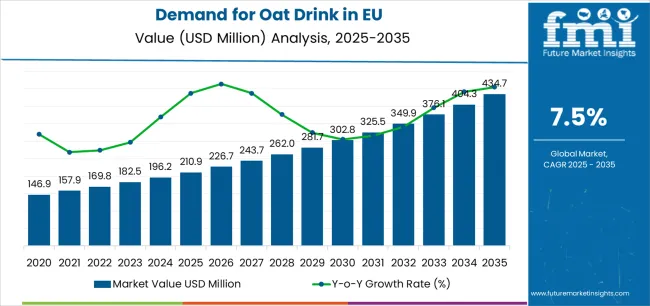

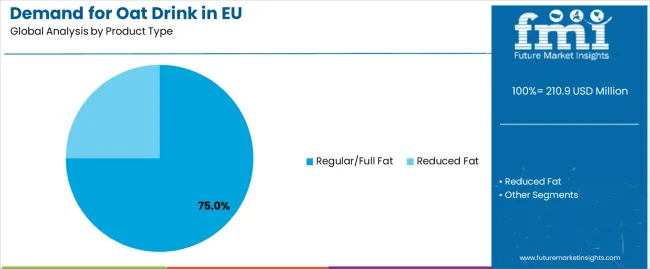

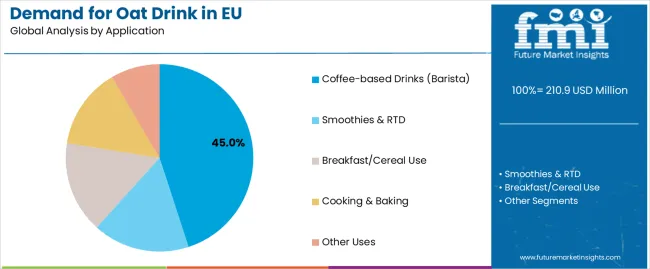

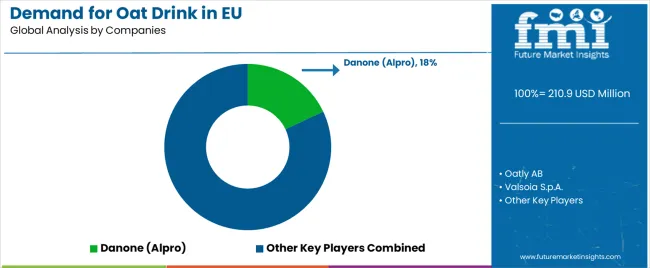

EU oat drink industry is likely to grow from USD 210.9 million in 2025 to USD 434.7 million by 2035, advancing at a CAGR of 7.5%. The regular/full fat segment is expected to lead sales with a 75.0% share in 2025, while the coffee-based drinks (barista) application is anticipated to account for 45.0% of the application segment.

FMI’s recent insights, acknowledged across nutrition, sweetener, and alternative protein markets, indicate that the industry size is expected to grow by nearly 2.1X during the same period, supported by the increasing shift toward plant-based beverages, growing barista-grade oat drink adoption in cafés, and developing applications across breakfast, cooking, and ready-to-drink formats throughout European retail and food service channels.

Between 2025 and 2030, EU oat drink demand is projected to expand from USD 210.9 million to USD 302.8 million, resulting in a value increase of USD 91.9 million, which represents 41.1% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer adoption of plant-based milk alternatives, increasing availability of barista-grade oat drink formulations across café chains, and growing mainstream acceptance of oat-based beverages across retail and food service channels. Manufacturers are expanding their product portfolios to address the evolving preferences for improved taste profiles, authentic milk-like texture, and functionally optimized formulations comparable to conventional dairy milk for coffee applications.

From 2030 to 2035, sales are forecast to grow from USD 302.8 million to USD 434.7 million, adding another USD 131.9 million, which constitutes 58.9% of the overall ten-year expansion. This period is expected to be characterized by further expansion of organic and premium varieties, integration of functional ingredients for enhanced nutritional benefits, and development of innovative flavor combinations targeting diverse consumer preferences. The growing emphasis on sustainable production practices and increasing consumer willingness to pay premium prices for high-quality plant-based alternatives will drive demand for superior oat drink products that deliver authentic dairy-like experiences with environmental sustainability credentials.

Between 2020 and 2025, EU oat drink sales experienced robust expansion at a CAGR of 7.5%, growing from USD 146.9 million to USD 210.9 million. This period was driven by increasing health consciousness among European consumers, rising awareness of plant-based nutrition benefits, and growing recognition of oat drink's superior frothing capabilities for coffee applications. The industry developed as major beverage companies and specialized plant-based brands recognized the commercial potential of oat-based milk alternatives. Product innovations, improved processing techniques, and taste profile enhancements began establishing consumer confidence and mainstream acceptance of oat drink products across café and retail channels.

Industry expansion is being supported by the rapid increase in flexitarian and vegan consumers across European countries and the corresponding demand for sustainable, nutritious, and functionally superior dairy alternatives with proven performance in coffee, smoothie, and culinary applications. Modern consumers rely on oat drink as a direct replacement for dairy milk in morning coffee routines, breakfast cereals, smoothie preparation, and cooking applications, driving demand for products that match or exceed dairy milk's functional properties, including creamy texture, neutral taste, and superior frothing performance for barista applications. Environmental consciousness and sustainability concerns are driving comprehensive adoption of oat drink as consumers recognize its lower carbon footprint compared to dairy milk and other plant-based alternatives.

The growing awareness of plant-based nutrition and increasing recognition of oat drink's health benefits are driving demand for oat drink products from certified producers with appropriate quality credentials and ingredient transparency. Regulatory authorities are increasingly establishing clear guidelines for plant-based beverage labeling, nutritional fortification standards, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and nutritional analyses are providing evidence supporting oat drink's digestive benefits and functional advantages, requiring specialized processing methods and standardized production protocols for authentic milk-like taste development, optimal nutritional profiles, and appropriate functional characteristics including protein content and calcium fortification.

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into regular/full fat and reduced fat formats. Based on application, sales are categorized into coffee-based drinks (barista), smoothies & RTD, breakfast/cereal use, cooking & baking, and other uses. In terms of distribution channel, demand is segmented into food services (HoReCa), retail stores (brick & mortar), and online retail. By nature, sales are classified into conventional and organic. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The regular/full fat segment is projected to account for 75.0% of EU oat drink sales in 2025, declining slightly to 73.0% by 2035, establishing itself as the dominant format across European consumers and food service operations. This commanding position is fundamentally supported by regular oat drink's superior taste characteristics, comprehensive application versatility from coffee to cooking, and optimal sensory experience delivering authentic milk-like satisfaction. The regular format delivers exceptional consumer appeal, providing retailers and cafés with a product category that facilitates household penetration, repeat purchase behavior, and brand loyalty essential for category growth.

This segment benefits from mature product development, well-established retail placement, and extensive variety from multiple plant-based brands who maintain rigorous quality standards and continuous innovation. Additionally, regular oat drink offers versatility across various applications, including coffee preparation, breakfast cereals, smoothie bases, and cooking ingredients, supported by proven formulation technologies that deliver superior frothing capabilities and taste neutrality enabling seamless dairy milk replacement.

Key advantages:

Coffee-based drinks and barista applications are positioned to represent 45.0% of total oat drink demand across European operations in 2025, expanding to 46.0% by 2035, reflecting the segment's dominance as the preferred use case within the overall category. This substantial share directly demonstrates that barista applications represent the primary consumption driver, with cafés, coffee shops, and home coffee enthusiasts utilizing oat drink for its superior frothing capabilities, neutral taste profile, and authentic milk-like performance in espresso-based beverages.

Modern consumers increasingly view oat drink as the optimal plant-based alternative for coffee preparation, driving demand for products optimized for steaming performance, microfoam creation, and taste compatibility with espresso that resonates beyond core vegan demographics. The segment benefits from continuous innovation focused on barista-specific formulations, professional-grade performance characteristics, and specialized processing enabling consistent frothing results comparable to dairy milk.

Key drivers:

EU oat drink sales are advancing rapidly due to increasing plant-based diet adoption, growing café culture embracing barista-grade alternatives, and rising environmental consciousness regarding dairy consumption. However, the industry faces challenges, including oat supply volatility affecting raw material costs, refrigerated logistics constraints limiting distribution flexibility, and regulatory labeling changes impacting marketing claims. Continued innovation in processing technologies and functional optimization remains central to industry development.

The rapidly accelerating development of barista-grade formulation technologies is fundamentally transforming oat drink from basic plant-based alternatives to professional-quality coffee ingredients, enabling frothing performance and steaming characteristics previously unattainable through standard oat drink formulations. Advanced processing platforms featuring enzyme treatment, homogenization optimization, and protein stabilization allow manufacturers to create barista-edition oat drinks with superior microfoam creation, temperature stability, and latte art capability comparable to whole dairy milk. These functional innovations prove particularly transformative for café operators, professional baristas, and coffee enthusiasts where frothing performance proves essential for beverage quality and customer satisfaction.

Major oat drink brands invest heavily in barista formulation development, café partnerships, and professional barista training programs, recognizing that barista-grade products represent breakthrough solutions for food service adoption challenges limiting category expansion. Manufacturers collaborate with café chains, coffee equipment suppliers, and professional baristas to develop scalable formulations that deliver consistent frothing results while maintaining taste neutrality and nutritional profiles supporting mainstream positioning.

Modern oat drink producers systematically incorporate functional ingredients, including calcium fortification, vitamin D enrichment, and protein supplementation that deliver nutritional parity, health benefits, and functional positioning comparable to fortified dairy milk. Strategic integration of nutritional ingredients optimized for oat-based matrices enables manufacturers to position oat drink as legitimate dairy alternatives where nutritional content directly determines health-conscious consumer purchasing behavior. These nutritional improvements prove essential for mainstream market positioning, as nutrition-focused consumers demand fortification validation, functional benefit communication, and nutritional equivalence supporting complete dairy milk replacement.

Companies implement extensive fortification programs, bioavailability testing, and stability validation targeting nutritional preservation, including calcium absorption enhancement, vitamin stability during storage, and protein content optimization throughout shelf life. Manufacturers leverage nutritional positioning in marketing campaigns, on-pack communication featuring fortification claims, and health benefit messaging, positioning fortified oat drink as complete dairy alternatives delivering functional nutrition.

European consumers increasingly prioritize sustainable oat drink featuring verified environmental credentials, transparent supply chains, and reduced carbon footprint that differentiate premium offerings through sustainability excellence and ethical production. This sustainability trend enables manufacturers to drive brand differentiation through environmental impact communication, premium positioning through sustainable sourcing, and competitive advantages resonating with eco-conscious consumers seeking plant-based alternatives with verified environmental benefits. Sustainability positioning proves particularly important for younger demographics where environmental values drive category engagement and brand loyalty.

The development of sophisticated sustainability programs, including regenerative agriculture partnerships, carbon footprint measurement, and circular packaging solutions expands manufacturers' abilities to create sustainability-leading products delivering authentic environmental benefits without greenwashing. Brands collaborate with environmental organizations, certification bodies, and agricultural partners to develop supply chains balancing environmental performance with production scalability, supporting premium positioning and consumer trust while maintaining cost competitiveness across diverse market segments.

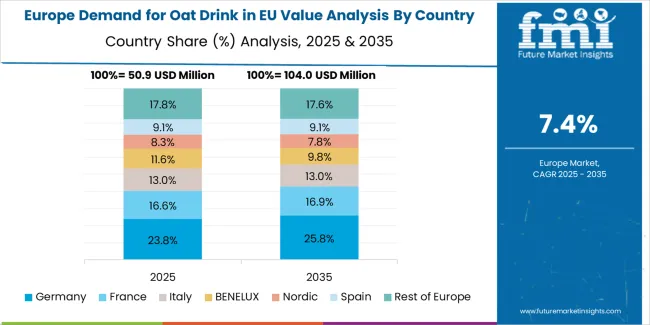

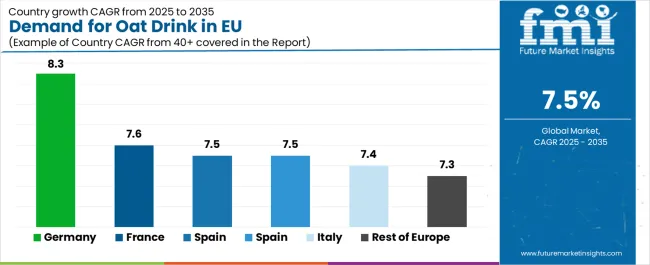

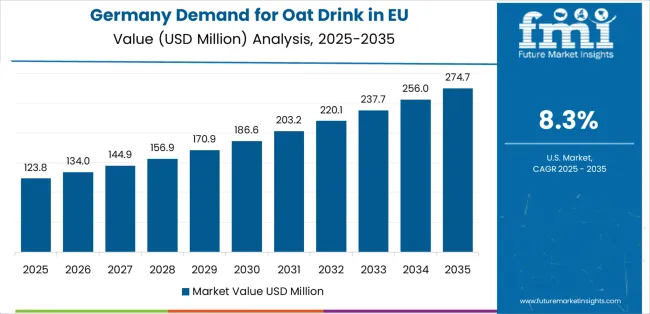

EU oat drink sales are projected to grow from USD 210.9 million in 2025 to USD 434.7 million by 2035, registering a CAGR of 7.5% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with an 8.3% CAGR, supported by progressive consumer adoption, strong plant-based food culture, and extensive café penetration. France follows with 7.6% CAGR, attributed to growing coffee culture and expanding plant-based awareness. Germany maintains the largest share at 16.8% in 2025, driven by established plant-based infrastructure and sustainability-conscious consumers. Spain and Netherlands demonstrate 7.5% CAGR each, while Italy records 7.4% CAGR. Rest of Europe shows 7.3% CAGR, reflecting diverse regional development stages and emerging market adoption.

| Country | CAGR % (2025-2035) |

|---|---|

| Germany | 8.3% |

| France | 7.6% |

| Spain | 7.5% |

| Netherlands | 7.5% |

| Italy | 7.4% |

| Rest of Europe | 7.3% |

EU oat drink sales demonstrate robust growth across major European economies, with Germany leading expansion at 8.3% CAGR through 2035, driven by progressive consumer attitudes and strong café adoption. France shows strong growth at 7.6% CAGR through expanding coffee culture and plant-based awareness. Spain and Netherlands maintain 7.5% CAGR through retail expansion and sustainability consciousness. Italy demonstrates 7.4% CAGR benefiting from emerging plant-based adoption. Rest of Europe shows 7.3% CAGR across diverse smaller operations. Overall, sales show consistent regional development reflecting EU-wide dietary shifts toward sustainable plant-based beverages and café culture evolution.

The oat drink industry in Germany is projected to exhibit robust growth with a CAGR of 8.3% through 2035, driven by exceptionally well-developed plant-based beverage culture, comprehensive retail infrastructure for dairy alternatives, and strong consumer commitment to sustainability-focused dietary choices throughout the country. Germany's sophisticated understanding of plant-based nutrition and internationally recognized leadership in environmental consciousness are creating substantial demand for diverse oat drink varieties across all consumer segments.

Major retailers, including Edeka, Rewe, Aldi, and specialized organic chains such as Alnatura, denn's Biomarkt, and Bio Company, systematically expand oat drink selections, often dedicating extensive refrigerated sections to plant-based beverages and positioning them prominently to encourage trial. German demand benefits from high environmental consciousness, substantial café culture supporting barista-grade adoption, and cultural openness to dietary innovation that naturally supports oat drink consumption across mainstream consumers beyond core vegan demographics.

Growth drivers:

The oat drink industry in France is expanding at a CAGR of 7.6%, supported by evolving consumer attitudes toward plant-based beverages and expanding coffee culture embracing specialty coffee and alternative milk options. France's growing urban café scene and increasing health consciousness among younger consumers are driving demand for quality oat drink alternatives across diverse demographic segments.

Major retailers, including Carrefour, Auchan, Leclerc, and specialized organic chains including Naturalia and Biocoop, gradually establish comprehensive oat drink ranges to serve continuously growing demand. French sales particularly benefit from specialty coffee culture demanding superior quality, driving product innovation and barista-grade formulation development within the oat drink category. Consumer education initiatives and café menu inclusion significantly enhance penetration rates despite historical preference for dairy milk in traditionally dairy-centric food culture.

Success factors:

The oat drink industry in taly is growing at a robust CAGR of 7.4%, fundamentally driven by increasing health conscioIusness, progressive urban consumer segments, and gradual modernization of Italian dietary patterns to incorporate plant-based alternatives. Italy's traditionally dairy-rich culture is gradually accommodating oat drink options as consumers recognize sustainability benefits and taste advantages of plant-based beverages while maintaining nutritional balance.

Major retailers, including Coop Italia, Esselunga, Conad, and Carrefour Italia, strategically invest in oat drink category expansion and consumer education programs to address growing interest in dairy alternatives. Italian sales particularly benefit from health-focused positioning, creating natural adoption among wellness-conscious consumers, combined with emerging café culture in Milan, Rome, and other major cities contributing to expansion through food service channels.

Development factors:

Demand for oat drink in Spain is projected to grow at a CAGR of 7.5%, substantially supported by expanding retail availability through major supermarket chains, growing environmental awareness among younger Spanish consumers, and increasing café penetration in major cities. Spanish consumer interest in wellness and sustainable consumption positions oat drink as aligned with health-focused dietary evolution.

Major retailers, including Mercadona, Carrefour España, Alcampo, and Lidl España, systematically expand oat drink offerings, with Mercadona's private-label plant-based products proving particularly successful in driving mainstream adoption through accessible pricing and prominent placement. Spain's growing sustainability consciousness supports oat drink trial among environmentally aware consumers seeking low-impact dairy alternatives.

Growth enablers:

Demand for oat drink in the Netherlands is expanding at a CAGR of 7.5%, fundamentally driven by exceptionally strong plant-based beverage culture, leadership in sustainable food innovation, and comprehensive retail support for dairy alternatives across mainstream and specialized channels. Dutch consumers demonstrate particularly high receptivity to plant-based messaging and willingness to adopt sustainable beverage alternatives for environmental reasons.

Netherlands sales significantly benefit from well-developed organic retail infrastructure, including Albert Heijn's extensive plant-based sections, Ekoplaza's specialized organic stores, and innovative beverage startups testing new oat drink products in a receptive Dutch environment. The country's progressive consumer attitudes and environmental consciousness support rapid oat drink adoption, with successful Dutch product launches often expanding to broader European operations.

Innovation drivers:

EU oat drink sales are defined by competition among multinational beverage companies, specialized plant-based brands, and emerging oat drink producers. Companies are investing in processing technologies, barista formulation development, sustainability programs, and café partnerships to deliver high-quality, functionally superior, and environmentally sustainable oat drink solutions. Strategic partnerships with café operators, retail expansion initiatives, and marketing campaigns emphasizing taste improvements and sustainability credentials are central to strengthening competitive position.

Major participants include Danone (Alpro) with an estimated 18.0% share, leveraging its dairy alternatives expertise, extensive European distribution networks, and established retail presence through Alpro brand operations. Danone benefits from comprehensive café partnerships, technical beverage development knowledge, and ability to position oat drink alongside other plant-based offerings, supporting mainstream acceptance and channel penetration.

Oatly AB holds approximately 16.0% share, emphasizing pioneering oat drink innovation, barista-grade product leadership, and café culture integration expertise supporting professional adoption. Oatly's success in developing superior barista formulations with exceptional frothing performance creates strong positioning and café loyalty, supported by brand building expertise and sustainability communication.

Valsoia S.p.A. accounts for roughly 6.0% share through its position as Italian plant-based beverage leader with strong retail presence, providing localized oat drink solutions through regional distribution and consumer understanding. The company benefits from Italian market knowledge, established retail relationships, and consumer trust helping penetrate traditionally dairy-focused markets, supporting regional positioning and growth.

Abafoods s.r.l. represents approximately 4.0% share, supporting growth through organic product focus, private-label manufacturing capabilities, and contract production serving major retailers. Abafoods leverages organic certification expertise, production flexibility, and retail partnerships, attracting sustainability-focused retailers seeking quality private-label oat drink alternatives.

Earth's Own holds approximately 2.0% share with limited EU availability, representing niche presence in specialized channels and organic retailers seeking diverse product portfolios.

Other companies collectively hold 54.0% share, reflecting competitive dynamics within European oat drink sales, where numerous specialized plant-based brands, regional producers, private-label suppliers for major retailers, and emerging startups serve specific consumer preferences, local operations, and niche applications. This competitive environment provides opportunities for differentiation through specialized formulations (barista, organic, flavored), innovative processing methods, sustainability credentials, and premium positioning resonating with health-conscious and environmentally aware consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 434.7 million |

| Product Type | Regular/Full Fat, Reduced Fat |

| Application | Coffee-based Drinks (Barista), Smoothies & RTD, Breakfast/Cereal Use, Cooking & Baking, Other Uses |

| Distribution Channel | Food Services (HoReCa), Retail Stores (Brick & Mortar), Online Retail |

| Nature | Conventional, Organic |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Danone (Alpro), Oatly AB, Valsoia S.p.A., Abafoods s.r.l., Specialized brands |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established beverage companies and specialized plant-based brands; consumer preferences for various oat drink formats and applications; integration with processing technologies and barista formulation development; innovations in functional fortification and sustainability programs; adoption across café, retail, and food service channels; regulatory framework analysis for plant-based beverage labeling and dairy alternative naming; supply chain strategies including oat sourcing and refrigerated logistics; and penetration analysis for mainstream and sustainability-conscious European consumers. |

Product Type

The global demand for oat drink in EU is estimated to be valued at USD 210.9 million in 2025.

The market size for the demand for oat drink in EU is projected to reach USD 434.7 million by 2035.

The demand for oat drink in EU is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in demand for oat drink in EU are regular/full fat and reduced fat.

In terms of application, coffee-based drinks (barista) segment to command 45.0% share in the demand for oat drink in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oat Drink Market Analysis - Size, Share & Forecast 2025 to 2035

Europe Sports Drink Market Report – Size, Share & Forecast 2025–2035

Market Share Distribution Among Europe Barrier Coated Paper Companies

Western Europe Boat Trailer Market Growth – Trends & Forecast 2024-2034

Western Europe Barrier Coated Paper Market by Material, Coating, Application, End user, and Country 2025 to 2035

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

Demand for Coil Coatings in EU Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Demand for Spice Coated Casing in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Seed Coating Material in the EU Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand of Heat Stable Whey for RTD Performance Drinks in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA