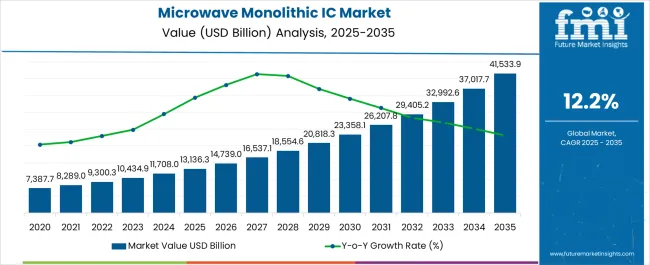

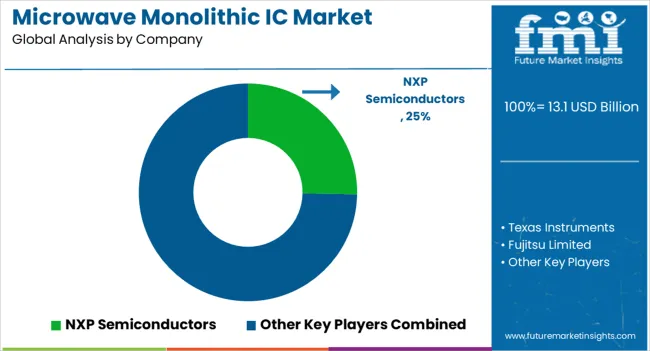

The Microwave Monolithic Integrated Circuits Market is estimated to be valued at USD 13.1 billion in 2025 and is projected to reach USD 41533.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.2% over the forecast period.

| Metric | Value |

|---|---|

| Microwave Monolithic Integrated Circuits Market Estimated Value in (2025 E) | USD 13.1 billion |

| Microwave Monolithic Integrated Circuits Market Forecast Value in (2035 F) | USD 41533.9 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The microwave monolithic integrated circuits market is expanding steadily due to increasing adoption of high frequency communication systems, defense modernization programs, and the proliferation of 5G infrastructure worldwide. Demand for compact, power efficient, and high performance semiconductor solutions has accelerated deployment across aerospace, satellite communication, and consumer electronics.

Advancements in material science and semiconductor fabrication techniques have enhanced device efficiency, enabling wider use in applications requiring superior bandwidth and power handling. Strategic investments by defense and telecommunication sectors are further propelling innovation in circuit design and integration.

The outlook for the market remains strong as emerging technologies such as radar, advanced wireless communication, and IoT ecosystems continue to rely on high frequency integrated solutions that balance efficiency, durability, and performance.

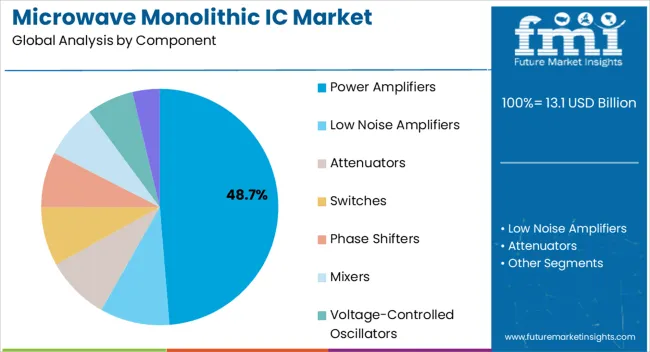

The power amplifiers segment is projected to hold 48.70% of total market revenue by 2025 within the component category, making it the leading segment. This dominance is supported by the critical role of power amplifiers in ensuring signal strength, efficiency, and coverage in both defense and commercial communication systems.

Their wide deployment in radar, satellite, and wireless applications has reinforced demand. Ongoing advancements in design efficiency and thermal management have further increased their suitability for high power, high frequency operations.

As communication systems expand and demand for reliable connectivity intensifies, the power amplifier segment continues to anchor growth within the component category.

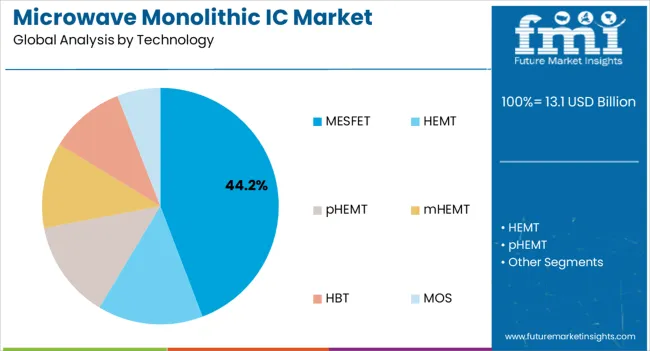

The MESFET technology segment is anticipated to account for 44.20% of market revenue by 2025 within the technology category. Its leadership is driven by its proven capability in delivering high frequency performance, power efficiency, and reliability in diverse applications.

MESFET devices are valued for their relatively simpler fabrication processes, cost effectiveness, and adaptability in power amplifier and switching applications. Their continued use in satellite communication, radar, and microwave links has positioned MESFET technology as a core enabler of high performance circuits.

As demand for robust and efficient technology grows, MESFET remains at the forefront due to its balance of cost and performance.

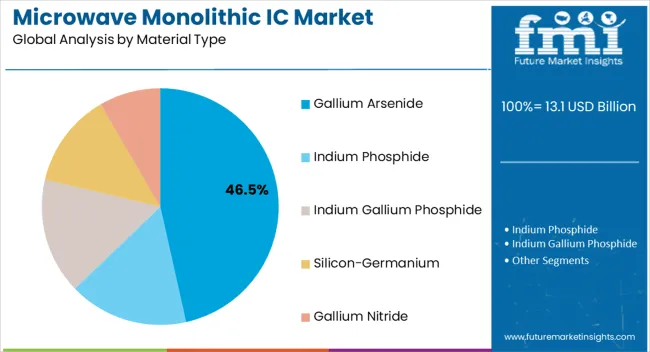

The gallium arsenide segment is expected to contribute 46.50% of total market revenue by 2025 under the material type category, making it the dominant material choice. This is attributed to its superior electron mobility, high thermal conductivity, and excellent high frequency characteristics, which are critical for advanced communication systems.

Gallium arsenide based circuits provide significant advantages in power handling and low noise performance, making them essential in radar, satellite, and 5G infrastructure. Its ability to outperform traditional silicon in microwave and millimeter wave applications has reinforced adoption across both defense and commercial markets.

With increasing requirements for efficiency, miniaturization, and reliability, gallium arsenide continues to lead as the preferred material in the microwave monolithic integrated circuits market.

North America is the most dominant region in the global microwave monolithic integrated circuits market analysis acquiring 35% of the share in the global microwave monolithic integrated circuits market.

The region comprises the maximum number of key players vending microwave monolithic integrated circuits. North America is followed by Asia Pacific, as Asia Pacific experiences an increasing number of emerging players in the market. North America accounted for a market share of 28.8% in 2025.

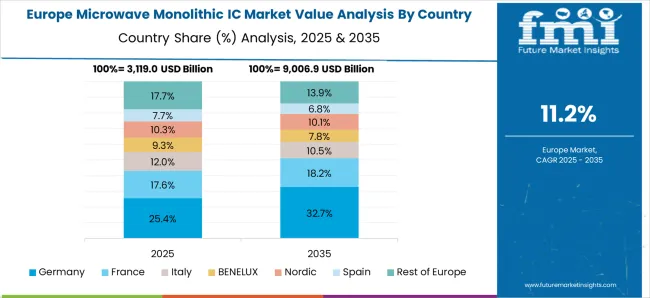

Europe region stood in the second position after North America in the microwave monolithic integrated circuits market analysis. It is also likely to acquire a large amount of 22% of its share in the microwave monolithic integrated circuits market share in the forecast period.

MIC and rising data transfer rates are estimated to increase Europe’s microwave market to the advancement of 5G technologies, increasing demand for Mave monolithic integrated circuits market trends. Europe accounted for a market share of 21.1% in 2025.

Asia Pacific has a significantly increasing microwave monolithic IC market share, and this trend is expected to continue during the forecast period.

There is a considerable move toward high-speed mobile technology, and great usage of cell phone services such as video, social media, e-commerce, and monetary services, as smartphone penetration is rising. Further, nations such as India, China, Japan, and South Korea are increasing their military spending.

China is an international manufacturing center with a strong electronics industry, as well as one of the globe's notably expanding economies. Therefore, the market in China is projected to expand significantly with a CAGR of 14.5% through 2035. Moreover, India is a rising country in the microwave monolithic IC industry, with a CAGR of 16.6% expected by 2035.

Gallium arsenide is the dominant segment in the microwave monolithic IC industry, with a projected CAGR of 11% through 2035. Gallium arsenide creates less noise in gadgets than other semiconductor components used in MMICs. Gallium arsenide cells, unlike silicon cells, are also highly heat resistant.

Gallium arsenide is a growing substitute to pure silicon for the production of semiconductors and electronics (SiC) owing to its:

Some of the start-ups are making a breakthrough in microwave monolithic integrated circuits using the cost factor. The manufacturing of novel low-cost and high-power integrated circuits is carried out for their use in the military and defense.

ADI brought about a significant disruption in the market with its HMC8193 monolithic microwave integrated circuits that can be used for the test, communications, and military applications.

The key competitors in the microwave monolithic integrated circuits market are the leading leaders who are continuously willing to acquire notable growth in the market. A few of them are as include NXP Semiconductors, Texas Instruments, Fujitsu Limited, Cree Incorporated, OSRAM Opto Semiconductors, Qorvo, Ya Guang microwave technologies, Avago Technologies1, Freescale, MACOM, and RF integration.

The key competitors in the microwave monolithic integrated circuits market are likely to grow the market at its height in the coming years to obtain maximum revenue.

Additionally, they are polishing their plans and methodologies in favor of increasing the microwave monolithic integrated circuits key trends & opportunities as per the microwave monolithic integrated circuits market report.

Recent Developments in the Microwave Monolithic Integrated Circuits Market

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.2% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Technology Type, IC Type, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | NXP Semiconductors; Texas Instruments; Fujitsu Limited; Cree Incorporated; OSRAM Opto Semiconductors; Qorvo; Ya Guang microwave technologies; Avago Technologies1; Freescale; MACOM; RF integration. |

| Customization | Available Upon Request |

The global microwave monolithic integrated circuits market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the microwave monolithic integrated circuits market is projected to reach USD 41,533.9 billion by 2035.

The microwave monolithic integrated circuits market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in microwave monolithic integrated circuits market are power amplifiers, low noise amplifiers, attenuators, switches, phase shifters, mixers, voltage-controlled oscillators and frequency multipliers.

In terms of technology, mesfet segment to command 44.2% share in the microwave monolithic integrated circuits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Microwave Oven Market Size and Share Forecast Outlook 2025 to 2035

Microwaveable Stuffed Animal Toys Market Size and Share Forecast Outlook 2025 to 2035

Microwave Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Microwave Market Size and Share Forecast Outlook 2025 to 2035

Microwave Backhaul System Market Size and Share Forecast Outlook 2025 to 2035

Microwave Device Market Size and Share Forecast Outlook 2025 to 2035

Microwave-Safe Utensils Market Size and Share Forecast Outlook 2025 to 2035

Microwave Absorbing Material Market Size, Growth, and Forecast 2025 to 2035

Microwave Power Meter Market

Microwave Antenna Market

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Commercial Microwave Ovens Market Analysis – Size, Share, and Forecast 2025 to 2035

Commercial Microwaves Market

Solid-State Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Point-to-point Microwave Antenna Market Analysis by Polarization, Antenna Type, Diameter, Frequency Range and Region Through 2035

WiMAX (Worldwide Interoperability For Microwave Access) Market Size and Share Forecast Outlook 2025 to 2035

Monolithic UPS Market Size and Share Forecast Outlook 2025 to 2035

Monolithic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA