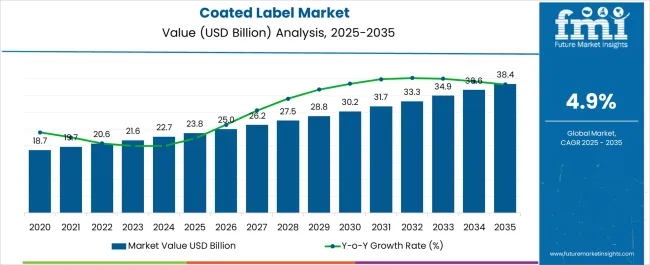

The Coated Label Market is estimated to be valued at USD 23.8 billion in 2025 and is projected to reach USD 38.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The Coated Label market is experiencing steady growth, driven by increasing demand for high-quality labeling solutions across diverse industries, particularly pharmaceuticals, food and beverage, and personal care. Rising regulatory requirements for product identification, traceability, and brand authenticity are compelling manufacturers to adopt coated labels with enhanced durability, print clarity, and resistance to environmental factors. Advancements in coating technologies, including polymer coatings and UV protection, are enabling improved adhesion, surface finish, and customization capabilities.

Growing adoption of automated labeling systems and integration with packaging lines is enhancing production efficiency while reducing operational costs. The market is further supported by the rising emphasis on brand differentiation, anti-counterfeiting measures, and consumer engagement through visually appealing and functional labels.

As manufacturers prioritize sustainability and compliance, coated labels are increasingly chosen for their ability to combine performance, aesthetics, and regulatory adherence With expanding pharmaceutical and consumer goods production, the market is expected to witness sustained growth, underpinned by innovations in coating materials and application technologies.

| Metric | Value |

|---|---|

| Coated Label Market Estimated Value in (2025 E) | USD 23.8 billion |

| Coated Label Market Forecast Value in (2035 F) | USD 38.4 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

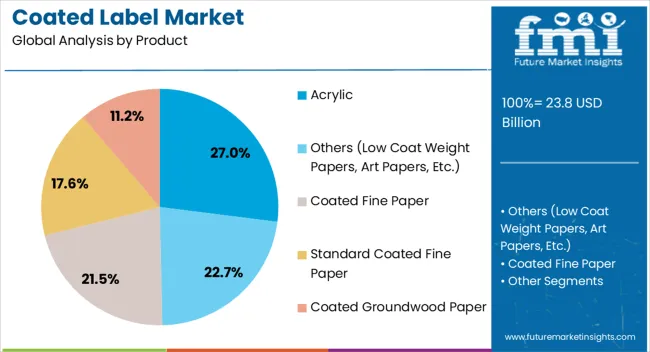

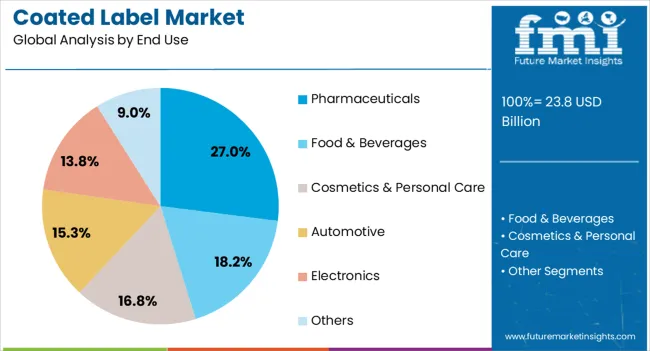

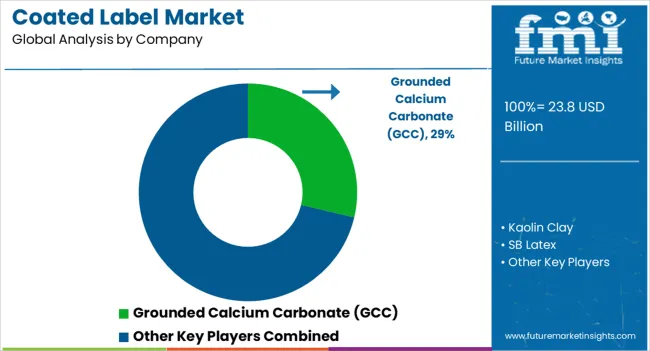

The market is segmented by Product and End Use and region. By Product, the market is divided into Acrylic, Others (Low Coat Weight Papers, Art Papers, Etc.), Coated Fine Paper, Standard Coated Fine Paper, and Coated Groundwood Paper. In terms of End Use, the market is classified into Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Automotive, Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic segment is projected to hold 27.0% of the Coated Label market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by the versatility, durability, and chemical resistance of acrylic-based coatings, which are suitable for a wide range of labeling applications. Acrylic coatings provide excellent print clarity, adhesion, and surface smoothness, making them ideal for high-quality labels that withstand exposure to moisture, heat, and chemicals.

The ability to support diverse printing techniques, including digital, flexographic, and offset, further enhances their adoption. Manufacturers are leveraging acrylic labels to meet compliance requirements, improve product appearance, and enhance consumer engagement.

The cost-effectiveness and performance reliability of acrylic-coated labels have made them a preferred choice for high-volume production As industries continue to demand scalable, high-performance labeling solutions, the acrylic segment is expected to maintain its market leadership, supported by continuous improvements in coating formulations and manufacturing processes.

The pharmaceuticals end-use segment is anticipated to account for 27.0% of the market revenue in 2025, making it the leading application area. Growth is being driven by stringent regulatory requirements for labeling, which demand high durability, legibility, and resistance to environmental conditions to ensure patient safety and compliance. Coated labels in pharmaceutical applications facilitate accurate information display, barcoding, and serialization, which are critical for tracking and anti-counterfeiting purposes.

Enhanced print clarity and chemical resistance allow labels to remain intact throughout transportation, storage, and usage. Automation and integration with packaging lines improve operational efficiency and reduce errors in labeling processes.

Pharmaceutical companies are increasingly adopting coated labels to maintain brand integrity, comply with global regulations, and ensure safe and efficient distribution As regulatory frameworks tighten and production volumes grow, the pharmaceuticals end-use segment is expected to remain a key driver of market growth, supported by continuous advancements in coating technologies and labeling solutions.

Acrylic coating’s supremacy is visible in the product segment. Coating labels perceive high demand from the pharmaceutical sector for their sustainability characteristic.

The acrylic coating segment is on track to acquire 27% of the market share in 2025 based on from. The components affecting the acrylic coating label are:

| Attributes | Details |

|---|---|

| Product | Acrylic |

| Market Share (2025) | 27% |

Pharmaceuticals are estimated to account for 27% of the market share in 2025 by end user category. Some of the factors influence the growing demand for coating in pharmaceutical industries:

| Attributes | Details |

|---|---|

| End User | Pharmaceuticals |

| Market Share (2025) | 27% |

The Asia Pacific region is leading the demand for coated labels. Increasing consumer awareness regarding misleading concepts and favorable regulatory compliance support this demand. Market players in this region prioritize enhancing the sustainability and durability of these labels to make them attractive by improving the quality of the label by coating.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 3.4% |

| Germany | 3.8% |

| United Kingdom | 3.7% |

| India | 6.0% |

| China | 5.1% |

Canada is set to see the market enlarge at a CAGR of 3.3% over the forecast period. Factors that influence the coated label market growth in this country are:

A CAGR of 3.8% for the market in Germany is calculated during the forecast period.

The market is on its way to registering a CAGR of 3.7% in the United Kingdom. Factors that drive market growth here are:

The market in India could record a CAGR of 6.0% through 2035. Some of the reasons supporting the growth of the coated label market in this country are:

The market is set to report a CAGR of 5.1% in China through 2035. Some of the factors driving the adoption of coated labels include:

The remarkable revolution in the coated label market is the manufacturing of eco-friendly, sustainable, and water-based coating by leading companies. These delivered the same level of performance as the traditional coating with a dropping environmental effect.

While manufacturing this label, market players used a renewable source and biodegradable substance with the capability of waterproof catering to fuel the sustainable packaging and label material. Market players are also involved in partnership and collaboration to get an edge in this highly competitive market.

Recent developments in the coated label market

The global coated label market is estimated to be valued at USD 23.8 billion in 2025.

The market size for the coated label market is projected to reach USD 38.4 billion by 2035.

The coated label market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in coated label market are acrylic, others (low coat weight papers, art papers, etc.), coated fine paper, standard coated fine paper and coated groundwood paper.

In terms of end use, pharmaceuticals segment to command 27.0% share in the coated label market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Casing Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Competitive Landscape of Coated Recycled Paperboard Providers

Coated White Board Paper Market

Coated Sack Kraft Paper Market

Coated Duplex Board Market

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

PE Coated Sack Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of PE Coated Sack Kraft Paper Providers

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA