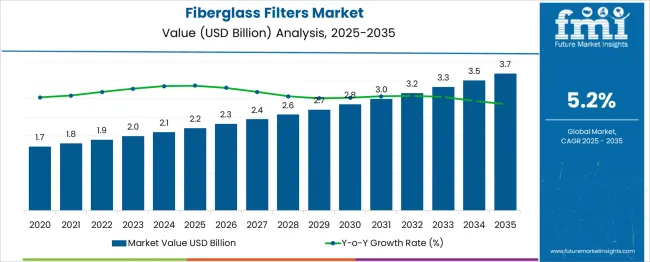

The Fiberglass Filters Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. This translates into a growth multiplier of 1.68x, supported by a steady CAGR of 5.2%. Rising demand for air quality control across HVAC systems, cleanroom environments, and industrial applications will drive consistent growth. The initial five-year period from 2025 to 2030 will contribute approximately USD 0.6 billion, or 40% of the total incremental value, as regulatory standards tighten for indoor air quality and replacement cycles in residential and light commercial HVAC systems accelerate.

The second half of the decade (2030–2035) will add USD 0.9 billion, representing 60% of total absolute growth, reflecting stronger adoption in commercial buildings, healthcare facilities, and advanced manufacturing requiring high-efficiency filtration. Incremental annual additions will rise from USD 0.1 billion in early years to USD 0.2 billion by 2035, signaling an accelerating trend. Growth will also be supported by investments in energy-efficient fiberglass media and low-pressure-drop filter technologies, reducing operational costs for end-users. Companies focusing on localized manufacturing and strategic partnerships will be positioned to capture the largest share of this USD 1.5 billion opportunity.

| Metric | Value |

|---|---|

| Fiberglass Filters Market Estimated Value in (2025 E) | USD 2.2 billion |

| Fiberglass Filters Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The fiberglass filters market holds a key role within various air filtration and HVAC-related sectors. In the air filtration market, its share is approximately 15–18%, as fiberglass filters are among the most common low-cost filtration solutions for residential and light commercial applications. Within the HVAC filters market, the share is around 10–12%, given the competition from pleated synthetic media and high-efficiency filters for advanced systems.

In the industrial filtration market, fiberglass filters contribute about 5–6%, as this sector includes heavy-duty filtration technologies such as baghouse systems and cartridge filters for dust and chemical control. For the building and construction air quality solutions market, the share stands at 6–8%, since it covers a wide range of ventilation and purification technologies for commercial spaces. In the automotive cabin air filters market, fiberglass filters account for only 3–4%, as synthetic and HEPA-based materials dominate.

Increasing concerns about indoor air quality, energy-efficient HVAC systems, and compliance with air quality standards in commercial and residential buildings support growth in this segment. The affordability, lightweight structure, and ease of installation make fiberglass filters a preferred choice for standard applications. As urbanization and infrastructure development expand, this market is expected to sustain demand across these parent markets globally.

Rising awareness of airborne contaminants and their impact on health and equipment performance has intensified demand for durable and cost-effective filtration products. Fiberglass filters are gaining preference due to their high dust holding capacity, temperature resistance, and low replacement frequency, which collectively reduce operational costs. Future growth is expected to be shaped by stricter indoor air quality standards, expanding construction activities, and technological enhancements improving filter efficiency.

Shift toward sustainable materials and energy-efficient systems is paving the way for further innovation and adoption across diverse end-user segments.

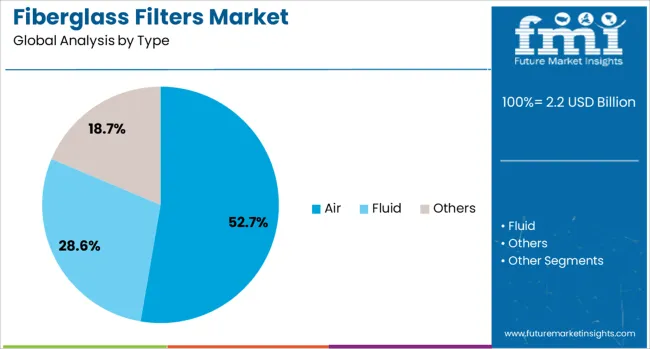

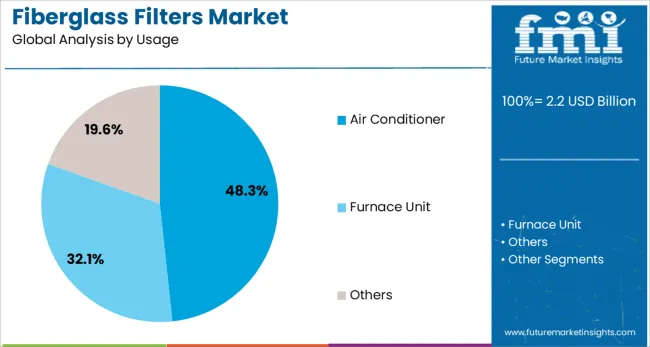

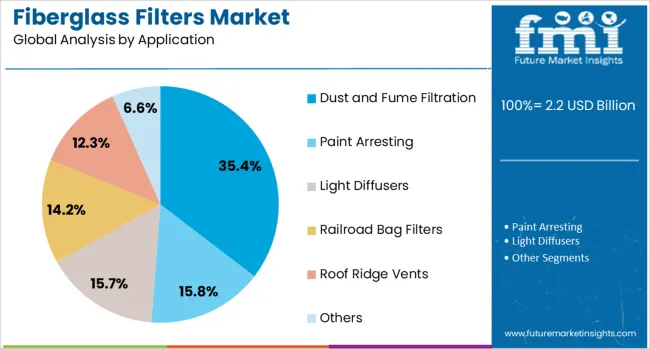

The fiberglass filters market is segmented by type, usage, application, end use, distribution channel, and geographic regions. The fiberglass filters market is divided by type into Air, Fluid, and Others. In terms of usage, the fiberglass filters market is classified into Air Conditioner, Furnace Unit, and Others. Based on the application of the fiberglass filters, the market is segmented into Dust and Fume Filtration, Paint Arresting, Light Diffusers, Railroad Bag Filters, Roof Ridge Vents, and Others. The fiberglass filters market is segmented by end use into Non-Residential and Residential.

The distribution channel of the fiberglass filters market is segmented into Direct and Indirect. Regionally, the fiberglass filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, air filters are projected to account for 52.7% of the total market revenue in 2025, establishing themselves as the leading segment. This leadership is being driven by heightened attention to indoor air quality in both residential and industrial settings, which has increased reliance on air filtration systems.

Fiberglass air filters have been favored for their ability to trap fine particulates effectively while maintaining airflow and energy efficiency. Their widespread use in HVAC systems, clean rooms, and industrial plants has reinforced their position by addressing both regulatory compliance and operational needs.

Moreover, ongoing upgrades of air handling units and demand for maintenance-friendly solutions have supported the continued growth of the air type segment within the fiberglass filters market.

When segmented by usage, air conditioner applications are expected to hold 48.3% of the market revenue in 2025, maintaining their status as the dominant usage segment. This dominance is being attributed to the rapid expansion of HVAC infrastructure in residential, commercial, and industrial buildings, where fiberglass filters are extensively integrated into air conditioning units.

Their cost-effectiveness, ease of replacement, and capability to handle high air volumes while ensuring adequate particulate capture have supported their strong adoption. The increasing focus on energy-efficient building solutions and demand for improved occupant health and comfort have also driven this segment.

Additionally, retrofitting and modernization of aging HVAC systems have further solidified the air conditioner segment’s leading share in the market.

When segmented by application, dust and fume filtration is forecast to account for 35.4% of the market revenue in 2025, making it the leading application segment. This leadership is being reinforced by the growing need to control industrial emissions and safeguard worker health in manufacturing environments.

Fiberglass filters have been increasingly deployed in factories, workshops, and processing plants to manage airborne dust, fumes, and fine particulates generated during operations. Their high resistance to heat and chemicals has made them particularly suitable for harsh industrial settings where standard filters are inadequate.

Heightened regulatory enforcement around workplace air quality and the imperative to protect sensitive equipment from contamination have further strengthened the dominance of the dust and fume filtration segment in the fiberglass filters market.

The fiberglass filters market is estimated at USD 2.1 billion in 2024, driven by industrial and HVAC demand enforcement. Applications in air and fluid filtration across automotive, pharmaceuticals, and semiconductor sectors are accelerating use. Regulatory mandates are creating opportunity for high-temperature and reinforced variants. Trends point to multi-layer media and nanocoatings adoption for thermal resistance and filtration efficiency.

Challenges include raw material price fluctuations and competition from alternative media. Firms focusing on performance-certified media and industrial-grade formats are viewed as best situated to lead through 2025 and beyond.

Growth in the fiberglass filter market has been driven by stringent emissions and air quality requirements in 2024, particularly within North America and Europe. Industrial filtration demand from manufacturing, automotive, and electronics sectors has increased adoption, while air filtration in HVAC systems has grown across commercial infrastructure. It is widely believed that compliance mandates issued by environmental agencies have pushed facilities to procure fiberglass media for durable, high-efficiency filtration, thus strengthening procurement volumes in critical end-use industries.

Opportunities are evident in high-temperature fiberglass media and reinforced plastic filter segments. In 2024 the high-temperature fiberglass filter media segment was valued at approximately USD 204 million, with projected uptake in energy and chemical applications. Usage in liquid and industrial process filtration is expanding in water treatment and pharmaceutical lines. It is considered that suppliers offering specialized media resistant to heat and corrosion will capture contracts in niche industrial verticals and specialized equipment OEMs.

Emerging trends include multi-layer composite media featuring nanofiber coatings to enhance efficiency and mechanical strength. In 2025 industrial application uptake was observed in semiconductor and automotive production zones, where precision filtration is critical. Coated and multi-layer fiberglass media offering extended lifespan and higher dust-holding capacity are gaining preference. It is strongly viewed that suppliers offering these advanced composite formats will secure market share in sectors demanding cleanroom-level air quality and tight particulate removal.

Restraints in the fiberglass filters market include volatility in glass fiber feedstock and reinforcement resin pricing, which impacts margins. Competition from alternative filter media such as polymer fibers and ceramic composites is intensifying, especially in liquid filtration and specialty airflow systems. Limited differentiated performance among commodity fiberglass offerings is weakening positioning versus higher-efficiency media. It is believed that without differentiated product portfolios or vertical specialization, smaller manufacturers may struggle to compete effectively.

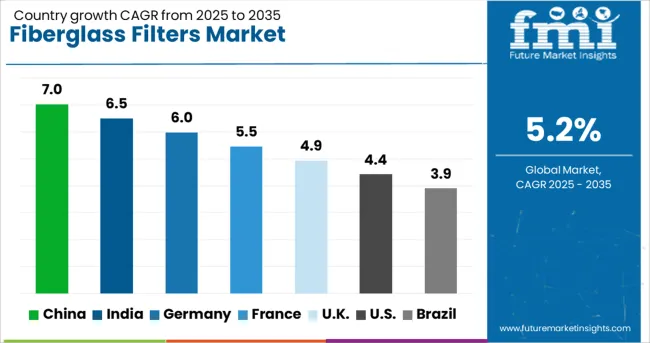

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global fiberglass filters market is projected to grow at a CAGR of 5.2% from 2025 to 2035. China leads with 7.0%, followed by India at 6.5% and Germany at 6.0%. France records 5.5%, while the United Kingdom posts 4.9%. Growth is supported by rising demand for HVAC systems, improved air quality standards, and industrial filtration needs. China and India dominate due to expanding construction activities and manufacturing hubs, while Germany emphasizes high-efficiency filters for industrial applications. France and the UK prioritize energy-saving designs and compliance with strict indoor air quality regulations.

The fiberglass filters market in China is expected to grow at 7.0%, driven by rising HVAC installations in commercial and residential buildings. Panel filters dominate demand due to cost-effectiveness and wide application. Manufacturers introduce eco-friendly fiberglass options with enhanced dust retention capabilities. Rapid urban development and smart building initiatives accelerate filtration product adoption.

The fiberglass filters market in India is forecast to grow at 6.5%, supported by industrial expansion and healthcare facility upgrades. Disposable fiberglass filters dominate usage in pharmaceutical and food processing sectors. Manufacturers develop multi-layer filters to enhance particulate capture. Government-driven air quality programs encourage the integration of high-efficiency filters in commercial spaces.

The fiberglass filters market in Germany is projected to grow at 6.0%, driven by advanced manufacturing practices and strict environmental norms. High-efficiency fiberglass filters dominate industrial and automotive sectors. Manufacturers integrate nanofiber layers with fiberglass for improved filtration performance. Adoption of energy-saving HVAC systems in commercial buildings enhances market opportunities.

The fiberglass filters market in France is expected to grow at 5.5%, supported by modernization of public infrastructure and commercial facilities. Pleated fiberglass filters dominate adoption in large-scale HVAC systems. Manufacturers offer customizable filter sizes for retrofitting older systems. Growing investment in clean indoor environments accelerates filter replacement cycles.

The fiberglass filters market in the UK is projected to grow at 4.9%, driven by rising emphasis on sustainable building designs and energy optimization. Panel and pleated filters dominate ventilation systems in offices and retail spaces. Manufacturers develop recyclable fiberglass filters to align with environmental goals. Increased demand for green building certifications fosters adoption of high-efficiency filters.

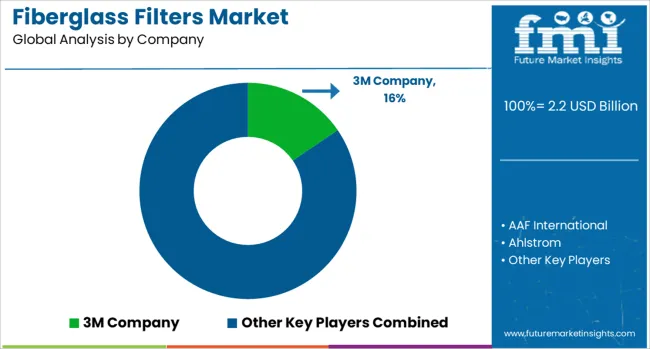

The fiberglass filters market is moderately consolidated, with 3M Company recognized as a leading player through its advanced air filtration solutions and strong global presence. The company offers a comprehensive range of fiberglass-based HVAC and industrial filters known for their durability, high dust-holding capacity, and efficiency across commercial and residential applications.

Key players include AAF International, Ahlstrom, Camfil AB, Donaldson Company, Inc., Filtration Group Corporation, Freudenberg Filtration Technologies, Glasfloss Industries, Koch Filter Corporation, Lydall, Inc., MANN+HUMMEL GmbH, Parker Hannifin Corporation, Smith Filter Corporation, Superior Filtration Europe Ltd., and Tri-Dim Filter Corporation. These companies provide fiberglass filters in multiple configurations, including panel filters, pocket filters, and high-efficiency particulate air (HEPA) filters, designed for HVAC systems, cleanrooms, and industrial environments.

Market growth is driven by rising awareness of indoor air quality, stricter regulations for particulate emissions, and expanding applications in healthcare and manufacturing sectors. Leading manufacturers are focusing on product innovations, such as filters with antimicrobial coatings, low-pressure-drop designs, and enhanced moisture resistance to improve energy efficiency and performance.

Digital monitoring integration for predictive maintenance is an emerging trend in commercial settings. North America and Europe dominate the market due to regulatory compliance and replacement demand, while Asia-Pacific shows strong growth with rapid industrialization and urban infrastructure development.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Type | Air, Fluid, and Others |

| Usage | Air Conditioner, Furnace Unit, and Others |

| Application | Dust and Fume Filtration, Paint Arresting, Light Diffusers, Railroad Bag Filters, Roof Ridge Vents, and Others |

| End Use | Non-Residential and Residential |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, AAF International, Ahlstrom, Camfil AB, Donaldson Company, Inc., Filtration Group Corporation, Freudenberg Filtration Technologies, Glasfloss Industries, Koch Filter Corporation, Lydall, Inc., MANN+HUMMEL GmbH, Parker Hannifin Corporation, Smith Filter Corporation, Superior Filtration Europe Ltd., and Tri-Dim Filter Corporation |

| Additional Attributes | Dollar sales segmented by filter type (air, liquid, industrial) and material grade (E-glass, S-glass, C-glass). Regional demand trends show North America as the largest market, while Asia-Pacific grows fastest at ~5–6% CAGR. Buyers prefer cost-efficient, regulatory-compliant solutions integrated with HVAC and dust systems. Innovations include nanofiber media, antimicrobial coatings, and long-life designs. |

The global fiberglass filters market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the fiberglass filters market is projected to reach USD 3.7 billion by 2035.

The fiberglass filters market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in fiberglass filters market are air, fluid and others.

In terms of usage, air conditioner segment to command 48.3% share in the fiberglass filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Electrical Enclosure Market Analysis - Size, Share & Forecast 2025 to 2035

Fiberglass Cloth Market

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Spin Filters Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Filters Market Size and Share Forecast Outlook 2025 to 2035

Pleated Filters Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Filters Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Filters Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Filters Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ring Panel Filters Providers

Power Line Filters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA