The marine base steering gear market will expand at a consistent rate between 2025 and 2035 due to increasing needs for improved navigation systems and updated naval vessels and expanding ocean commerce operations worldwide. Steering gear systems constitute vital components on board marine vessels which manage rudder movement while maintaining stability during different sea conditions.

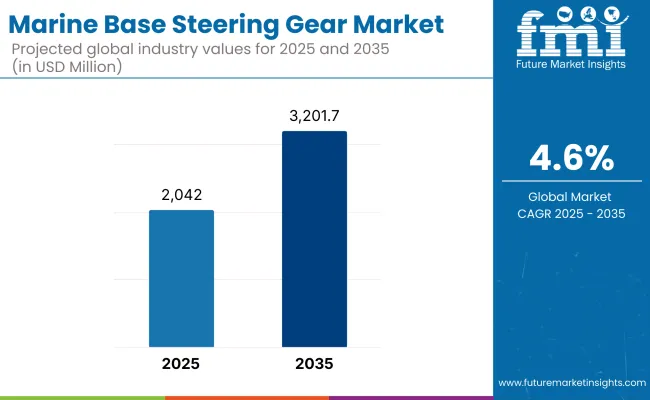

Modern commercial and military fleets adopt hydraulic systems and electro-hydraulic systems at increasing frequencies because fuel efficiency and better vessel manoeuvrability gained importance. In the projected period between 2025 and 2035 the steering gear system market is expected to grow from USD 2,042 million to USD 3,201.7 million at a compound annual growth rate of 4.6%.

The requirements for better maritime safety and increased shipbuilding business and offshore exploration activities drive growing demands for dependable steering systems. Manufacturers respond to industry challenges by creating compact yet powerful steering gear solutions despite the difficulties of expensive equipment and ship retrofitting obstacles and sophisticated maintenance needs.

The introduction of distant diagnostic tools alongside electric actuation technology has brought about better system response and decreased power consumption while enabling easier adoption in future navigation control systems. The naval modernization efforts combined with investments into upgrading port facilities will maintain industrial growth patterns.

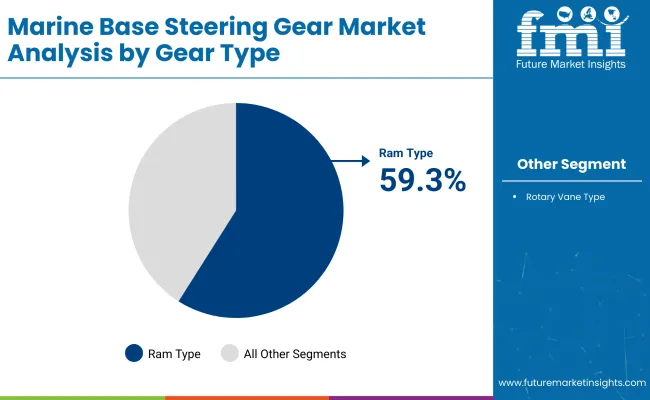

The marine base steering gear market develops through gear type and vessel type categories to determine maritime applications' operational and design priorities. Manufacturers choose between ram-type and rotary vane gear systems to deliver steering systems for their applications yet each selection depends primarily on vessel size alongside manoeuvrability requirements and hydraulics efficiency.

The power and accuracy advantage of Ram-type systems drives their selection for bigger ships but the smaller size advantages of rotary vane systems make them suitable for smaller vessels. The demand for steering gears exists between container ships and tankers and naval vessels and offshore support vessels. The different ship categories require custom-designed gear configurations that optimize responsiveness together with load-handling capabilities and system integration inside naval controls.

Growth in North America is driven by naval fleet upgrades and rising investments in offshore exploration. The focus of the USA is on compact, high-response steering systems for commercial and defense maritime applications.

Advanced shipbuilding and regulatory compliance lead Europe’s usage. Energy-efficiency solutions for steering gear in commercial vessels are being adopted by countries like Germany and Norway with naval ships also utilising integration according to type.

The major growth in the ship launch industry comes from the Asia-Pacific, where ship production has been on the rise and port size has increased considerably. For certain regions, like China, South Korea and Japan, the emphasis is on scalable steering solutions for bulk carriers, tankers and coastal surveillance vessels.

Challenge

Maintenance Complexity and Hydraulic System Dependence

The worldwide marine base steering gear market is also facing challenges with regard to complex maintenance structure and dependence on hydraulic-based systems that are susceptible to leakage, component wear and energy-inefficiency. Many older vessels operate with legacy gear systems that don't feature redundancy and smart monitoring, and could lead to mechanical failure.

For large commercial vessels, downtime through a steering problem means expensive delays and safety complications. Additionally, the malignant marine environment intensifies corrosion and material fatigue. Newer control technologies are also not easily compatible with existing hull designs, curbing retrofitting options and hindering modernization across aging global fleets.

Opportunity

Digital Steering Systems and IMO Safety Mandates

The market is set to gain considerable ground as enhancements in electro-hydraulic and fully electric steering systems, that provide superior energy efficiency, real-time diagnostics, and improved redundancy sustains momentum. With increasing International Maritime Organization (IMO) and Safety of Life at Sea (SOLAS) maritime regulations, the industry is moving toward more reliable and fault tolerant steering gear.

Fusing predictive maintenance and integration with autopilot and navigation systems, smart marine steering units are being utilized to enhance operational reliability. The steering system with compact, low power consumption, and better control accuracy is holding the future of the shipbuilding and retrofitting strategies in the direction of greener vessels and autonomous shipping.

The marketplace saw steady demand between 2020 and 2024 from commercial cargo, military and offshore service vessels. Most systems stayed hydraulic-based, but there was growing interest in compact electro-hydraulic alternatives. Retrofits were expensive and technically limited on older ships.

Between 2025 and 2035 Steering gear with integrated digital technologies; digital solutions will enable condition-based maintenance, automated operations. As shipbuilders look for lighter and more responsive equipment utilizing a minimum of fluid, fully electric systems will become more prevalent. Standards around sustainability, fuel efficiency targets for next-gen propulsion systems will also lead to smarter, integrated steering solutions.

Market Shifts: Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Factor | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with basic IMO and SOLAS steering gear standards. |

| Technological Advancements | Predominantly hydraulic systems with limited automation. |

| Sustainability Trends | Low environmental focus; high reliance on hydraulic fluids. |

| Market Competition | Dominated by maritime engineering OEMs and retrofit specialists. |

| Industry Adoption | Common in cargo, tankers, and naval vessels. |

| Consumer Preferences | Reliability and low-cost maintenance were key. |

| Market Growth Drivers | Driven by trade recovery, fleet expansion, and regulatory compliance. |

| Market Factor | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Focus on digital fail-safes, smart redundancy, and energy-efficient compliance systems. |

| Technological Advancements | Emergence of fully electric, digitally managed steering systems with diagnostics. |

| Sustainability Trends | Shift toward fluid-free electric systems with lower emissions and lifecycle efficiency. |

| Market Competition | Entry of smart marine tech firms and automation platform providers. |

| Industry Adoption | Expansion into green ships, offshore energy fleets, and autonomous shipping applications. |

| Consumer Preferences | Increased demand for integrated control, digital monitoring, and safety assurance. |

| Market Growth Drivers | Fueled by smart shipping, energy efficiency goals, and next-gen vessel automation. |

USA marine base steering gear market is flourishing powered by naval fleet modernization and commercial cargo and offshore support vessel construction increasing defense contracts and jones act compliance is driving the demand for resilient and agile steering gear systems.

Boat builders are all more soaking in electro-hydraulic and redundant steering systems for operational manoeuvrability and fault tolerance. Digital monitoring and remote diagnostics for improved operational reliability at sea are also benefiting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

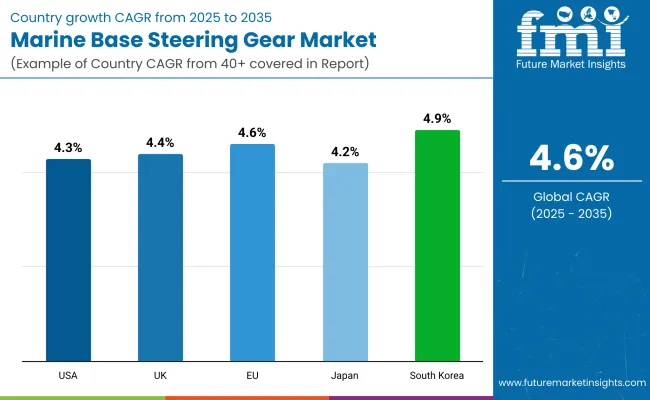

| USA | 4.3% |

The UK marine base steering gear market is supported by the country’s booming naval shipbuilding industry and investment in sustainable maritime technology. Ports and ship-owners are upgrading older ships with efficient, electronically controlled steering technology to meet carbon emission quotas and International Maritime Organization (IMO) requirements.

This has been installed by UK shipyards as more modular steering gear units, which appear more maintenance friendly and also provide improved control of the hydraulic. Royal Navy’s fleet upgrades are also driving continued demand for advanced marine manoeuvring systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

Germany, Italy, and the Netherlands are the countries in the European Union (EU) where shipbuilding activity is focused making EU the dominant region for marine base steering gear market. The sovereignty over our seas has a lot to do with the EU regulations which are promoting marine safety and decarbonization and these regulations also see their way into the energy saving steering gear solutions being adopted on various cargo ships, ferries and cruise vessels.

Country manufacturers are developing electro-mechanical system for low maintenance and responsive steering under dynamic marine operating condition. These systems play a critical role in matching vessel performance to the region’s wider environmental goals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.6% |

There is a well-developed marine base steering gear market in Japan, supported by the robust commercial shipbuilding sector, as well as a vibrant export-oriented maritime economy. Japanese shipyards always prefer the flush mount steering gear assembly to maximize the ship layout efficiency and better steering compliance.

The demand for automated and remote-controlled steering solutions, notably for LNG carriers and bulk vessels, continues to influence product evolution in the country. They also focus on compliance with new Class rules and higher fatigue life performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

South Korea accounts for a significant share of global shipbuilding and among construction of tankers, container ships, and offshore vessels, which in turn, is making South Korea a hotbed for marine base steering gear manufacturers. Top Korean shipbuilders plan the adoption of electronic-ready high-torque steering gear to accommodate high-speed manoeuvring and automated navigation.

Some Local manufacturers are using smart control platforms and predictive maintenance software to improve steering system reliability. The country’s green shipping strategic investments also promote demand for low-energy steering technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The global marine base steering gear market is marked with presence of global and regional players. Steering gears are essential for controlling rudder movement and allowing vessels to manoeuvre in diverse marine environments. By gear type, the ram type steering gears dominate the market owing to their mechanical ruggedness and powerful balanced rudder control in severe sea conditions.

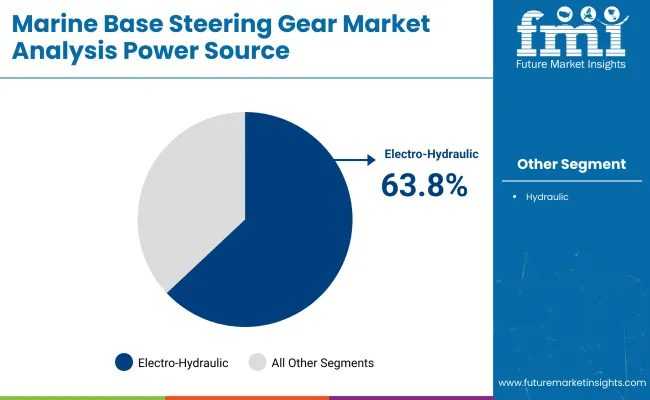

Power wise, electro-hydraulic systems have become the prominent solution as they allow better optimization with regards to energy consumption, automation integration, and more dynamic operation. The types of the segments, all together, define the course to the smart, reliable, high performance marine steering systems.

With increasing maritime regulation and the need for reliable operating for commercial and defense fleets, the adoption of these kinds of steering gear configurations is fast-tracked. Power systems with ram type gear and electro-hydraulic systems have several advantages to ship operators, such as improved operational safety, improved fuel economy and compatibility with existing bridge automation systems, making them the preferred choice for task-oriented designs, both new and in retrofitting projects.

In the gear type segment, ram type steering gears dominate, providing highly reliable and balanced assignment of forces in medium to large vessels that operate with variable loads. Hydraulic systems utilizing double-acting rams hooked up to tillers or crossheads are used to provide controlled rudder movement.

It features a symmetrical design responsible for uniformly distributing pressure on both of the rudder sides, which translates to improved steering stability and lowered hydraulic components wear. Most ship builders opt for ram type gear owing to its durability, precision and adaptability to single and twin rudder systems.

The ram type system maintains the rudder in the correct position so as to enable optimal performance in extreme pressure and direction shift, crucial for vessels working in adverse and unpredictable maritime environments such as oil tankers, bulk carriers, and naval ships among others.

These gears are easy to maintain and have good resistance to mechanical shock and vibration. The high torque capacity of ram type steering gears and their proven performance in commercial and defense marine fleets will ensure that ram type steering gears will maintain their dominance for steering applications across global shipbuilding markets.

Based on the type of power source, the marine base steering gear market is dominated by electro-hydraulic systems, which blend the reliability of hydraulic systems with the operational precision of electric systems. These systems use electrically powered pumps to pressurize hydraulic circuits which allow quicker and smoother rudder movements with lower energy consumption.

Real-time feedback and improved accuracy of control, critical in contemporary bridge systems and computer-integrated ship steering, can be incorporated into ship steering systems to allow operators to benefit more. Compared to traditional hydraulic only systems, electro-hydraulic systems also reduce noise and mechanical losses, enhancing on board comfort and operational efficiency.

Shipbuilders incorporates electro-hydraulic steering systems on both commercial and naval vessels to complement intelligent navigation and autopilot systems. These units offer easier diagnostics, configurable control, and enhanced fail-safe features perfect for next generation marine architecture.

Driven by an increasing focus on digital transformation and energy optimisation of marine propulsion and control, electro-hydraulic steering gears will continue to drive forward innovation to remain a key enabler of vessel compliance and improved performance.

All types of vessels from commercial cargo ships and tankers to naval fleets and offshore vessels rely on the global marine base steering gear market as it plays an essential role of controlled directional movement of the ship. In high-load maritime environments, steering gear systems are critical for ensuring navigation precision.

Typical systems involve hydraulic, electro-hydraulic and rotary vane systems, with growing optimisation for automation, redundancy, and compact designs. The critical factors driving market growth include increasing seaborne trade, stringent maritime safety policies, and modernization of the aging naval fleet.

Competition has been fueled by innovation in compact, high-torque steering gear, integrated control systems and serviceability in extreme marine environments. It is an industry of global manufacturers and specialist marine engineering companies, producing bespoke systems that will meet the various requirements of IMO and classification society.

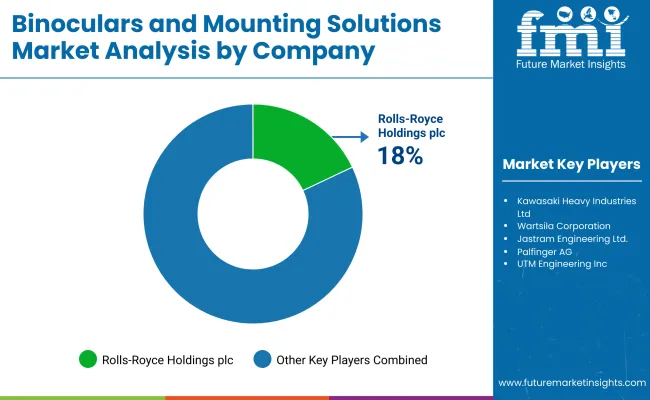

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Rolls-Royce Holdings plc | 18-22% |

| Kawasaki Heavy Industries Ltd. | 14-18% |

| Wartsila Corporation | 12-16% |

| Jastram Engineering Ltd. | 9-13% |

| Palfinger AG | 7-11% |

| Data Hidrolik Makina Endüstri A.S. | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Rolls-Royce Holdings plc | Introduced integrated electro-hydraulic steering systems with redundancy for naval ships in 2025. |

| Kawasaki Heavy Industries | Released high-torque hydraulic steering gear systems for LNG carriers in 2024. |

| Wartsila Corporation | Launched compact rotary vane steering gear units with digital monitoring in 2025. |

| Jastram Engineering Ltd. | Developed modular electro-hydraulic systems for offshore vessels and tugboats in 2025. |

| Palfinger AG | Rolled out servo-assisted steering gear optimized for small to mid-size commercial vessels in 2024. |

| Data Hidrolik Makina | Expanded production of rudder actuator systems for coastal cargo fleets in 2025. |

Key Company Insights

Rolls-Royce Holdings plc

Rolls-Royce remains a top-tier supplier in the naval and defense segment, offering precision-engineered steering gear systems with built-in fault tolerance, control automation, and naval-grade certification, particularly suited for mission-critical operations.

Kawasaki Heavy Industries Ltd.

Kawasaki delivers robust hydraulic steering solutions tailored for bulk carriers and LNG ships. Its systems are designed for continuous high-load performance, ensuring responsiveness and safety under dynamic marine conditions.

Wartsila Corporation

Wartsila's rotary vane steering gears are known for space-saving architecture and high reliability. The company integrates advanced digital diagnostics and control modules, enabling proactive maintenance and remote vessel operations.

Jastram Engineering Ltd.

Jastram specializes in configurable steering gear systems for offshore support vessels and harbour tugs. Its focus on customization, quick installation, and precise manoeuvrability enhances its appeal to smaller shipbuilders and operators.

Palfinger AG

Palfinger brings versatility to the market with compact, cost-effective steering systems for mid-range marine applications. Its servo-assisted designs offer reduced energy consumption and simplified installation across vessel classes.

Data HidrolikMakina

Data Hidrolik supplies efficient rudder actuator systems primarily to regional cargo fleets. The company emphasizes simplicity, corrosion resistance, and compliance with SOLAS and classification body standards for coastal and riverine vessels.

Other Key Players (20-30% Combined)

Numerous regional and specialized suppliers contribute to the marine base steering gear market by offering vessel-specific systems and retrofit solutions:

The overall market size for the marine base steering gear market was USD 2,042 million in 2025.

The marine base steering gear market is expected to reach USD 3,201.7 million in 2035.

The increasing demand for advanced marine navigation systems, rising focus on safety and manoeuvrability in vessel operations, and growing use of ram type gears and electro-hydraulic systems fuel the marine base steering gear market during the forecast period.

The top 5 countries driving the development of the marine base steering gear market are the USA, UK, European Union, Japan, and South Korea.

Ram type gears and electro-hydraulic systems lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA