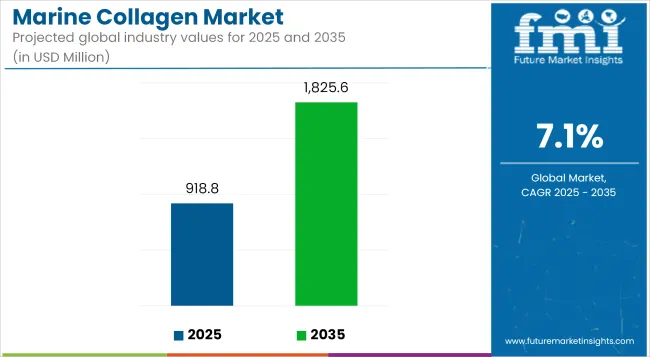

The global marine collagen market, valued at USD 918.8 million in 2025, is set to reach USD 1,825.6 million by 2035, advancing at a 7.1% CAGR. This expansion is being underpinned by broader acceptance of clean-label ingestibles, growing preference for pescatarian protein sources, and active R-and-D into high-purity peptide extraction that improves bioavailability. Key trends in the market include the arrival of animal-free recombinant variants and the upcycling of fishery by-products into premium collagen inputs.

| Attributes | Details |

|---|---|

| Market Size, 2025 | USD 918.8 million |

| Market Size, 2035 | USD 1,825.6 million |

| Value-based CAGR (2025 to 2035) | 7.1% |

The marine collagen market is poised for sustained expansion through 2035, fueled by advancements in enzymatic hydrolysis, deodorization, and clean-label processing. A rising preference for high-bioavailability proteins among wellness-focused consumers is propelling marine collagen into mainstream formats like ready-to-drink beverages, functional powders, and soft chews.

Key growth has also stemmed from the valorization of fish skin and scales once discarded as waste into high-purity collagen peptides, enabling both environmental impact reduction and margin expansion for processors. Asia Pacific, led by Japan, China, and South Korea, is expected to remain at the forefront of global demand due to the normalization of ingestible skincare and beauty-from-within routines across all age demographics.

In parallel, next-gen applications are emerging that stretch beyond traditional nutraceuticals. Biomedical interest in marine collagen is rising due to its biocompatibility and lower immunogenicity compared to bovine or porcine sources, making it suitable for wound dressings, surgical scaffolds, and tissue engineering.

Recombinant and bioengineered variants are being explored to offer animal-free alternatives with enhanced peptide stability. Meanwhile, increasing regulatory scrutiny is encouraging full traceability in sourcing and refining, pushing brands to adopt blockchain tagging and third-party certification. This convergence of science, sustainability, and personalization is anticipated to define the next wave of market competitiveness.

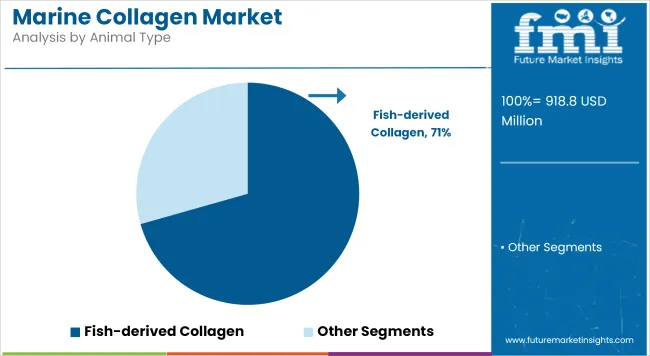

Fish-derived collagen continued to dominate the marine collagen market in 2025, holding a 70.6% value share. Companies like Rousselot, GELITA AG, and Nitta Gelatin Inc. have been instrumental in shaping this segment through innovations in fish collagen peptide formulations. Rousselot’s Peptan® marine collagen is widely used in supplements for joint and skin health, targeting health-conscious consumers across Asia and North America.

GELITA AG focuses on sustainable sourcing and advanced hydrolysis techniques to increase absorption and functionality, ensuring premium-grade fish collagen for cosmetic and pharmaceutical uses. Meanwhile, Nitta Gelatin has leveraged its Japanese heritage in collagen science to create high-purity marine collagen that appeals to clean-label and eco-conscious consumers.

The fish segment’s versatility in applications-including powders, beverages, creams, and capsules-has attracted both wellness brands and cosmeceutical giants. With strong backing from clinical studies and marketing campaigns centered around anti-aging and joint care, fish-based collagen continues to secure strategic investment and product development across global markets.

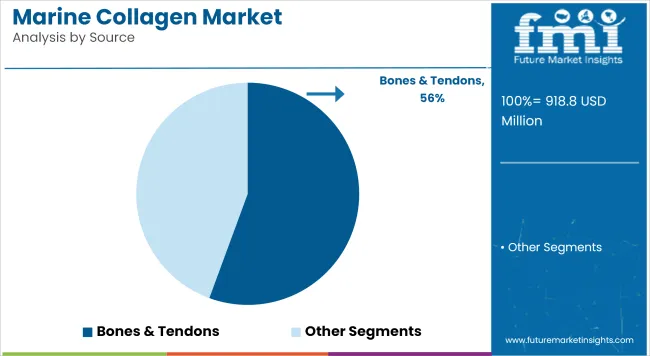

Bones and tendons maintained their lead as the main source of marine collagen, accounting for 55.9% of the market in 2025. Major players like Weishardt Group, Amicogen Inc., and Vital Proteins (Nestlé Health Science) are actively involved in this segment. Weishardt has expanded its marine collagen portfolio through sustainable extraction from fish bones and tendons, especially in Europe. Its ingredients are widely used in clinical-grade supplements and beauty drinks. South Korea’s Amicogen focuses on enzymatic hydrolysis methods to extract bioactive peptides from fish tendons, supporting applications in medical nutrition and sports recovery.

Vital Proteins, backed by Nestlé, integrates bone- and tendon-sourced collagen into its flagship products, targeting millennials and athletes, reinforcing credibility through influencer campaigns and verified claims. These companies not only emphasize scientific backing but also streamline traceability and sustainability certifications, further boosting consumer trust. As the demand for clinically proven, multi-functional wellness ingredients rises, bones and tendons are projected to remain the primary extraction source for marine collagen.

Emergence of Animal-free Collagen Disrupts the Industry

Due to changing customer demands for sustainable, morally-responsible, and cruelty-free products, the formation of animal-free marine collagen is an important milestone in the marine collagen industry.

As environmental sustainability and animal welfare become more pressing issues, there is more of an urge for ethical substitutes for the conventional marine collagen made from fish. Traditional methods of producing marine collagen frequently entail overfishing, habitat degradation, and marine pollution.

The availability of marine collagen made without using animals expands the prospects for collagen-based goods by drawing in customers who were previously turned off by dietary or ethical restrictions.

Leveraging this trend, leading global cosmetic company L'Oréal debuted its second version of Age Perfect Collagen Royal Anti-Aging Face Cream in December 2023; it was created especially for the discriminating Chinese market.

This innovative release signaled a turning point for L'Oréal Paris skincare as it first included recombinant collagen into its product range, a first for the industry. It also represents a significant step toward the recombinant collagen industry's commercialization.

Emphasis on Clean Label and Transparency Boosting Market Demand

In the current era of increased consumer consciousness and ingredient inspection, the marine collagen industry is exhibiting an apparent shift toward clean label and transparent formulations. Customers are placing a higher value on goods that don't include artificial chemicals, preservatives, or allergies. They also want complete transparency when it comes to the sourcing, production, and quality control procedures.

Prioritizing clean label initiatives and offering complete transparency throughout the product lifecycle can help brands stand out in an increasingly crowded market that is flooded with deceptive claims and greenwashing techniques. It can also help brands gain consumer trust and enhance brand credibility.

Personalization and Customization Trends Gain Traction in the Market

Personalized marine collagen products are becoming increasingly popular as customers look for solutions that are specifically designed to meet their unique demands in terms of wellbeing and health.

Companies are using technological advancements like artificial intelligence and DNA testing to provide tailored formulas and suggestions based on the needs, interests, and genetic profiles of each customer.

This trend encourages brand support and loyalty in the highly competitive market environment by driving customer pleasure and product efficacy in addition to improving consumer engagement.

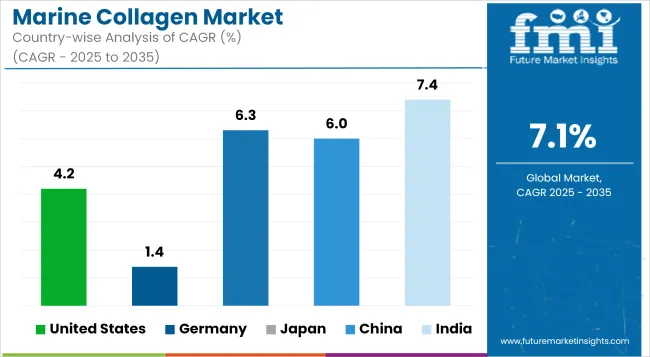

| Countries | Value-based CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Germany | 1.4% |

| Japan | 6.3% |

| China | 6.0% |

| India | 7.4% |

The demand for marine collagen in the United States is projected to surge at a 4.2% CAGR through 2035. As a result, plant-based collagen substitutes made from fungus or algae present a great opportunity for marine collagen producers to meet the rising demand for vegan-friendly goods and plant-based diets.

For consumers looking for cruelty-free and eco-friendly collagen products, these vegan alternatives provide a morally and environmentally sound choice. Marine collagen companies can boost customer diversity, capitalize on changing dietary habits in the United States, and diversify their product offerings by entering the growing plant-based sector.

The sales of marine collagen in Germany will amplify at a 1.4% CAGR through 2035. Natural and organic items are preferred by German customers who value natural components over artificial ones. Germany's marine collagen industry is growing due to consumer demand for clean-label collagen products derived from premium, organic sources.

German consumers looking for high-end marine collagen goods are drawn to companies that promote organic certification, transparency, and visibility in their sourcing and production procedures. The market is growing because of the societal inclination for natural and organic components, which carves out a niche for high-end collagen products that suit the tastes and values of consumers.

The marine collagen market growth in Japan is estimated at a 6.3% CAGR through 2035. Japan's population is aging fast, which raises concerns over age-related health problems and staying youthful. The demand for collagen supplements that target bone density, skin elasticity, and joint health is driving growth in the marine collagen industry in Japan.

Businesses can capitalize on this demographic shift and propel market penetration in Japan's lucrative aging population segment by positioning marine collagen as a scientifically validated solution for age-related health problems.

The demand for marine collagen in China is going to increase at a 6.3% CAGR through 2035. With a focus on youthful, glowing skin and a healthy lifestyle, China's beauty industry is gravitating toward Western beauty standards. China's marine collagen industry continues to flourish as more people look to collagen supplements to address problems associated with aging, maintain youthful skin, and enhance complexion.

Businesses can take advantage of this changing customer demand and propel market expansion in the Chinese beauty industry by positioning marine collagen as a crucial component in skincare and beauty products that are in line with Western beauty standards.

The sales of marine collagen in India are bound to rise at a 7.4% CAGR through 2035. Indian beauty and wellness industry is expanding quickly because of shifting tastes and lifestyle fads. Customers are looking for new and effective skincare products to cope with aging, damage caused by pollution, and uneven skin tone.

Businesses that create skincare products using marine collagen and target these new beauty trends can gain from the rising demand for high-end skincare brands. Offering marine collagen formulas that are clinically proven to provide noticeable benefits can help companies stand out and get momentum in the Indian beauty and wellness market.

Product launches, product approvals, and other organic growth techniques, such as patents and events, are being prioritized by a number of companies. Acquisitions and partnerships, as well as collaborations, were identified as two inorganic growth strategies in the market.

Market participants are growing their client base and expanding their operations. With rising global demand for marine collagen, market are expected to benefit from promising growth prospects in the future.

The marine collagen supply chain has been characterised by a clear two-tier structure. Tier 1 comprises globally integrated ingredient producers Darling Ingredients’ Rousselot, Gelita AG, and Nitta Gelatin whose internal networks handle everything from fish-by-product procurement to multi-step hydrolysis and in-house application labs.

Tier 2 is occupied by regional processors and bio-start-ups that specialise in niche formats such as recombinant or flavour-masked peptides, often relying on contract hydrolysis and third-party blending facilities.

Product innovation is being pursued as the primary competitive lever. High-purity peptide cuts, low-odour extraction, and rapid-dispersibility technologies are being prioritised so that collagen can be used in gummies, RTD beverages, and powdered sachets. Batch-level QR traceability is being rolled out, reassuring brand owners about origin, allergen status, and good-manufacturing compliance. Forward-integration into joint-care, sports-recovery, and medical-nutrition channels is expected to accelerate as clinical data packages are strengthened.

Capacity build-out has been observed across Asia and Latin America where fishery by-products are plentiful. Joint ventures with local seafood processors are locking in low-cost feedstock and helping firms bypass cold-chain bottlenecks.

Recombinant, animal-free collagen has been identified as the next disruption, with Tier 2 bio-foundries expected to supply base molecules that Tier 1 companies will refine and commercialise once cost parity is reached.

Recent Marine Collagen Industry Updates

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 918.8 million |

| Projected Market Size (2035) | USD 1,825.6 million |

| CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2023 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value; Metric tons for volume |

| Sources Analyzed (Segment 1) | Skin, Muscles, Scales, Bones & Tendons |

| Animal Types Analyzed (Segment 2) | Fish, Marine Organisms |

| Applications Analyzed (Segment 3) | Cosmetic, Healthcare, Medical, Nutraceuticals |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Ashland Inc., Darling Ingredients Inc. (including Rousselot brand), Weishardt Group, Gelita AG, Nitta Gelatin Inc., Seagarden AS, Vital Proteins LLC, Amicogen, Inc., BHN International Co. Ltd., Connoils LLC, Italgelatine S.p.A, COBIOSA, ETChem, Hangzhou Nutrition Biotechnology Co., Ltd., HUM Nutrition Inc., Titan Biotech Limited |

| Additional Attributes | Growing preference for sustainable collagen alternatives, Expansion in beauty and wellness products, Rising clinical use in regenerative medicine |

| Customization and Pricing | Customization and Pricing Available on Request |

The marine collagen market is valued at USD 918.8 million in 2025.

The marine collagen market size is estimated to increase at a 7.1% CAGR through 2035.

The marine collagen market is expected to be worth USD 1,825.6 million by 2035.

Bones and tendons are highly preferred in the market.

The Indian marine collagen market is predicted to expand at a 7.4% CAGR through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA