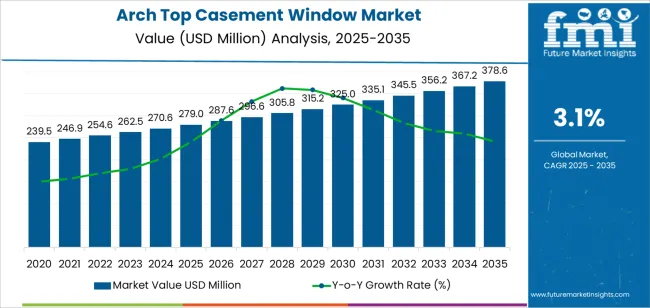

The global arch top casement window market is projected to reach USD 378.6 million by 2035, recording an absolute increase of USD 99.6 million over the forecast period. The market is valued at USD 279 million in 2025 and is set to rise at a CAGR of 3.1% during the assessment period. The overall market size is expected to grow by nearly 1.4 times during the same period, supported by increasing demand for architectural design differentiation worldwide, driving demand for efficient premium window solutions and increasing investments in residential renovation projects and commercial building aesthetic enhancement initiatives globally. However, higher installation costs compared to standard window designs and limited availability of skilled installation contractors may pose challenges to market expansion.

The market expansion reflects fundamental shifts in residential and commercial building design, where arch top casement windows enable property owners and developers to achieve superior aesthetic appeal and architectural distinction while maintaining energy efficiency and ventilation performance. Building projects across custom home construction, historic property restoration, and upscale commercial developments face mounting pressure to incorporate distinctive design elements that enhance curb appeal and property value, with arch top casement windows typically providing 15-25% higher perceived value compared to standard rectangular windows, making these products essential for premium building segments. The transition toward personalized home design and increasing homeowner willingness to invest in distinctive architectural features creates demand for specialty window products that can deliver both functional performance and visual impact.

Technological advancements in frame materials, glazing systems, and manufacturing precision are reshaping the arch top casement window landscape. Modern systems incorporate low-emissivity glass coatings that maintain thermal performance while accommodating curved top designs, enabling energy efficiency without compromising aesthetic goals. Integration with multi-point locking mechanisms and weather-resistant sealing systems allows superior security and moisture protection across the curved frame geometry. Advanced manufacturing techniques including computer-controlled cutting and precision assembly processes enable consistent quality in custom arch configurations that previously required extensive hand-crafting, supporting cost-effective production of traditionally expensive architectural window designs for broader market accessibility.

Government building energy efficiency mandates and historic preservation incentives accelerate market growth. Residential renovation tax credits and energy efficiency rebate programs in developed markets provide financial support for window replacement projects that improve building performance while enhancing architectural character. Historic district regulations and preservation standards create sustained demand for architecturally appropriate window replacements that maintain period design aesthetics while incorporating modern performance features. Premium residential construction market expansion in emerging economies drives adoption of distinctive architectural elements that differentiate luxury properties, enabling developers to command price premiums in competitive real estate markets through incorporation of signature design features including arch top windows that signal craftsmanship and attention to architectural detail supporting buyer preferences for unique residential environments.

Between 2025 and 2030, the arch top casement window market is projected to expand from USD 279 million to USD 325.0 million, resulting in a value increase of USD 46.0 million, which represents 46.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for premium residential construction and renovation solutions, product innovation in energy-efficient glazing systems and durable frame materials, as well as expanding integration with smart home systems and automated window operation technologies. Companies are establishing competitive positions through investment in advanced manufacturing capabilities, custom design services, and strategic market expansion across commercial building projects, residential new construction, and historic restoration applications.

From 2030 to 2035, the market is forecast to grow from USD 325.0 million to USD 378.6 million, adding another USD 53.6 million, which constitutes 53.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized window systems, including ultra-low-E glazing configurations and integrated shading solutions tailored for specific climate requirements, strategic collaborations between window manufacturers and architectural design firms, and an enhanced focus on sustainable materials and circular economy principles. The growing emphasis on building performance optimization and architectural heritage preservation will drive demand for advanced, high-performance arch top casement windows across diverse residential and commercial building applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 279 million |

| Market Forecast Value (2035) | USD 378.6 million |

| Forecast CAGR (2025-2035) | 3.1% |

The arch top casement window market grows by enabling property owners and developers to achieve distinctive architectural character and enhanced property value while maintaining modern window performance standards. Building designers and homeowners face mounting pressure to create visually compelling spaces that stand out in competitive real estate markets, with arch top casement windows typically contributing 10-20% premium positioning for residential properties compared to standard window installations, making these products essential for custom home construction and upscale renovation projects. The premium residential construction sector expansion creates demand for specialty architectural products that can deliver both aesthetic differentiation and functional performance including ventilation efficiency, natural light optimization, and energy conservation.

Government initiatives promoting energy-efficient building upgrades and historic preservation programs drive adoption in residential renovation projects, commercial property refurbishment, and heritage building restoration applications, where architecturally distinctive windows have a direct impact on property valuation and market appeal. The global shift toward personalized living spaces and design-conscious home improvement accelerates arch top casement window demand as homeowners seek products that express individual style preferences and architectural sophistication. However, premium pricing ranging 40-80% above standard casement windows and specialized installation requirements demanding experienced contractors may limit adoption rates among price-sensitive renovation projects and markets with limited skilled labor availability.

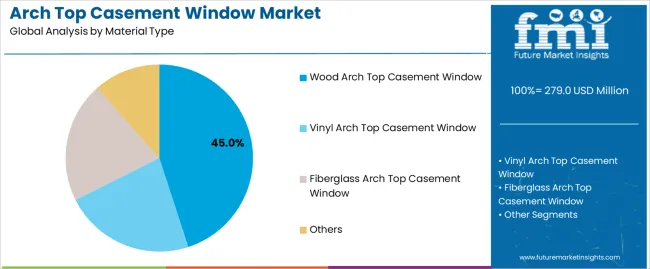

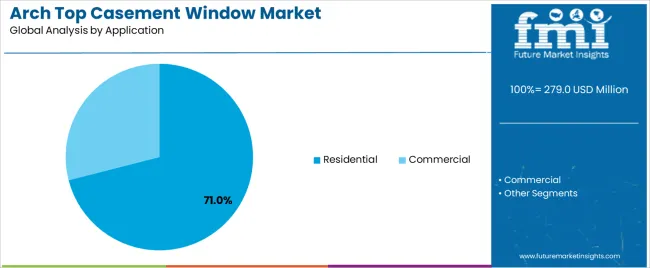

The market is segmented by material type, application, and region. By material type, the market is divided into wood arch top casement window, vinyl arch top casement window, fiberglass arch top casement window, and others. Based on application, the market is categorized into commercial and residential. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The wood arch top casement window segment represents the dominant force in the arch top casement window market, capturing approximately 45.0% of total market share in 2025. This advanced category encompasses premium hardwood frames, engineered wood composites, factory-finished wood products, and custom-milled architectural profiles, delivering comprehensive aesthetic versatility with traditional craftsmanship appeal and superior customization capabilities. The wood arch top casement window segment's market leadership stems from its essential role in historic property restoration, luxury residential construction, and high-end commercial building projects where authentic material character and design flexibility determine product selection decisions.

The vinyl arch top casement window segment maintains a substantial 32.0% market share, serving cost-conscious buyers requiring low-maintenance solutions through extruded PVC frames, fusion-welded construction, multi-chamber thermal designs, and factory color finishes that eliminate painting requirements. The fiberglass arch top casement window segment accounts for 18.0% market share, featuring high-strength composite materials, dimensional stability, and superior thermal performance. The others segment, including aluminum-clad and hybrid material configurations, represents 5.0% market share.

Key advantages driving the wood arch top casement window segment include:

Residential applications dominate the arch top casement window market with approximately 71.0% market share in 2025, reflecting the strong consumer preference for distinctive architectural features in custom home construction, luxury residential developments, and high-end renovation projects targeting property value enhancement. The residential segment's market leadership is reinforced by widespread adoption in single-family custom homes, upscale townhouse developments, historic home restoration projects, and luxury condominium buildings where arch top windows serve as signature design elements differentiating properties in competitive real estate markets.

The commercial segment represents 29.0% market share through specialized deployments including boutique hotels, upscale retail locations, professional office buildings, religious facilities, and hospitality venues that incorporate arch top casement windows to create welcoming atmospheres and distinctive architectural identities supporting brand positioning and customer experience objectives.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to residential construction trends and architectural design preferences. First, premium residential construction growth creates increasing requirements for distinctive architectural products, with luxury home segment expanding by 5-8% annually in major markets, requiring proven window solutions that deliver both aesthetic impact and functional performance in custom designs. Second, historic preservation and restoration activity drives demand for architecturally appropriate window replacements, with property owners investing USD 50,000-200,000 in comprehensive historic home restoration projects requiring period-correct window designs that accommodate modern performance features. Third, residential property value optimization strategies accelerate adoption as real estate studies document 8-15% higher resale values for homes incorporating distinctive architectural elements including specialty windows compared to standard construction in comparable neighborhoods.

Market restraints include premium pricing creating affordability barriers, as arch top casement windows typically cost USD 800-2,500 per unit compared to USD 400-800 for standard casement windows of similar size, representing significant budget impacts for whole-house window replacement projects involving 15-30 windows. Installation complexity and contractor availability pose practical challenges, as arch top window installation requires specialized skills and careful attention to curved frame sealing that many general contractors lack, limiting project execution capacity in markets with skilled labor shortages. Lead time considerations create project planning complications, as custom arch top windows often require 6-12week manufacturing periods compared to 2-4 weeks for standard products, complicating construction schedules and renovation project timelines.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where luxury residential construction boom and increasing Western architectural influence drive demand for distinctive window designs previously uncommon in regional construction practices. Technology advancement trends toward energy-efficient glazing systems optimized for curved geometries, factory-applied protective coatings extending wood frame durability, and precision manufacturing techniques reducing custom window costs by 20-30% are driving market accessibility improvements. However, the market thesis could face disruption if consumer preferences shift toward modern minimalist design aesthetics favoring clean geometric lines over traditional architectural ornamentation or if building energy codes mandate window designs prioritizing thermal performance over aesthetic considerations.

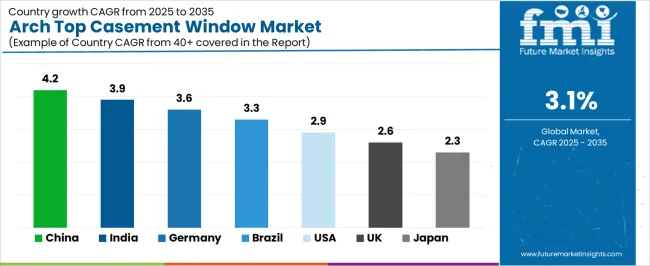

| Country | CAGR (2025-2035) |

|---|---|

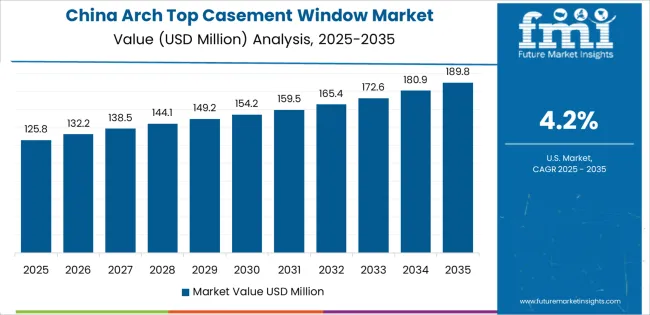

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| Brazil | 3.3% |

| USA | 2.9% |

| UK | 2.6% |

| Japan | 2.3% |

The arch top casement window market is gaining momentum worldwide, with China taking the lead thanks to aggressive luxury residential development and increasing Western architectural design adoption. Close behind, India benefits from premium housing sector expansion and growing affluent consumer base, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where historic building preservation traditions and architectural design excellence strengthen its role in European specialty window markets.

Brazil demonstrates robust growth through expanding upper-middle-class housing and increasing construction quality standards, signaling continued investment in premium building products. Meanwhile, the USA stands out for its mature custom home construction market and established historic preservation sector, while the UK and Japan continue to record consistent progress driven by heritage property maintenance and premium residential renovation activity. Together, China and India anchor the global expansion story, while established markets build stability and craftsmanship traditions into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Arch Top Casement Window Market with a CAGR of 4.2% through 2035. The country's leadership position stems from comprehensive luxury residential construction expansion, rapid urbanization supporting premium housing demand exceeding 2 million units annually, and increasing adoption of Western architectural styles incorporating distinctive window designs. Growth is concentrated in major metropolitan areas, including Beijing, Shanghai, Shenzhen, and Hangzhou regions, where high-net-worth individuals and upper-middle-class buyers are commissioning custom homes and luxury apartments featuring architectural details including arch top windows as status symbols and design differentiators.

Distribution channels through specialized building material dealers, architectural design firms, and direct manufacturer showrooms expand deployment across villa developments, luxury high-rise projects, and upscale renovation markets. The country's quality-of-life improvement initiatives provide policy support for construction standards elevation, including building design guidelines encouraging architectural diversity and aesthetic enhancement in residential developments.

Key market factors:

In metropolitan regions, satellite cities, and emerging luxury residential clusters, the adoption of arch top casement windows is accelerating across premium villa projects, upscale apartment developments, and custom home construction, driven by rising disposable incomes and aspirational lifestyle preferences among urban professionals and business owners. The market demonstrates strong growth momentum with a CAGR of 3.9% through 2035, linked to comprehensive premium housing sector expansion and increasing focus on residential design differentiation.

Indian homeowners and developers are implementing distinctive architectural features and premium building products to create differentiated properties commanding price premiums in competitive real estate markets serving affluent buyer segments. The country's Smart Cities Mission and urban development programs create sustained demand for quality construction products, while increasing emphasis on international design standards drives adoption of specialty architectural elements previously limited to luxury segment projects.

Germany's established architectural heritage demonstrates sophisticated implementation of arch top casement window technology, with documented case studies showing seamless integration in historic building restoration projects and new construction replicating traditional design vocabularies across Bavaria, Baden-Württemberg, and other regions with strong architectural preservation traditions. The country's building industry infrastructure in major urban centers, including Munich, Hamburg, Berlin, and Frankfurt regions, showcases integration of modern performance features with traditional window designs, leveraging expertise in precision manufacturing and quality craftsmanship standards.

German property owners emphasize authentic materials and proper restoration techniques, creating demand for high-quality arch top windows that support historic preservation standards and meet stringent thermal performance requirements under national energy regulations. The market maintains strong growth through focus on restoration market and premium new construction segments, with a CAGR of 3.6% through 2035.

Key development areas:

The Brazilian market leads Latin American adoption based on integration with expanding upper-middle-class housing and increasing construction sophistication across São Paulo, Rio de Janeiro, Brasília, and southern region metropolitan areas serving affluent homebuyer segments. The country shows solid potential with a CAGR of 3.3% through 2035, driven by premium residential construction growth and increasing consumer preferences for distinctive architectural features differentiating properties in competitive real estate markets.

Brazilian developers and homeowners are adopting arch top casement windows for upscale residential projects, particularly in gated community developments, luxury condominiums, and custom home construction serving affluent buyers seeking European and American design aesthetics. Distribution channels through architectural product distributors, specialty window dealers, and direct importation expand coverage across premium construction segments and renovation markets.

Leading market segments:

The USA arch top casement window market demonstrates mature implementation focused on established custom home construction sector and active historic preservation community, with documented integration across custom residential projects in traditional architectural styles including Colonial, Victorian, Mediterranean, and Craftsman designs popular throughout northeastern states, southern regions, and California markets.

The country maintains steady growth momentum with a CAGR of 2.9% through 2035, driven by continued custom home construction representing 15-20% of new single-family housing starts and strong renovation market supporting window replacement industry exceeding USD 10 billion annually. Major residential construction markets including Texas, Florida, California, and northeastern metropolitan areas showcase widespread availability of arch top window products through established distribution networks serving builders, remodelers, and homeowners.

Key market characteristics:

In conservation areas, listed buildings, and traditional residential neighborhoods across England, Scotland, Wales, and Northern Ireland, property owners are implementing arch top casement window replacements to address heritage building maintenance requirements while incorporating modern performance features including double glazing and weather sealing systems.

The market shows solid growth potential with a CAGR of 2.6% through 2035, linked to extensive historic building inventory requiring ongoing maintenance and planning authority requirements mandating architecturally appropriate window replacements in designated conservation areas. British property owners are adopting specialized window products and restoration techniques to ensure planning permission compliance while addressing building performance improvement objectives and property value maintenance in heritage property markets.

Market development factors:

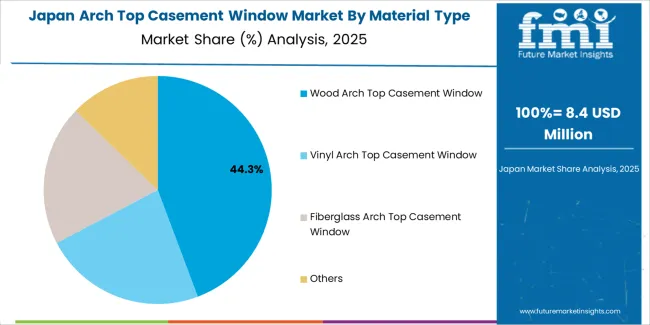

Japan's arch top casement window market demonstrates sophisticated implementation focused on Western-style residential construction and imported house designs, with documented integration of arch top windows in European-inspired homes and traditional Western architectural styles popular in upscale residential developments across Tokyo suburbs, Yokohama, Osaka, and other metropolitan areas.

The country maintains steady growth through emphasis on construction quality and design authenticity, with a CAGR of 2.3% through 2035, driven by continued interest in Western architectural styles among affluent homebuyers and established market for imported house designs replicating American and European residential traditions. Japanese homeowners prioritize authentic materials and proper design execution when commissioning Western-style homes, creating demand for specification-grade window products that deliver appropriate architectural character and reliable performance.

Key market characteristics:

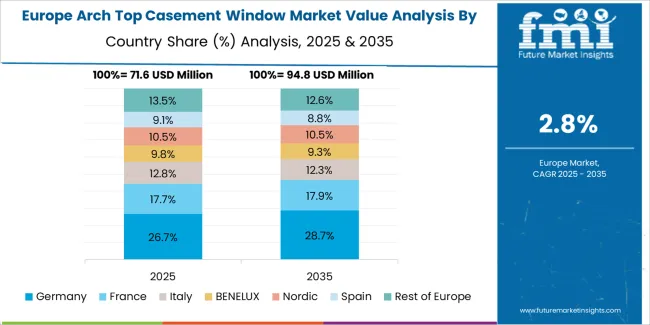

The arch top casement window market in Europe is projected to grow from USD 89.5 million in 2025 to USD 118.5 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership position with a 27.2% market share in 2025, declining slightly to 26.8% by 2035, supported by its extensive historic building inventory and major architectural preservation centers including Bavaria, Rhineland, and Baden-Württemberg regions.

France follows with a 23.5% share in 2025, projected to reach 23.8% by 2035, driven by comprehensive historic monument preservation programs and traditional architectural design preferences in Provence, Brittany, and Loire Valley regions. The United Kingdom holds a 20.8% share in 2025, expected to reach 21.2% by 2035 through conservation area window replacement activity. Italy commands a 14.5% share in both 2025 and 2035, backed by extensive historic property inventory and restoration market activity.

Spain accounts for 8.2% in 2025, rising to 8.4% by 2035 on coastal luxury residential development. The Netherlands maintains 5.8% market share throughout the forecast period. The Rest of Europe region is anticipated to hold 10.0% in 2025, expanding to 10.3% by 2035, attributed to increasing arch top window adoption in Nordic countries and emerging Central & Eastern European premium residential construction and historic preservation programs.

The Japanese arch top casement window market demonstrates a specialized and quality-focused landscape, characterized by sophisticated integration of imported wood window systems and authentic design replication with Western-style residential construction standards across custom home developments, imported house projects, and European-inspired villa communities. Japan's emphasis on construction quality and design authenticity drives demand for specification-grade window products that support architectural integrity and meet rigorous Japanese building performance requirements including typhoon resistance and seismic standards.

The market benefits from established relationships between specialized import distributors and North American window manufacturers including Marvin, Pella, and Andersen, creating reliable supply chains that prioritize product quality and comprehensive installation support. Residential developments in Tokyo suburbs, Kanagawa prefecture, and other affluent metropolitan areas showcase authentic Western architectural implementations where arch top windows deliver appropriate design character meeting homeowner expectations for architectural accuracy and long-term product reliability.

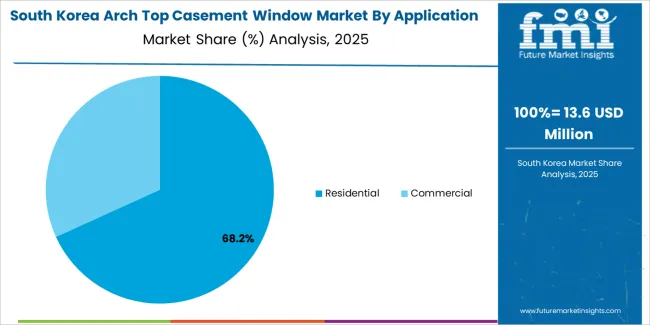

The South Korean arch top casement window market is characterized by growing international product presence, with companies maintaining positions through specialized distribution services and technical support capabilities for Western-style residential construction and luxury apartment applications. The market demonstrates increasing emphasis on distinctive architectural features and premium building products, as Korean developers and homeowners increasingly demand specialty windows that differentiate properties and signal quality construction in competitive real estate markets serving affluent buyer segments.

Regional building product distributors are gaining market share through strategic partnerships with international window manufacturers, offering specialized services including Korean building code compliance verification and customized warranty programs for residential projects. The competitive landscape shows increasing collaboration between multinational window companies and Korean architectural design firms, creating distribution models that combine international product quality with local market understanding and construction industry relationship networks supporting specification and project execution.

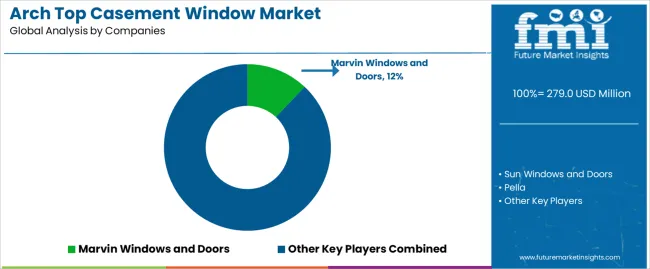

The arch top casement window market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 30-35% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on customization capabilities, material quality, and manufacturing precision rather than price competition alone. Marvin Windows and Doors leads with approximately 12% market share through its comprehensive custom window program and established architectural design community relationships.

Market leaders include Marvin Windows and Doors, Pella, and Andersen Windows, which maintain competitive advantages through decades of residential window manufacturing expertise, extensive dealer networks spanning North America and select international markets, and proven product reliability supporting warranty commitments and professional specification preferences. These companies leverage manufacturing investments in advanced fabrication equipment, comprehensive product testing facilities, and skilled craftsman workforces to defend market positions while expanding into emerging luxury residential markets and commercial specialty applications.

Challengers encompass JELD-WEN and Milgard, which compete through value-oriented product lines and strong regional presence in specific geographic markets offering professional-grade quality at competitive price points. Product specialists, including Sierra Pacific and Sun Windows and Door, focus on specific material types or regional markets, offering differentiated capabilities in custom wood fabrication, specialized glazing options, and architectural design consultation services.

Regional manufacturers including Doorwin Group and emerging specialty window fabricators create competitive pressure through localized production advantages and rapid custom fulfillment capabilities, particularly in high-growth markets including China where domestic manufacturers increasingly master specialty window production techniques previously dominated by established Western brands. Market dynamics favor companies that combine proven manufacturing quality with comprehensive design services and responsive custom fabrication capabilities that address the complete project lifecycle from architectural specification through final installation and long-term warranty support.

| Item | Value |

|---|---|

| Quantitative Units | USD 279 million |

| Material Type | Wood Arch Top Casement Window, Vinyl Arch Top Casement Window, Fiberglass Arch Top Casement Window, Others |

| Application | Commercial, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Marvin Windows and Doors, Sun Windows and Door, Pella, JELD-WEN, Milgard, Sierra Pacific, Doorwin Group, ORIDOW, Kendra Windows, Modernize, Andersen Windows, Zen Windows, Champion Windows, ProVia |

| Additional Attributes | Dollar sales by material type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with specialty window manufacturers and distribution networks, customization capabilities and design specifications, integration with historic preservation standards and modern energy efficiency requirements, innovations in frame materials and glazing technologies, and development of specialized window systems with enhanced thermal performance and architectural authenticity capabilities. |

The global arch top casement window market is estimated to be valued at USD 279.0 million in 2025.

The market size for the arch top casement window market is projected to reach USD 378.6 million by 2035.

The arch top casement window market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in arch top casement window market are wood arch top casement window, vinyl arch top casement window, fiberglass arch top casement window and others.

In terms of application, residential segment to command 71.0% share in the arch top casement window market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Architectural Metal Coating Market Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Architectural Flat Glass Market Size and Share Forecast Outlook 2025 to 2035

Architectural Lighting Market

Arch Top Door Market Size and Share Forecast Outlook 2025 to 2035

Parchment Paper Market Size and Share Forecast Outlook 2025 to 2035

Search and Rescue Equipment (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Research And Development (R&D) Analytics Market Size and Share Forecast Outlook 2025 to 2035

Research Antibodies Market Size and Share Forecast Outlook 2025 to 2035

AI Search Engine Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA