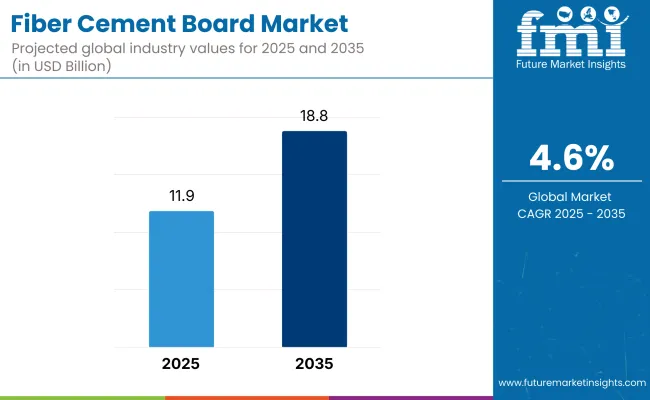

In 2025, the global fiber cement board market is estimated at USD 11.9 billion. By 2035, the market is projected to reach USD 18.8 billion, driven by a CAGR of 4.6%. Increased adoption of fiber cement boards has been supported by their fire-resistance, dimensional stability, and mold resilience. Demand has grown sharply across residential and commercial projects. Their suitability for cladding, flooring underlayment, and partition walls has been widely acknowledged by global manufacturers.

In February 2025, James Hardie Industries disclosed a third-quarter adjusted EBITDA of USD 262 million and a margin of 27.5%. According to the company’s official release, “our strategy execution and operational discipline are enabling us to deliver strong results and manage decisively through cycles,” stated CEO Aaron Erter.

The company's North American fiber cement segment recorded a 6% volume increase year-over-year, driven by builder demand and an exclusive partnership with David Weekley Homes, one of the largest private homebuilders in the United States. This agreement was announced on the company’s investor site and is expected to sustain fiber cement board volumes through 2030.

At the global level, Etex Group, headquartered in Belgium, expanded its European footprint in 2025 with the opening of a €200 million plasterboard and fiber cement board facility in Bristol, UK. In its official March 2025 communication, the company stated that the site would enable over 98% of its Siniat-brand boards sold in the UK and Ireland to be manufactured locally, reducing supply chain dependency and increasing capacity. The company’s CEO, Bernard Delvaux, declared, “This investment reaffirms our commitment to sustainable growth and building performance solutions.”

The demand for fiber cement has surged in Asia-Pacific, with notable traction in India and Vietnam where urban infrastructure upgrades and low-cost housing initiatives are ongoing. Local governments have included fiber cement materials in green building codes to lower carbon footprints in mass construction.

Advancements in production methods have enabled thinner, lighter, and higher-strength boards. Automation and AI-based defect detection systems have been integrated into manufacturing lines by multiple European producers. Challenges such as energy-intensive curing processes and skilled labor shortages remain. However, targeted R&D investments have been initiated by producers to improve formulation efficiency and reduce emissions.

The annual growth rates of the Fiber Cement Board market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 4.3% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.3% (2024 to 2034) |

| H2 2024 | 4.4% (2024 to 2034) |

| H1 2025 | 4.5% (2025 to 2035) |

| H2 2025 | 4.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 4.5% in the first half and grow to 4.6% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 10 BPS each.

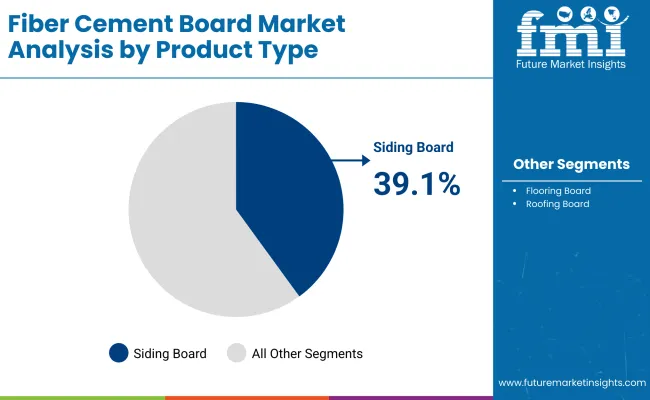

The global fiber cement board market is expected to witness continued expansion in 2025, with specific segments clearly leading in terms of value share. According to recent segmental analysis, siding boards, categorized under product type, are projected to hold the largest share at approximately 39.1% in 2025.

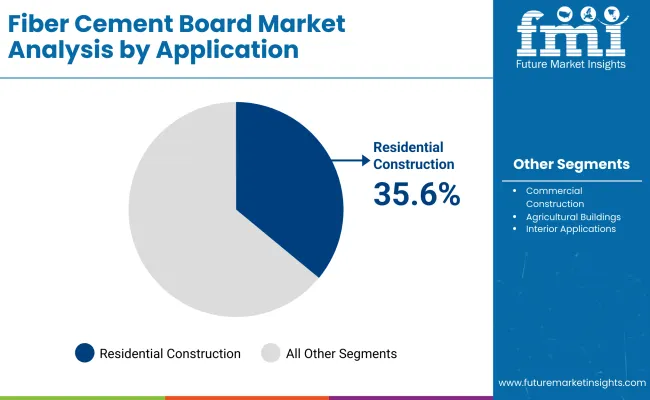

On the application front, residential construction is anticipated to remain the dominant user segment, capturing 35.6% of total market value during the same period. These insights provide strategic direction for stakeholders seeking to enter or expand within this sector, enabling them to identify high-value investment areas with clarity and confidence.

Among product categories, siding boards have emerged as the most demanded fiber cement product. The preference for siding boards stems from their exceptional fire resistance, moisture tolerance, and low maintenance profile, making them ideal for external cladding across diverse climates. As of 2025, the segment’s 39.1% value share illustrates its foundational role in the broader market.

The global emphasis on sustainable construction has intensified the demand for energy-efficient and environmentally friendly building materials. Fiber cement siding, which combines Portland cement, silica, and cellulose fibers, offers a superior solution for long-lasting cladding. Its robustness under extreme temperatures and exposure to the elements has positioned it as a compelling alternative to traditional wood or vinyl sidings.

In particular, contractors and builders are increasingly opting for fiber cement over wood or vinyl, especially in projects where building codes mandate materials with high fire resistance ratings. This trend is especially prominent in fire-prone regions like parts of North America, Australia, and Southern Europe. The adoption of stricter regulatory frameworks requiring non-combustible siding materials further fuels demand.

The siding boards segment is also benefiting from the aesthetic flexibility of fiber cement, as these products can replicate textures like wood grain, stucco, or stone without compromising performance. This has enhanced their appeal among homeowners and real estate developers seeking to maintain curb appeal while meeting building codes and sustainability goals.

On the basis of application, residential construction stands out as the largest segment, commanding a 35.6% market share in 2025. The growing popularity of fiber cement boards in residential projects is driven by their long lifespan, structural integrity, and visual versatility. Homeowners are increasingly attracted to materials that combine aesthetics with low upkeep, particularly in markets undergoing housing booms or urban redevelopment.

In addition to resistance against fire, insects, and moisture, fiber cement boards provide the visual warmth of natural wood or stone finishes without the associated maintenance burden. This makes them a preferred choice for exterior siding, facades, gables, and eaves. The trend is further strengthened by the availability of pre-finished panels in various colors and textures, which reduce on-site labor and material waste.

Environmental considerations are also playing a pivotal role. As awareness of green building practices rises, demand has shifted toward materials that contribute to LEED certifications and similar sustainability benchmarks. Fiber cement boards, which are non-toxic and recyclable, align with these priorities and are being incorporated into eco-conscious residential designs globally.

Between 2020 and 2024, the target market registered growth rate of 3.3% by reaching a value of USD 17,190.4 million in 2024 from USD 15,121.4 million in 2020. This growth was driven by rise in projects new residential & commercial buildings and initiatives towards public infrastructure.

Fiber cement boards, also called as fiber-reinforced cement boards, were its production takes place in the early phase which acts as a substitute alternative to cement-based materials containing asbestos materials. These boards are widely used for external cladding, which offering excellent properties like weather resistance and durability. Availability of various textures which is used for both interior and exterior linings. Interior lining is used in tile installation or plastering, while the exterior can be finished with paint or other cladding materials.

Fiber cement boards are also used to create fire-rated partitions due to their non-flammable properties, providing excellent fire resistance and safety for buildings. Using as a substrate for tiling, these boards offer a strong, water resistant for wall and floor tiles. Their excellent properties also make them suitable for sound acoustic All these factors have played pivotal role in expanding the demand for Fiber Cement Board industry in 2020 to 2024.

Anticipating the period from 2025 to 2035, the market is expected to expand rapidly due to innovations in Fiber cement boards, known for their versatility and increased utilization across diverse construction applications. It has properties such as strong and resilient characteristics fits perfect for various applications such as flooring, furniture, wall coverings/paneling, and gates.

Most widely used of fiber cement boards is due to bearing capacity to endure heavy loads and high foot, which makes suitable for flooring in both commercial and residential spaces. Durable in nature guarantees extended functionality and fulfilment of consumer needs, makes and economical option in building and construction sector.

Looking for all cladding and paneling, fiber cement boards offer both visual attractiveness and practical advantages over traditional materials. It is most widely installed to form impressive feature walls, enhancing texture and visual appeal for both interiors and exteriors.

The boards can additionally be painted and textured to complement any design aesthetic, rendering them very versatile for various styles and preferences. Fiber cement boards are frequently utilized for gates due to their strong structure and ability to withstand external conditions. For both residential and commercial properties, these boards can be trusted to offer security, durability, and aesthetic charm.

Rising Demand for Aesthetic Versatility in Construction

With the growing demand for construction projects highlighting new, distinctive, and visually attractive designs, the importance of customizable building materials has escalated. Fiber cement boards offer great versatility with respect to texture, finish, and color, enabling numerous design possibilities. Architects and designers can shape these boards into diverse patterns, including smooth, rough, or wood-like textures, making them appropriate for both contemporary and classic architectural styles.

The capacity to paint or stain fiber cement boards in numerous colors enhances their versatility. Moreover, these materials are applicable in various construction sectors, ranging from facades to interior walls, providing a pleasing combination of longevity and visual attractiveness. The increasing demand from consumers for homes and commercial structures that showcase personalized and modern designs bolsters the expansion of the fiber cement board market.

Commitment towards Sustainability Through Innovative Approaches

As the construction industry is focusing towards eco-conscious practices, manufacturers are channeling their efforts into developing fiber cement boards that align with stringent environmental standards. Initially, there's a focus on utilizing recycled materials and reducing carbon footprints during production. Manufacturers are exploring ways to incorporate post-industrial and post-consumer waste into their board formulations, minimizing resource consumption and waste generation.

Advanced technologies and optimized production techniques are being adopted to decrease energy consumption and greenhouse gas emissions, contributing to a greener manufacturing cycle. Furthermore, the durability of fiber cement boards supports long-term sustainability.

These boards' resistance to fire, moisture, pests, and weathering reduces the need for frequent replacements, thereby conserving resources and minimizing construction waste. As regulations and consumer preferences drive demand for greener alternatives, sustainable fiber cement boards are gaining traction in the market.

Fast-Tracking Urban Growth and advancements in Infrastructure developments

Worldwide move towards urban living is fueling a greater need for modern housing and business spaces frameworks. Fiber cement boards have become vital components in building these contemporary structures, driven by their outstanding characteristics. Properties exist their longevity, fireproof qualities, and design versatility, these panels integrate effortlessly into the construction of modern structures.

Furthermore, fiber cement boards have impressive properties like weather resistance and outstanding thermal insulation capabilities. These characteristics increase their attractiveness for urban infrastructure initiatives and real estate projects.

Sudden increasing in urbanization transforming landscapes and increasing infrastructural demands, fiber cement boards become a crucial and highly elected option in the construction sector. Their ability to overcome urban challenges and assist in the development of safe, efficient, and aesthetically pleasing buildings highlights their importance in the changing construction landscape.

Installation Barriers Due to Complexity and High Skill Labour Requirements

Proper installation requires a skilled and knowledgeable team in the handling and unique methods to these used for fiber cement boards installation. Errors made during installation can have serious issue, which leads to reducing insulation effectiveness, and possibly leading to environment-related issues. Significant weight requires specialized tools and methods to guarantee secure and proper installation.

Requirement may prolong project schedules and increase labor expenses, affecting the overall efficiency and budget of the project. Moreover, allocating resources to training and educational programs for construction experts guarantees the spread of proper installation techniques.

Working together with manufacturers, contractors, and skilled workers can expedite the installation process, reducing mistakes and improving the overall value of fiber cement boards. Overcome this obstacle will build trust in the product's efficacy and speed up wider acceptance in the construction sector.

Tier 1 companies comprise players with a revenue of above USD 4400 million capturing a significant share of 35-45% in the global market. These players are characterized by high production capacity and a wide product portfolio. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple Fiber Cement Board applications and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include James Hardie Industries PLC, Etex Group NV, Cembrit, Saint-Gobain and other players.

Tier 2 companies include mid-size players with revenue of below USD 4500 million having a presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Mahaphant Fibre Cement Co., Ltd., Elementia, S.A.B de C.V., Everest Industries, and other player.

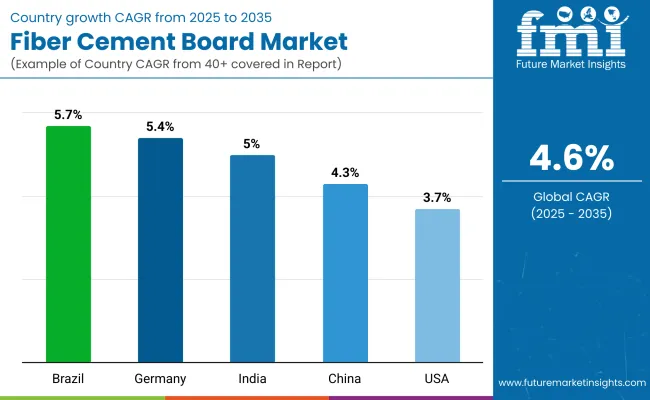

The section below covers the industry analysis for Fiber Cement Board demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided.

USA will hold 37.3% in North America drives due to sustainability initiatives and regulatory building standards. The China will capture 21.5% in East Asia owing to increasing demand for rapid urbanization and infrastructure development. India will lead South Asia Pacific with 12.3% due to growing demand in urbanization and affordability to fulfil needs for housing. These companies play a significant role in driving market growth by introducing new, environmentally friendly, and more efficient waterproof coatings.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Germany | 5.4% |

| India | 5.0% |

| USA | 3.7% |

| Brazil | 5.7% |

| China | 4.3% |

The Fiber Cement Board market is dominated by the USA because of its strong construction sector and the need for fire-resistant, environmentally friendly materials. Strict building regulations and eco-friendly construction practices, combined with increased activity in residential and commercial building, render fiber cement boards a perfect choice. Key manufacturers, like James Hardie, guarantee a robust market presence and growth opportunities in the area. Rising trend of renovations and home enhancements, where waterproof coatings are frequently utilized to safeguard basements, roofs, and foundations against water penetration.

China's fiber cement board market drives because of swift urban growth, significant infrastructure developments, and governmental programs. Sudden increase in need of eco-friendly and long-lasting construction materials corresponds with the expansion of the housing and commercial industries. Fiber cement boards provide economical options for urban and rural projects, further supported by the rise of China's middle class and the greater use of contemporary building methods.

India is witnessing rapid expansion in the fiber cement board sector, followed by urban development and the government's focusing on budget-friendly housing. The movement towards sustainable, low-maintenance, and long-lasting building materials, alongside the rise in construction projects in both residential and commercial areas, positions fiber cement as an excellent option. Increasing disposable incomes and urban growth lead to the widespread use of fiber cement boards across region.

Key companies producing Fiber Cement Board are slightly consolidating the market with about 35-45% share that are prioritizing technological advancements, integrating sustainable practices, and expanding their footprints in the region. Customer satisfaction remains paramount, with a keen focus on producing Fiber Cement Board to meet diverse applications. These industry leaders actively foster collaborations to stay at the forefront of innovation, ensuring their Fiber Cement Board align with the evolving demands and maintain the highest standards of quality and adaptability.

Recent Industry Developments:

The Product Type segment is further categorized into Siding Boards, Flooring Boards, Roofing Boards, Ceiling Boards, Partition Boards, Decorative Boards and Insulation Boards.

The Application segment is classified into Residential Construction, Commercial Construction, Industrial Construction, Agricultural Buildings, Interior Applications, Walls, Ceilings, Partitions and Exterior Applications.

The End Use segment is classified into Below 6 mm, 6 mm to 12 mm and Above 12 mm.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The global Fiber Cement Board market for application residential construction was valued at USD 11.9 billion in 2025.

The demand for Fiber Cement Board industry is set to reach USD 18.8 billion in 2035.

Fiber cement boards are highly favored in residential construction for their durability, aesthetic versatility, fire resistance, and eco-friendly attributes, positioning them as a preferred material for siding and cladding applications.

The Fiber Cement Board demand is projected to reach USD 18.8 billion by 2035 growing at CAGR of 4.6% in the forecast period.

Residential construction application is expected to lead during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Sq. Mtr) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 4: Global Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 12: North America Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 20: Latin America Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 28: Western Europe Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 52: East Asia Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Sq. Mtr) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Sq. Mtr) Forecast by Raw Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Sq. Mtr) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Sq. Mtr) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Sq. Mtr) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 10: Global Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Raw Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 34: North America Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Raw Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 58: Latin America Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Raw Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Raw Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 154: East Asia Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Raw Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Sq. Mtr) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Sq. Mtr) Analysis by Raw Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Sq. Mtr) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Sq. Mtr) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Raw Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Cement Boards Market

Corrugated Fiberboard Market Analysis - Size, Demand & Forecast 2025 to 2035

Demand for Fiber Cement in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Fiber Cement in Japan Size and Share Forecast Outlook 2025 to 2035

High density Fiberboard (HDF) Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA