The marine nutraceutical market is experiencing strong growth due to increasing consumer awareness of the health benefits associated with marine-derived compounds. Demand is being driven by the growing preference for natural and functional ingredients that support cardiovascular health, cognitive function, and overall wellness. Current market dynamics reflect an expansion of the dietary supplement sector and a rising inclination toward preventive healthcare.

Manufacturers are investing in sustainable sourcing practices, advanced extraction technologies, and formulation innovation to improve purity and bioavailability. Regulatory emphasis on quality and safety standards is further enhancing consumer trust and market acceptance.

The future outlook is positive as product diversification, technological advancements, and expansion into emerging markets continue to boost global demand Growth rationale is anchored on evolving dietary patterns, increased consumer spending on premium nutraceutical products, and the ability of marine ingredients to deliver proven physiological benefits, positioning the market for sustained long-term development.

| Metric | Value |

|---|---|

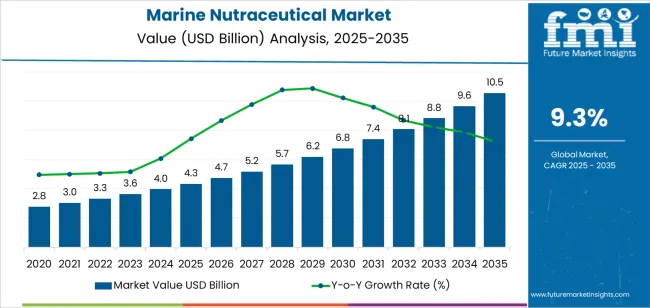

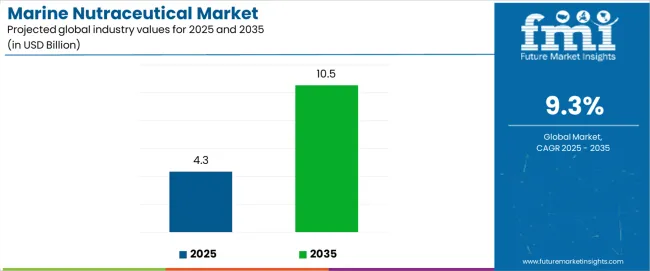

| Marine Nutraceutical Market Estimated Value in (2025 E) | USD 4.3 billion |

| Marine Nutraceutical Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

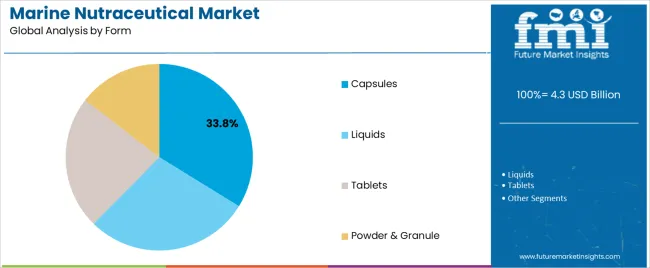

The market is segmented by Active Compounds, Product Type, Form, and Sales Channel and region. By Active Compounds, the market is divided into Fatty Acids, Vitamins, Minerals, Carotenoids, and Marine Collagen. In terms of Product Type, the market is classified into Dietary Supplement, Functional Foods, Probiotics Fortified Foods, Omega fatty Acid Fortified Foods, Functional Beverages, Energy Drinks, Health Drinks, Fortified Juices, Protein Supplements, Vitamins And Minerals, Herbal Supplements, and Other Dietary Supplements. Based on Form, the market is segmented into Capsules, Liquids, Tablets, and Powder & Granule. By Sales Channel, the market is divided into Indirect Sales/B2C, On Direct Sales/B2B, Pharmacies/Drugstores, Modern Trade Channel, and Online Retailing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

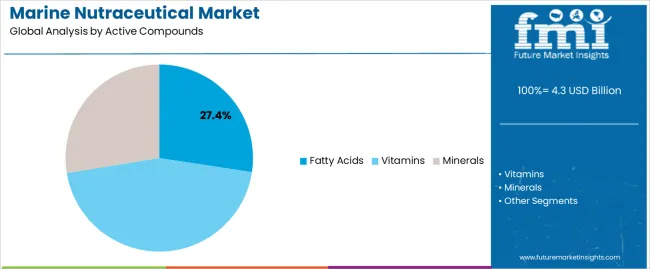

The fatty acids segment, accounting for 27.40% of the active compounds category, has been leading the market due to its established role in promoting cardiovascular, neurological, and metabolic health. Omega-3 and other marine-derived fatty acids have gained consistent demand owing to their clinically validated benefits and strong consumer recognition.

Production improvements and purification technologies have enhanced concentration levels and absorption efficiency, strengthening the segment’s competitive position. Regulatory approvals and favorable labeling standards have supported market penetration across multiple regions.

Increasing research activities and new product launches incorporating fatty acids into functional foods and supplements are expected to sustain segment growth The combination of scientific validation and consumer familiarity ensures the segment’s continued dominance within the marine nutraceutical landscape.

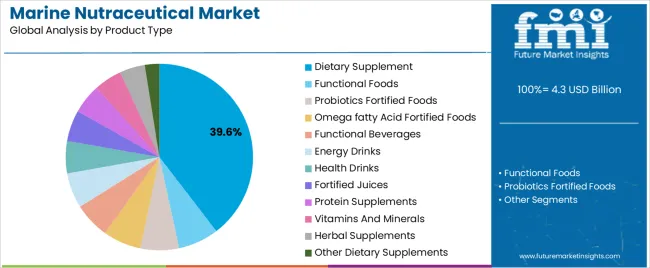

The dietary supplement segment, representing 39.60% of the product type category, has maintained leadership due to rising global adoption of preventive health practices and increasing availability of marine-based formulations. Product innovation, including blends with vitamins, minerals, and botanical extracts, has expanded consumer appeal.

The segment’s growth is supported by the shift toward self-care and the increasing use of e-commerce platforms for supplement distribution. Enhanced product stability and improved taste-masking techniques have further strengthened acceptance.

Manufacturers are prioritizing clean-label claims and sustainable sourcing to meet consumer expectations for transparency and environmental responsibility Continued R&D investment and growing awareness of marine-derived health benefits are expected to reinforce the dietary supplement segment’s leading position over the forecast period.

The capsules segment, holding 33.80% of the form category, has emerged as the dominant delivery format due to its convenience, accurate dosage, and extended shelf life. Capsules provide superior protection for sensitive marine compounds such as omega oils, ensuring stability and efficacy throughout the product’s lifecycle.

Their popularity has been supported by consumer preference for easy-to-consume, portable formats with minimal aftertaste. Advances in encapsulation technologies, including soft-gel and enteric-coated variants, have improved absorption and consumer compliance.

The pharmaceutical-grade presentation of capsules has enhanced trust among health-conscious users and healthcare professionals With sustained demand for high-quality marine nutraceuticals and innovations in capsule formulation, this segment is expected to retain its leadership and contribute significantly to the overall market expansion.

According to the latest analysis, global marine nutraceuticals sales grew at a CAGR of 8.8% from 2020 to 2025. For the next ten years, the worldwide marine nutraceutical industry is forecast to progress at 9.3% CAGR.

In this section, the marine nutraceutical market is compared to the global nutraceutical industry and the marine active ingredient market based on growth factors and key trends. This will help businesses to get a better understanding of the market scenario.

The global marine nutraceutical industry is set to grow at a higher CAGR during the forecast period. Factors like rising awareness of the potential benefits of marine-based nutraceuticals and rising interest in preventive healthcare will likely drive this growth.

Global Marine Nutraceutical Market Analysis:

| Attributes | Global Marine Nutraceutical Market Forecast |

|---|---|

| CAGR (2025 to 2035) | 9.3% |

| Growth Factor | Increasing marine nutraceutical applications in functional foods and dietary supplements is expected to foster growth of sea-based nutraceutical industry. |

| Global Trends in Marine Nutraceutical Market | Rising interest in preventive healthcare and growing demand for fish oil nutraceuticals are key growth-shaping trends. |

Global Nutraceutical Market Analysis:

| Attributes | Global Nutraceutical Industry Outlook |

|---|---|

| CAGR (2025 to 2035) | 5.3% |

| Growth Factor | Growing health consciousness and rising demand for nutraceuticals for specific health issues are expected to foster market growth. |

| Global Nutraceutical Market Trend | Increasing demand for organic and natural ingredients and shift towards healthier and more sustainable food options will likely fuel sales. |

Global Marine Active Ingredient Market Analysis:

| Attributes | Marine Active Ingredient Demand Outlook |

|---|---|

| CAGR (2025 to 2035) | 6.4% |

| Growth Factor | Escalating demand for natural and sustainable ingredients is set to fuel sales of marine active ingredients. |

| Marine Active Ingredient Market Trends | Key growth-shaping trends include rising popularity of collagen in anti-aging and skin rejuvenation treatments and development of new marine chemicals. |

The table below highlights key countries’ marine nutraceutical market revenues. The United States, China, and Japan are expected to remain the top three consumers of marine nutraceuticals, with estimated valuations of USD 2,545.1 million, USD 895.0 million, and USD 389.3 million, respectively, in 2035.

| Countries | Projected Marine Nutraceutical Market Revenue (2035) |

|---|---|

| United States | USD 2,545.1 million |

| United Kingdom | USD 373.8 million |

| China | USD 895.0 million |

| India | USD 315.4 million |

| Japan | USD 389.3 million |

The below table shows the predicted growth rates of the top nations. India, Japan, and China are anticipated to record higher CAGRs of 7.5%, 7.2%, and 6.3%, respectively, through 2035.

| Countries | Projected Marine Nutraceutical Market CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

| United Kingdom | 5.8% |

| China | 6.3% |

| India | 7.5% |

| Japan | 7.2% |

As per the latest analysis, China marine nutraceutical market is expected to reach a valuation of around USD 895.0 million by 2035. Overall demand for marine nutraceuticals in China will likely increase at 6.3% CAGR during the next ten years, driven by factors like:

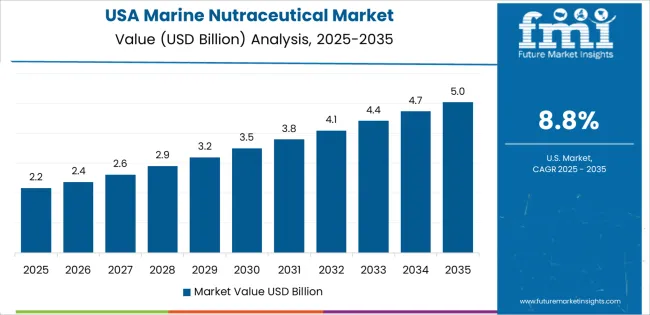

The United States marine nutraceutical industry is set to exhibit a CAGR of 5.3% during the assessment period. By 2035, the United States market size is expected to reach USD 2,545.1 million. Some of the key drivers/trends include:

Marine nutraceutical demand in India is anticipated to rise at a rapid CAGR of 7.5% during the forecast period. Accordingly, the marine nutraceutical market in India is expected to be valued at USD 3,15.4 million by 2035. This can be attributed to factors like:

India has a long history of traditional medicine systems like Ayurveda, which uses organic materials and herbs for medicinal reasons. This huge knowledge base is being leveraged to explore potential of marine-derived ingredients in Ayurvedic formulations and dietary supplements.

The rise of e-commerce platforms and online retail play a key role in the accessibility and availability of marine collagen, omega 3, vitamins, and calcium dietary supplements in India. This, in turn, will likely improve India’s marine nutraceutical market share through 2035.

Key marine nutraceutical manufacturers in India are trying to market their products to reach every potential customer. Hence, strong growth has been predicted for India's marine-derived nutraceutical industry over the next ten years.

The below section shows the fatty acids category dominating the marine nutraceutical industry. It is projected to grow at 5.3% CAGR through 2035. Based on product type, the functional foods segment will likely progress at a CAGR of 7.6% during the assessment period.

| Top Segment (Active Compounds) | Fatty Acids |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.3% |

Based on active compounds, demand is expected to remain high for marine-based fatty acids during the assessment period. As per the latest analysis, the fatty acids segment is projected to grow at 5.3% CAGR, totaling a valuation of USD 4,150.0 million in 2035.

| Top Segment (Product Type) | Functional Foods |

|---|---|

| Predicted CAGR (2025 to 2035) | 7.6% |

As per the latest analysis, the functional food segment is expected to register a CAGR of 7.6% during the assessment period. It will likely generate revenue worth USD 3,23.8 million by 2035.

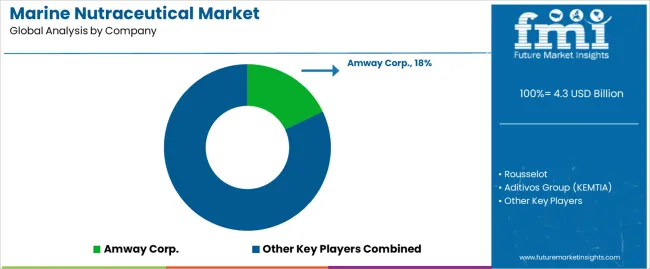

Leading manufacturers of marine nutraceuticals are constantly launching a new range of marine nutraceutical products to meet growing consumer demand. Ongoing advancements in marine biotechnology are enabling them to discover new marine bioactive compounds and extractive techniques.

Several marine nutraceutical companies are shifting toward sustainable sourcing practices to reduce environmental impacts. They are also using strategies such as partnerships, distribution agreements, mergers, advertisements, acquisitions, collaborations, and celebrity endorsements to stay ahead of the competition.

Recent Developments in the Marine Nutraceutical Market

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 4.3 billion |

| Market Forecast Value in 2035 | USD 10.5 billion |

| Anticipated Growth Rate (2025 to 2035) | 9.3% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Volume (MT) and Value (USD Million) |

| Key Regions Covered | Latin America; North America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | Canada, United States, Mexico, Brazil, Chile, Peru, Argentina, Germany, France, Italy, Spain, United Kingdom, Netherlands, Belgium, Nordic, Russia, Poland, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Central Africa, and others |

| Key Market Segments Covered | Active Compounds, Product Type, Form, Sales Channel, and Region |

| Key Companies Profiled |

Rousselot; Aditivos Group (KEMTIA); GFR Pharma; Amway Corp.; General Mills Inc; Standard Functional Foods Group Inc.; Abbott Laboratories; Roquette Kloetze; AlgaNovo International Co., Ltd; Yigeda Bio-Technology Co., Ltd; EID Parry; BASF; Natural Beta Technologies; Cyanotech; Mera Pharma; BioReal |

The global marine nutraceutical market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the marine nutraceutical market is projected to reach USD 10.5 billion by 2035.

The marine nutraceutical market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in marine nutraceutical market are fatty acids, _omega 3, _omega 6, _amino acid, _arginine, _histidine, _isoleucine, _methionine, _others (threonine, phenylalanine, valine, tyrosine, etc), vitamins, _vitamin a, _vitamin d, _vitamin b complex, minerals, _iron, _zinc, _calcium, _iodine, carotenoids and marine collagen.

In terms of product type, dietary supplement segment to command 39.6% share in the marine nutraceutical market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA