The global marine radar market is valued at USD 1.57 billion in 2025 and is slated to be worth USD 2.56 billion by 2035, which shows a CAGR of 5% over the forecast period. This growth is projected to be driven by increasing demand for advanced navigation systems, rising maritime security concerns, and the expansion of global shipping activities. Furthermore, contributions to market expansion are expected to be made by advancements in AI-powered radar technologies and increasing investments in autonomous vessels over the forecast period.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 1.57 billion |

| 2035 Market Size | USD 2.56 billion |

| CAGR (2025 to 2035) | 5% |

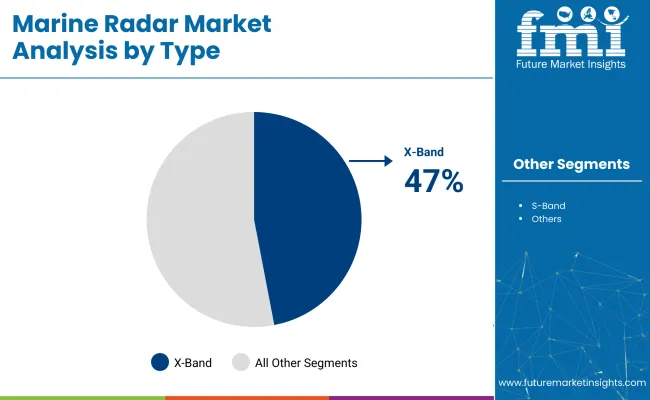

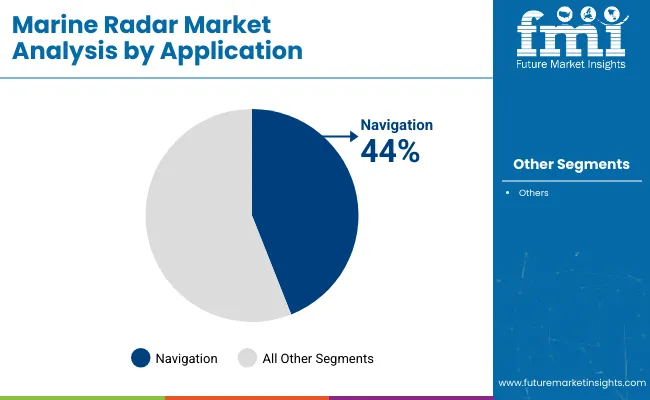

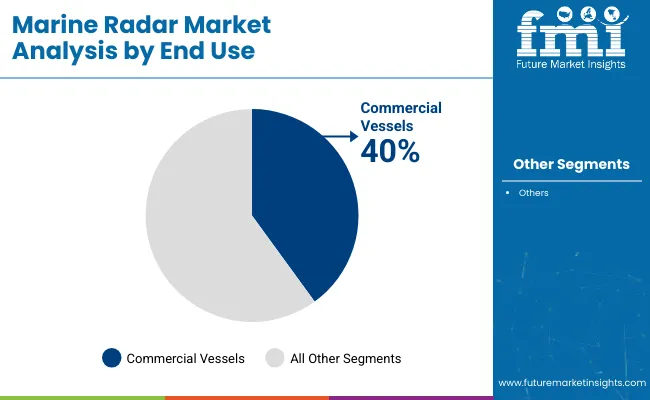

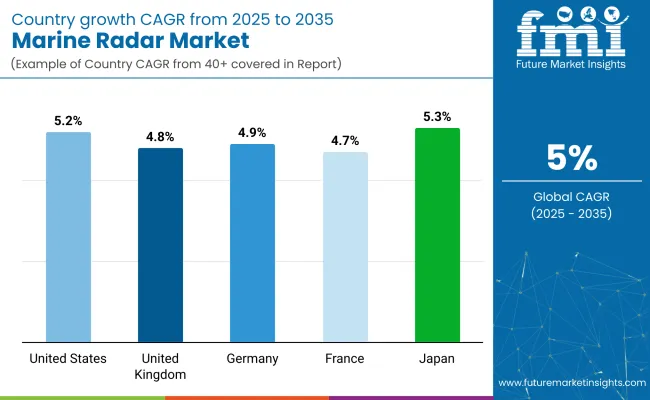

Japan is expected to be the fastest-growing country, with a projected CAGR of 5.3% from 2025 to 2035. X-Band radar will dominate the type segment, capturing a 47% market share in 2025. Navigation applications are anticipated to lead with a 44% share, driven by rising demand for precise route tracking. Commercial vessels will account for 40% of total end use. The USA and Germany are also projected to grow steadily, with CAGRs of 5.2% and 4.9%, respectively.

Marine radar technology has undergone significant innovation in recent years, enhancing safety, navigation, and situational awareness at sea. One of the most transformative advances is the adoption of solid-state radar systems, such as those using CHIRP (Compressed High-Intensity Radiated Pulse) and Doppler processing.

These systems offer superior target resolution and range discrimination compared to traditional magnetron-based radars. CHIRP technology, in particular, enables radars to distinguish between small targets like buoys or kayaks and large vessels, even in cluttered environments or poor weather.

Another key innovation is the integration of automatic target tracking (ARPA) with AIS (Automatic Identification System) data. This fusion provides dynamic, real-time information on the movement, speed, and identity of nearby vessels, improving decision-making and reducing collision risk. Modern systems also incorporate doppler-based color-coding to indicate whether objects are approaching or receding, which enhances threat assessment.

The market is segmented into type, component, application, end use, and region. By type, the market is divided into X-band radar, S-band radar, and others (K-band and C-band radars). Based on component, the market is categorized into transmitters, antennas, receivers, displays, and processors. In terms of application, the market is segmented into navigation, collision avoidance, and surveillance & security.

By end use, the market is divided into commercial vessels, fishing vessels, naval & defense, recreational boats, and offshore oil & gas. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

X-Band radars are projected to lead the product type segment with a 47% share in 2025.Their prominence is being driven by high-resolution imaging, compact design, and suitability for short-range maritime navigation.

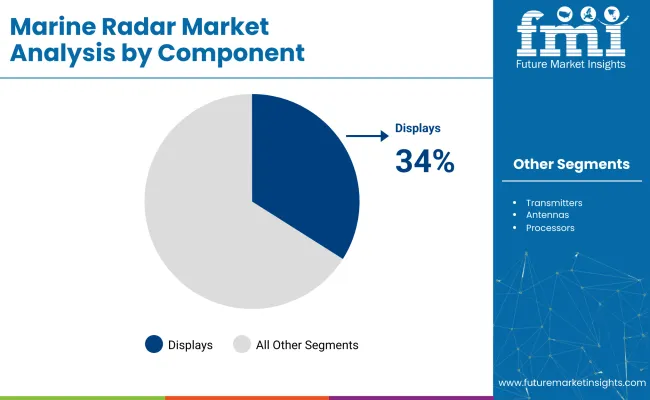

Displays are expected to lead the component segment with a 34% share in 2025. This dominance is anticipated to be driven by the rising adoption of integrated, high-definition radar interfaces across commercial and defense marine vessels.

Navigation is set to lead the application segment, holding an estimated 44% share by 2025.This prominence is driven by its critical role in ensuring safe vessel movement and route optimization across global waters.

Commercial vessels are projected to capture 40% of the marine radar market by end use in 2025.

The market is being driven by advancements in navigation technology, rising demand for maritime safety, and global shipping growth. However, growth is being constrained by high installation costs, compliance burdens, and cybersecurity risks associated with radar-linked systems.

Recent Trends in the Marine Radar Market

Challenges in the Marine Radar Market

The USA marine radar market is projected to expand at a CAGR of 5.2% during 2025 to 2035, driven by navy modernization and maritime surveillance investments. Radar innovation is being led by Raytheon, Lockheed Martin, and Northrop Grumman, contributing to the region’s growth. Integration with satellite and cloud-based systems is being prioritized.

The UK marine radar market is forecasted to grow at 4.8% CAGR, supported by investments in coastal radar networks and port infrastructure. BAE Systems and Kelvin Hughes are leading development in this area.

Germany’s marine radar market is anticipated to expand at 4.9% CAGR due to defense radar innovation and shipping modernization efforts. Rohde & Schwarz and Hensoldt are advancing local marine electronics R&D.

France’s marine radar market is forecasted to expand at 4.7% CAGR, led by naval defense initiatives and NATO radar collaborations. Thales Group is expanding radar solutions for coast guards and research fleets.

Japan’s marine radar market is forecasted to grow at a CAGR of 5.3% from 2025 to 2035fueled by maritime safety priorities and strong radar technology innovation. Furuno, JRC, and Mitsubishi Electric are delivering advanced radar for coastal, defense, and commercial vessels.

The marine radar market is consolidated, with major players such as Simrad (Navico), Hexagon AB, HENSOLDT (Kelvin Hughes), SAAB, and BAE Systems controlling significant market shares. Competition is being driven by AI-driven radar innovation, strategic defense partnerships, geographic expansion, and enhanced integration capabilities. Premium features such as cloud connectivity and multi-band operability are justifying higher price points in select segments.

Hexagon AB has been emphasizing sensor fusion and precision engineering, as demonstrated by its recent MoU with GPR, Inc. to integrate ground-penetrating radar into its navigation platforms, alongside a planned spin-off of its Asset Lifecycle Intelligence business.

Marine Radar Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.57 billion |

| Projected Market Size (2035) | USD 2.56 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billions /units |

| By Type | X-Band Radar, S-Band Radar, and Others (K-Band, C-Band) |

| By Component | Transmitters, Antennas, Receivers, Displays, and Processors |

| By Application | Navigation, Collision Avoidance, Surveillance & Security |

| By End Use | Commercial Vessels, Fishing Vessels, Naval & Defense , Recreational Boats, and Offshore Oil & Gas |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Hexagon AB, Blum- Novotest GmbH, Marposs S.p.A., Heidenhain GmbH, Simrad ( Navico Group), SAAB AB, Kelvin Hughes Ltd., Koden Electronics Co., Ltd., BAE Systems plc, and Hensoldt AG. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis. |

The market is segmented into X-Band Radar, S-Band Radar, and Others.

The industry is divided into Transmitters, Antennas, Receivers, Displays, and Processors.

The market caters to Navigation, Collision Avoidance, and Surveillance & Security.

The report covers key sectors, including Commercial Vessels, Fishing Vessels, Naval & Defense, Recreational Boats, and Offshore Oil & Gas.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The market is expected to reach USD 2.56 billion by 2035.

The market is projected to grow at a CAGR of 5% from 2025 to 2035.

X-Band radar leads the market with a 47% share due to its high-resolution and cost-efficiency.

North America holds the leading regional share, driven by defense and port security investments.

Key players include Furuno, Simrad (Navico), HENSOLDT, Hexagon AB, and BAE Systems.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA