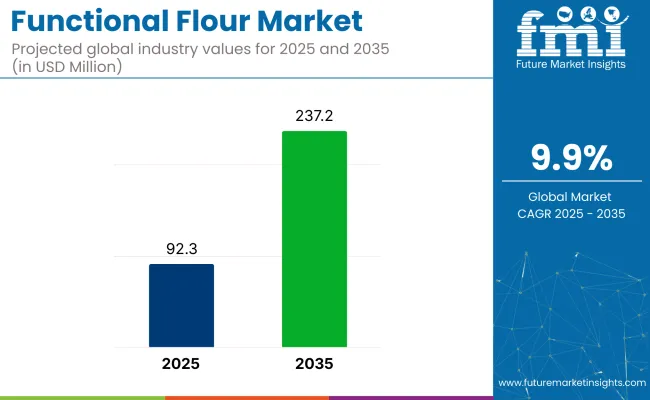

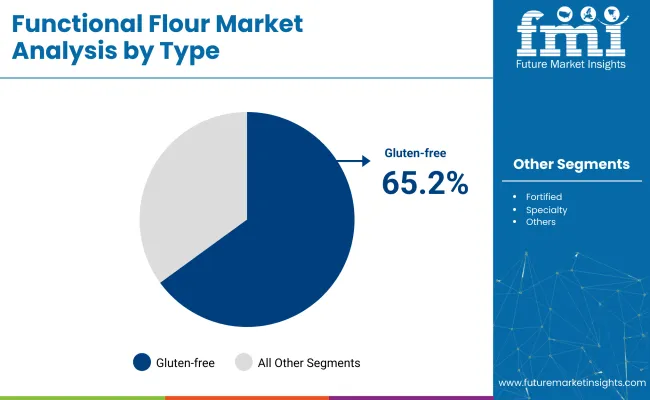

The functional flour market has been projected to advance from USD 92.3 million in 2025 to USD 237.2 million by 2035, delivering a 9.9% CAGR during the period. Gluten-free functional flour is expected to command 65.2% of 2025 sales, its share supported by rising coeliac-safe and clean-label claims across baked snacks and meal kits.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 92.3 million |

| Market Size in 2035 | USD 237.2 million |

| CAGR (2025 to 2035) | 9.9% |

High-protein and fiber-enriched variants are set to hold the balance, propelled by consumer interest in macronutrient density without textural compromise.

In a March 2023 interview with AgFunderNews, Dr. Tom Simmons, Founder and CEO of The Supplant Company, stated, “On a wheat plant, two-thirds of the above-ground biomass is not currently used [for human food]. If you think about the energy and inputs needed to grow it, and the carbon emissions, it doesn’t make sense that we’re wasting the high-fiber, low-calorie part of the crop.” This reflects their approach to upcycling wheat plant by-products.

The functional flour market has different shares in its parent markets. In the food ingredients market, it accounts for around 4-6%, driven by increasing consumer demand for functional foods that provide added nutritional benefits. Within the bakery ingredients market, the share is approximately 5-7%, as these flours improve texture, nutrition, and shelf life in baked goods.

The gluten-free products market sees a share of 3-5%, influenced by the rise in gluten-free diets and the need for alternatives. In the health and wellness food market, the flour contributes about 4-6%, as consumers seek healthier, fiber-rich options. The plant-based food market holds a share of 2-4%, as they are used in plant-based products for improved nutritional profiles.

The industry is expected to see strong growth, with gluten-free functional flour leading with 65.2% of the industry share in 2025. High-protein and fiber-enriched flour will hold 34.8%, while bakery products will dominate end-use applications with 50% industry share.

Gluten-free functional flour is projected to capture 65.2% of the industry share in 2025. Its growth is driven by the need for celiac-safe claims and cross-contact protocols, especially among multinational snack producers. Heat-treated rice and sorghum fractions deliver batter viscosity similar to wheat at 30% hydration, while particle-size standardization ensures smooth texture in high-ratio cake mixes.

Enzymatic dextrinization improves water-holding capacity, extending the shelf life of soft cookies by two days. Fortification with calcium and B-vitamins compensates for the nutrients lost when wheat is removed from formulations. Dedicated mill lines in Kansas and Minnesota lower contamination risks, ensuring GFSI audit clearance.

High-protein and fiber-enriched flour is expected to account for 34.8% of the industry share in 2025. This segment reflects growing consumer demand for satiety-enhancing ingredients and glycemic moderation in meal-replacement products. Pea-protein concentrates elevate protein content to 28g per 100g, meeting fortification goals for ready-to-eat cereals.

Resistant starches, which cut postprandial glucose spikes, are gaining traction with claims for "reduced glycemic response" by the European Food Safety Authority (EFSA). Extrusion-activated fibers improve dough gas retention, maintaining loaf volume without added gluten. Fine oat bran boosts beta-glucan content, supporting "heart-health" claims under FDA guidelines.

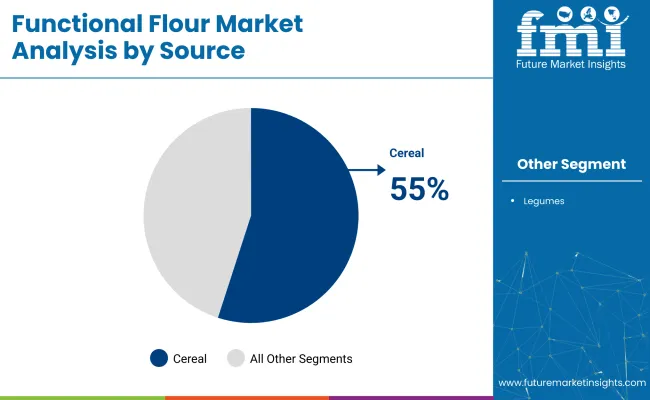

Cereal-derived flours are projected to account for 55% of the industry share in 2025. The segment benefits from established agronomic networks and existing roller-mill compatibility, minimizing capital upgrades. Hard-red winter wheat streams are heat-treated to stabilize future blends by deactivating amylase, which ensures better blend storage. Barley-based flours supply intrinsic beta-glucans, reducing reliance on isolated hydrocolloids.

Sorghum sourcing contracts mitigate the risk of corn price volatility in the Midwest. Malting-grade rye fractions contribute natural enzymes that enhance dough elasticity in artisan breads, while integrated grain silos use real-time NIR sensors to maintain protein targets with ±0.2% accuracy.

Bakery products are expected to hold 50% of the industry share in 2025, driven by demand for crumb tenderness, shelf-life extension, and clean-label formulations. The flours replace DATEM emulsifiers in sandwich loaves while ensuring slice cohesion after toasting. Muffin batter viscosity stability reduces pan-top variance, improving weight consistency by 5%.

Gluten-free pizza bases benefit from starch-optimized flour blends, reducing chew-force by 25%. Sugar-reduced brownies retain moisture due to improved hydration from modified cereal starches. Frozen par-baked baguettes remain intact at −20°C, thanks to enzyme-activated flour matrices that prevent surface cracking during storage.

Label compliance pressures and digestibility claims are increasing demand in specialized food categories. At the same time, niche demand for gluten-free meal kits and therapeutic formulations is opening new commercialization channels in export-focused regions.

Regulatory Push for Clean-Label Texturizers Accelerating Use in RTE

Processed food manufacturers are substituting modified starches with the flours to meet EU and USA clean-label guidelines. Functional rice and lentil flours are used as thickeners and stabilizers in sauces, soups, and frozen entrees. Ingredients previously labeled with E-numbers are being replaced to allow for declarations like “whole lentil flour” or “pre-gelatinized rice flour.”

Suppliers such as Limagrain and Ingredion have developed flours with thermal stability and shear resistance for high-output processing lines. Microwaveable soups and shelf-stable sauces now specify flour-based texturizers to avoid labeling complications and regulatory scrutiny.

Gluten-Free Medical and Meal Kit Formats Opening New Channels

Functional flours are gaining traction in prescription meal kits and therapeutic diets targeting gluten intolerance and metabolic disorders. In Japan, rice and amaranth-based flours are being included in pre-cooked diabetic meal trays. USA DTC brands like Modify Health and Epicured have integrated resistant starch flours into FODMAP-compliant menus.

Hospitals are sourcing stabilized flours with validated glycemic profiles for institutional foodservice use. Exporters targeting medical supply chains and clinical nutrition providers are now developing heat-treated, low-viscosity flours that maintain texture under extended hold and reheat conditions.

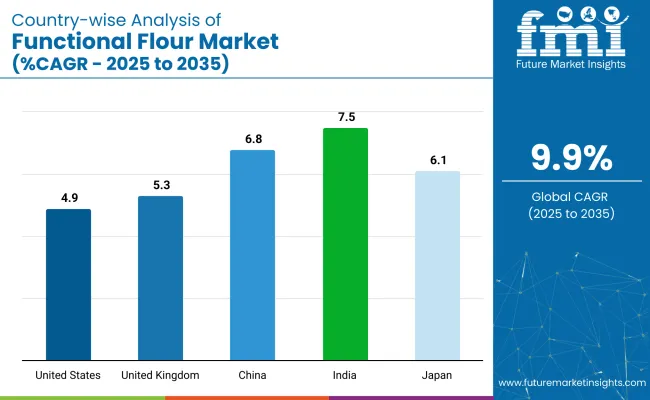

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| United Kingdom | 5.3% |

| China | 6.8% |

| Japan | 6.1% |

| India | 7.5% |

The industry demand is projected to rise at a 9.9% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 7.5%, followed by China at 6.8%, and Japan at 6.1%, while the United Kingdom posts 5.3% and the United States records 4.9%.

These rates translate to a growth premium of +9% for India, +6% for China, and -7% for the United States versus the baseline, while the United Kingdom and Japan show moderate growth. Divergence reflects local catalysts: rising health awareness and demand for functional ingredients in India and China, while more mature industries in the United States, the United Kingdom, and Japan exhibit slower growth driven by industry saturation and established consumption patterns.

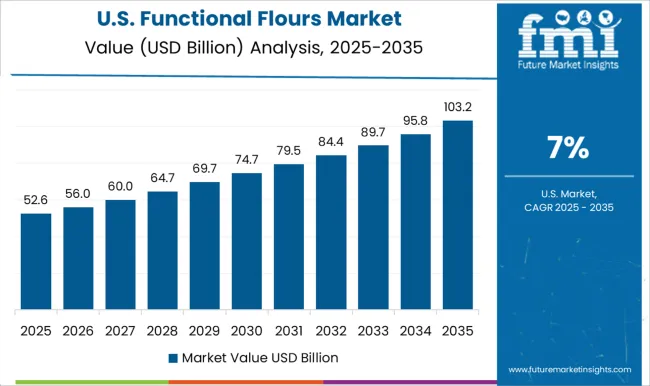

The industry in the United States is set to record a CAGR of 4.9% from 2025 to 2035. FDA proposals requiring declared resistant-starch values and USDA whole-grain rules in school meals have driven reformulation toward wheat-legume blends.

Minnesota and North Dakota value-added grants offset the cost of extrusion lines that raise protein digestibility in pea and chickpea flours. Large bakers now pilot high-amylose wheat flour in cafeteria bread contracts to meet fiber targets without texture loss.

Sales of the flours in the United Kingdom are projected to grow at a CAGR of 5.3% through 2035. DEFRA’s fiber-enrichment roadmap prioritizes barley- and oat-based flours for private-label bread, while HFSS guidelines trim refined wheat in packaged snacks.

Innovate UK funds enzyme-activated, low-GI wheat blends destined for public-sector catering. Major retailers commit to 50% whole-grain share in own-brand bakery by 2030, raising demand for the flours with declared β-glucan content.

Demand for the flours in China is estimated to rise at a CAGR of 6.8% between 2025 and 2035. National Standard GB 14880 now permits micronutrient fortification, accelerating adoption of vitamin-enriched sorghum blends.

Hainan Free Trade Port tariff waivers lower the landed cost of cassava-based resistant-starch concentrates, supporting growth in low-GI bakery formats. Guangdong science grants underwrite extrusion pilot plants converting mung-bean flour into noodle bases for metropolitan school canteens.

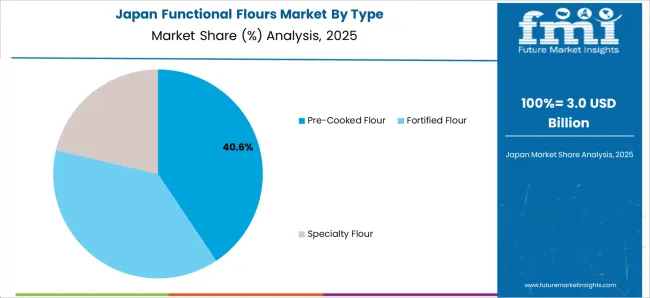

The industry in Japan is projected to expand at a CAGR of 6.1% from 2025 to 2035. FOSHU labeling enables cholesterol-control claims on barley β-glucan flours, prompting branded launches.

MAFF’s Smart Food System program subsidizes dry-milling of high-amylose rice for gluten-free mixes, while Hokkaido retrofits roller mills to supply protein-fortified wheat flours to elder-care kitchens. Retailers highlight low-GI seals on rice-flour breads positioned for diabetic consumers.

The industry in India is forecast to grow at a CAGR of 7.5% through 2035. FSSAI’s Eat Right program endorses millet-fortified flour, lifting demand for pearl- and finger-millet blends in snacks and flatbreads.

Production-Linked Incentive bonuses reimburse pneumatic conveying systems that handle heat-sensitive coarse-grain flours in Rajasthan and Karnataka. National Mission on Millets funds glycemic-index trials, enabling diabetic-health claims on sorghum-based rotis and bakery mixes.

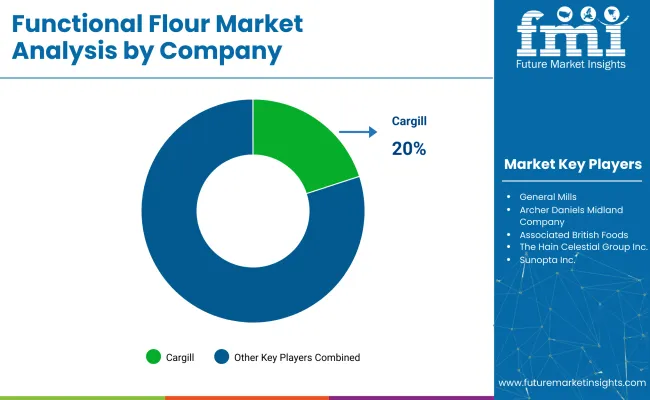

Leading Company - Cargill, Incorporated Industry Share - 20%

The industry is highly competitive, with key players like Cargill, General Mills, and Archer Daniels Midland Company dominating through extensive product ranges and global reach. These companies focus on expanding their portfolios to include the flours that cater to the growing demand for gluten-free, high-protein, and low-carb options.

Associated British Foods and The Hain Celestial Group utilize strategic acquisitions and R&D to enhance their industry presence in health-oriented food sectors. Smaller players such as Maticnjak and Shipton Mill differentiate through niche products and regional appeal. The industry remains fragmented, with large companies holding significant shares while specialized firms target specific consumer preferences and regional demands.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Industry Value (2025) | USD 92.3 million |

| Projected Industry Value (2035) | USD 237.2 million |

| CAGR (2025 to 2035) | 9.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, metric ton for volume |

| Source | Cereal-based, Legume-based |

| Type | Fortified, Gluten-free, Specialty, Other Functional Flours |

| Application | Bakery Products, Soups and Sauces, Ready-to-eat, Other Applications |

| Regions | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Cargill, General Mills, Archer Daniels Midland Company, Associated British Foods, The Hain Celestial Group Inc., Sunopta Inc., Maticnjak, Shipton Mill, Bos’s Red Mill, Other Emerging Players |

| Additional Attributes | Dollar sales, CAGR trends, product type distribution, size preferences, price range segmentation, competitor dollar sales & industry share, regional growth patterns |

By source, the industry is bifurcated into cereals and legumes.

By type, the industry has been categorized into fortified, gluten-free, specialty, and other functional flours.

By application, the industry is segmented into bakery products, soups and sauces, ready-to-eat products, and other applications.

By region, the industry is studied across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and Middle East & Africa.

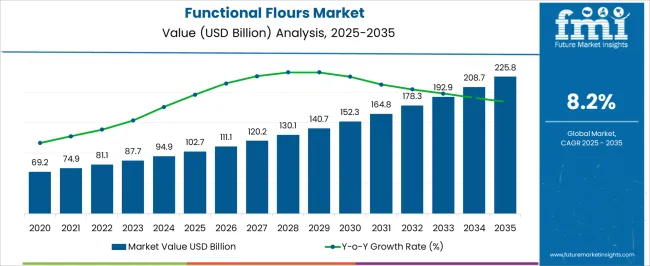

The global functional flour market is estimated to be valued at USD 92.3 billion in 2025.

The market size for the functional flour market is projected to reach USD 227.9 billion by 2035.

The functional flour market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in functional flour market are cereals and legumes.

In terms of type, fortified segment to command 48.6% share in the functional flour market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA