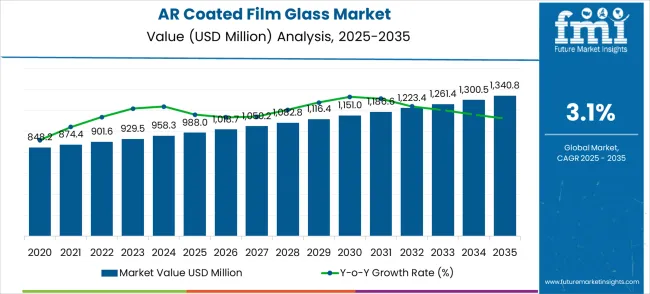

The global AR coated film glass market is projected to reach USD 1,340.8 million by 2035, recording an absolute increase of USD 352.8 million over the forecast period. The market is valued at USD 988.0 million in 2025 and is set to rise at a CAGR of 3.1% during the assessment period. The market size is expected to grow by nearly 1.36 times during the same period, supported by increasing demand for energy-efficient building solutions, expanding solar photovoltaic installations, and growing adoption of advanced optical applications across global markets. Market expansion faces constraints from manufacturing complexity and competitive pressure from alternative coating technologies.

Between 2025 and 2030, the AR coated film glass market is projected to expand from USD 988.0 million to USD 1,151.0 million, resulting in a value increase of USD 163.0 million, which represents 46.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for solar energy applications, product innovation in double-layer coating technologies and enhanced optical performance systems, and expanding applications across photovoltaic installations and architectural decoration sectors. Companies are establishing competitive positions through investment in advanced coating process development, strategic partnerships with solar panel manufacturers, and market expansion across renewable energy projects, green building initiatives, and emerging optical technology applications.

From 2030 to 2035, the market is forecast to grow from USD 1,151.0 million to USD 1,340.8 million, adding another USD 189.8 million, which constitutes 53.8% of the ten-year expansion. This period is expected to be characterized by expansion of specialized coating solutions including multi-functional AR coatings and smart glass applications tailored for specific industry requirements, strategic collaborations between glass manufacturers and technology developers, and enhanced integration with building standards and energy efficiency regulations. The growing emphasis on renewable energy adoption and energy-efficient construction will drive demand for advanced AR coated glass solutions across diverse industrial and commercial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 988.0 million |

| Market Forecast Value (2035) | USD 1,340.8 million |

| Forecast CAGR (2025-2035) | 3.1% |

The AR coated film glass market grows by enabling glass manufacturers and end-users to achieve enhanced light transmission efficiency that reduces reflection losses and improves energy performance. Demand drivers include expanding photovoltaic energy installations requiring maximum light transmission efficiency, increasing architectural decoration applications for energy-efficient building solutions, and growing adoption in optical instruments for enhanced performance capabilities. Priority segments include solar panel manufacturers and architectural glass suppliers, with China and India representing key growth geographies due to expanding renewable energy initiatives and construction industry development. Market growth faces constraints from manufacturing cost pressures and the need for specialized coating technology expertise to achieve consistent quality standards.

The AR Coated Film Glass market is entering a growth phase, driven by demand for renewable energy solutions, expanding energy-efficient construction, and evolving optical performance standards across industries. By 2035, these pathways together can unlock USD 580-750 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Photovoltaic Energy Leadership (Solar Panel Applications) The photovoltaic energy segment already holds the largest share due to its critical role in solar energy conversion efficiency. Expanding high-transmission coatings, enhanced durability solutions, and specialized solar glass can consolidate leadership. Opportunity pool: USD 180-230 million.

Pathway B - Single-layer Coating Technology Optimization (Cost-Effective Solutions) Single-layer AR coating applications account for significant market demand. Growing requirements for cost-effective anti-reflective solutions, especially in volume applications, will drive higher adoption of optimized single-layer systems. Opportunity pool: USD 140-180 million.

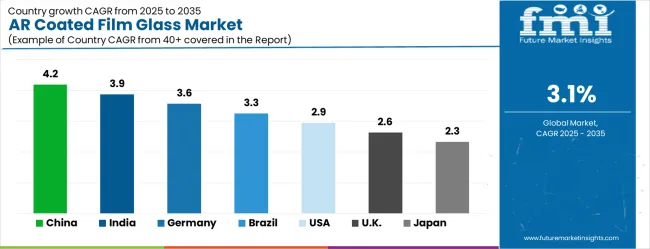

Pathway C - China & India Market Expansion (Renewable Energy Growth) China and India present the highest growth potential with CAGRs of 4.2% and 3.9% respectively. Targeting expanding solar energy projects and green building initiatives will accelerate adoption. Opportunity pool: USD 120-155 million.

Pathway D - Architectural decoration applications (energy-efficient buildings). Architectural decoration and energy-efficient building applications represent significant growth potential with increasing construction standards. Glass optimized for building performance and aesthetic requirements can capture substantial growth. Opportunity pool: USD 85-110 million.

Pathway E - Double-layer coating innovation, with increasing demand for enhanced optical performance, there is an opportunity to promote advanced double-layer coating systems optimized for premium applications and superior light transmission. Opportunity pool: USD 65-85 million.

Pathway F - Optical instruments expansion (precision applications) systems optimized for optical instruments, precision equipment, and specialized industrial applications offer premium positioning for high-performance market segments. Opportunity pool: USD 45-60 million.

Pathway G - Smart glass integration, advanced coating technologies enabling smart glass functionality, electrochromic integration, and responsive optical properties create opportunities for next-generation building applications. Opportunity pool: USD 35-45 million.

Pathway H - Manufacturing process innovation Advanced manufacturing processes, automated coating systems, and quality control technologies can improve production efficiency and product consistency across global operations. Opportunity pool: USD 25-35 million.

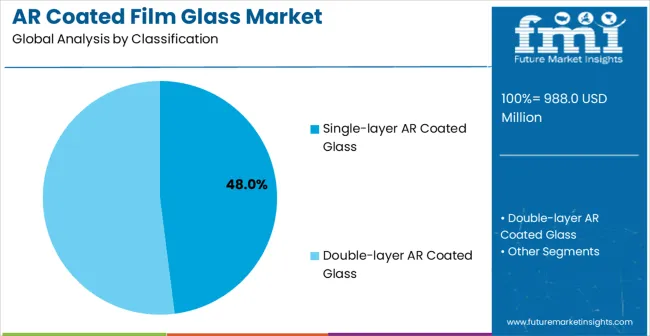

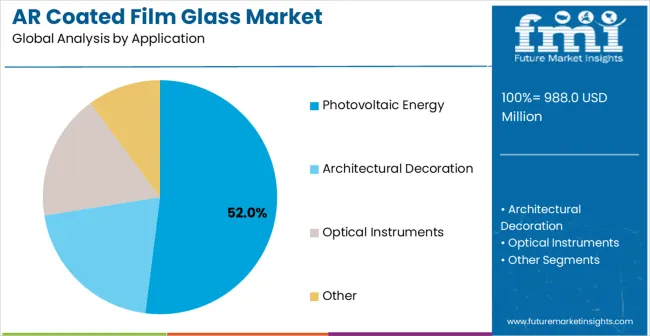

The market is segmented by coating type, application, end-user, technology, and region. By coating type, the market is divided into single-layer AR coated glass, double-layer AR coated glass, and other coating technologies. Based on application, the market is categorized into photovoltaic energy, architectural decoration, optical instruments, and other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

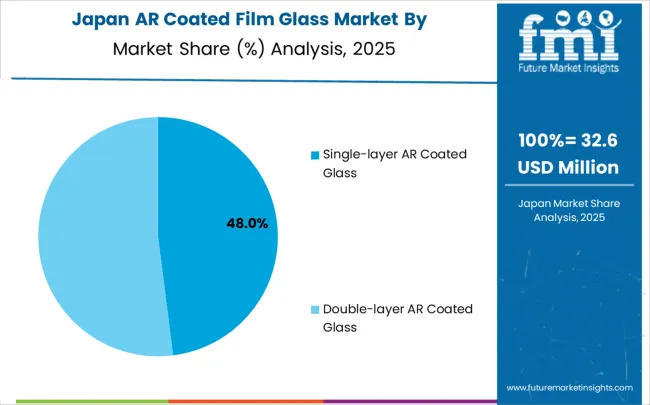

Single-layer AR coated glass is projected to account for a substantial 48% of the AR coated film glass market in 2025, establishing its position as the leading technology segment with significant growth momentum. This commanding market share is driven by cost-effective manufacturing processes and reliable anti-reflective performance characteristics that meet standard application requirements across diverse industries. Single-layer coating technology provides effective light transmission improvement and proven durability for moderate AR performance applications, enabling stakeholders to benefit from established manufacturing processes and competitive pricing for high-volume production scenarios.

The manufacturing process for single-layer AR coated glass primarily utilizes sol-gel chemistry processing, which involves metal oxides and organic solvents condensing into inorganic polymer bonds. The most common fabrication methods include dip coating, spin coating, and meniscus coating techniques. In the sol-gel process, silicon compounds undergo hydrolytic condensation to form a porous silica (SiO2) structure with controlled refractive index properties. Key factors supporting widespread single-layer AR coating adoption include cost-effective manufacturing processes suitable for large-scale production, proven performance reliability for standard anti-reflective applications across diverse industries, reduced production time while maintaining durability standards, and strong preference in emerging regions where cost considerations are paramount for market penetration and growth.

Key factors supporting single-layer AR coating adoption:

Photovoltaic energy applications are expected to represent the largest share of 52% of the AR coated film glass applications in 2025, establishing itself as the dominant segment in the anti-reflective coated glass market. This commanding market position reflects the critical need for maximum light transmission efficiency in solar panel applications that appeals to solar module manufacturers and renewable energy developers globally. The segment provides essential performance enhancement for solar energy conversion efficiency and long-term durability requirements for outdoor installations, with anti-reflective coated glass demonstrating superior light absorption capabilities that significantly boost energy conversion rates.

Growing demand for renewable energy solutions, supported by comprehensive government incentives including subsidies, tax benefits, and renewable portfolio standards, continues driving accelerated adoption across residential, commercial, and utility-scale solar installations worldwide. The photovoltaic segment's advantages include its critical role in solar energy conversion efficiency enhancement, where AR coated glass minimizes sunlight reflection and maximizes light absorption by solar panels, resulting in measurably improved energy output. The segment benefits from wide application across multiple solar installation categories, from rooftop residential systems to large-scale utility projects, positioning it as the primary growth driver in the AR coated glass market with momentum through 2035.

Photovoltaic Energy segment advantages include:

Market drivers include expanding renewable energy initiatives requiring enhanced solar panel efficiency, increasing architectural decoration applications for energy-efficient building solutions, and growing adoption in optical instruments where AR coatings support advanced performance requirements. These drivers reflect direct market outcomes including improved energy conversion efficiency, reduced operational costs, and enhanced optical performance across multiple application areas.

Market restraints encompass manufacturing cost pressures that limit adoption among cost-sensitive applications, technical complexity requiring specialized coating process expertise and quality control systems, and long product qualification cycles for critical applications that slow market penetration. Additional constraints include competition from alternative coating technologies and the need for continuous process innovation to maintain competitive performance advantages.

Key trends show adoption accelerating in China and India, where expanding renewable energy policies and construction industry growth drive demand, while technology shifts toward multi-layer coating systems and smart glass applications enable broader market access. Technology advancement focuses on enhanced durability and self-cleaning properties that expand application possibilities across demanding environments. Market thesis faces risk from alternative surface treatment technologies that could provide similar optical performance benefits at lower costs or with simplified manufacturing processes.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| Brazil | 3.3% |

| USA | 2.9% |

| UK | 2.6% |

| Japan | 2.3% |

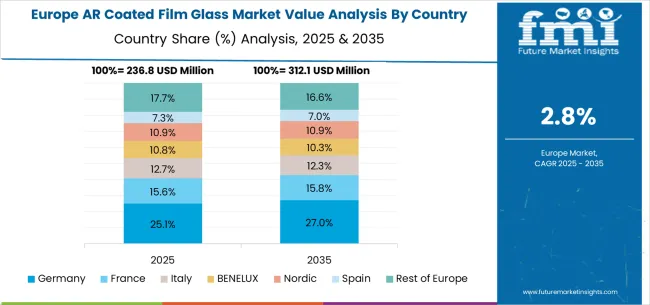

The AR coated film glass market shows moderate but consistent growth dynamics across key countries from 2025 to 2035. China leads globally with a CAGR of 4.2%, fueled by massive solar energy deployment, government renewable energy targets, and expanding glass manufacturing capabilities. India follows closely at 3.9%, driven by solar mission initiatives, green building regulations, and growing industrial glass demand. Germany maintains Europe's leadership with 3.6%, leveraging its advanced glass technology sector and strong renewable energy infrastructure development. Brazil records 3.3%, reflecting opportunities in solar energy development and architectural applications despite economic challenges. The United States maintains steady expansion at 2.9%, supported by renewable energy policies and energy-efficient building standards. Growth in the United Kingdom (2.6%) and Japan (2.3%) remains stable, backed by established glass manufacturers and building initiatives, though comparatively slower than emerging markets.

The report covers an in-depth analysis of 40+ countries; 7 top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the AR coated film glass market with its expanding renewable energy sector and substantial government investment in solar energy technologies. The market is projected to grow at a CAGR of 4.2% through 2035, driven by massive photovoltaic installations, expanding architectural glass applications, and growing adoption across manufacturing facilities in Guangdong, Jiangsu, and Zhejiang provinces. Chinese glass manufacturers are adopting advanced AR coating technologies for solar panel applications and energy-efficient building solutions, with particular emphasis on manufacturing cost optimization and production scale advantages. Government support for renewable energy targets and green building standards expands deployment across solar energy projects and construction applications.

India's AR coated film glass market reflects strong potential based on expanding solar energy initiatives and increasing energy-efficient construction requirements. The market is projected to grow at a CAGR of 3.9% through 2035, with growth accelerating through cost-effective manufacturing strategies under quality and performance constraints, particularly in solar panel applications and green building projects in Delhi, Mumbai, and Bangalore. Indian glass manufacturers and solar companies are adopting AR coated glass for photovoltaic applications and architectural solutions, with growing emphasis on light transmission efficiency and durability performance. Strategic partnerships with international technology providers expand access to advanced coating technologies and technical expertise.

Germany demonstrates established strength in the AR coated film glass market through its advanced glass manufacturing sector and robust renewable energy infrastructure. The market shows steady growth at a CAGR of 3.6% through 2035, with established glass technology companies and renewable energy developers driving demand in Munich, Dresden, and Cologne. German manufacturers focus on high-performance AR coating applications and precision optical solutions, particularly in solar energy and architectural glass sectors requiring advanced light transmission properties. The country's strong engineering capabilities and established technology partnerships support consistent market development across multiple application areas.

Brazil's AR coated film glass market shows moderate growth potential at a CAGR of 3.3% through 2035, driven by expanding solar energy development and building initiatives. The market benefits from increasing renewable energy projects and green construction standards, with particular strength in large-scale solar installations. Brazilian construction companies and renewable energy developers adopt AR coated glass for solar applications and energy-efficient building solutions, addressing both energy performance and regulatory requirements. Market development benefits from growing awareness of energy efficiency benefits and expanding manufacturing capabilities in the glass sector.

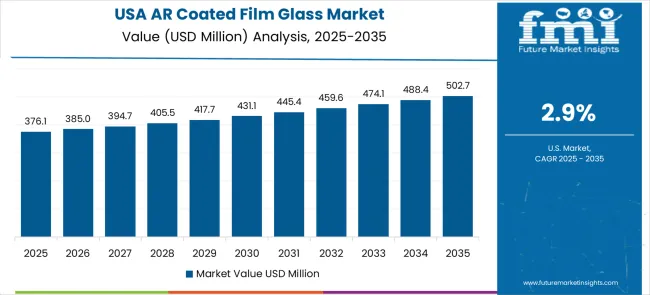

The United States maintains steady growth in the AR coated film glass market through its established renewable energy sector and energy efficiency standards. Market expansion at a CAGR of 2.9% through 2035 reflects consistent demand from solar developers, architectural glass suppliers, and optical technology manufacturers requiring advanced coating capabilities. American glass manufacturers and end-users utilize AR coated glass across photovoltaic, architectural, and optical applications, with particular emphasis on performance optimization and long-term durability. The country's strong renewable energy policies and established supply networks support stable market conditions and continued technology advancement.

The United Kingdom demonstrates consistent progress in the AR coated film glass market with a CAGR of 2.6% through 2035, supported by established glass manufacturers and building regulations. British construction companies and renewable energy developers adopt AR coated glass for energy-efficient building applications and solar installations, with particular focus on light transmission optimization and building performance standards. The market benefits from strong initiatives and established relationships with European glass technology suppliers. Development remains steady across multiple application areas despite economic uncertainties affecting construction investment levels.

Japan's AR coated film glass market shows steady development with a CAGR of 2.3% through 2035, as established glass technology companies and precision manufacturers maintain consistent demand. Market growth reflects mature market conditions and established optical glass capabilities across industrial and construction sectors. Japanese glass manufacturers and technology companies utilize AR coated glass for precision optical applications and energy-efficient building solutions, particularly in electronics and construction industries. The market benefits from domestic glass manufacturing expertise and strong technical support infrastructure, though growth remains moderate compared to emerging renewable energy markets.

The AR coated film glass market operates with a moderately concentrated structure featuring approximately 20-25 meaningful players, with the top five companies holding roughly 55-60% market share. Competition centers on coating technology capabilities, manufacturing scale advantages, and comprehensive application support rather than price competition alone. Market leaders include Xinyi Solar, Flat Glass Group, and AGC, which maintain competitive positions through established manufacturing networks, comprehensive product portfolios, and strong research and development capabilities. These companies benefit from scale advantages in glass production, extensive technical support networks, and established relationships with key photovoltaic manufacturers and architectural glass customers worldwide.

Challenger companies include CSG Holding, IRICO Group, and Jinxin Solar, which compete through specialized coating solutions and regional market focus, particularly in specific application areas or geographic regions. These companies differentiate through innovative coating technologies, competitive manufacturing strategies, and targeted customer service approaches. Ancai High-Tech, CNBM, Saint-Gobain, and NSG Group represent additional significant players with established presence in glass manufacturing markets and strong technical capabilities in coating and surface treatment technologies.

Competition intensifies around manufacturing innovation, with companies investing in advanced coating processes, enhanced durability performance, and integrated quality control systems that improve production efficiency and product consistency. Market dynamics reflect the importance of technical support services, application development programs, and ongoing quality assurance capabilities that influence customer purchasing decisions. Strategic partnerships with solar panel manufacturers and architectural glass distributors shape competitive positioning across different regional markets and application segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 988.0 million |

| Coating Type | Single-layer AR Coated Glass, Double-layer AR Coated Glass, Other |

| Application | Photovoltaic Energy, Architectural Decoration, Optical Instruments, Other |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Xinyi Solar, Flat Glass Group, AGC, CSG Holding, IRICO Group, Jinxin Solar, Ancai High-Tech, CNBM, Saint-Gobain, NSG Group |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across solar panel manufacturers and architectural glass suppliers, integration with renewable energy projects and energy-efficient building standards, innovations in single-layer and double-layer coating technologies, and development of specialized AR glass solutions with enhanced optical performance capabilities. |

The global AR coated film glass market is estimated to be valued at USD 988.0 million in 2025.

The market size for the AR coated film glass market is projected to reach USD 1,340.8 million by 2035.

The AR coated film glass market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in AR coated film glass market are single-layer AR coated glass and double-layer AR coated glass.

In terms of application, photovoltaic energy segment to command 52.0% share in the AR coated film glass market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Ear Simulator Market Size and Share Forecast Outlook 2025 to 2035

Area Gripper Market Size and Share Forecast Outlook 2025 to 2035

Arch Top Casement Window Market Size and Share Forecast Outlook 2025 to 2035

Arc Flash Risk Assessment Market Size and Share Forecast Outlook 2025 to 2035

Arch Top Door Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Aromatherapy Market Size and Share Forecast Outlook 2025 to 2035

Arthroscopy Devices Market Size and Share Forecast Outlook 2025 to 2035

Architectural Metal Coating Market Forecast Outlook 2025 to 2035

Aramid Honeycomb Core Material Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

AR and VR in Training Market Size and Share Forecast Outlook 2025 to 2035

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Art and Office Marker Pen Market Size and Share Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA