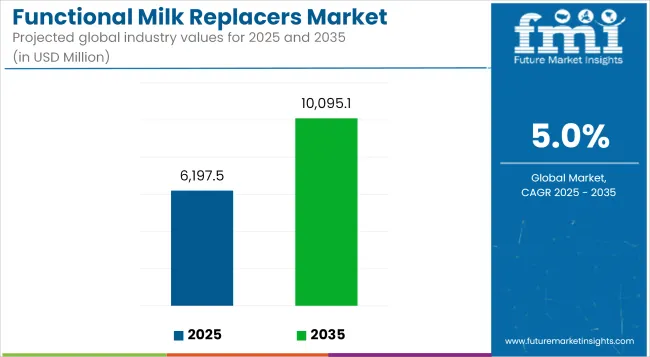

Surging demand is expected to elevate the global functional milk replacers market from USD 6,197.54 million in 2025 to approximately USD 10,095.14 million by 2035, translating to a CAGR of 5.0% over the decade.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6,197.54 Million |

| Market Size in 2035 | USD 10,095.14 Million |

| CAGR (2025 to 2035) | 5.0% |

The rising emphasis on animal nutrition and health resilience has strengthened the demand for milk replacers that go beyond basic nourishment. These products are being adopted not only for economic benefits but also for the functional advantage of boosting immunity, improving gut health, and reducing mortality in neonatal livestock.

Market dynamics are actively shifting due to growing awareness of the long-term economic and productivity gains associated with early-life nutritional optimization in farm animals. Growth is also being influenced by the increased global livestock population, which continues to stress conventional dairy sources. In parallel, sustainability pressures and feed cost volatility are accelerating the adoption of plant-based or alternative milk replacers.

However, fluctuating raw material prices and regulatory scrutiny over formulation quality are acting as mild growth restraints. Several market participants are investing in enhanced functional blends, targeting precision nutrition and better solubility to capture share in emerging regions. Tailored product lines and nutrient-enriched formulations for different livestock categories are becoming commonplace, as competition intensifies.

By 2035, a wider transition toward non-dairy formulations and digital livestock monitoring systems is expected to shape product development priorities. As antimicrobial resistance becomes a growing concern in the animal farming sector, bioactive-enriched milk replacers with gut-stabilizing benefits are likely to gain prominence.

Functional claims around immunity, growth rate, and nutrient utilization will continue to drive premiumization in this category. While Asia-Pacific and Latin America offer expansion potential due to growing dairy and meat sectors, Europe and North America will see demand driven by innovation and welfare-centric rearing models.

Medicated functional milk replacers are projected to account for approximately 12.7% of the global market share by 2025. Their strategic importance is rising as livestock producers seek alternatives to in-feed antibiotics and respond to stricter drug residue regulations.

These replacers are increasingly formulated with bioactive components, including prebiotics, phytogenics, and selected probiotics, to deliver targeted immune modulation and gastrointestinal stability. Regulatory pressure from bodies such as the European Medicines Agency (EMA) and the USA FDA on antimicrobial use in feed has pushed industry players toward antibiotic-free livestock solutions.

Companies such as Nukamel and Trouw Nutrition have invested in milk replacer lines that integrate functional ingredients addressing neonatal diseases like diarrhea, respiratory distress, and gut inflammation. In particular, phytogenic additives and encapsulated acidifiers are being incorporated to promote microbial balance and reduce pathogenic load.

The trend is more prominent in high-density farming systems, especially in parts of Europe and Southeast Asia, where disease incidence is closely tied to economic losses. Formulation science is now focused on balancing therapeutic efficacy with nutritional completeness and digestibility. This convergence of health and nutrition is expected to become a defining feature of the segment, accelerating its adoption in both large-scale and smallholder operations.

By 2025, customized formulations targeting multi-species use represent nearly 9.4% of the functional milk replacers market. While calf milk replacers continue to dominate, emerging demand in piglets, goat kids, and lambs has led to the development of segment-specific nutrient profiles.

These tailored replacers address species-dependent variations in digestive enzyme availability, microbiota composition, and immunoglobulin requirements. Companies such as Volac International and Denkavit are actively innovating in this space, offering goat milk-based solutions or plant-oil-rich formats that align with fat metabolism patterns in non-bovine neonates.

For example, in piglets, early-life replacers are being enriched with medium-chain triglycerides and nucleotides to enhance gut integrity and support higher weaning weights. In lambs and kids, emphasis lies on enhancing fiber digestibility and reducing bloating risks through the inclusion of plant polysaccharides and emulsifiers.

Precision blending, microencapsulation, and solubility optimization have become key formulation tools to ensure species-specific performance. This customization trend is further supported by digital livestock monitoring, allowing real-time nutritional adjustments. As small ruminant farming expands in Latin America and parts of Africa, the demand for non-generic replacers is expected to accelerate further.

Challenge

High Production Costs and Ingredient Sourcing Complexity

The functional milk replacers market is expected to face considerable challenges, primarily because of the costly nature of plant-based proteins, essential vitamins and probiotics required to produce quality functional milk replacers. Complexity in ensuring nutritional balance while staying cost-effective increases production costs.

Supply problems and rising prices of ingredients such as soy, almond and oat proteins also erode profit margins. To combat these problems faced by consumers, manufacturers need to dedicate time and resources to smart sourcing practices, other formulations using alternative ingredients as well as scalable production methods to keep the prices down while still providing an effective product.

Regulatory Compliance and Product Standardization

Manufacturers of functional milk replacers must navigate the complexity of strict food safety regulations and disparities in global standards. Specific regional labeling requirements, quality certifications and nutritional guidelines compound the complexity and costs involved in compliance.

Concerns over potential allergens and food safety risks mean rigorous testing and validation procedures are required. To comply with international standards and expand their global presence, companies need strong quality assurance frameworks, third-party certifications and platforms to streamline compliance.

Opportunity

Rising Demand for Plant-Based and Lactose-Free Alternatives

This demand for functional milk replacers is being fueled by the increasing incidence of lactose intolerance and the trend towards consuming plant-based diets. The rising consumer preference for dairy, convenience, and innovative nutrition will stimulate market growth across multiple segments, including infant nutrition, sports supplements, and eldercare nutrition. Companies focusing on advanced formulations that include a range of omega fatty acids, probiotics, and immune-boosting nutrients will dominate this growing market.

Advancements in Nutritional Science and Personalized Nutrition

However, the Functional milk replacers market faces challenges due to the availability of raw material, pricing competition, and negative impact on animal health. Bioengineering, precision nutrition, and gut-health-oriented formulations are used by companies to create custom-formulated milk replacers based on individual health requirements.

Moreover, the rise of AI-powered food innovation enables manufacturers to create new, improved products designed for certain consumer segments, such as athletes, seniors, and those with dietary constraints, maximizing product appeal and market penetration.

The USA functional milk replacers market is propelled by the advancements in the field of animal nutrition, dairy farming, and livestock management. Market growth is driven by rising demand for high-quality, nutrient-dense feed solutions.

Growth is partly being driven by the presence of major feed producers and large R&D efforts. Trend for bio-based and probiotic-enhanced milk replacers, among other developments, is also marking its way to the industry.

The combination of precision farming, automated feeding systems, and sustainable farming is accelerating product innovation and efficiency. The market dynamics are also empowered by rising organic livestock farming and antibiotic-free animal feed.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The UK is experiencing increased demand for functional milk replacers in dairy farming, calf nutrition, and animal husbandry. The market is being propelled forward by increased investment in advanced livestock management and strict regulatory compliance

The milk replacers based on plant-based and non-GMO ingredients have also started to become popular. Breakthroughs in feed additives, enriched nutrient mixes, and sustainable production processes are key drivers of growth in the industry.

Moreover, research in exploring alternative protein sources and gut health-enhancing formulations is being driven through collaborations between government agencies and feed manufacturers. Soaring consumer preference for sustainable and organic dairy substitutes is driving sector upgrades.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

Germany, France, and the Netherlands are instrumental in the European Union’s functional milk replacers market owing to the high demand in the dairy, swine, and poultry farming.

Implementation of strict food safety standards and sustainability programs is driving the demand for high-quality, nutritionally dense feed. The rise of gut health-boosting additives, prebiotics and probiotics is additionally boosting market growth.

European Union investment in precision livestock farming, sustainable feed substitutes and carbon-neutral manufacturing techniques is driving growth. In addition, the growing need for lactose-free, antibiotic-free, and organic milk replacers is advancing the market dynamics and promoting innovations in animal nutrition.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5% |

The Japan functional milk replacers market is growing on the back of increasing applications across high-tech dairy farms, precision animal husbandry and pet nutrition industries. Its strong emphasis on both technological advances and optimization of feed efficiency is creating demand for fortified, highly digestible milk replacers. Enzyme-fortified, probiotic-rich, and plant-based formulations are also driving market growth.

Moreover, increasing investments in automation, robotic milking systems, and sustainable feed production further contribute to the growth of the market. Japan's focus on these issues is further solidifying its place in the functional milk replacers market, due to its endeavor to reduce livestock-associated emissions and promote alternative protein sources.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Functional milk replacers are a developing market in South Korea due to the fast evolution of livestock feed technology, aquaculture, and nutrition of pet animals. Investment by the country in high-performance feed additives and bioactive ingredients has also created demand for nutrient-dense, easily digestible milk replacers.

The adoption of functional peptides, gut microbiome enhancing additives, and sustainable feed production techniques is also complementing the product development. Moreover, the growing demand for functional milk replacers in pet food, livestock feeds, and calf starters is also contributing to market expansion. Furthermore, research institutions, agricultural universities, and feed manufacturers are collaborating to work on alternative protein and enzyme-based formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Rising demand for high quality and nutritionally balanced alternatives with the optimal formulation for young animal nutrition is expected to drive the growth of functional milk replacers market. To improve immunity, manufacturers are working on the digestibility, nutritional profile of the products, in addition to the inclusion of probiotics and other essential fatty acids. Some of the key trends observed in the market include species-specific formulation, economic beneficial feed, and sustainable source of ingredients.

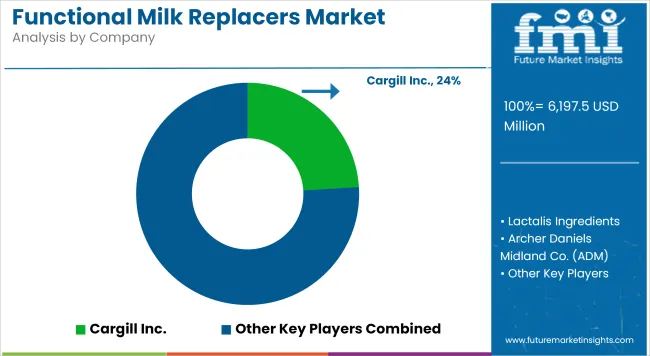

Cargill Inc. (20-24%)

The leader in functional milk replacers market offers specialized nutrition for young livestock. They focus on sustainably sourcing ingredients and research-backed product development for better digestion and immune support. Its solid distribution network expands its reach in global markets.

Archer Daniels Midland (ADM) (15-19%)

ADM is an important ingredient in the milk replacers market and offers innovative formulations such as probiotics, essential fatty acids, and digestive enzymes. Its solutions are driven by science in areas including animal gut health and nutrient absorption.

Land O’Lakes Inc. (12-16%)

Land O' Lakes, Inc. delivers expert functional milk replace that optimize protein and fat levels for increasing the growth of livestock. It also invests in research to create innovative feed solutions that are both affordable and nutritionally adequate in order to help dairy and meat producers.

FrieslandCampina (9-13%)

FrieslandCampina offers sustainable dairy-based milk replacers that provide optimum levels of essential nutrients and high digestibility. The company has differentiated itself in the industry due to its strong focus on environmentally-friendly production processes and efficient livestock nutrition solutions.

Nutreco N.V. (7-11%)

Nutreco N.V. manufactures scientifically developed milk replacers designed to support weight gain and digestive health in young animals. Its products apply cutting-edge nutritional science for more efficient livestock rearing.

Other Key Players (30-40% Combined)

The global functional milk replacers market is made up of numerous local and regional companies that focus on the innovation of functional milk replacers through sustainable ingredients, species-specific formulation, and enhanced nutritional value. Key players include:

The overall market size for functional milk replacers market was USD 6,197.54 million in 2025.

The functional milk replacers market expected to reach USD 10,095.14 million in 2035.

The demand for the functional milk replacers market will be driven by increasing adoption in the livestock and pet food industries, rising awareness of animal nutrition and health, growing demand for cost-effective dairy alternatives, advancements in fortified formulations, and expanding commercial dairy farming practices worldwide.

The top 5 countries which drives the development of functional milk replacers market are USA, UK., Europe Union, Japan and South Korea.

Milk-based and plant-based functional milk replacers drive market growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Milk Replacers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Calf Milk Replacers Market Share & Growth Factors

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA