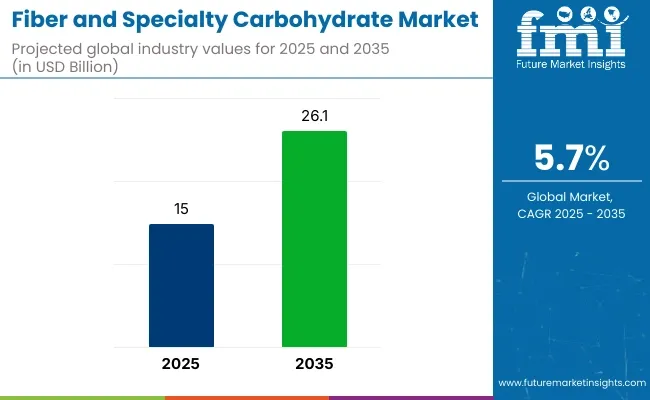

The global fiber and specialty carbohydrate market is anticipated to be valued at USD 15 billion in 2025 and is projected to reach USD 26.1 billion by 2035, expanding at a CAGR of 5.7%. Strong growth is being driven by increased consumer awareness regarding the health benefits of dietary fiber and specialty carbohydrates.

Rising demand for functional foods and beverages is being observed due to the growing incidence of obesity, diabetes, and cardiovascular diseases. Lifestyle modifications and a shift toward preventive healthcare have also contributed to market expansion. Digestive health, weight management, and glycemic control have been prioritized by health-conscious consumers.

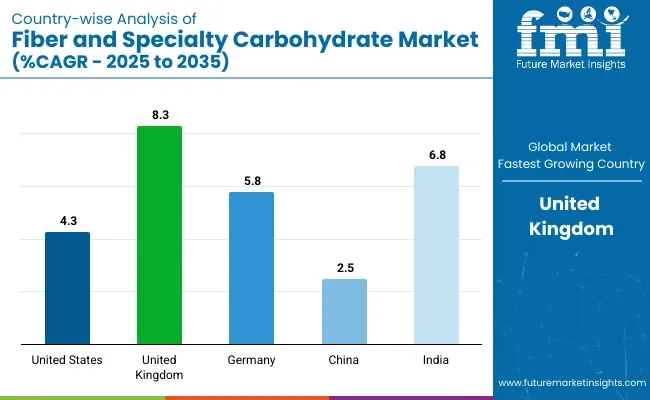

The global fiber and specialty carbohydrate market is projected to witness robust growth, expanding at a CAGR of 5.7% from 2025 to 2035. The USA. is anticipated to hold the largest market share, while the United Kingdom is forecasted to grow the fastest with an 8.3% CAGR.

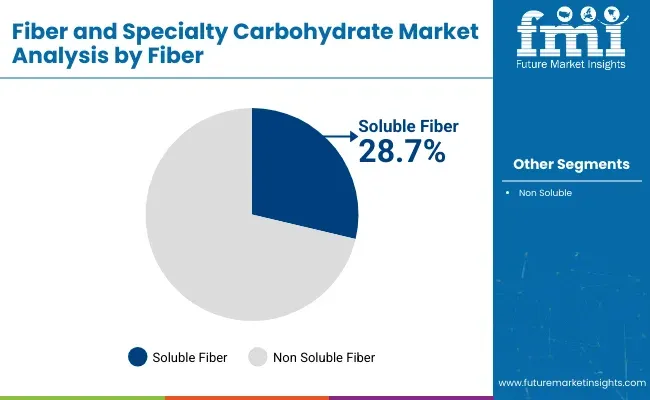

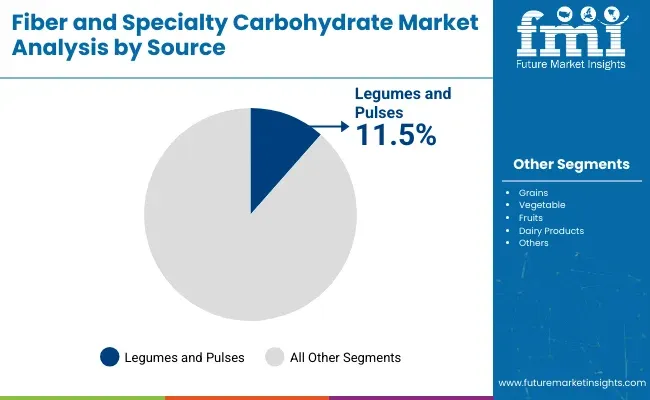

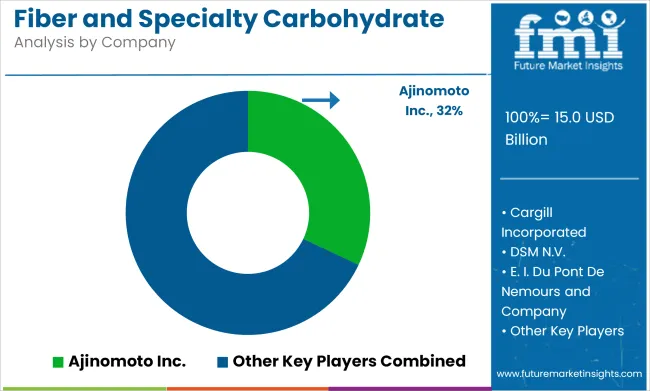

Soluble fiber is expected to dominate the fiber type segment with a 28.7% share by 2025, driven by its digestive and metabolic health benefits. Legumes will emerge as the leading source due to their high nutritional content. Functional foods are set to lead application growth. Ajinomoto Inc. remains the top market leader with a 20% share.In a March 2025 Bloomberg interview, Corning CEO Wendell Weeks discussed the company’s performance amid the AI-driven infrastructure boom. He noted, “As demand for AI-powered data centers accelerates, we’re seeing strong momentum in fiber optics.

This surge is driving core sales beyond expectations.” Weeks emphasized that improving market conditions and strategic positioning in telecom infrastructure are fueling this growth. Looking ahead, he acknowledged that personalized nutrition, microbiome innovation, and sustainable fermentation will reshape adjacent markets. With rising investment in plant-based, clean-label, and eco-efficient technologies, Weeks affirmed that Corning and its peers are well-positioned to capitalize on these converging industry shifts by 2035.

The global fiber and specialty carbohydrate market is expanding steadily due to rising consumer awareness around digestive health, heart wellness, and sustainable nutrition. Soluble fiber, grains, and legumes are emerging as primary investment areas across food, beverage, and supplement applications.

Soluble fiber will hold 28.7% of the fiber segment share by 2025.

Grains are projected to contribute 30% of the source segment share by 2025.

Functional foods will account for the largest share in the application segment by 2025.

Legumes will hold 11.5% of the source segment share by 2025.

In recent times, significant strides in technology and production methodologies have revolutionized the extraction and integration of fiber and specialty carbohydrates into diverse food and beverage products. The advancements not only drive cost effectiveness but also enhance overall efficiency, marking a transformative era for the industry.

The surge in demand for functional beverages, featuring added fibers and specialty carbohydrates, reflects a paradigm shift in consumer preferences as they increasingly seek healthier alternatives to traditional sugary drinks. The transformative trend is propelled by several factors contributing to the growth of the functional beverages market.

The escalating preference for plant based diets, heightened sustainability consciousness is propelling a surge in demand for fibers, and specialty carbohydrates derived from plant sources, replacing traditional animal based ingredients. The transformative shift is reshaping dietary choices and contributing to the evolution of a more eco conscious and health oriented food industry.

Ongoing research and development efforts within the food industry are sparking a revolutionary wave of innovations in product formulations, displaying the art of seamlessly incorporating fibers and specialty carbohydrates into an extensive array of food and beverage products.

The dynamic shift not only meets the rising demand for nutritional enhancements but also successfully navigates the intricate balance of preserving taste and texture, fostering a new era of culinary creativity.

The intricacy not only poses limitations on market expansion but also underscores the need for accessible alternative sources to maintain the delicate balance of inclusivity and safety.

| Attributes | Details |

|---|---|

| Trends |

|

| Opportunities |

|

Europe stands out as a dominant force in the fiber and specialty carbohydrate industry. There will be a substantial increase in demand for advanced fiber and specialty carbohydrates in the United Kingdom and Germany. The below table showcases revenues in terms of the top 5 leading countries, which are expected to lead the market through 2035.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

| United Kingdom | 8.3% |

| Germany | 5.8% |

| China | 2.5% |

| India | 6.8% |

Demand for fiber and specialty carbohydrates in the United States is rising with an anticipated CAGR of 4.3% through 2035. Key factors influencing the demand include,

The United Kingdom fiber and specialty carbohydrate market is forecasted to inflate at a CAGR of 8.3% through 2035. Top aspects supporting the market growth are,

The demand for fiber and specialty carbohydrates in Germany are estimated to record a CAGR of 5.8% through 2035. Key variables backing up this phenomenon are,

Adoption of fiber and specialty carbohydrate in China is likely to exhibit a CAGR of 2.5% through 2035. Reasons supporting this rapid adoption include,

The India fiber and specialty carbohydrate market is expected to surge at a CAGR of 6.8% through 2035. Top factors that helped in the market growth are:

The fiber and specialty carbohydrate market is characterized by a competitive landscape with suppliers divided into three tiers based on their strategies and scale of operations. Leading companies like Ajinomoto Inc., Archer Daniels Midland Company, and Cargill Incorporated dominate the market with extensive global reach, diverse product portfolios, and strong investments in research and development.

These tier 1 players continuously innovate and focus on sustainability, creating products that cater to health-conscious consumers. For instance, Ajinomoto has been focusing on plant-based fibers and functional ingredients, capitalizing on the growing demand for clean-label products.

In contrast, Tier 2 players such as DSM N.V. and FMC Corporation focus on specialized market segments, leveraging technological advancements and strategic partnerships to stay competitive. Smaller, Tier 3 suppliers like SunOpta, Inc. and Roquette Freres often focus on regional markets or specific niches, offering customized solutions.

Entry barriers in this market are high due to the significant investment required in R&D and regulatory hurdles, and consolidation is occurring as larger companies acquire smaller players to expand their product offerings and geographical presence.

Recent Fiber and Specialty Carbohydrate Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 15 billion |

| Projected Market Size (2035) | USD 26.1 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand tons for volume |

| Types Analyzed (Segment 1) | Fibers, Specialty Carbohydrates |

| Applications Analyzed (Segment 2) | Functional Foods, Functional Beverage, Dietary Supplements, Animal Nutrition, Personal Care |

| Sources Analyzed (Segment 3) | Grains, Vegetable, Fruits, Dairy Products, Legumes and Pulses, Nuts and Seeds |

| Fibers Analyzed (Segment 4) | Soluble, Non Soluble |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Fiber and Specialty Carbohydrate Market | Ajinomoto Inc., Archer Daniels Midland Company, Cargill Incorporated, DSM N.V., E. I. Du Pont De Nemours and Company, FMC Corporation, Ingredion Incorporated, J. Rettenmaier & Söhne GmbH & Co. Kg, Roquette Freres, Südzucker AG Company, SunOpta Inc. |

| Additional Attributes | Demand trends for soluble vs non-soluble fibers, Growth in plant-based and functional nutrition, Expansion in animal feed applications, Technological advances in carbohydrate extraction and purification, Regional variations in dietary fiber consumption |

| Customization and Pricing | Customization and Pricing Available on Request |

The market is projected to reach a valuation of USD 15 billion in 2025.

The fiber and specialty carbohydrates industry is set to expand by a CAGR of 5.7% through 2035.

The fiber and specialty carbohydrates market is forecast to reach USD 26.1 billion by 2035.

The United Kingdom is expected to be the top performing market, exhibiting a CAGR of 8.3% through 2035.

Soluble fiber and specialty carbohydrate is expected to account for a share of 28.7% in 2024, making it a highly preferred product type.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA