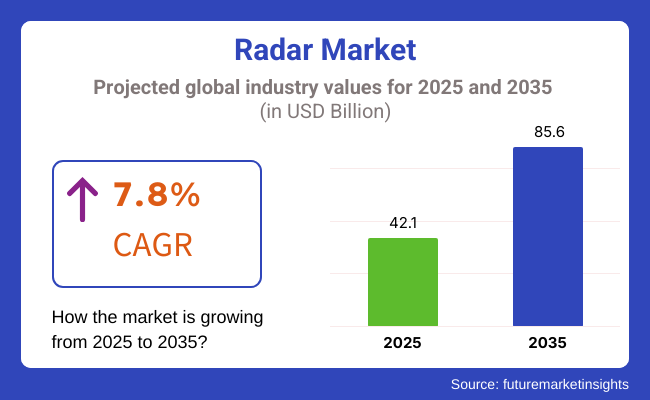

The radar market is projected to attain USD 42.1 billion in 2025 and grow significantly to USD 85.6 billion by 2035, with a CAGR of 7.8% during the forecast period. Some of these developments include ongoing innovations in solid-state radar, synthetic aperture radar (SAR), and multifunctional phased array radar.

Additionally, machine learning and AI are being incorporated into the systems for enhanced detection accuracy, real-time analytics, and overall operational efficiency. With advancing technologies for defense, automotive, aerospace, and meteorological use, industry demand is being created.

These systems are an integral part of the contemporary security and transport industry, science, and also military defense for surveillance, missile detection, and battlefield reconnaissance. The transportation sector is being revolutionized with technologies such as collision avoidance, adaptive cruise control, and traffic monitoring, all enabled by the application for transportation safety.

Aerospace navigation employs advanced technology for air traffic control, and meteorology delivers forecasts of the weather, whereas meteorologists utilize the technology to forecast and closely track weather patterns, particularly significant weather.

There are several reasons that are driving the growth of the industry. The rise in automotive uptake in driver assistance systems is enhancing road safety as well as the development of the autonomous car. Defense agencies globally are spending money on future-generation technology to advance situational awareness as well as counteract the ever-dynamic security challenges.

Increasing need for weather and environmental surveillance because of growing frequency of extreme weather conditions is also driving system adoption. The incorporation of AI system analytics is also assisting mechanisms to store and manage data in the best possible manner and process timely data.

Commercial challenges in the future for a high growth industry High cost of development and implementation of sophisticated systems can be a hindrance to adoption, especially for small-scale applications. Apart from this, there are a number of regulatory constraints with regard to frequency spectrum allocation that hinders the implementation of these systems.

Electronic warfare capabilities which interfere with the operation and cyber threats are also applicable for commercial and defense consumers. Overcoming these challenges ith improved cybersecurity methods and economical manufacturing processes will be essential to the industry growth.

Technological innovations and dynamics in industry trends drive the technology development. AI-driven analytics, 5G-driven transmission, and quantum technology will be likely to minimize detection time and enhance the data processing speed.

In addition, developments in miniaturized and low-power systems create new opportunities for portable and drone-based applications. With governments increasing their investments in defense modernization, intelligent transportation infrastructure, and climate monitoring, the industry will expand in the next decade and reshape global security, mobility, and scientific exploration.

The Land segment is estimated to witness an industry share of 57% in 2025, propelled by the demand for ground-based surveillance, air defence systems, and border security systems. Countries are designing advanced systems for military and homeland security, particularly due to increased geopolitical tensions and cross-border threats.

Major defense contractors, including Lockheed Martin, Raytheon Technologies, and Saab AB, are working on next-generation ground-based systems, such as the ANTPQ-53 counter-fire and Giraffe 4A multi-mission radar. They also play a pivotal role in modern warfare and urban security, where they have become essential for observations such as missile tracking and UAV detection.

By 2025, the Naval segment has emerged as the largest industry contributor, with a share of 43%, considering the rising demand for shipborne, sea-based surveillance, and anti-submarine warfare. The demand for multi-mode long-range naval radars is surging due to the fleet expansion and defense modernization by world navies.

This has led companies such as Thales, BAE Systems, and Northrop Grumman to develop active electronically scanned array (AESA) like the APAR Block 2 and SPY-7 radar to enhance their warships, aircraft carriers, and submarines' threat detection and missile defence capabilities.

Favourable investment conditions across the industry in land and naval platforms are expected to read through as a steady growth process ensuing owing to a rise in defence spending across North America, Europe, and Asia-Pacific regions, fuelling increased efforts towards security and combat readiness.

The Short-Range section is projected to hold an industry share of 48% (2025), owning to the growing demand for Ground-Based Surveillance, Automotive and Urban Security Radars. These are common in border security, perimeter surveillance, UAV detection, and autonomous vehicle collision avoidance.

The focus on advanced short-range systems such as RADA MHR (Multi-Mission Hemispheric Radar) and Thales Ground Observer 12 with high-resolution imaging and real-time threat detection capabilities are increasingly being pursued by key manufacturing Industry Players such as Raytheon Technologies, Thales Group, and Lockheed Martin. Smart cities, smart city development, counter-drone solutions, and the rise of autonomous vehicles are pushing the expected growth in this segment.

As its primary applications include air defense, missile tracking, and military surveillance, the Medium-Range segment is projected to dominate the industry with a 52% industry share by the year 2025. Such systems find applications in battlefield surveillance, coastal monitoring, and air traffic control.

As enemy missile threats increase, next-generation AESA (Active Electronically Scanned Array), like the Giraffe AMB and AN/TPS-77, are being developed by defense contractors Northrop Grumman and BAE Systems and Saab AB, which improve situational awareness and multi-target tracking.

Rising defense budgets in North America, Europe, and Asia-Pacific will likely strengthen home and security, military operations, and civilian infrastructure protection, with short-range and medium-range technologies playing an important role during the next few years.

The industry is experiencing a rapid change driven by the factors of technological advancement, increased security issues, and automation trends. Besides that, in the military and defense forces, they are much important in operations such as surveillance, missile detection, and battlefield monitoring, thus, they are mostly focused on the highest detection range and max precision.

The automotive industry is adapting radars for ADAS (Advanced Driver Assistance Systems) and autonomous vehicles, mainly stressing the high accuracy and high resolution of the sensors. On top of that, the aviation industry uses them for air traffic control and collision avoidance as they are the prerequisite to high-performance and integration capabilities.

Maritime applications also have these for navigation, vessel tracking, and anti-collision functions while weather monitoring radars are important for the prediction of storms and the tracking of the climate. The sector of industry has been majorly progressed on the low-power solutions for automation and material detection.

Contracts and Deals Analysis

| Company | Contract Value (USD million) |

|---|---|

| Indra Sistemas and Poland | 284 |

| Raytheon and Missile Defense Agency (MDA) | 900 |

| Northrop Grumman and USA Navy | 167.1 |

| Bharat Electronics Limited (BEL) and Indian Army | Not specified |

Investment in current and prospective contracts and advancements in technology pushed the industry significantly in 2024 & early 2025. Indra Sistemas' contract is to strengthen air traffic control for the military of the Polish Armed Forces as part of the growing trend of countries strengthening defense infrastructure. Raytheon's long-term collaboration with the Missile Defense Agency reflects a sustained requirement for reliable missile defense systems.

In contrast, Northrop Grumman's activity with the USA Navy reflects improvements in sea defense upgrades. The Indian Army's Akashteer system from Bharat Electronics Limited reflects improvement in automatic air defense systems. The above innovations reflect a defensive and generative environment driven by defense modernization and foreign collaboration, respectively.

During 2020 to 2024, the industry grew dramatically as defense, automotive, and aerospace sectors adopted advanced technology for better surveillance, navigation, and weather monitoring. The military forces upgraded the system for threat detection, missile defense, and battlefield situational awareness, and the automotive companies embedded radar-based driver assistance systems to enhance road safety.

Regulations for frequency spectrum management and deployment of these systems are established by governing bodies like the FAA and EASA. Technological innovation in AI-based processing of the data, quantum, and 5G-based radar improved range detection, signal processing, and target discrimination. Phased-array radar, millimeter-wave sensors, and synthetic aperture radar (SAR) were designed by engineers for accurate tracking and imaging.

Quantum radar, artificial intelligence-enhanced signal processing, and multi-band networks will transform the industry during 2025 to 2035. It will enable military forces to detect stealth aircraft and missiles with unprecedented precision, and AI-powered systems will enhance target detection and projected threat awareness. It will rely on autonomous vehicles for immediate threat recognition, cruise control optimization, and collision avoidance. Weather networks with artificial intelligence capabilities will enhance climate monitoring and disaster forecasting.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Radar frequency rules and policies for managing spectrum were enforced by authorities. | Governance will be defined by AI-based spectrum allocation, quantum protection protocols, and adaptive compliance models. |

| Processing with AI, millimeter-wave, and synthetic aperture enhanced performance. | Quantum, AI-based multi-band networks, and 6G-integrated radar will redefine detection capabilities. |

| Defense, automotive, and weather forecasting industries extensively used the technology. | AI-based for autonomous vehicles, smart cities, and climate risk assessment will increase industry applications. |

| Military, aviation, and automotive sectors utilized high-resolution systems. | Quantum-secured networks, AI-based threat assessment, and radar-assisted urban mobility will fuel adoption. |

| The producers reduced power consumption and maximized signal processing. | Artificial intelligence-powered energy efficiency, green radar production, and sustainable material sourcing will maximize efficiency. |

| AI-powered data fusion, real-time situational awareness, and automatic threat detection enhanced operations. | Quantum-boosted predictive analytics, AI-powered early warning systems, and autonomous surveillance will transform data analysis. |

| The producers optimized production processes and supply chain resilience. | AI-tuned production, distributed network deployment, and sustainable radar component purchasing will improve scalability. |

| Military upgrades, autonomous driving tech innovation, and climate monitoring propelled industry growth. | AI-led automation, quantum defense technology, and intelligent infrastructure installations will fuel growth going forward. |

The industry is booming due to the surge in demand for various applications including, defense, automotive, and weather monitoring sectors. But the high development and deployment costs are financial concerns. The companies shall focus on the implementation of cost-effective production methods, technology partnerships, and technological advancement in order to improve sales and maintain the industry's competitive status.

The supply chain being affected, such as lack of semiconductor availability, and the necessity to use specialized components, could slow down the production process and drive up costs. Mixed geopolitical situations and trade embargos create further difficulties in procurement of essential materials. Thus, businesses should consider supplier networks diversification, alternative sourcing, and local manufacturing investment to shorten supply chain vulnerabilities.

The technological progress in the systems leads to the risk of the product becoming outdated. The shift from the conventional systems to the new line of the equipment like phased array and quantum channels amidst the constant R&D expenditure. The companies have to be leading in modular designs, software upgrades, and product customization for the sake of survival in the briskly transforming industry.

Cybersecurity has emerged as the major risk factor especially for the defense and autonomous vehicle sectors. The hacking, interference of signals, and data leak can undermine the integrity of these systems. Therefore, the introduction of the latest encryption systems, the use of AI-based threat detection, and constant updates of security protocols will play a critical role in the preservation of operational security and the trust of customers.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 6.5% |

| France | 6.4% |

| Germany | 6.6% |

| Italy | 6.3% |

| South Korea | 6.9% |

| Japan | 6.7% |

| China | 7.1% |

| Australia | 6.2% |

| New Zealand | 6% |

A growth rate of 6.8% is anticipated for the USA from 2025 to 2035. The USA industry is thriving due to increased defense spending, technological progress, and an increasing need for surveillance and automotive radar systems. The USA military is heavily investing in radar-based missile defense, air surveillance, and electronic warfare solutions, and therefore the nation is a world leader in the technology. Industry leaders like Raytheon, Lockheed Martin, and Northrop Grumman are spearheading the technology, with further industry growth anticipated.

Increased demand from autonomous transport and aviation safety is also driving further industry growth. Weather surveillance networks are also being enhanced by the United States National Oceanic and Atmospheric Administration (NOAA) to provide better forecasting ability as well as disaster readiness. Moreover, increasing spending on smart infrastructure along with border security also is fueling the system consumption even more. Use of AI as well as machine learning in radar-based technologies is enhancing capabilities for different industries too, further boosting the USA industry.

The UK industry is growing on the back of robust government spending on defense modernization, airspace monitoring, and naval protection. The Ministry of Defense is emphasizing the deployment of next-generation the systems for national security and intelligence. UK organizations such as BAE Systems and QinetiQ are creating advanced the technologies for military and civilian use, which is increasing the country's technological superiority.

The growing requirements for radar-aided navigation in the maritime and air transport sectors are a growth driver. The growing applications of these sensors for autonomous vehicles are increasing too, influencing road safety, as well as traffic management. Weather the technology in the UK is also enhancing to support better climate observation and disaster relief. Growing investment in space-based technology is expected to drive industry growth in the UK over the next few years.

France's industry is booming due to good investment in military and aerospace applications. France is bolstering its defense planning by integrating superior technology for missile defense, maritime surveillance, and air traffic control. Industry leaders Thales Group and Safran are focusing on improving radar solutions for performance in all applications.

France is also experiencing rapid expansion in the application of car radar because of the growing need for advanced driver-assistance systems (ADAS). Climate resilience has led to the increasing deployment of weather networks to support disaster management in France. Developments in SAR technology are also supporting environmental monitoring and geospatial applications. Continued developments in the technology are positioning France as a key player in the global industry.

Germany dominates the industry in terms of technology innovation, with robust demand from the defense, automotive, and transport sectors. The German defense is investing in state-of-the-art systems for surveillance, along with air defense operations, to improve national security. Hensoldt and Rohde & Schwarz are dominating players in the technology development, stimulating industry growth.

Germany's densely concentrated automotive sector, ruled by the likes of BMW, Mercedes-Benz, and Volkswagen, is rapidly progressing toward the adoption of radar-based safety technologies like collision warning and adaptive cruise control.

Its emphasis on Germany in autonomous driving technology also finds impetus for high-precision sensors. Germany's commitment to mitigating climate change has also created a network expansion of weather for higher precision forecasting and catastrophe preparedness. All these put Germany in the position of being one of the leading premium technology markets.

The industry in Italy is expanding as it strategically invests in naval surveillance, defense, and aviation. The government in Italy is upgrading its infrastructure for the sake of more national security and border patrol. Leonardo S.p.A. and others are leading the advancement of technology in both civil and military applications.

Italy's automotive manufacturing sector is also embracing technology for future autonomous driving and safety applications. Italy's aerospace industry is applying technology in air traffic control and collision avoidance systems. Italy's focus on meteorological advancements is also driving the application of weather technology for enhanced accuracy in forecasting. Ongoing investment in technologies ensures ongoing industry growth.

South Korea is advancing rapidly in the field on the back of enormous defense, automotive, and space reconnaissance spending. The Ministry of National Defense is implementing advanced radar systems to enhance military capabilities. Leading players like Hanwha Systems and LIG Nex1 are in charge of the development of applications.

The country's automotive sector is embracing the driver assistance systems for improved road safety. The development of weather the technology in South Korea also enhances disaster management and climate monitoring. Growing demand for space-based solutions is expected to propel the industry in South Korea towards solid growth.

Japan's industry is growing as it has taken massive strides in the automobile, aviation, and military industries in terms of technology. Investments by the government are favoring the technology to enhance national security and rescue efforts during calamities. Fujitsu and Mitsubishi Electric are breaking the trail in making radars, which is the way to healthy industry competition.

The growing use of the technology in self-driving cars is propelling demand. The high-level environment observation in Japan also stimulated the innovation of weather networks. Shipping in Japan is also embracing them to provide higher-level navigation and security, further stimulating industry development.

The Chinese industry is developing at a rapid rate with vast defense spending, technological developments, and increasing needs for automotive systems. The Chinese military is utilizing sophisticated solutions in missile detection and tracking. Players like CETC and Huawei are leading the growth in the industry.

The country's intelligent transport systems are creating markets for radar-based navigation and collision avoidance systems. China is also investing in space-based technology in disaster management and environmental monitoring. These all lead to China emerging as a future participant in the international industry.

Australia's industry is growing with the increasing investment in defense, aviation, and meteorology usage. The government of Australia is enhancing Australia's border security and air traffic control systems through the assistance of advanced technology.

The application of sensors in agriculture to detect weather and pests is developing, increasing industry opportunity. In addition, the application of radar-based surveillance in naval security is driving demand. Companies like CEA Technologies are at the forefront of the development of the industry in Australia.

New Zealand's industry is growing with increased investments in aviation security, meteorological forecasting, and maritime surveillance. The government is upgrading the industry networks for national security and disaster mitigation.

The industry’s uses in intelligent transport and environmental surveillance are gaining momentum. The industry meteorological applications are being developed in New Zealand, and weather forecasting is being improved. As autonomous technology becomes more fashionable, innovation with the industry will be on the rise.

The industry is very competitive as the demand for the industry is growing in many different industries, including defense, aerospace, automotive, weather monitoring, and industrial automation. The growth of the industry is driven by increasing geopolitical tensions, the development of autonomous vehicle technology, and the growth and development in air traffic management. Growing demand for the same in the industry due to rising demand for early warning systems, surveillance, and precision-guided weapons in the defense sector is also expected to propel the growth of the industry.

The industry is characterized by dominance by a few companies with a strong R&D portfolio, significant defense contracts, and innovative technological achievements, which are Lockheed Martin, Raytheon Technologies, Thales Group, Northrop Grumman, and BAE Systems. Similarly, startups and niche players are developing solid-state radar, AI-enabled radar systems, and miniaturized sensors for use in emerging military and commercial applications.

Other key trends influencing the growth of the industry include the development of solid-state the industry technology, AI-powered threat detection, and improved signal processing for increased accuracy and efficiency. An increasing demand for multi-mission systems, for 3D imaging, and for cognitive radar is fostering innovation in defense, aeronautics, automotive, and weather observation solutions.

Organizations are looking towards product diversification and portfolio expansion, emphasizing the integration of AI, ML, and edge computing to improve real-time data processing and decision-making. Military and defense applications continue to be the main growth bellwether, although accelerating penetration into autonomous vehicles, industrial automation, and smart city infrastructure is unlocking new revenue streams.

Industry factors shaping competitive dynamics include cost pressure, supply chain resilience, and regulatory compliance in industries such as aviation, defense, and automotive safety standards. We have seen a trend of growing demand for both multifunctional and high-frequency solutions, forcing companies to compete on performance reliability, robustness against cybersecurity threats, and AI-enabled automation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lockheed Martin Corporation | 20-25% |

| Raytheon Technologies | 15-20% |

| Northrop Grumman Corporation | 12-17% |

| Thales Group | 8-12% |

| BAE Systems | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lockheed Martin Corporation | Providing systems in defense and aerospace: missile defense, air surveillance, etc. |

| Raytheon Technologies | Builds complex solutions for military, weather forecasting, and air traffic control |

| Northrop Grumman Corporation | Focuses on multimode, airborne surveillance, and stealth sensor integration. |

| Thales Group | It offers AI-enabled tracking and threat detection systems, which are used for ground-based and naval solutions. |

| BAE Systems | It specializes in military, naval defense systems, and automotive for self-driving car applications. |

Key Company Insights

Lockheed Martin Corporation (20-25%)

Lockheed Martin makes more than two dozen defense systems, including high-precision surveillance and missile defense systems. Its progressive work on phased-array radars and sensor fusion can significantly improve military situational awareness.

Raytheon Technologies 15%-20%

Raytheon designs radar applications that serve a range of applications, from military defense to weather and aviation safety. Its AI-based radar analytics innovations propel it to the forefront of the industry.

Northrop Grumman Corporation (12-17%)

Northrop Grumman specializes in next-generation radar technology for stealth aircraft, airborne surveillance, and integrated defense systems.

Thales Group (8-12%)

Thales provides a wide array of solutions, leveraging strengths in air defense, naval surveillance, and next-generation AI-driven analytics.

BAE Systems (5-9%)

BAE Systems is a manufacturer of military systems for marine and aerial observation and a provider of automotive systems for self-driving cars.

Others Key Players (30-40% Combined)

By platform, the industry covers land, naval, airborne, and space.

By application, the industry includes short range, medium range, and long range.

By type, the industry spans defense & aerospace, marine, weather forecasting, remote sensing, and automotive.

By region, the industry covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and The Middle East & Africa (MEA).

The industry is expected to generate USD 42.1 billion in revenue by 2025.

The industry is projected to reach USD 85.6 billion by 2035, growing at a CAGR of 7.8%.

Key players include Lockheed Martin Corporation, Raytheon Technologies, Northrop Grumman Corporation, Thales Group, BAE Systems, Saab AB, Leonardo S.p.A., Indra Sistemas S.A., Mitsubishi Electric Corporation, and Honeywell International Inc.

North America and Europe, driven by strong defense budgets, increasing adoption of automotive, and advancements in air traffic control systems.

Airborne and automotive systems dominate due to their critical roles in military applications, autonomous vehicle safety, and weather forecasting.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Range, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Platform, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Range, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Platform, 2023 to 2033

Figure 22: Global Market Attractiveness by Range, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Range, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Platform, 2023 to 2033

Figure 47: North America Market Attractiveness by Range, 2023 to 2033

Figure 48: North America Market Attractiveness by Application, 2023 to 2033

Figure 49: North America Market Attractiveness by Type, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Range, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Range, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Range, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Platform, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Range, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Range, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Platform, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Range, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Platform, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Range, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Platform, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Range, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Platform, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Range, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Platform, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Range, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Platform, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Range, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Range, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Range, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Range, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Platform, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Range, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA