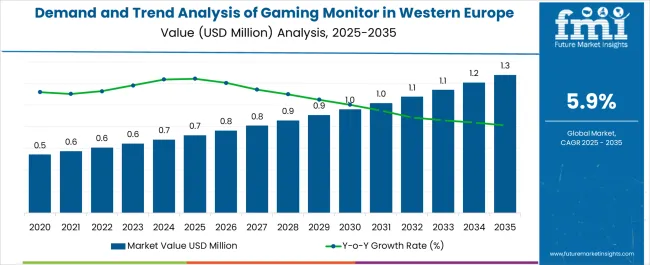

The Demand and Trend Analysis of Gaming Monitor in Western Europe is estimated to be valued at USD 0.7 million in 2025 and is projected to reach USD 1.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Trend Analysis of Gaming Monitor in Western Europe Estimated Value in (2025 E) | USD 0.7 million |

| Demand and Trend Analysis of Gaming Monitor in Western Europe Forecast Value in (2035 F) | USD 1.3 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The gaming monitor market in Western Europe is witnessing notable growth driven by expanding adoption of high-performance gaming hardware, increasing popularity of competitive eSports, and rising consumer expectations for immersive visual experiences. Demand is being supported by continuous innovation in display technologies, including higher refresh rates, faster response times, and adaptive sync features that cater to both casual and professional gamers.

Consumer spending on premium gaming setups has been increasing, supported by higher disposable incomes and the strong presence of global gaming hardware brands in the region. Online platforms and physical retail chains are actively competing to expand market reach, with promotions, bundled offers, and product customization options contributing to wider adoption.

The future outlook remains optimistic as gaming continues to transition into mainstream entertainment, with growth further accelerated by integration of cloud-based gaming, augmented reality, and next-generation consoles The market is positioned for sustainable expansion as product differentiation and brand strategies align with evolving gamer preferences across the region.

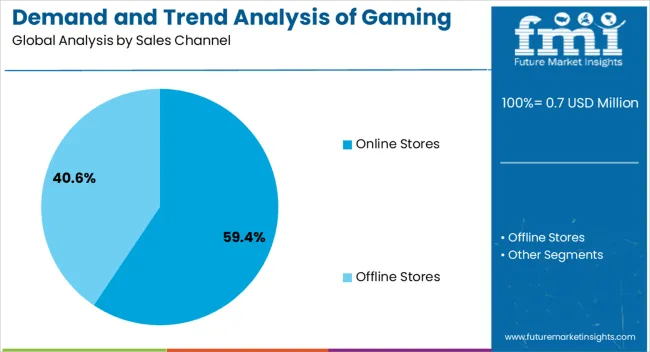

The online stores segment, holding 59.40% of the sales channel category, is dominating the market due to its ability to offer competitive pricing, product variety, and convenience. Growth has been supported by the increasing consumer preference for digital shopping experiences, coupled with widespread access to high-speed internet and secure payment systems in Western Europe.

Online platforms have become the primary distribution channel for gaming monitors, as they facilitate transparent price comparisons, detailed product specifications, and customer reviews that drive informed purchasing decisions. Market share has been reinforced by frequent promotional campaigns, exclusive online deals, and direct-to-consumer models adopted by leading brands.

With expanding logistics networks and reduced delivery timelines, online channels are expected to maintain dominance, while integration of virtual product demonstrations and AR-based visualization tools will further enhance consumer engagement and sustain growth.

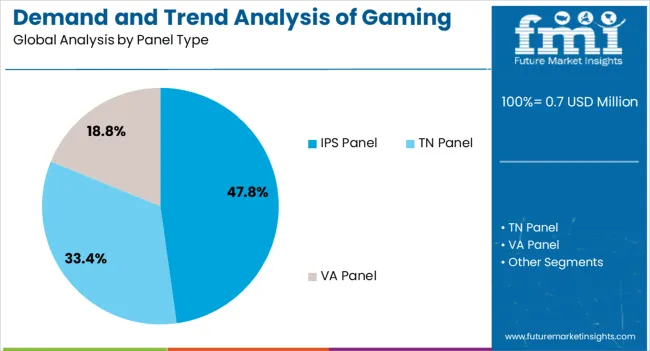

The IPS panel segment, accounting for 47.80% of the panel type category, has emerged as the leading choice among consumers due to its superior color accuracy, wide viewing angles, and balanced performance in both gaming and multimedia applications. Adoption has been supported by consistent demand from competitive gamers and content creators who prioritize visual fidelity alongside responsive gameplay.

The segment’s growth has been further strengthened by advancements in IPS technology, which have reduced latency and improved refresh rates, closing the gap with alternative panel types. Brand positioning strategies have emphasized IPS monitors as premium offerings, appealing to both mid-range and high-end buyers.

Market leadership is also being reinforced by increasing availability across online and offline channels, while product innovations such as HDR support and energy-efficient designs are expected to drive sustained demand, ensuring the IPS panel segment continues to anchor market growth across Western Europe.

Online stores are the dominant way in which gaming monitors are bought in Western Europe. For 2025, online stores are expected to account for 65.0% of the industry share by sales channel.

| Demand for Gaming Monitor in Western Europe Based on Sales Channel | Online Stores |

|---|---|

| Industry Share in 2025 | 65.0% |

Online stores not only provide convenience to consumers but also facilitate easy comparisons between different products. In a technologically advanced industry like gaming monitors, online-only product launches are common. Thus, the online sector is dominating the sales channel for gaming monitors in Western Europe.

VA panels are the preferred panel type in Western Europe. In 2025, VA panels are predicted to hold 55.4% of the industry share by panel type.

| Demand for Gaming Monitor in Western Europe Based on Panel Type | VA Panel |

|---|---|

| Industry Share in 2025 | 55.4% |

Advancements in frame rates are making consumers try out different panels like IPS panels. However, the VA panel remains the prevalent type of panel in Western Europe. VA panels are generally regarded to deal with contrast better and thus Western European consumers are buying VA panel gaming monitors.

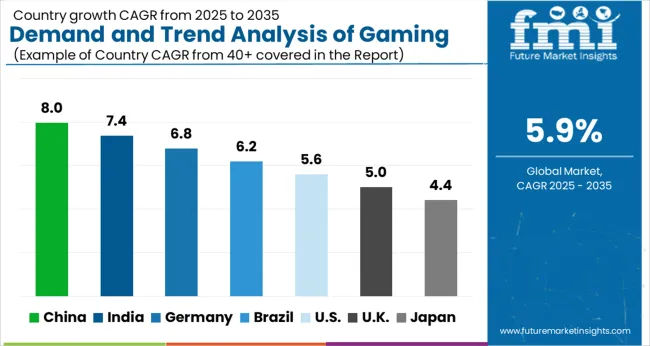

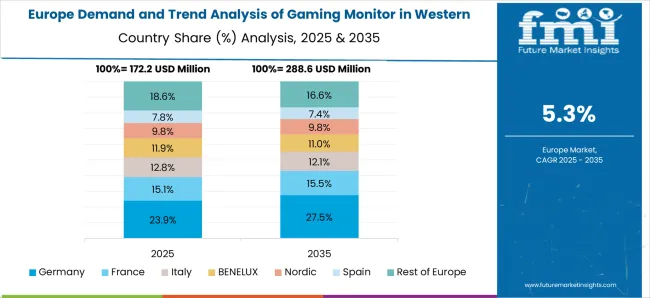

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.9% |

| Germany | 6.4% |

| France | 6.1% |

The United Kingdom is a highly lucrative place for gaming monitors. During the forecast period, gaming monitor demand in the United Kingdom is set to progress at an encouraging CAGR of 6.9%. Companies in the country are attracting consumers by offering discounts. For instance, the prominent player Currys regularly hosts online sales of gaming monitors at discounted prices

Germany is set to see sturdy growth in the gaming monitor industry, with a predicted CAGR of 6.4% for the forecast period. Germany is home to several manufacturing plants from prominent companies.

The country hosts several manufacturing plants operated by prominent companies, including Dell Technologies and Cherry Europe. The presence of these manufacturing plants is contributing to the increased sale of gaming monitors in the country.

France is another Western European country where the industry is expected to thrive. For the forecast period, the projected CAGR for the industry in France is a solid 6.1%. In recent times, the number of gamers in France have increased at a rapid pace.

It is claimed that about one-third of the population in this country at least plays video games or views gaming content. Thus, gaming monitor sales are going up in France.

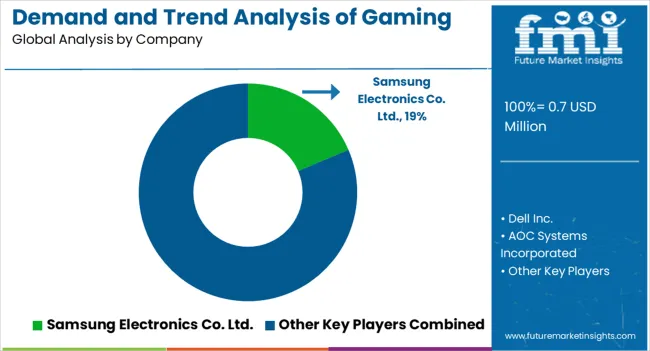

The gaming monitor scene in Western Europe is moderately fragmented. While established players with popular products have captured a sizable chunk of the industry, there is plenty of room for small-scale players.

Development in technology is the name of the game in Western Europe. As the resolutions and frame rates get better, there is jostling among the players to incorporate newer technology into products.

Recent Developments Observed in Gaming Monitor in Western Europe

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.7 million |

| Projected Industry Size in 2035 | USD 1.3 million |

| Anticipated CAGR between 2025 to 2035 | 5.9% CAGR |

| Historical Analysis of Demand for Gaming Monitor in Western Europe | 2020 to 2025 |

| Demand Forecast for Gaming Monitor in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Gaming Monitor in Western Europe, Insights on Global Players and Leading Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western European Providers |

| Key Companies Profiled | Samsung Electronics Co. Ltd.; Dell Inc.; AOC Systems Incorporated; LG Electronics; Lenovo Group Limited; Acer Inc.; MICRO-STAR INTERNATIONAL CO. LTD.; Qisda Corporation; SCEPTRE Inc.; ViewSonic Corporation; Gigabyte Technology |

| Key Countries Profiled | United Kingdom, Germany, France, BENELUX, Sweden, Norway, Denmark, Italy, Spain |

The global demand and trend analysis of gaming monitor in western europe is estimated to be valued at USD 0.7 million in 2025.

The market size for the demand and trend analysis of gaming monitor in western europe is projected to reach USD 1.3 million by 2035.

The demand and trend analysis of gaming monitor in western europe is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand and trend analysis of gaming monitor in western europe are online stores and offline stores.

In terms of panel type, ips panel segment to command 47.8% share in the demand and trend analysis of gaming monitor in western europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA