Themarine cranes market is segmented by type, lifting capacity, application, and regions from 2025 to 2035.

Rising investments in offshore infrastructure, a growing global trade by sea, and rapid modernization of port handling equipment are also driving the growth of the Marine Cranes Market. Marine cranes also encountered on offshore platforms, ships and harbours have critical uses in oil and gas extraction, and lifting and container logistics-handling, in addition to rescue operations. The rise in energy demand propelled by offshore wind and exploratory deep-sea oil exploration creates demand for dependable heavy-day marine lifting systems working in austere marine environments.

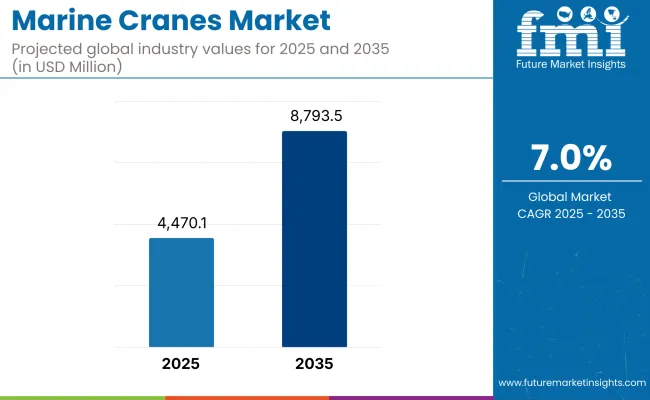

The CAGR for the market to grow from USD 4,470.1 million in 2025 to USD 8,793.5 million by 2035 is 7.0% for the forecast period. Hydraulic and electric marine cranes are undergoing rapid technological advancements, Asia-Pacific is witnessing increasing shipbuilding activities and rising demand for energy-efficient and corrosion-resistant equipment are the factors driving the market growth.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 4,470.1 million |

| Market Value (2035F) | USD 8,793.5 million |

| CAGR (2025 to 2035) | 7.0% |

Government initiatives on decarbonisation and maritime safety help further the widespread adoption of automated, low-emission cranes. Crane manufacturers as well as marine service providers benefit from the recurring revenue of aftermarket services, such as retrofitting, maintenance, and upgrades.

North America marine crane market is projected to grow substantially, on account of increasing offshore drilling across the Gulf of Mexico, rising investments toward naval modernization and strong demand for port automation systems. The United States was concentrating on port infrastructure upgrades to match changing cargo capacity and enhance operational security.

Regulatory policies directed to curbing emissions and enhancing energy efficiency are supporting the growth of electric and hybrid marine cranes. Demand for replacement cranes and lifting modules is also being seen in the refurbishment of aging offshore oil platforms.

Europe has a significant share in the market, mainly due to the increasing offshore wind energy deployment in the North Sea and the growing ship repair and upgrades activities in the region. Norway, Germany and the Netherlands, for example, have ordered a multitude of dedicated vessels with heavy-duty marine cranes to install and service turbines.

Snapping and snap-tightening marine security and EU-funded sustainability programs are moving the switch students to smart crane solutions and fuel-efficient systems. Port automation is also elevating demand for precision control systems and remote diagnostics.

Asia-Pacific is still the fastest-growing region with China, South Korea and Japan continuing to lead world shipbuilding. An explosive expansion of port infrastructure, an uptick in offshore-oil exploration, and increasing trade activity are all driving up demand.

China currently integrates marine cranes in categorical ships on both civil and defence fleets at an accelerated rate whereas India is upgrading its shipyard capabilities to fill regional marine needs. This presents massively lucrative market opportunities for both domestic and foreign crane manufacturer as the government pushes for indigenous equipment manufacture, government support for port modernization etc.

Challenge

High Installation Costs and Operational ComplexityHigh capital investment in marine crane installation is one of the key challenges affecting the market, especially while integrating such cranesinto offshore rigs and bulk carriers. Installation demands precision, corrosion-proof materials, and adherence to international maritime standards, which drive up costs. Finally, for smaller operators, operational complexity and maintenance requirements over time in remote locations restrict both rapid deployment and longer-term sustainability.

Opportunity

Growth in Offshore Renewable Energy and Port AutomationDespite its significant potential, offshore growth continues focusing on sectors such as renewable energy, with wind taking the lion's share, which bodes well for marine cranes. There is a growing demand for specialized cranes to install and service turbines. Simultaneously, increasing utilization of automated systems and AI-based diagnostics in port cranes is facilitating real-time performance tracking, predictive maintenance, and lowering downtime.

The Report covers the manufacturer data, agreements, financial transactions, revenues, and innovative strategies of various companies as they invest in modular, energy-efficient, and innovative marine cranes to gain an edge over the competition as global ports embark on a journey of digital transformation and sustainable practices.

The growth rate of marine cranes during 2020 to 2024 can be attributed to the rapid growth in offshore oil & gas exploration, increasing global trade and upgradation of port infrastructure. Such cranes were much favoured by cargo, ship and offshore construction. Technology advancement has led to the development of advanced knuckle boom and telescopic cranes that can provide enhanced safety, better operational efficiency, and superior lifting capabilities. Some constraints were posed by variable raw material prices and limited maritime investments in developing regions.

Between 2025 and 2035, the marine cranes market is anticipated to accelerate, driven primarily by surging offshore renewable energy projects, particularly in offshore wind farms. It’s here that smart crane systems with advanced telemetry, remote diagnostics, and automated safety protocols go mainstream.

In addition, military modernization programs will be one of the key factors contributing to the demand for heavy-duty marine cranes. We expect manufacturers will focus on innovations in lightweight materials and more fuel-efficient hydraulic systems to comply with stringent environmental and performance standards wide ranging across heavy equipment categories.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Industry Applications | Dominated by cargo handling and offshore oil & gas activities. |

| Regulatory Environment | Governed by marine safety and emissions regulations. |

| Technological Integration | Adoption of basic hydraulic and electric systems with limited automation. |

| Market Expansion | Growth in port infrastructure and offshore platforms in developed economies. |

| Consumer Preferences | Preference for lifting capacity and basic operational reliability. |

| Market Shift | 2025 to 2035 |

|---|---|

| Industry Applications | Expansion into offshore wind farms, naval operations, and subsea infrastructure. |

| Regulatory Environment | Stricter emissions, safety automation, and carbon compliance mandates. |

| Technological Integration | Deployment of smart cranes with telemetry, diagnostics, and remote operation. |

| Market Expansion | Surge in demand from Asia-Pacific, Middle East, and emerging coastal economies. |

| Consumer Preferences | Shift toward intelligent, energy-efficient, and low-maintenance marine solutions. |

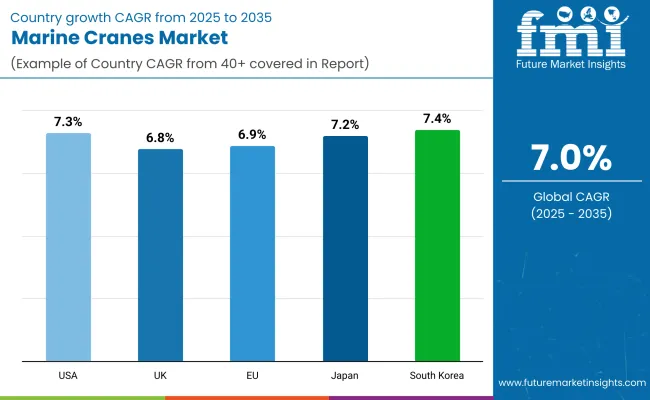

This domain of the Marine Cranes market in the United States is bushing with a growth view of 7.3% CAGR over 2025 to 2035. The high performance marine crane demand is further led by the strong marine infrastructure of the country and increasing offshore oil and gas activities in the Gulf of Mexico.

Facilities modernization at ports, and an increased shipbuilding, have also motivated manufacturers to develop cranes with enhanced load capacity, stability and remote operability. Sustained procurement of marine cranes is being fuelled largely by continued investment in vessel maintenance and logistics improvement for the USA Navy and Coast Guard.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.3% |

The UK Marine Cranes Market is anticipated to register a CAGR of 6.8% during the forecast period. Within the context of the North Sea's new focus on offshore wind energy development, the region has seen rising demand marine cranes for installation and maintenance operations.

Industry-leading knuckle boom and telescopic cranes capable of safe handling of heavy subsea equipment are being deployed by offshore engineering companies. With the increasing number of research vessels and supply ships from UK, the market expansion is further enhanced. Increased attention to marine safety and precision handling is enabling a broader roll-out of intelligent lifting systems among crane layouts.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.8% |

The Marine Cranes Market in Europe is expected to achieve a CAGR of 6.9% between 2025 and 2035. Other nations, such as Norway, the Netherlands, and Germany have continued to invest heavily in offshore platforms, floating production storage units (FPSOs) and marine research vessels.

This demand for marine cranes with advanced corrosion resistance and extreme weather ruggedness is continuing to grow. In addition to this, implementation of maritime environmental regulations is ultimately compelling crane manufacturers to generate eco-efficient equipment with decreased hydraulic oil spillage and energy hunger. Like the Baltic and advertisement mediated markets, carriers look an airborne favourable like.

| Region | CAGR (2025 to 2035) |

|---|---|

| Europe | 6.9% |

Japan Marine Cranes Market is expected to grow at a high CAGR of 7.2% during the forecasting period 2025 to 2035. Japan has a strong shipbuilding industry and is investing in its port infrastructure, making it an essential market for advanced marine cranes. The trend in the country, which has set carbon neutrality goals, is for semi-automated and electric marine cranes.

Japanese companies are embedding smart monitoring systems into their crane equipment to ensure operational safety and maintenance predictability at work in severe marine environments. The demand has also been boosted by Japan’s expanding maritime logistics network with demand levels increasing from both cargo handling as well as offshore supply vessel segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

Korea is expected to report a CAGR of 7.4% in the Marine Cranes Market in the upcoming decade. South Korea, one of the top shipbuilders in the world, maintains interest in heavy-duty marine cranes for mounting on bulk carriers, LNG vessels and container ships.

Due to the nation’s focus on modernizing the dockyards and naval fleets, crane manufacturers are working on new, modular design crane systems, utilizing less space, providing speeds of deployment, as well as improved safety features. In addition, the use of digital diagnostics and remote-control functions in marine cranes is increasingly common, embodying South Korea's smart manufacturing and smart shipbuilding projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

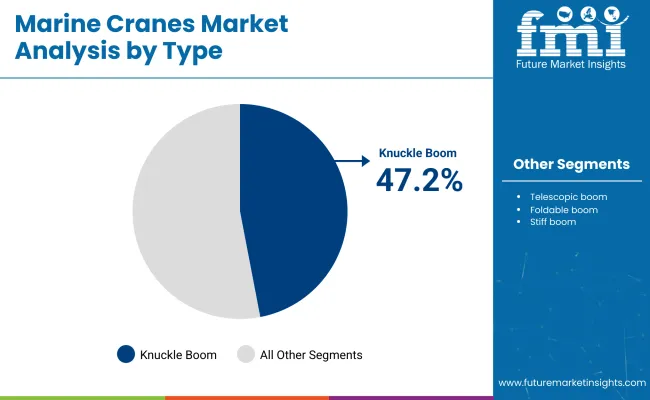

| By Type | Market Share (2025) |

|---|---|

| Knuckle Boom | 47.2% |

Due to superior flexibility, compact structure, and material handling capabilities in rugged marine environment, knuckle boom marine cranes are ruling the market share front. These cranes work with offshore support vessels, fishing boats, research vessels, and cargo handling ships, where precision lifting and movement is essential. The articulated boom design of knuckle boom cranes makes them fold like a finger, allowing less space, and making it safer to operate in tight working spaces.

The component companies include knuckle boom cranes due to their operational reliability and multi-tasking supporting capacity, which continues to urge shipbuilding and marine logistics giants to follow appropriate purchasing policies. These cranes are enabling easier maintenance, transfer of personnel and handling of subsea equipment. Newer knuckle boom cranes include hydraulic stabilization systems and also typically have remote-control capabilities, which enhance their functionality in harsh sea conditions.

The increase in offshore oil and gas activities globally, and rising demand for efficient cargo loading and unloading, has made knuckle boom cranes substitutes for marine vessels operating in both commercial and defence marine sectors. Additionally, manufacturers have started to produce corrosion-resistant variants capable of enduring extreme saline environments, thus promoting prolonged functional service.

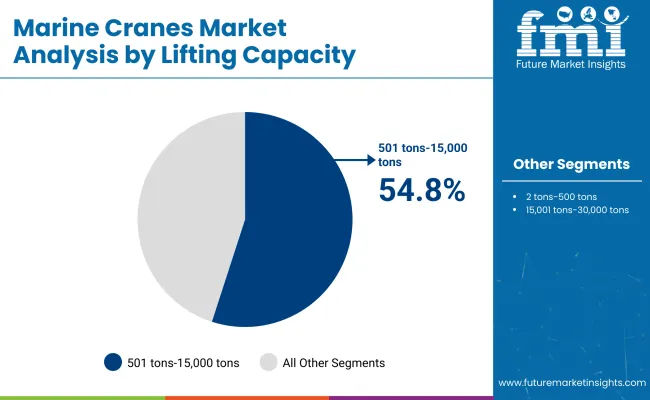

| By Lifting Capacity | Market Share (2025) |

|---|---|

| 501 tons-15,000 tons | 54.8% |

Marine cranes with a lift capacity between 501 to 15,000 tons dominate the market owing to their broad placement on offshore service vessels, container ships & heavy-lift carriers. From module install to rig component moving, subsea equipment deployment and heavy cargo transfers, these cranes are put to work on mission-critical tasks. Their strong lift performance allows maritime operators to complete operations in fewer lifts, minimizing operational risk and reducing a time-intensive turnaround time.

These cranes are mainly used in maritime and offshore construction for lifting huge structures, such as wind turbine blades, subsea pipelines and large oil rig assemblies. This lifting range enables shipbuilders to design vessels with reinforced hulls and decks that will be compatible with heavy-lift solutions for many years to come. To gain better control (and safety) with feedback diagnostics for lifting, manufacturers embedded these cranes with sensors and automation system.

The increasing number of offshore wind energy projects and deep-sea exploration programs across the globe continues to underpin demand for cranes in this segment. They are due to their ability to handle heavy equipment and containers on a variety of marine platforms.

Demand for improved lifting solutions across offshore platforms, shipyards, and naval vessels is driving the evolution of the Marine Cranes market. Top manufacturers focus on product longevity, load accuracy and smart automation to support the expanding offshore oil, wind and shipping industries. To enhance reliability in harsh marine environments, companies are increasingly employing anti-corrosion materials, dynamic load compensation systems, and remote-control capabilities.

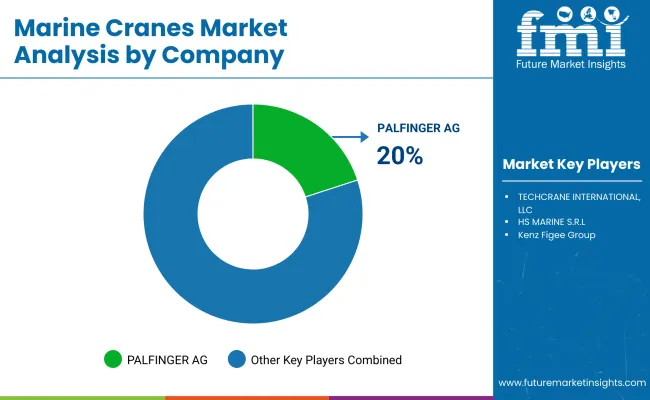

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PALFINGER AG | 20-24% |

| TECHCRANE INTERNATIONAL, LLC | 14-18% |

| DMW Marine Group, LLC | 11-14% |

| HS MARINE S.R.L. | 9-12% |

| Kenz Figee Group | 7-10% |

| Other Companies (combined) | 22-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| PALFINGER AG | In 2025 , expanded its knuckle boom crane lineup with higher load moment ratings for offshore vessels. |

| TECHCRANE INTERNATIONAL, LLC | In 2024 , introduced modular pedestal cranes with adaptive hydraulics for dynamic marine conditions. |

| DMW Marine Group, LLC | In 2025 , launched a new heavy-lift series for navy and oceanographic vessels with corrosion-resistant build. |

| HS MARINE S.R.L. | In 2024 , improved its articulated crane systems with electronic overload protection and remote diagnostics. |

| Kenz Figee Group | In 2025 , deployed energy-efficient offshore cranes with regenerative braking technology. |

Key Company Insights

PALFINGER AG (20-24%)

PALFINGER maintains its dominance with a broad range of marine cranes, offering innovative knuckle boom and telescopic cranes tailored to offshore wind and logistics platforms.

TECHCRANE INTERNATIONAL, LLC (14-18%)

TECHCRANE continues to lead in fixed pedestal and telescoping boom cranes, prioritizing customization for deepwater drilling and vessel-mounted applications.

DMW Marine Group, LLC (11-14%)

DMW secures market share by focusing on rugged and long-lasting marine cranes, particularly for military and subsea deployment vessels.

HS MARINE S.R.L. (9-12%)

HS MARINE advances its global presence by offering versatile cranes equipped with hydraulic stabilization and compact designs for limited-deck spaces.

KenzFigee Group (7-10%)

KenzFigee pioneers energy-efficient crane systems with emphasis on wind energy platforms, incorporating automation and digital control modules.

Other Key Players (22-30% Combined)

Additional players support regional demand, specialized vessel classes, and tailored crane systems:

The overall market size for the Marine Cranes Market was USD 4,470.1 million in 2025.

The Marine Cranes Market is expected to reach USD 8,793.5 million in 2035.

The demand is driven by increasing offshore oil and gas exploration activities, expansion of offshore wind energy projects, and advancements in marine logistics and cargo handling.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

The Knuckle Boom segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA