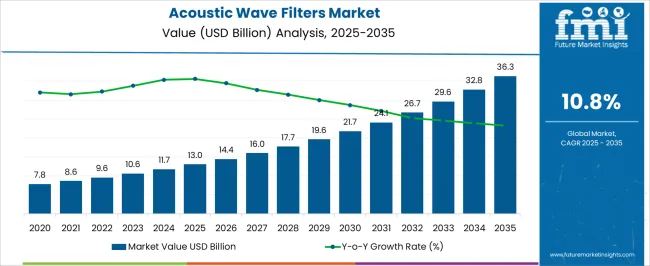

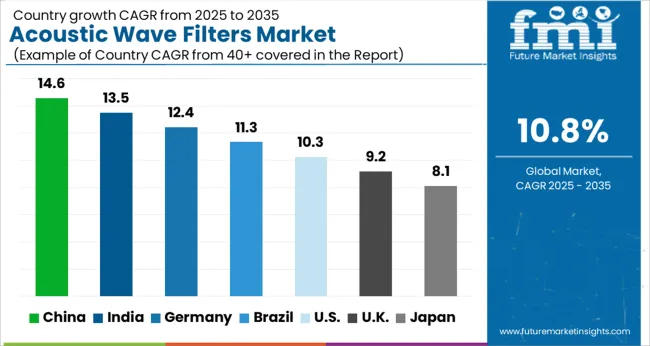

The Acoustic Wave Filters Market is estimated to be valued at USD 13.0 billion in 2025 and is projected to reach USD 36.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

| Metric | Value |

|---|---|

| Acoustic Wave Filters Market Estimated Value in (2025 E) | USD 13.0 billion |

| Acoustic Wave Filters Market Forecast Value in (2035 F) | USD 36.3 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The acoustic wave filters market is expanding steadily due to rising demand for efficient frequency management in wireless communication and the growing penetration of connected consumer devices. The increasing adoption of 4G and 5G networks has accelerated the need for compact, high performance filters that can handle multiple frequency bands with minimal interference.

Advances in miniaturization and integration with semiconductor technologies are further enhancing product adoption across consumer electronics and telecommunications equipment. Additionally, regulatory pressure on improving spectrum efficiency and the proliferation of Internet of Things devices are reinforcing demand.

The market outlook remains strong as manufacturers focus on improving filter performance, lowering power consumption, and supporting higher data transmission speeds, positioning acoustic wave filters as critical enablers of next generation connectivity solutions.

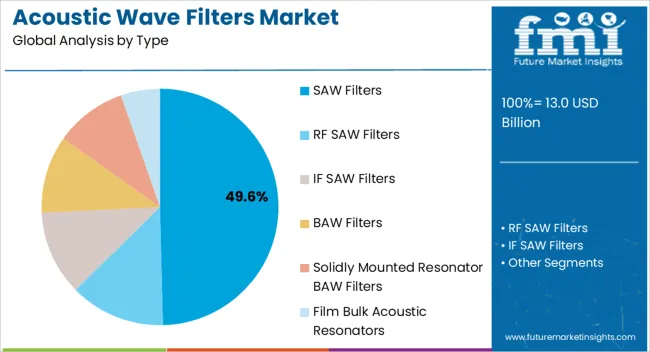

The SAW filters segment is expected to account for 49.60% of total market revenue by 2025 within the type category, making it the leading segment. Its dominance is driven by cost effectiveness, mature manufacturing processes, and proven efficiency in handling lower frequency ranges used in smartphones, tablets, and other wireless devices.

The widespread use of SAW filters in high volume consumer electronics has cemented their market position.

Their ability to deliver reliable performance at competitive pricing continues to attract manufacturers, ensuring their leadership in the type category.

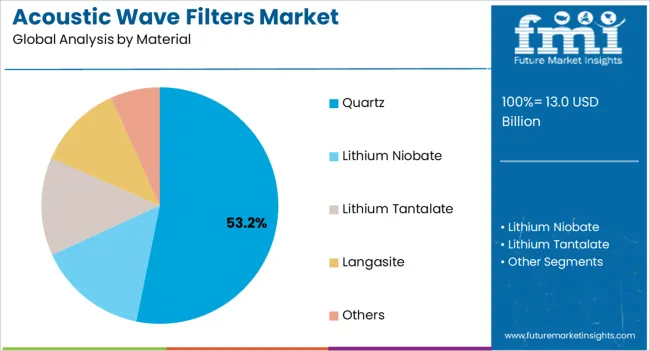

The quartz segment is projected to hold 53.20% of total market revenue by 2025 under the material category, positioning it as the most significant contributor. This leadership is attributed to quartz’s superior piezoelectric properties, high stability, and cost efficiency, which make it the preferred choice for acoustic wave filter production.

Its extensive availability and ability to provide consistent performance across a wide range of frequencies have strengthened its role in mainstream manufacturing.

As demand grows for reliable and scalable solutions in mobile communication, quartz continues to dominate the material segment.

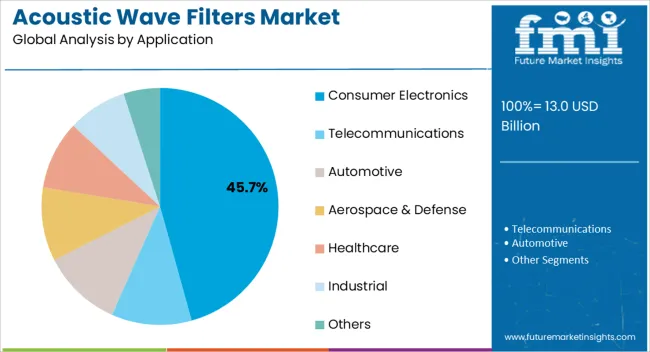

The consumer electronics segment is forecasted to capture 45.70% of total market revenue by 2025 within the application category, establishing it as the leading end use. Growth in this segment is driven by the surging demand for smartphones, wearables, laptops, and connected devices that rely on acoustic wave filters for effective frequency management.

The ongoing rollout of 5G networks and rising consumer expectations for seamless connectivity have intensified adoption within this application.

With continuous innovation in device design and increasing penetration of wireless technologies, consumer electronics remain the primary driver of growth in the acoustic wave filters market.

FMI has projected the global acoustic wave filters market to witness a growth in revenue from USD 13 billion in 2025 to USD 36.3 billion by 2035. The acoustic wave filters market was estimated to grow at a CAGR of 8.7% from 2020 to 2025.

The rising popularity of smartphones and developments in the automotive industry is expected to drive the acoustic wave filters sector over the coming years. Businesses are growing increasingly forced to handle mobile gadgets, apps, and a wide range of voice and collaboration tools in order for teams to communicate across geographies, platforms, and devices.

A substantial rise in the worldwide prevalence of smartphone users is likely to motivate consumers to adopt 5G-enabled offerings. This includes self-driving cars, ultra-high-definition video, augmented reality, virtual reality, and artificial intelligence. These factors are expected to drive consumption of LTE advanced and 5G technologies, propelling the acoustic wave filters market forward.

The widespread use of wireless, visual, and other high-speed and high-frequency offerings has driven up the popularity of BAW filters that are optimized for efficiency, price, and practical development complexity. The easy incorporation of myriad applications including broadcast receivers to select desired channel frequencies is driving up the consumption of RF acoustic wave filters.

These filters are used in radio receivers to remove unwanted frequencies. RF filters separate signal frequencies while also reducing interference from external signals that can degrade the quality or effectiveness of systems for communication.

The anticipated expansion of the bulk acoustic wave filters marketplace is predicted to be aided by a substantial rise in the overall number of mobile devices in various countries around the globe.

As smartphone penetration grows, so does the use of radio frequency (RF) filters including the mass acoustic filters in smartphones. Bulk acoustic wave filters are used for the most difficult interference, as well as for high speed and higher bandwidth by utilizing a wider spectrum.

Studies and research in the field of acoustic wave filters devices have been performed with enormous potential in recent years, and today acoustic wave filters are quickly growing popular in industries ranging from high-end manufacturing and military sectors to customer wireless usage sectors.

Rising demand for acoustic wave filters in electronic products including mobile phones, tablets, and others, as well as increasing use of this equipment, the rising popularity of acoustic wave technology in LTE, 4G, 5G, and Wi-Fi technology, and higher demand for small and efficiency microwave transmitters for the developing wireless communication system market are expected to boost market growth during the forecast period.

Technical issues such as size and power utilization limit market growth. Furthermore, interruptions to the supply chain, concerns regarding the environment, shifts in consumer tastes, and evaluations of markets are expected to create challenges in the coming decades.

ky

ky

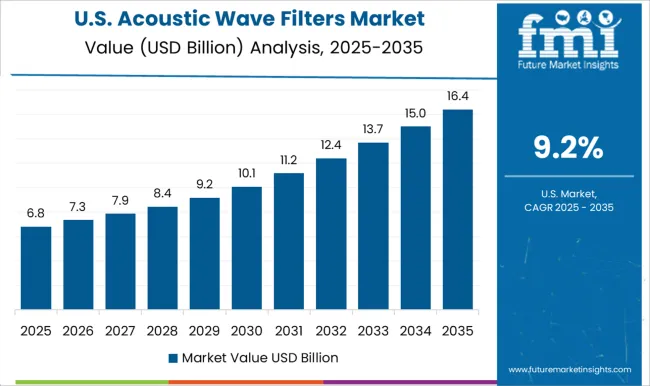

According to the report, the United States was predicted to account for a market share of 22.2% in 2025. The United States is predicted to continue accounting for the lion’s share of sales registered in the region. The United States saw an increase in demand for interface norms such as Wi-Fi and LTE for a variety of services including wireless charging, voice commands, blind spot awareness, and autonomous cars.

The growing acceptance of RF filters technology by aviation consumers such as Airbus and Boeing, as well as increased adoption by the United States Department of Defense, in RADAR systems, electronic surveillance, GPS, navigation, and ATC (Air Traffic Control), is driving the market for acoustic wave filters in the United States.

Akoustis Technologies, Inc., which has an important presence in the United States, disclosed the development of nine new patents encompassing BAW Filters gadgets and techniques for 5G, WiFi 6, WiFi 6E, and C-V2X in April 2024. besides the rights to its patent portfolio, Akoustis owns useful trade secrets related to the production of its proprietary XBAW high-band RF filters products and single-crystal piezoelectric materials. These trends are increasing the demand for acoustic wave filters in the United States.

The acoustic wave filters market in the United Kingdom is anticipated to expand at a CAGR of 10.6% from 2025 to 2035. The consumer electronics industry in the United Kingdom is expected to expand rapidly over the next decade. Furthermore, the adoption of wireless technologies has seen remarkable advancement and growth.

The growing popularity of smartphone devices has boosted the need for RF filters in this nation. According to the study, the United Kingdom is recognized as a primary market and is projected to continue to exhibit substantial demand for acoustic wave filters throughout the forecast period.

The acoustic wave filters market in India is anticipated to expand at a CAGR of 15.5% over the forecast period. India is one of the nations with the greatest economic growth, and it is expected to provide favorable market conditions for suppliers of acoustic wave filters.

The country is experiencing rapid development as a result of digital transformation and increased demand for wireless connectivity. The growing popularity of cell phones in India is a major factor resulting in the high growth rate.

The country has a large number of established SMEs that are expanding at an exponential rate to serve the large customer base. The country has witnessed an increase in demand for RF filters in usages such as digital surveillance, GPS, navigation, mobile phones to transit, filters, and recipient paths for 3G and 4G technologies over the past few years.

As a result of their low insertion characteristics, BAW filters are highly efficient at dissipating heat at elevated power levels. The BAW filters segment was estimated to account for an impressive market share of 20.6% in 2025.

BAW filters additionally conserve board space by creating filters smaller, allowing them to be easily integrated into RF front-end (RFFE) modules, which meet 5G requirements.

The increasing use of BAW filters in communications systems such as LTE networks and 5G technology, as well as the Internet of Things (IoT), boosts demand for the BAW filters segment, which is expected to drive market growth between 2025 and 2035.

According to Future Market Insights, the lithium niobate and lithium tantalate segments accounted for USD 11.7 billion in the acoustic wave filters market in 2024. The increasing need for high-speed connectivity for small and large-scale applications, as well as the debut of Internet of Things (IoT) technology in the consumer space, is projected to drive developments.

The requirement for lithium niobate crystals will be sustained by an ongoing increase in the demand for communication networks with wide bandwidths. In turn, the rollout of 5G networks retains the key to increased sales for the landscape. In 2025, the lithium niobate segment was expected to account for 43.4% of the market.

To achieve a competitive edge, market participants are concentrating on innovation and strategic collaborations.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.8% from 2025 to 2035 |

| Market Value in 2025 | USD 13.0 billion |

| Market Value in 2035 | USD 36.3 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Segments Covered | Type, Material, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Covered |

United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | KYOCERA Corporation; Murata Manufacturing Co. Ltd; Microchip Technologies; Skyworks Solutions Inc.; Qualcomm Technologies Inc.; Qorvo Inc.; Tai-Saw Technology Co. Ltd.; Microsaw OY; API Technologies Corp; Crystek Corporation; Anatech Electronics Inc.; Taiyo Yuden Co. Ltd.; Abracon; Broadcom; Akoustis |

| Customization & Pricing | Available upon Request |

The global acoustic wave filters market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the acoustic wave filters market is projected to reach USD 36.3 billion by 2035.

The acoustic wave filters market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in acoustic wave filters market are saw filters, rf saw filters, if saw filters, baw filters, solidly mounted resonator baw filters and film bulk acoustic resonators.

In terms of material, quartz segment to command 53.2% share in the acoustic wave filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acoustic Vehicle Alerting System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acoustic Insulation Market Analysis & Forecast for 2025 to 2035

Acoustic Respiration Sensors Market Outlook 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Acoustic Puncture Assist Devices Market

Acoustic Neurinoma Treatment Market

Acoustic Wave Sensors Market Size and Share Forecast Outlook 2025 to 2035

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Bioacoustics Sensing Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Microscopy Market Growth – Industry Trends & Forecast 2024-2034

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Sustained Acoustic Medicine Market

Underwater Acoustic Communication Market Growth - Trends & Forecast 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Wavefront Aberrometers Market Size and Share Forecast Outlook 2025 to 2035

Wavelength Division Multiplexing (WDM) Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Mid Wave Mid-IR Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA