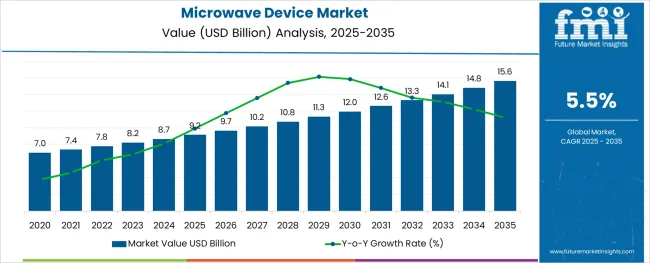

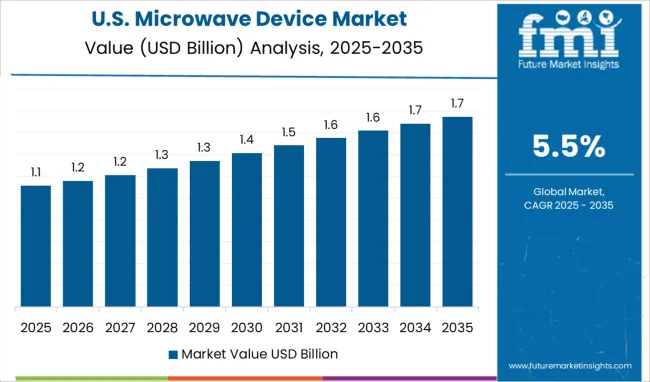

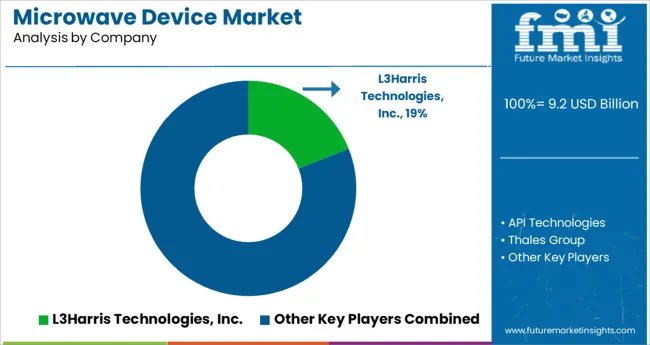

The Microwave Device Market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The microwave device market is experiencing sustained momentum, driven by demand across defense, aerospace, and communication sectors for high-frequency signal processing components. The evolution of radar systems, satellite communication infrastructure, and 5G technologies has accelerated the integration of advanced microwave components.

Manufacturers are expanding investments in solid-state designs and high-power handling systems to meet the growing expectations for compactness, efficiency, and thermal resilience. In addition, the miniaturization of components and advancements in semiconductor packaging have enabled greater functionality and performance at lower cost.

Government-backed defense modernization programs, increased space launches, and enhanced commercial telecommunication deployments are expected to create long-term growth pathways. Moving forward, the fusion of microwave technology with AI-driven systems and integrated electronic warfare solutions will further elevate demand, particularly across national security and mission-critical applications.

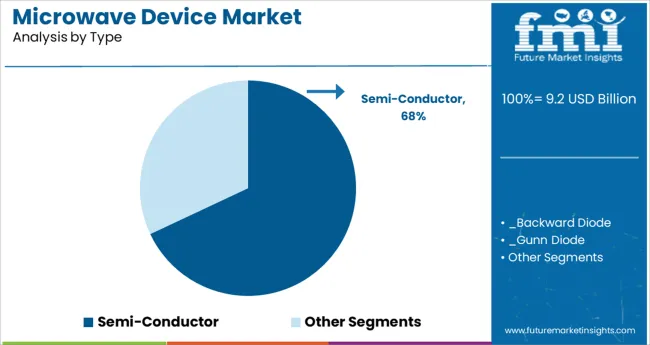

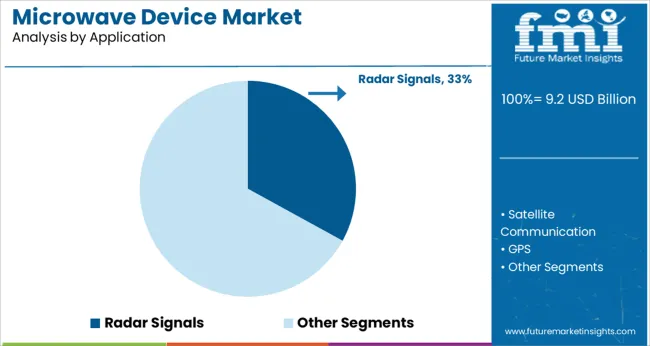

The market is segmented by Type and Application and region. By Type, the market is divided into Semi-Conductor and Tube. In terms of Application, the market is classified into Radar Signals, Satellite Communication, GPS, Medical Treatment, Household, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The semiconductor segment is anticipated to contribute 68.0% of the overall microwave device market revenue in 2025, making it the leading technology type. This leadership is being driven by the growing replacement of traditional vacuum tube devices with compact, solid-state alternatives offering higher energy efficiency, signal stability, and reduced maintenance.

Advances in GaN (gallium nitride) and GaAs (gallium arsenide) materials have significantly enhanced the performance of microwave semiconductor devices under high-frequency and high-power conditions. These materials support better thermal conductivity and power density, which are critical for aerospace, satellite, and tactical defense systems.

Additionally, semiconductor devices are favored for their ease of integration into modern digital architectures, enabling greater system-level flexibility and reliability. As operational environments become more complex and signal precision more critical, semiconductor microwave devices remain the foundation for scalable and future-ready technologies.

Radar signals are projected to account for 33.0% of the total revenue share in the microwave device market by 2025, securing their place as the dominant application. This segment’s prominence is attributed to the widespread deployment of radar systems across air traffic control, automotive safety, military surveillance, and weather forecasting.

The increasing demand for real-time situational awareness and tracking accuracy has reinforced investment in high-frequency radar platforms, particularly in defense and aerospace domains. Microwave devices form the core of these systems, enabling high-resolution signal transmission, target detection, and Doppler processing.

Rising cross-border tensions, modernization of armed forces, and autonomous mobility advancements are further contributing to the radar segment’s dominance. The integration of AI with radar signal processing is also boosting interest in next-gen adaptive systems, where microwave devices play a critical enabling role.

The demand for semiconductor devices used in defense applications in nations like India, the USA, China, and Russia has increased dramatically as a result of recent global war crises, such as Russia's massive invasion of Ukraine and the border dispute between China and India. Additionally, the supply chain and distribution network for defense and commercial aviation has been completely interrupted due to the ongoing war between Russia and Ukraine.

One of the most important parts of any electronic or avionics setup is the microwave equipment. Due to the ongoing conflict, there has been an interruption in the delivery of essential commodities.

A whopping 70% of the world's neon gas comes from Ukraine. Neon is used for a wide variety of purposes, including but not limited to lighting, vacuum tubes, high-voltage indicators, lightning arresters, wave meter tubes, television tubes, and helium-neon lasers. Ninety percent of the neon used in American semiconductor manufacturing comes from Ukraine. There will be long-term effects on the microwave device market from the war, as adjusting the global supply chain and distribution network will take some time.

During the forecast period, the Ku-Band segment of the microwave device market is likely to grow at the quickest rate due to rising investments in space Research and Development activities and rising demand for satellite communications. Ku-band systems and equipment are becoming increasingly popular in the defense sector, which is anticipated to drive future microwave device market expansion.

In 2024, the L-Band market sector was the most lucrative. This microwave device market is dominated by the proliferation of high-tech L-Band microwave systems used in GPS, radio, telecommunications, and air traffic control.

S-Band, X-Band, C-Band, and Ka-Band radio frequency spectrums are anticipated to have a sizable microwave device market share throughout the forecast period because of their widespread use in modern communications and computing.

In 2025, the telecommunications industry is predicted to be the most lucrative. Wireless networks, microwave radio relay networks, radar, satellite, and spacecraft communication, and point-to-point links are all contributing to the market's growth and dominance. Therefore, increased rates of microwave device market expansion are expected in the not-too-distant future.

The space industry is expected to post the fastest growth rate over the projection time frame. Market expansion is expected to be driven by rising satellite launches and spending on space Research and Development activities in both established and emerging economies.

As the current pandemic enters a recovery phase, the healthcare industry is expected to expand at a rapid rate. It is expected that the healthcare industry would experience rapid expansion as a result of rising demand for the product to detect cancer cells and treat severe ailments. Thus, the demand for microwave devices is expected to grow consistently.

Microwave device market share is likely to increase due to the usage of navigation radars used by UAVs, as these microwaves are suitable for wireless transmission of signals having larger bandwidth.

The microwave device is generally used for satellite communications, radar signals, phones, and marine applications, which is likely to boost the demand for microwave devices by end-user companies.

The sales of microwave device are rapidly rising as it provides more antenna gain, higher data & frequency rates, and reduces the antenna size with the benefit of low power consumption. This leads to an increase in microwave devices as per the microwave device market survey.

Microwave device is further used for medical treatments, drying materials, and in households for the preparation of food which increase the adoption of microwave device in the market.

Microwave device technology consists of electromagnetic rays having frequencies of 300 MHz to 300 GHz in the electromagnetic spectrum traveling in straight lines due to its high-efficiency technology, and heat tolerance is likely to rise in the microwave device market size during the forecast period from 2025 to 2035.

Microwave device is generally of two types semiconductor microwave devices and tube microwave devices, the increasing usage of GAN & SIC devices in the amplifier technology is boosting the adoption of microwave devices in the coming year.

Microwave devices are supposed to enhance accuracy, and it is executed in telecom applications which is another factor of rising in the microwave device market growth during the forecast period.

The microwave device is broadly used with a high bandwidth that helps to generate data transmission at high rates, which is also efficient for detecting, measuring, and generating microwaves. These are all the key factors that are upsurging the microwave device market statistics in the coming year.

The major factor driving the adoption of microwave devices is the increasing usage of microwave devices in various segments such as cooking, medical and security purpose. This usage of microwave devices helps in providing wide bandwidth without the need for cable during the forecast period from 2025 to 2035.

Another factor driving this microwave device market is that Microwaves can carry a high quantity of information due to which microwave devices are used for faster operations. This factor is supposed to rise the microwave device market trends in the coming year.

The key challenge for the microwave device market is the high cost of these devices, and line-of-sight will be disrupted if any obstacle, such as new buildings, is in the way due to which signal can be missed. It is a huge issue as per the microwave device market report during the forecast period.

It also takes high transit time for carriers through these microwave devices, which is another challenge faced by end users and is anticipated to decrease the sales of microwave devices in the market.

Among the segments, the C-band segment is anticipated to dominate the microwave device market statistics all around the region. A rising in development and innovation is encouraging the vendors to raise the production for the consumers as per their demand.

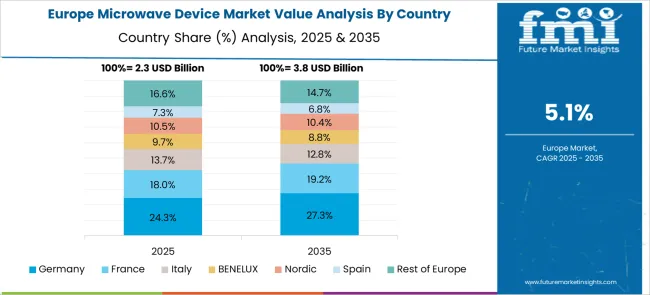

Presently, Europe holds the largest market share in the microwave device market analysis due to the presence of major market players in the region.

The microwave device is rapidly used in various end-user industries & it also various types of microwave devices, including semi-conductor microwave devices, backward diodes, Gunn diodes, Impatt diodes, Schottky diodes, tunnel diodes and tube microwave devices, and others which increase the microwave device market share in the coming year.

Presently, Europe is likely to lead the microwave device market growth by acquiring 25.9% of the share in the microwave device market all around the region during the forecast period from 2025 to 2035.

The rising usage of microwave technology for various medical and household appliances is helping this market to increase the adoption of microwave devices in the region.

North America stood in the second position after Europe with a share of 21.9% in the microwave device market size due to the increase in the adoption of microwave device technologies with the entry of major & established players in the region.

The key industry manufacturers are also likely to launch new products in the market as cost-friendly & high-quality, which is anticipated to boost the demand for microwave devices during the forecast period from 2025 to 2035.

The start-ups operating in the microwave device market find low-entry barriers. To name a few, MinWave Technologies, SenSiC, School Rebound, and Rhovica Neuroimaging won the initial stage of Venture Kick’s financial and entrepreneurial support.

These start-ups are formulating microwave devices, which are 10X smaller and 10X lighter for facilitating the ease of studying challenging systems and assisting biotechs in addressing unmet needs of the medical facility.

The key competitors are using various technical adoption to expand the business of microwave devices and increase production which is anticipated to surge in the microwave device market trends & forecast in the coming year.

In the microwave device market, there are many providers some of them are L-3 Communications, API Technologies, Thales Group, Electron Energy Corporation, and others.

The Government is also a key player in the microwave device market growth while investing in huge expenditures on the defense force. All these key competitors are likely to boost the microwave device market opportunities in the coming forecast period from 2025 to 2035.

Recent Development in Microwave Device Market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product, End User, Frequency, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | L-3 Communications; API Technologies; Thales Group; Electron Energy Corporation |

| Customization | Available Upon Request |

The global microwave device market is estimated to be valued at USD 9.2 billion in 2025.

It is projected to reach USD 15.6 billion by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are semi-conductor, _backward diode, _gunn diode, _impatt diode, _schottky diode, _tunnel diode, _others and tube.

radar signals segment is expected to dominate with a 33.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microwave Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Microwave Monolithic Integrated Circuits Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Microwave Oven Market Size and Share Forecast Outlook 2025 to 2035

Microwaveable Stuffed Animal Toys Market Size and Share Forecast Outlook 2025 to 2035

Microwave Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Microwave Backhaul System Market Size and Share Forecast Outlook 2025 to 2035

Microwave-Safe Utensils Market Size and Share Forecast Outlook 2025 to 2035

Microwave Absorbing Material Market Size, Growth, and Forecast 2025 to 2035

Microwave Power Meter Market

Microwave Antenna Market

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA