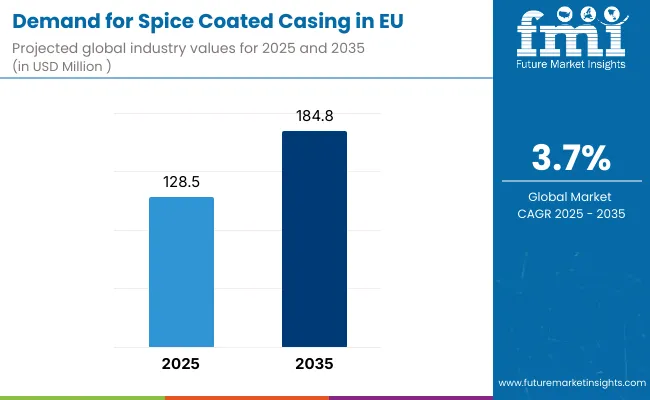

European Union spice coated casing sales are projected to grow from USD 128.5 million in 2025 to approximately USD 184.8 million by 2035, recording an absolute increase of USD 55.6 million over the forecast period. This translates into total growth of 43.3%, with demand forecast to expand at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.4X during the same period, supported by the increasing demand for convenience in meat processing, growing consumer preference for flavored and specialty sausages, and developing innovations in coating technologies that enhance product differentiation throughout European meat processing industries.

Between 2025 and 2030, EU spice coated casing demand is projected to expand from USD 128.5 million to USD 154.0 million, resulting in a value increase of USD 25.5 million, which represents 45.9% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer demand for authentic regional flavors in processed meats, increasing processor adoption of value-added casing solutions that streamline production, and growing recognition that spice-coated casings deliver consistent flavor profiles while reducing labor costs. Manufacturers are expanding their product portfolios to address the evolving preferences for clean-label coatings, organic spice blends, and specialized casings targeting specific meat applications including traditional sausages, smoked products, and artisanal charcuterie.

From 2030 to 2035, sales are forecast to grow from USD 154.0 million to USD 184.8 million, adding another USD 30.1 million, which constitutes 54.1% of the overall ten-year expansion. This period is expected to be characterized by mainstream adoption of advanced coating technologies across industrial meat processors, integration of natural preservation systems extending shelf life, and development of innovative spice combinations addressing ethnic cuisine trends and premiumization. The growing emphasis on production efficiency through pre-seasoned casings and increasing understanding of coating uniformity's role in product quality will drive demand for technologically-advanced casings that deliver flavor consistency, visual appeal, and processing advantages.

Between 2020 and 2025, EU spice coated casing sales experienced steady expansion at a CAGR of 3.6%, growing from USD 107.3 million to USD 128.5 million. This period was driven by increasing meat processor consolidation requiring standardized flavor solutions, rising labor costs encouraging automated seasoning approaches, and growing consumer appetite for globally-inspired sausage varieties. The industry developed as casing manufacturers invested in coating technologies and spice suppliers recognized opportunities for value-added partnerships. Product innovations, technical support services, and customization capabilities began establishing processor confidence and market differentiation for spice-coated casing solutions.

Industry expansion is being supported by the rapid evolution in meat processing efficiency requirements across European facilities and the corresponding demand for value-added casing solutions that reduce production complexity while enhancing product differentiation. Modern meat processors increasingly adopt spice-coated casings as integral components of lean manufacturing strategies, driving demand for products that address multiple operational needs including labor reduction through elimination of manual seasoning steps, consistency assurance across production batches, and flavor innovation enabling rapid product development responding to market trends.

The growing focus on food safety and quality control throughout European meat industries is driving demand for pre-validated spice coating systems from manufacturers with appropriate certifications and traceability protocols. Food safety authorities and industry organizations are increasingly establishing standards for casing coatings, including specifications for microbiological safety, allergen management, and clean-label requirements. Technical developments are providing solutions supporting coating adhesion, spice distribution uniformity, and moisture barrier properties, requiring specialized manufacturing processes that address the unique challenges of applying dry spices to casing surfaces while maintaining functionality during stuffing, smoking, and cooking operations.

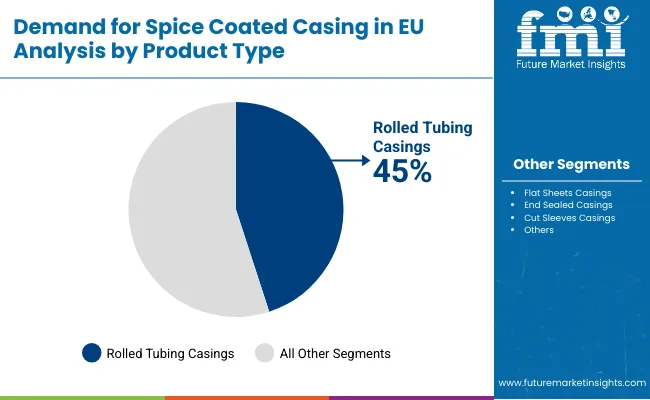

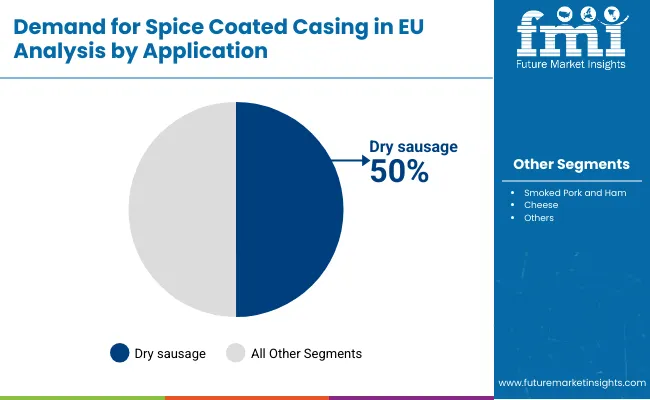

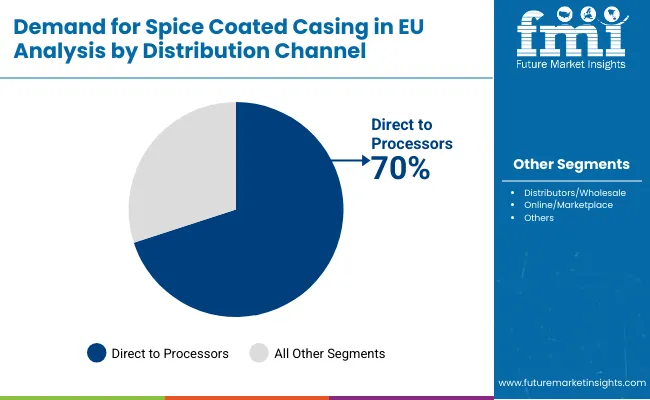

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into rolled tubing casings, flat sheets casings, end sealed casings, and cut sleeves casings. Based on application, sales are categorized into dry sausage, smoked pork and ham, and cheese. In terms of distribution channel, demand is segmented into direct to processors, distributors/wholesale, and online/marketplace. By nature, sales are classified into conventional and clean-label/organic. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The rolled tubing casings segment is projected to account for 45.0% of EU spice coated casing sales in 2025, declining slightly to 43.0% by 2035, establishing itself as the foundational category addressing high-volume sausage production requirements. This commanding position is fundamentally supported by operational efficiency in continuous stuffing operations, established compatibility with automated processing equipment, and versatility across multiple sausage diameters and lengths. The segment delivers comprehensive production solutions, providing processors with ready-to-use casings featuring uniform spice coatings, consistent caliber control, and reliable performance essential during high-speed stuffing operations.

This segment benefits from extensive technical optimization, processor equipment compatibility, and established supply chains that build operational confidence in production planning. The rolled tubing offers advantages in inventory management, storage efficiency, and rapid changeover capabilities that address both seasonal production peaks and just-in-time manufacturing requirements, supported by advanced coating processes ensuring spice adhesion throughout distribution and processing.

The segment's slight share decline through 2035 reflects growing diversification toward specialized formats, with flat sheets and end sealed casings gaining share as processors seek differentiation through unique product presentations and portion control solutions throughout the forecast period.

Key advantages:

Dry sausage application is positioned to represent 50.0% of total spice coated casing demand across European operations in 2025, moderating slightly to 48.0% by 2035, reflecting the segment's dominance as the primary application for flavored casing systems. This considerable share directly demonstrates that traditional fermented sausages, including salami, chorizo, and regional specialties, represent core markets where external spice coatings deliver both functional and aesthetic benefits.

Modern processors increasingly optimize dry sausage production through pre-spiced casings, driving demand for products featuring mold-inhibiting spice blends, traditional appearance coatings, and fermentation-compatible formulations. The segment benefits from continuous innovation focused on authentic regional spice profiles, natural preservation systems extending ambient shelf life, and visual differentiation through distinctive coating patterns common during artisanal production periods.

The segment's stable share through 2035 reflects its fundamental importance, though smoked products show modest growth as processors expand into value-added categories requiring specialized smoke-permeable coatings with complementary spice profiles.

Key drivers:

Direct to processor distribution is strategically estimated to control 70.0% of total European spice coated casing sales in 2025, declining to 64.0% by 2035, reflecting the channel's importance for technical support and customization while facing growing wholesale consolidation. European casing manufacturers consistently provide direct relationships with meat processors, offering technical consultation, customization services, and quality assurance valuable for specialized production requirements.

The segment provides essential services through application specialists offering processing optimization, R&D collaboration developing proprietary spice blends, and supply chain integration ensuring just-in-time delivery aligned with production schedules. Major European casing suppliers, including Kalle, Walsroder, and Viskase, systematically strengthen processor relationships through technical partnerships, training programs, and co-innovation projects supporting mutual growth.

The segment's declining share through 2035 reflects distribution evolution, with wholesale channels growing from 25.0% in 2025 to 28.0% in 2035, as regional distributors expand technical capabilities while online marketplaces emerge for standardized products enabling price discovery and supplier diversification.

Success factors:

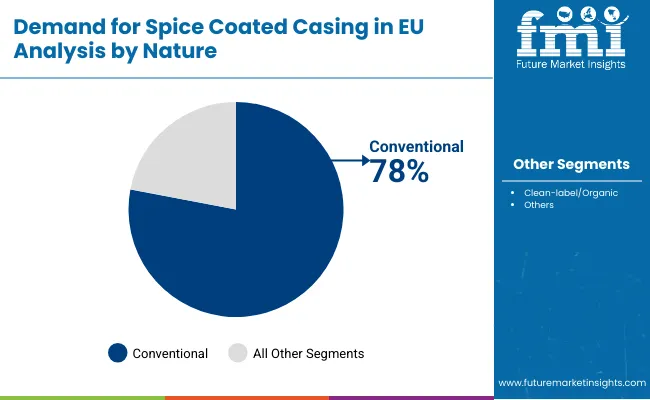

Conventional spice coated casings are strategically positioned to contribute 78.0% of total European sales in 2025, declining to 68.0% by 2035, representing products manufactured through standard processes without organic certification requirements. These conventional products successfully deliver cost-effective solutions essential for mainstream meat products while ensuring consistent quality and comprehensive spice selection that prioritizes functionality over premium credentials.

Conventional production serves volume processors, private label manufacturers, and price-competitive markets where operational efficiency determines profitability. The segment derives significant competitive advantages from established spice supply chains, economies of scale enabling competitive pricing, and extensive application knowledge supporting processor confidence and adoption patterns.

The segment's declining share through 2035 reflects clean-label expansion, which grows from 22.0% in 2025 to 32.0% in 2035, as quality-conscious processors increasingly prioritize organic certification, natural ingredients, and transparent sourcing supporting premium product positioning aligned with consumer health trends.

Competitive advantages:

EU spice coated casing sales are advancing steadily due to increasing labor costs driving automation adoption, growing consumer demand for authentic ethnic flavors, and rising processor focus on operational efficiency through value-added inputs. The industry faces challenges, including spice price volatility affecting coating costs, regulatory complexity regarding allergen labeling, and technical difficulties achieving uniform coating adhesion. Continued innovation in coating technologies and spice formulations remains central to industry development.

The rapidly accelerating development of natural antimicrobial coating systems is fundamentally transforming spice coated casings from flavoring vehicles to functional preservation platforms, enabling extended shelf life previously unattainable through conventional approaches. Advanced coating formulations featuring rosemary extracts, cultured ingredients, and botanical antimicrobials allow companies to create multi-functional casings addressing flavor, safety, and shelf life with precision meeting clean-label requirements. These preservation innovations prove particularly transformative for ambient-stable products, export markets, and retailers where extended shelf life without synthetic preservatives provides competitive advantages.

Major casing manufacturers invest heavily in natural preservation research, university collaborations, and pilot-scale testing, recognizing that functional coatings represent breakthrough solutions for food waste reduction and market expansion. Companies collaborate with spice suppliers, ingredient specialists, and research institutions to develop validated preservation systems that balance antimicrobial efficacy with sensory acceptance and regulatory compliance supporting commercial viability.

Modern casing producers systematically incorporate authentic ethnic spice blends, regional flavor profiles, and fusion combinations, recognizing culinary diversity as critical differentiation requiring specialized coating expertise beyond traditional European seasonings. Strategic integration of global flavors enables manufacturers to address demographic shifts through products including Middle Eastern harissa coatings, Asian five-spice blends, and Latin American chili combinations where authentic taste profiles determine market success. These ethnic formulations prove essential for market expansion, as European populations increasingly embrace diverse cuisines affecting both retail and foodservice demand.

Companies implement extensive flavor development programs investigating spice authenticity, heat level optimization, and cultural appropriateness, including sensory panels, ethnic consumer testing, and chef collaborations ensuring market relevance. Manufacturers leverage ethnic positioning in customer communications, highlighting authenticity credentials, regional sourcing stories, and culinary applications, positioning coated casings as enablers of menu innovation beyond commodity inputs.

European processors increasingly demand advanced coating uniformity, adhesion durability, and visual consistency, driving manufacturers toward sophisticated application technologies and quality control systems that ensure product differentiation. This technology trend enables companies to build competitive advantages through proprietary processes, command premium pricing through superior performance, and differentiate products in commodity markets where coating quality influences processor selection. Technology leadership proves particularly important for industrial processors where consistency across millions of units directly determines brand reputation and consumer satisfaction.

The development of electrostatic coating systems, tumble-coating innovations, and inline application technologies expands manufacturers' abilities to meet uniformity demands while maintaining production efficiency. Brands collaborate with equipment manufacturers, automation specialists, and quality system providers to develop integrated coating lines balancing precision with throughput, supporting premium positioning while meeting cost targets and sustainability goals.

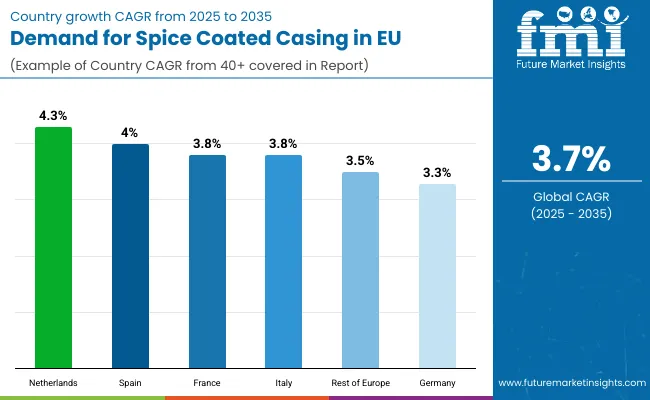

| Country | CAGR % (2025-2035) |

|---|---|

| Netherlands | 4.3% |

| Spain | 4.0% |

| France | 3.8% |

| Italy | 3.8% |

| Rest of Europe | 3.5% |

| Germany | 3.3% |

EU spice coated casing sales demonstrate differentiated growth trajectories across major European economies, with smaller innovative markets outpacing larger established ones through 2035, driven by varying meat processing traditions, export dynamics, and value-added adoption rates. Netherlands shows steady growth from USD 5.6 million in 2025 to USD 8.5 million by 2035 at 4.3% CAGR. Spain expands from USD 14.5 million to USD 21.5 million at 4.0% CAGR. France records growth from USD 28.9 million to USD 42.1 million at 3.8% CAGR. Italy demonstrates USD 19.3 million to USD 28.1 million at 3.8% CAGR. Rest of Europe shows USD 20.1 million to USD 28.4 million at 3.5% CAGR. Germany maintains steady expansion from USD 40.1 million to USD 55.6 million at 3.3% CAGR. Overall, sales show varied regional development reflecting different meat processing scales, export orientations, and premium product strategies across European countries.

The demand for coated casings in Germany is projected to exhibit steady growth with a CAGR of 3.3% through 2035, driven by exceptionally well-developed meat processing infrastructure, extensive sausage manufacturing traditions, and established distribution networks throughout the country. Germany's sophisticated meat industry and internationally recognized quality standards create substantial demand for standardized spice coated casings across industrial and artisanal processors.

Major German processors including Tönnies, Vion, and Müller Group systematically adopt spice coated casings for operational efficiency, product consistency, and rapid flavor innovation responding to retail demands. German demand benefits from high automation levels requiring compatible casing solutions, substantial private label production demanding cost optimization, and regional sausage varieties supporting specialized coating requirements. The strong export sector, particularly to other EU markets, drives volume demand for standardized products.

The relatively moderate growth rate reflects Germany's mature market status where established processing patterns leave limited room for dramatic expansion, requiring innovation and premiumization rather than volume growth for value creation throughout the forecast period.

Growth drivers:

The spice coated casings industry in France is expanding at a CAGR of 3.8%, supported by strong charcuterie traditions demanding quality differentiation, artisanal processor innovation, and increasing adoption among regional producers. France's renowned gastronomy culture and protected designation products create unique opportunities for premium spice coated casings meeting authenticity standards.

Major French processors including Cooperl, Bigard, and regional charcutiers actively adopt spice coated casings through quality programs, flavor innovations, and efficiency initiatives balancing tradition with modernization. French sales particularly benefit from AOC/AOP products requiring specific spice profiles, tourist demand for regional specialties, and retailer emphasis on French origin products. The country's focus on terroir and provenance creates opportunities for casings featuring local spice blends and traditional coating patterns.

Success factors:

The spice coated casings sector in Italy is growing at a CAGR of 3.8%, fundamentally driven by premium salumi traditions emphasizing quality, expanding protected designation products, and growing integration of efficiency solutions into traditional production. Italy's evolving meat processing landscape increasingly recognizes spice coated casings' role in maintaining consistency while preserving artisanal character, creating favorable conditions for selective adoption among quality-focused processors.

Major Italian processors including Cremonini, Pini Group, and regional salumifici actively evaluate spice coated casings through pilot programs, particularly for export products requiring standardization while maintaining Italian authenticity. Italian sales particularly benefit from increasing processor consolidation driving efficiency needs, growing export markets demanding consistency, and younger generation processors embracing innovation while respecting tradition.

Development factors:

Demand for spice coated casings in Spain is projected to grow at an impressive CAGR of 4.0%, substantially supported by expanding jamón and chorizo sectors, increasing export orientation requiring standardized products, and growing processor modernization investments. Spanish market transformation and improving production efficiency position spice coated casings as essential components supporting competitiveness in global markets.

Major Spanish processors including El Pozo, Campofrío, and regional producers systematically introduce spice coated casings for signature products, particularly paprika-based coatings for chorizo and specialty seasonings for export markets. Spain's growing reputation for quality cured meats and increasing penetration of international markets drive specific coating applications for consistent flavor delivery and visual appeal. The country's modernizing production facilities and expanding retail partnerships enable technology adoption supporting coated casing integration.

Growth enablers:

Demand for spice coated casings in the Netherlands is expanding at a leading CAGR of 4.3%, fundamentally driven by innovative meat processing sector, export-focused production strategies, and sophisticated understanding of value-added solutions among Dutch processors. Dutch meat industry demonstrates particular strength in efficiency optimization, supply chain integration, and early adoption of processing innovations positioning the Netherlands as European leader in casing technology utilization.

Netherlands sales significantly benefit from concentrated processing sector enabling rapid technology adoption, proximity to German markets driving volume opportunities, and logistics advantages supporting pan-European distribution. Dutch processors' focus on operational excellence and continuous improvement creates receptive environment for spice coated casings delivering measurable efficiency gains. The country's trading heritage and international orientation position Dutch companies as innovation bridges between global casing manufacturers and European processors.

Innovation drivers:

EU spice coated casing sales are projected to grow from USD 128.5 million in 2025 to USD 184.8 million by 2035, registering a steady CAGR of 3.7% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 4.3% CAGR, supported by innovative meat processing sector, export-oriented production, and early adoption of value-added technologies. Spain follows with 4.0% CAGR, attributed to strong charcuterie traditions and growing premium meat products sector.

Germany maintains the largest share at 31.2% in 2025, driven by extensive meat processing infrastructure and established sausage culture, while growing at 3.3% CAGR. France follows with 22.5% share and 3.8% CAGR growth reflecting strong artisanal traditions. Italy demonstrates 3.8% CAGR, aligning with premium positioning trends.

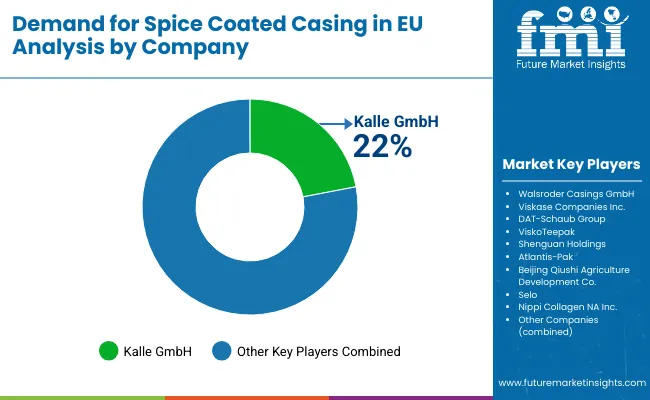

EU spice coated casing sales are defined by competition among specialized casing manufacturers, integrated meat processing suppliers, and regional coating specialists. Companies are investing in coating technology, flavor development, technical services, and processor partnerships to deliver consistent, innovative, and efficient casing solutions. Strategic relationships with spice suppliers, equipment manufacturers, and research institutions emphasizing quality consistency and application support are central to strengthening competitive position.

Major participants include Kalle GmbH with an estimated 22.0% share, leveraging its European manufacturing footprint, technical expertise, and comprehensive flavor casing portfolio. Kalle benefits from proprietary coating technologies, extensive processor relationships, and innovation capabilities supporting customization across diverse applications.

Walsroder Casings GmbH holds approximately 15.0% share through its German heritage, sausage application focus, and quality reputation. The company's success in traditional meat processing regions and ability to provide consistent coating solutions creates strong positioning among established processors.

Viskase Companies Inc. accounts for roughly 10.0% share through its pan-European distribution network, diverse seasoning range, and technical support capabilities. The company benefits from global R&D resources, multi-site manufacturing, and comprehensive product portfolio addressing various market segments.

Other key players including DAT-Schaub Group (6.0%) and additional companies collectively hold 47.0% share, reflecting the moderately concentrated nature of European spice coated casing market where specialized expertise, regional presence, and technical capabilities determine competitive success.

| Item | Value |

|---|---|

| Quantitative Units | USD 184.8 million |

| Product Type | Rolled Tubing Casings, Flat Sheets Casings, End Sealed Casings, Cut Sleeves Casings |

| Application | Dry Sausage, Smoked Pork and Ham, Cheese |

| Distribution Channel | Direct to Processors, Distributors/Wholesale, Online/Marketplace |

| Nature | Conventional, Clean-label/Organic |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Kalle GmbH, Walsroder Casings, Viskase, DAT-Schaub, ViskoTeepak, Shenguan Holdings |

| Additional Attributes | Dollar sales by product type, application, and distribution channel; regional demand trends across major European economies; competitive landscape analysis with specialized casing manufacturers; processor preferences for coating uniformity and flavor authenticity; integration with automated stuffing equipment; innovations in natural preservation and ethnic flavors; adoption across industrial and artisanal processors; regulatory framework for spice coatings and allergen management; technical support services and customization capabilities; penetration analysis for clean-label and organic products |

Product Type

The global demand for spice coated casing in EU is estimated to be valued at USD 128.5 million in 2025.

The market size for the demand for spice coated casing in EU is projected to reach USD 184.8 million by 2035.

The demand for spice coated casing in EU is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in demand for spice coated casing in EU are rolled tubing casings, flat sheets casings, end sealed casings and cut sleeves casings.

In terms of application, dry sausage segment to command 50.0% share in the demand for spice coated casing in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spice Coated Casing Market Analysis - Size, Share & Forecast 2025 to 2035

Coated Casing Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Europe Barrier Coated Paper Companies

Europe Collagen Casings Market Report – Demand, Growth & Industry Forecast 2025–2035

Europe Herbs and Spices Market Analysis – Size, Share & Forecast 2025–2035

Western Europe Barrier Coated Paper Market by Material, Coating, Application, End user, and Country 2025 to 2035

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Demand for Herb & Spice Extracts in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA