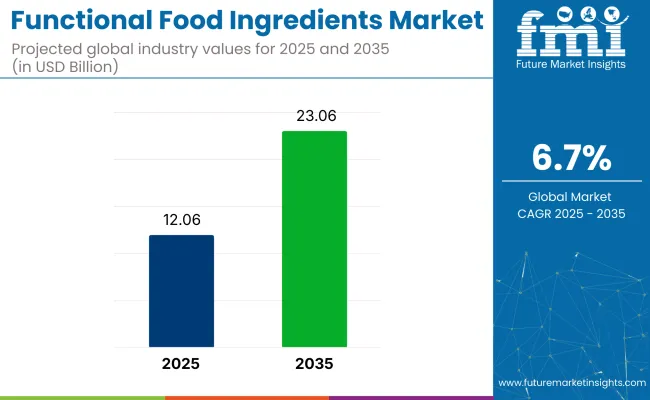

The functional food ingredients market is projected to grow from USD 12.06 billion in 2025 to USD 23.06 billion by 2035, implying a 6.7% CAGR during the forecast period.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 12.06 billion |

| Industry Value (2035) | USD 23.06 billion |

| CAGR (2025 to 2035) | 6.7% |

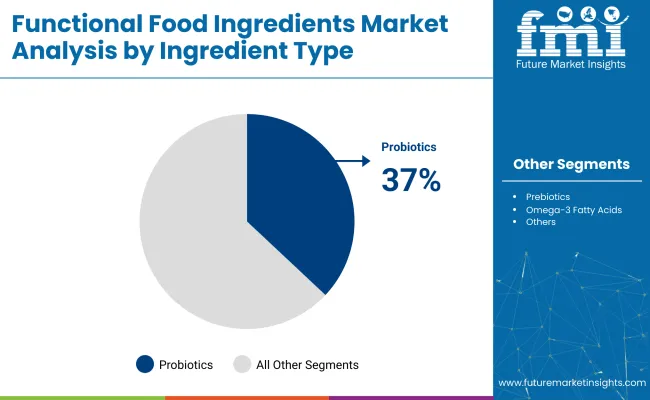

Market progression has been reinforced by nutrition-forward reformulations that combine natural antioxidants, micronutrient fortifiers, and gut-health modifiers within finished foods. Probiotics are forecast to dominate, contributing 36.7% of share in 2025, because of documented benefits in digestive balance and immune modulation. Natural sources dominate input streams as formulators pivot toward botanical extracts, algal concentrates, and bio-fermented cultures that fit clean-label parameters.

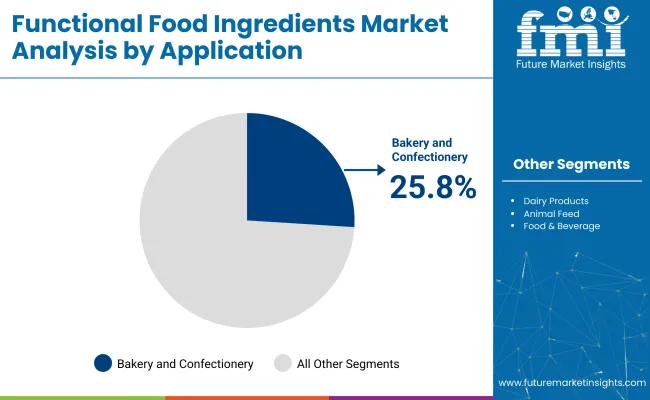

Bakery and confectionery applications account for 25.8% of volume in the functional ingredients segment, primarily through the use of fiber-rich prebiotic blends that improve crumb texture and extend shelf life. In parallel, dairy alternatives and infant-nutrition categories are integrating lipid-soluble vitamins, plant-protein concentrates, and long-chain omega fatty acids to meet targeted nutritional profiles while avoiding common allergens.

Scaled manufacturing is supported by precision-controlled fermentation processes used to develop probiotics, alongside enzymatic platforms that enhance the absorption of plant-derived minerals. Technologies like spray-drying and micro encapsulation protect heat-sensitive compounds such as vitamins and polyphenols, making them easier to include in meal-replacement powders, fortified bakery items, and beverage systems.

Ongoing research keeps this category dynamic. A recent arXiv study introduced hierarchical plant-protein microcapsules capable of carrying both hydrophobic and hydrophilic nutraceuticals-broadening delivery options in beverage and supplement formats.

In terms of market overlap, functional ingredients account for 15-20% of the food ingredients market, 10-15% in food processing ingredients, 25-30% in the functional foods segment, 20-25% in health and wellness foods, and 5-10% in the plant-based food category. These shares reflect how health-oriented formulations are becoming integral across multiple product categories.

Growth in 2025 centres on probiotic cultures, bakery-and-confectionery fortification, and natural-source inputs. Each focus area aligns with clinically validated health benefits, processing compatibility, and clean-label preferences, guiding contract manufacturing, formulation R&D, and branded-product launches across North American and European retail channels.

Probiotics are projected to account for 36.7% of the functional ingredient market in 2025, supported by growing evidence for strain-specific benefits and better stability across diverse formats. Manufacturers are using encapsulated spores to maintain viability through heat-based processing methods like extrusion and pasteurization.

Strains with registered clinical data are being used to support health claims under FDA-compliant pathways. Cold-chain infrastructure is being upgraded to support live-culture beverages in co-packed formats, while synbiotic combinations with inulin help premium SKUs command higher price points. Shelf-stable probiotic tablets sold online are expanding category access beyond refrigerated channels.

Bakery and confectionery hold a 25.8% market share in 2025 due to successful use of heat-tolerant functional systems. Probiotic strains now survive par-baking and ambient storage, while seed flours rich in omega fatty acids are improving nutritional value without affecting dough performance.

Formulators are blending is omaltulose with cocoa to lower glycemic impact in confections, and soluble-fiber syrups are improving moisture retention in sugar-reduced muffins. Allergen-free formats are supported by new depositor systems enabling protein bars made with fava concentrates in segregated lines.

Natural ingredients are expected to hold 60% of the market in 2025 as clean-label priorities continue to shape buying behavior. Botanical extracts and fermented concentrates are now replacing synthetic inputs across categories.

Turmeric oleores in standardized at 95% curcuminoids meets potency requirements for anti-inflammatory claims, while acerola juice replaces synthetic ascorbic acid in fruit-based snacks. Pea peptides produced through membrane ultrafiltration offer consistent profiles for protein shakes. Blockchain-linked sourcing is enabling QR-based origin verification, and high-pressure homogenization preserves taste and color in natural drinks without relying on artificial stabilizers.

Demand for nutrient-dense convenience food accelerates functional ingredient integration across manufacturing sectors. Cross-category processors seek solutions for cleaner labels and health claims, pushing enzyme, prebiotic, and lipid suppliers to tailor ingredient systems for exacting application environments.

Multipurpose Fortification Demands Catalyse Broad Ingredient Adoption

Adoption of functional proteins, resistant starches, and micro encapsulated omega-3 concentrates is being promoted across food and beverage processing lines to meet claim thresholds for fibre, immune support, and brain health. Retort-stable prebiotic inulin blends permit label-friendly viscosity in functional beverages, while heat-treated chickpea flour enriches dairy alternatives without emulsifier reliance.

Bakery enrichment projects now specify mineral-chelated iron systems that withstand proofing and oven stress. Infant nutrition products incorporate high-purity MCT oils combined with lactose-free carbohydrate matrices to support weight-gain protocols.

Personalised Platforms Unlock Niche Functional Ingredient Pipelines

Direct-to-consumer personal nutrition brands are partnering with contract dietary supplement manufacturers to deliver capsule and sachet formats personalised through digital biomarker feedback. Wellness product formulators now utilise liposomal curcumin and fermented mushroom beta-glucans, offering measurable bio availability surges documented through wearables.

Clinical nutrition sector contracts reward suppliers who provide patient-coded lot traceability for fat-soluble vitamin microbeads blended into enteral feeds. Investors are funding vertically integrated pilot plants producing targeted postbiotic concentrates for subscription refills.

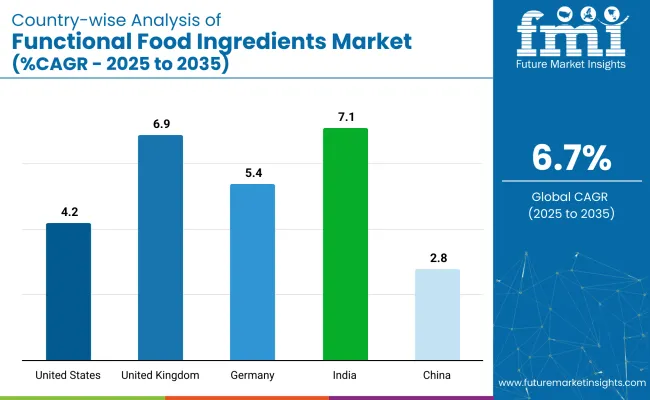

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2 % |

| United Kingdom | 6.9 % |

| Germany | 5.4 % |

| India | 7.1 % |

| China | 2.8 % |

The industry is forecasted to grow at a CAGR of 6.7%. India’s momentum is driven by millet fortification, chickpea proteins, and ayurvedic extracts entering packaged snacks. China lags at 2.8 % amid cautious retail spending and slow approvals for imported probiotics.

OECD peers-the United Kingdom (6.9 %), Germany (5.4 %), and the United States (4.2 %)-operate at a 0.63-1.03x clip against the 6.7 % global mean. The United Kingdom benefits from fibre-enrichment targets in bakery chains; Germany advances via gut-health cultures for sports nutrition; the United States sees plateauing pea-protein demand in meal-replacement beverages. As the category adds over USD 5 billion by 2035, high-growth and high-value regions will shape its trajectory.

Functional food ingredient demand in the United States is growing with a 4.2% CAGR. It is being led by heightened interest in digestive wellness, muscle repair, and label transparency. Brands are modifying traditional recipes by incorporating plant-based isolates, fermented amino blends, and gut-supportive cultures.

Regulatory alignment has encouraged fiber and omega fortification across meal kits and convenience snacks. Mass retailers are segmenting shelves by functional claims, while sports-nutrition brands continue to diversify into general wellness. Domestic sourcing of ingredients has been prioritized to reinforce supply continuity and local identity. The market is projected to grow at a CAGR of 4.2% from 2025 to 2035.

In the United Kingdom, the projected 6.9% CAGR through 2035 reflects a combination of reformulation mandates and retailer pressure to improve product nutrition profiles. High-fat and high-sugar food categories are being redesigned with resistant starches, bioactive fibers, and advanced sweetener alternatives.

Functional waters and nootropic drinks have gained listings in convenience outlets. Locally sourced ingredients are increasingly prioritized to maintain transparency amid import instability. Regulatory nudges, advertising limits, and digital grocery platform adjustments have reinforced the shift toward nutrient-rich packaged options.

Germany’s functional food ingredient growth at 5.4% CAGR is rooted in clinical validation and structured retail channels. Pharmacies and health shops stock collagen, omega-3s, and flavonoid-rich products, blending pharmaceutical credibility with food convenience.

Regional suppliers have ramped up fermented actives, while bakery and dairy categories have embraced traceable vitamin fortification. Product development across cities such as Cologne and Munich continues to favor clean-label and nutrient-dense profiles. Packaged wellness food has been positioned as both a health intervention and a premium indulgence.

India’s functional food ingredients market is projected to rise at 7.1% CAGR, reflecting deep integration of botanicals into modern packaged formats. Herbal extracts like moringa, tulsi, and ashwagandha are being infused into snacks, beverages, and gummies aimed at daily wellness.

Domestic protein concentrate production has gained momentum, reducing the cost burden for clean-label manufacturers. Functional ingredient claims have been supported by evolving nutraceutical rules that favor clinically backed formulations. Social influencers and wellness-centric retail sections are expanding consumer access across metros and Tier-II cities.

China’s 2.8% CAGR of functional food ingredients reflects a complex regulatory landscape and slow approval cycles for health-positioned products. Fortified foods must comply with stringent certification rules, prompting many companies to explore online cross-border strategies.

Domestic brands in the dairy and traditional Chinese medicine space are using functional fungi, peptides, and probiotics to align with established consumer trust systems. Government-backed campaigns are promoting micronutrient enrichment in daily staples, while ingredient innovation remains concentrated in higher-tier cities.

The industry is competitive, with top players like Kerry Group, Cargill, Archer Daniels Midland (ADM), and DuPont Nutrition & Biosciences driving innovation through extensive R&D and product diversification. These companies focus on expanding their functional ingredient offerings, targeting health-conscious consumers and enhancing their presence across food, beverage, and dietary supplement sectors.

Ingredion and Tate & Lyle pursue growth by developing tailor-made solutions for specific applications like probiotics and fibers. BASF SE, Royal DSM, and Glanbiahave strategic partnerships, acquisitions, and expanding production capacity. The industryis fragmented, with large players holding good shares while numerous smaller companies innovate in niche regions, intensifying competition.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 12.06 billion |

| Projected Market Value (2035) | USD 23.06 billion |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Ingredient Type | Probiotics, Prebiotics, Proteins & Amino Acids, Phytochemicals & Plant Extracts, Omega-3 Fatty Acids, Carotenoids, Fibers & Specialty Carbohydrates |

| Source | Natural, Synthetic |

| Application | Food & Beverage, Dairy Products, Bakery & Confectionery, Animal Feed |

| Regions | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Kerry Group, Cargill, Incorporated, Archer Daniels Midland (ADM), DuPont Nutrition & Biosciences, Ingredion Incorporated, Tate & Lyle PLC, BASF SE, Royal DSM, Arla Foods Ingredients, Chr. Hansen Holding A/S, Glanbia plc, FrieslandCampina, Roquette Frères, Naturex (acquired by Givaudan), Kemin Industries, Inc., Bioriginal Food & Science Corp., Sabinsa Corporation, Nutraceutical International Corporation, AIDP, Inc., Brenntag Group, Others |

| Additional Attributes | Dollar sales, CAGR trends, ingredient type distribution, size preferences, price range segmentation, competitor dollar sales & market share, regional growth patterns |

Probiotics, prebiotics, proteins and amino acids, phytochemicals and plant extracts, omega-3 fatty acids, carotenoids, fibers and specialty carbohydrates.

Natural, synthetic.

Food and beverage, dairy products, bakery and confectionery, animal feed.

North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa.

The projected valuation of functional food ingredients in 2025 is USD 12.06 billion.

The forecast valuation for functional food ingredients by 2035 is USD 23.06 billion.

The functional food ingredients market is projected to grow at a CAGR of 6.7% from 2025 to 2035.

Probiotics are expected to lead the functional food ingredients market in 2035, contributing around 37% of the share.

India is expected to experience the highest growth, with a 7.1% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bulk Food Ingredients Market Growth – Industry Insights & Trends 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food & Beverage Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Multifunctional Food Ingredient Business

Textural Food Ingredients Market Analysis – Size, Share & Forecast 2023-2027

Specialty Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA