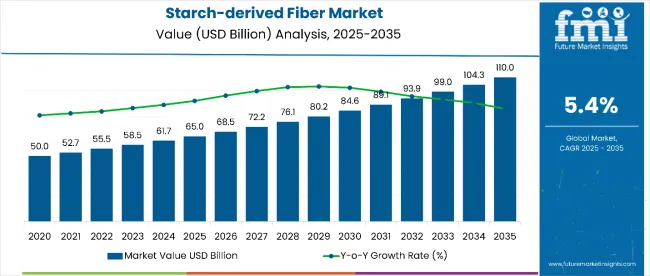

The starch-derived fiber market is estimated to be valued at USD 65.0 billion in 2025 and is projected to reach USD 110.0 billion by 2035, registering a CAGR of 5.4% over the forecast period. The starch-derived fiber market is projected to add an absolute dollar opportunity of USD 41.9 billion over the forecast period.

| Metric | Value |

|---|---|

| Starch-derived Fiber Market Estimated Value in (2025E) | USD 65.0 billion |

| Starch-derived Fiber Market Forecast Value in (2035F) | USD 110.0 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

This reflects a 1.69 times growth at a compound annual growth rate of 5.4%. The market's evolution is expected to be shaped by rising demand for natural dietary fiber ingredients in functional foods, pharmaceutical applications, and industrial biotechnology sectors, particularly where digestive health benefits and clean-label positioning are prioritized.

By 2030, the market is likely to reach approximately USD 85.0 billion, accounting for USD 20.0 billion in incremental value over the first half of the decade. The remaining USD 25.0 billion is expected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for synthetic fiber ingredients and traditional dietary supplements is gaining traction due to starch-derived fiber's superior functional properties and natural origin positioning.

Companies such as Cargill Incorporated and Ingredion Incorporated are advancing their competitive positions through investment in biotechnology research and scalable fiber extraction technologies. Health-focused procurement models are supporting expansion into nutraceutical manufacturing, pharmaceutical excipient production, and industrial biotechnology applications. Market performance will remain anchored in clean-label certification standards, functional efficacy benchmarks, and sustainable sourcing practices.

The market holds approximately 26% of the functional fiber ingredients market, driven by its superior digestive health benefits and versatility across food and pharmaceutical applications. It accounts for around 18% of the specialty dietary fiber market, supported by its clean-label positioning and compatibility with natural food formulation requirements.

The market contributes nearly 14% to the nutraceutical ingredients market, particularly for products targeting digestive wellness and metabolic health support. It holds close to 22% of the pharmaceutical excipient market for fiber-based applications, where starch-derived fibers are used for drug delivery, binding, and disintegration properties.

The market is undergoing structural change driven by rising demand for natural and sustainable fiber ingredients with proven health benefits. Advanced extraction and processing methods using enzymatic modification and controlled fermentation have enhanced fiber functionality, bioavailability, and application versatility, making starch-derived fibers viable alternatives to synthetic and traditional fiber ingredients.

Manufacturers are introducing organic certifications and functional health claims tailored for nutraceutical brands and pharmaceutical companies, expanding their role beyond basic dietary supplementation. Strategic collaborations between agricultural suppliers and biotechnology companies have accelerated innovation in specialized fiber production.

The market is segmented by raw material, form, type, and region. By raw material, the market is divided into corn, wheat, sweet potatoes, others (such as cassava, barley, and rice). Based on form, the market is bifurcated into spun and filaments. In terms of type, the market includes edible/food-grade and industrial-grade. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

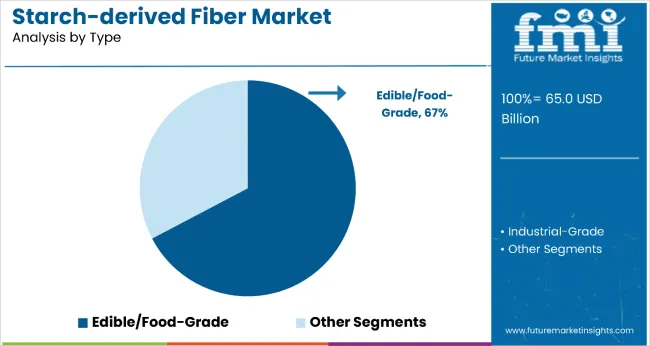

The edible/food-grade segment leads the type category with a dominant 67% market share, driven by growing consumer demand for functional foods and dietary supplements containing safe, natural fiber ingredients. Food-grade starch-derived fiber complies with stringent regulatory and quality standards necessary for human consumption, reinforcing its credibility across health-focused product formulations.

Its alignment with nutraceutical applications enhances market adoption, especially as innovations in purification and bioavailability continue to improve product efficacy without compromising safety.

The segment thrives amid rising interest in digestive health claims and transparent, evidence-based nutrition. As the functional ingredient market evolves, food-grade starch-derived fiber remains a preferred choice for manufacturers seeking to meet consumer expectations for wellness, clean labels, and scientifically backed health benefits.

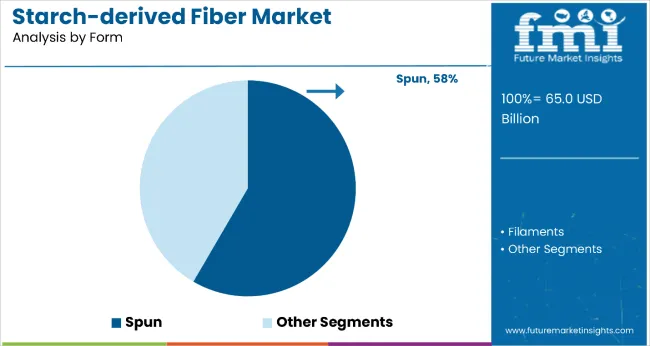

The spun form segment commands a 58% share in the starch-derived fiber market, reflecting increased demand for processed fiber formats that offer enhanced functionality and processing efficiency. Spun starch-derived fiber delivers superior dispersibility and integration compared to conventional forms, making it ideal for use in both food and pharmaceutical applications.

Advanced manufacturing processes allow for uniform particle sizes and reliable performance, addressing formulation needs across diverse product categories.

Growth is further supported by technological advancements that lower production costs while maintaining consistent quality. As functional foods and pharmaceutical excipients gain importance, spun starch-derived fiber is expected to play a growing role in delivering high-performance, application-specific solutions within specialty ingredient and industrial processing sectors.

Starch-derived fiber's proven digestive health benefits, superior functional properties, and natural origin make it an attractive ingredient for health-conscious consumers seeking effective dietary fiber solutions.

Growing awareness of gut health importance and the connection between fiber intake and overall wellness is further propelling adoption, especially among nutraceutical manufacturers targeting digestive health applications. Government support for functional food development, along with innovations in biotechnology processing techniques, are also enhancing product quality and application versatility.

As consumer preferences shift toward clean-label ingredients and evidence-based nutrition, and as research continues to validate starch-derived fiber's health benefits in clinical studies, the market outlook remains favorable. With manufacturers and formulators prioritizing ingredient transparency, functional efficacy, and sustainable sourcing practices, starch-derived fiber is well-positioned to expand across various food, pharmaceutical, and industrial applications.

From 2025 to 2035, biotechnology advancement systems were introduced in fiber processing facilities, improving extraction efficiency, enhancing product purity, and supporting scalable production capabilities. These developments position technology-enabled fiber producers as key partners for brands seeking consistent quality ingredients and verified functional claims for health-focused product formulations.

Digestive Health Awareness Drives Starch-derived Fiber Adoption

The growing recognition of starch-derived fiber's superior digestive health benefits and prebiotic properties has been identified as the primary catalyst for growth in the starch-derived fiber market. In 2024, increased consumer awareness of gut health importance prompted widespread adoption of starch-derived fiber ingredients in functional foods, dietary supplements, and pharmaceutical formulations targeting digestive wellness applications.

By 2025, nutraceutical manufacturers were incorporating specialized starch-derived fiber formulations into probiotic products, digestive health supplements, and functional beverages to address consumer demand for evidence-based gut health solutions.

Biotechnology Innovation Creates Advanced Processing Opportunities

In 2024, fiber processing companies began implementing advanced biotechnology systems to optimize starch-derived fiber extraction, purification, and modification processes, leading to improved product consistency and enhanced functional properties.

By 2025, specialized processing facilities were adopting enzymatic modification and controlled fermentation technologies for starch-derived fiber production, supporting premium positioning and expanded application possibilities. These implementations demonstrate that when starch-derived fiber adopts advanced biotechnology processing and quality control systems, product performance and market positioning opportunities are significantly enhanced.

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.0% |

| Brazil | 4.2% |

| Russia | 4.0% |

| USA | 3.8% |

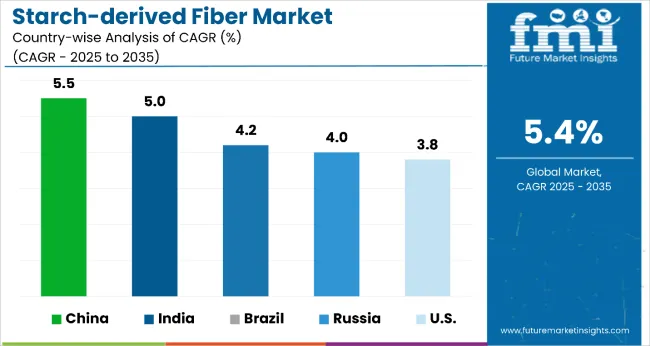

In the starch-derived fiber market, China leads with the highest projected CAGR of 5.5% (2025 to 2035). India follows closely with a CAGR of 5.0%, supported by regional processing hubs and strong government backing for pharmaceutical applications. Brazil ranks third at 4.2% CAGR, leveraging its dual corn harvest system and low-cost processing advantages.

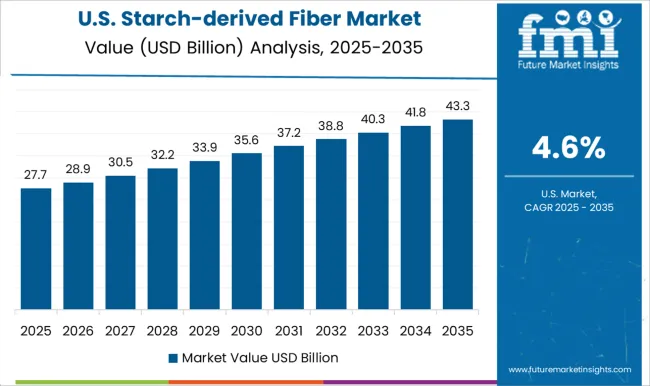

Russia’s market is growing at 4.0% CAGR, supported by increasing corn acreage and domestic demand, though constrained by geopolitical trade limits. The USA posts a comparatively modest CAGR of 3.8%, slightly below the global average, due to mature markets but strong demand in regulated nutraceutical sectors.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

Starch-derived fiber market in China is projected to grow at a CAGR of 5.5% from 2025 to 2035, outperforming the global average by 1.8%. The growth is linked to large-scale biotechnology research facilities in Jiangsu, Shandong, and Guangdong provinces. Advanced fiber extraction technologies are widely adopted in pharmaceutical manufacturing and functional food production.

Output has been expanded by government support for biotechnology innovation and health ingredient development programs. Starch-derived fiber products are increasingly replacing synthetic additives in domestic food manufacturing and pharmaceutical applications. More than half the production is linked to certified facilities catering to export demand in Southeast Asia, North America, and Europe.

Starch-derived fiber revenue in India is forecast to grow at a CAGR of 5.0% from 2025 to 2035, ahead of the global average by 1.4%. Regional processing clusters in Maharashtra, Gujarat, and Karnataka have expanded production of specialty starch-derived fibers for pharmaceutical and nutraceutical applications.

Government-supported biotechnology initiatives are encouraging fiber ingredient development for domestic healthcare markets. Processing companies have developed integrated supply chains from agricultural sourcing to finished fiber products while maintaining cost competitiveness. Export volumes to Middle Eastern and African markets are rising, particularly for pharmaceutical-grade fiber ingredients used in drug formulation and dietary supplements.

The USA starch-derived fiber demand is expected to grow at a CAGR of 3.8% from 2025 to 2035, slightly underperforming the global average by 0.1%. Demand is driven by nutraceutical manufacturers and pharmaceutical companies seeking FDA-compliant fiber ingredients for functional food and drug applications.

Regional production in Midwest agricultural states supports domestic supply chains, though specialized applications require premium-grade imports from biotechnology leaders. Advanced processing facilities are developing application-specific fiber formulations for targeted health benefits while maintaining regulatory compliance.

Sales of starch-derived fiber in Brazil are projected to grow at a CAGR of 4.2% during the forecast period. Brazil’s corn starch market is expanding rapidly, supported by the country’s abundant corn production from both its primary and safrinha (second) harvest seasons. Its competitive agricultural cost structure makes Brazil one of the most efficient corn processors globally.

As demand for starch in the food and industrial sectors grows, Brazilian manufacturers are ramping up capacity. Additionally, favorable climatic conditions and government-backed agricultural financing aid long-term production expansion. Though infrastructure remains a challenge in some regions, investments in logistics are improving supply chain efficiency.

The starch-derived fiber revenue in Russia is expected to register a CAGR of 4.0% during the forecast period. Russia is gaining traction in the corn starch market through modernization of its agricultural systems and increasing domestic processing capacity. While wheat remains the dominant crop, corn cultivation is expanding steadily, especially in the southern regions.

Russian corn starch is primarily consumed within the country, supporting sectors like food processing, paper, and construction materials. Additionally, Russia’s geopolitical orientation toward self-reliance has driven investment into local starch production. Government incentives and technology upgrades are helping improve yields and quality. Although exports are limited due to trade restrictions, there is growing potential for expansion into Asia and Eastern Europe.

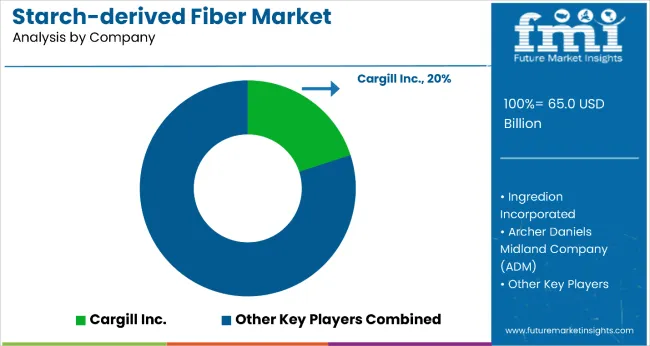

The starch-derived fiber market is moderately consolidated and the company holds a dominant position through its advanced biotechnology processing capabilities, extensive agricultural supply networks, and established relationships with pharmaceutical and nutraceutical manufacturers.

Dominant player status is held exclusively by Cargill Inc. Key players include Ingredion Incorporated, Archer Daniels Midland, Dadtco Phil Africa B.V., Alliance Grain Traders Inc., Pocantico Resources, Ixtlera, HL Agro, Viva Pharmaceutical Inc., and Watson Inc., each providing specialized starch-derived fiber solutions featuring advanced extraction technologies, pharmaceutical-grade purity standards, and application-specific formulations designed for digestive health, pharmaceutical excipients, and industrial biotechnology applications.

Emerging players are limited in this category due to high biotechnology investment requirements and the dominance of established agricultural processing companies with integrated supply chains. Market demand is driven by growing consumer awareness of digestive health benefits, increasing pharmaceutical excipient applications, and rising adoption of clean-label functional ingredients in health-focused product formulations.

Key Developments in Starch-derived Fiber Market

Manufacturers are advancing biotechnology processing techniques and enzymatic modification methods for improved fiber functionality and bioavailability, expanding starch-derived fiber's suitability for pharmaceutical, nutraceutical, and specialized food applications. Agricultural suppliers are investing in sustainable sourcing practices and quality certification systems, while processing companies scale biotechnology operations for global distribution.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.0 Billion |

| Raw Material | Corn, Wheat, Sweet Potatoes, and Others |

| Form | Spun and Filaments |

| Type | Edible/Food-Grade and Industrial-Grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, and 40+ countries |

| Key Companies Profiled | Ixtlera, Cargill Inc., Dadtco Phil Africa B.V., Alliance Grain Traders Inc., Pocantico Resources, Ingredion Incorporated, Archer Daniels Midland, HL Agro, Viva Pharmaceutical Inc., Watson Inc. |

| Additional Attributes | Dollar sales by raw material and type classification, growing usage in pharmaceutical excipient applications and functional food manufacturing for digestive health benefits, stable demand in nutraceutical and biotechnology markets, innovations in extraction processing and biotechnology modification improve product functionality, bioavailability, and application versatility |

The global starch-derived fiber market is estimated to be valued at USD 65.0 billion in 2025.

The market size for the starch-derived fiber market is projected to reach USD 110.0 billion by 2035.

The starch-derived fiber market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in starch-derived fiber market are corn, wheat, sweet potatoes and others (cassava, barley, rice, sorghum).

In terms of form, spun segment to command 62.7% share in the starch-derived fiber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA