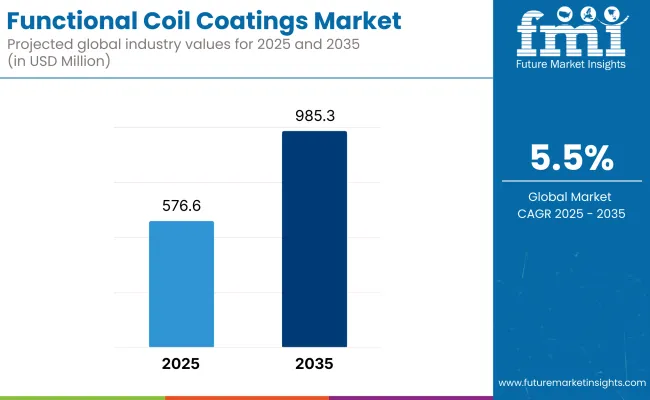

The industry is expected to have a valuation of USD 576.6 million in 2025, which is likely to be around USD 985.3 million by 2035 at a CAGR of about 5.5%. The demand for hard-wearing, multicomponent surface solutions in numerous end-user industries fuels growth.

Among the major growth drivers is the growth of the construction industry, particularly in emerging economies. Weather-resistant and anti-corrosion-coated steel and aluminum coils are used extensively in roofing, facades, wall cladding, and HVAC systems-applications where longevity and appearance are both paramount.

In the transportation industry, aluminum and other such materials are becoming more commonly employed to enhance the fuel efficiency of vehicles. Coatings on coil protect these from environmental wear and damage, qualifying them as essential components in car part manufacturing and adding lifecycle performance for interior and exterior use.

Sustainability is also increasingly dominating the industry. The coil coating process is less energy-consuming and less wasteful compared to traditional painting technologies. As green building standards that are environmentally sustainable gain popularity, functional coil coatings are now the standard solution for green manufacturers.

However, supply chain disruptions and raw material price volatility can be hindrances to growth. Fluctuations in the cost of resin, pigment, and metal substrate can impact profit margins and budgets for production, especially for small manufacturers with tighter financial models.

Despite challenges such as these, new opportunities exist. The emerging technological developments of coatings, i.e., self-cleaning, antimicrobial, anti-fingerprint, and energy-saving coatings, are opening new avenues for consumer products, cleanroom premises, and the food processing industries. These new-generation solutions make more value available from coated metal materials.

Demand for pre-coated metal coils is also growing in prefab home building and modular construction applications, where speed, performance, and efficiency are the top priorities. Coil coatings offer a solution that is scalable and addresses architectural, regulatory, and design needs while reducing construction time and the cost of maintenance.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 576.6 million |

| Industry Value (2035F) | USD 985.3 million |

| CAGR (2025 to 2035) | 5.5% |

The industry is growing at a significant rate, which is driven by increasing demand from sectors like construction, automotive, and appliances. These coatings improve the durability, aesthetic appeal, and functionality of metal substrates, making them indispensable in various applications.

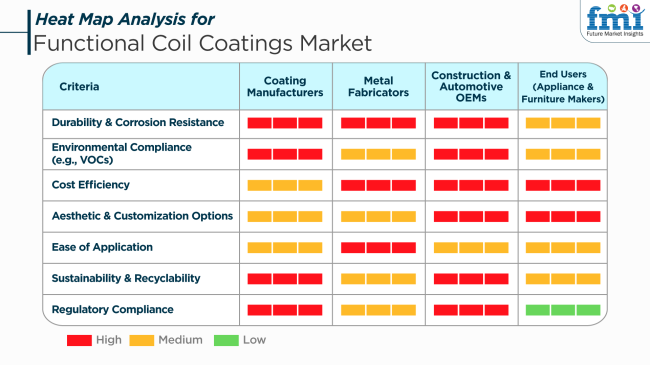

Metal Fabricators emphasize cost-effectiveness and application ease, wanting coatings that simplify the manufacturing process without affecting quality. The uniformity and efficiency with which coatings can be applied are paramount to help ensure production schedules and minimize waste. Automotive OEMs and Construction require coatings that offer aesthetic flexibility and customizability to accommodate varied consumer tastes. Besides, regulatory conformity and sustainability are essential drivers in their buying behavior, as they seek to supply environmentally friendly products.

End Users such as appliance and furniture manufacturers are concerned with coatings that make the products look and last better. Cost-effectiveness is also very important to them since they desire high performance in terms of pricing. The stakeholders engineer and apply efficient coil coatings that satisfy performance expectations, adhere to environmental regulations and respond to changing consumer requirements.

The functional coil coatings market between 2020 and 2024 experienced steady growth, dominated mainly by growth in the construction and white goods industries. Metal products resistant to corrosion and pre-coated with durability coupled with design flexibility were gaining traction-mainly for roofings, wall panels, and home appliances.

There are growing sustainability initiatives, such as a transition to low-VOC and waterborne products. Advances were typically incremental, with companies emphasizing mechanical and weather-resistant properties to address industry requirements.

Between 2025 and 2035, the industry will transition towards high-performance smart coatings. Properties like self-healing, antimicrobial activity, and energy efficiency (e.g., heat-reflective surfaces) will redefine product design. The emphasis on being eco-friendly will increase as producers invest in bio-based and solvent-free formulations under the pressure of increasing environmental regulations.

Also, functional coatings will be developed more to enhance modular construction movements, with specially designed applications for rapid-installation building systems and infrastructure developments in the emerging world. The current decade will put equal stress on performance and sustainability.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Construction (wall panels, roofing), automotive, home appliances | Smart coatings that offer self-healing, antimicrobial, and energy-saving performance |

| Improved corrosion protection and durability | Creation of environment-friendly paints and coatings |

| Driver demand for aesthetics and long service life of material | Sustainability, innovative technologies, and integrated smart functionality emphasis |

| Exceptional growth in the Asia-Pacific, led by China and India | Continuing development in growth industrie s with strong urbanization rates |

| Traditional solvent-born coatings | Moving to "eco-friendly" formulating alternatives |

| First steps towards green practices | Increased focus on sustainable production and circular economy principles |

The industry is sensitive to raw material price volatility. Price volatility of key inputs like resins and pigments has the potential to impact the costs of production significantly. Sudden jumps in prices have the potential to erode margins, and producers may find it challenging to maintain competitive price levels.

Supply chain disruptions, like transportation delays or geopolitical tensions, can prevent the timely delivery of raw materials and finished goods. Interruptions like these can cause production shutdowns and failure to meet customer demand, negatively impacting sales and long-term business relationships.

Technological innovation and advancements are central in the functional coil coatings market. Companies that fail to invest in new product development risk becoming defunct. There is a requirement for constant research aimed at improving efficiency, reducing environmental impacts, and meeting the specific needs of diverse applications.

Numerous players are competing for a good revenue share. Competition will attract price wars, hence making profitability low. Companies need to differentiate based on quality, innovation, and customer services so that they can remain competitive and survive long term.

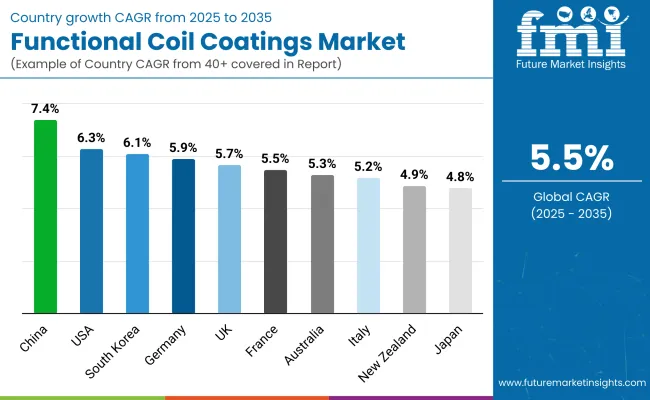

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

| UK | 5.7% |

| France | 5.5% |

| Germany | 5.9% |

| Italy | 5.2% |

| South Korea | 6.1% |

| Japan | 4.8% |

| China | 7.4% |

| Australia | 5.3% |

| New Zealand | 4.9% |

The USA is expected to witness a CAGR of 6.3% during the period 2025 to 2035, driven by sustained investments in infrastructure upgrades and increasing demand for pre-coated metal consumption in the construction and vehicle industries. The need for long-lasting, environmentally friendly, and corrosion-resistant coatings has fueled the development of high-performance products. Growth is supported by strong regulatory frameworks promoting energy-saving and sustainable coating technologies.

Major players in the USA, such as Akzo Nobel, PPG Industries, and Sherwin-Williams, continue to enhance production capacities and incorporate superior technologies to meet commercial and residential industries. Higher use of functional coil coatings in HVAC systems, household appliances, and metal roofs also rises at a higher rate, thereby fueling the market drive more securely in the forecast period.

The UK is expected to increase at a CAGR of 5.7% between the years 2025 and 2035. The growth of the market is primarily fuelled by the country's focus on green building products and energy-efficient buildings. The imposition of strict building codes and environmental regulations is driving higher consumption of high-performance coatings with thermal insulation and anti-bacterial and anti-corrosion properties.

Key players in the UK market include local and European-origin manufacturers such as Beckers Group and Akzo Nobel, which are investing significantly in R&D to supply specialized coatings suitable for coastal and urban environments. Commercially versatile coating demand in commercial buildings is most likely to stimulate further innovation and usage diversity across industries.

France is expected to have a CAGR of 5.5% between 2025 and 2035. The increase is driven by a surge in demand for durable and environmentally friendly coating solutions in the housing and industrial equipment segments. Green building policies and the circular economy are compelling manufacturers to adopt bio-based and low-VOC formulations.

Market leaders such as BASF Coatings and Axalta Coating Systems are strategically locating their operations to meet demand in France's expanding renovation and residential sectors. The trend of modernizing public infrastructure is also likely to continue the demand for heat-reflective and corrosion-resistant coil coatings in the near future.

Germany is expected to post a CAGR of 5.9% over the forecast period. Strong demand from the automotive and construction industries, along with the country's engineering-driven approach to innovation, continues to propel the take-up of advanced coil coating technologies. Emphasis on energy efficiency and climate resilience further underpin the role of functional coatings in meeting sustainability goals.

Key leaders such as BASF, Henkel, and Dörken MKS-Systeme GmbH are leveraging their technical capabilities to deliver solutions that are appropriate for high-performance applications. The integration of nanotechnology and self-healing properties in coatings is likely to gain momentum, especially for industrial-grade steel used in architecture and transport infrastructures.

Italy is anticipated to grow at a CAGR of 5.2% in 2025 to 2035. The recovery of the domestic construction sector, along with growth in investment in industrial refurbishment activities, is driving the demand for coil coatings that are pleasing to the eye and functionally superior. Decorative versatility and weather resistance remain top choice factors in residential and commercial applications.

Industry giants such as Akzo Nobel and Valspar are building strong local supply chains to provide customized solutions for coping with Mediterranean climatic conditions. The increasing demand for coatings featuring antimicrobial, UV-resistant, and thermal control properties is in line with the trend toward multifunctional coatings with protective and performance-improving properties.

South Korea will most likely register a 6.1% CAGR until 2035, driven by strong expansion in the electronics, automotive, and high-tech manufacturing sectors. The demand for high-durability, reduced-weight parts in home appliances and electric cars is stimulating greater consumption of high-performance coil coatings featuring thermal, anti-fingerprint, and corrosion protection qualities.

Major South Korean conglomerates like POSCO and Dongkuk Steel are investing in advanced coil coating lines to meet industry-specific requirements. Continued government encouragement of smart manufacturing and eco-innovation is expected to propel broader adoption of energy-efficient coatings across domestic and export markets.

Japan is projected to expand at a CAGR of 4.8% during the period 2025 to 2035. An aging infrastructure base, coupled with population dynamics favoring renovation and retrofitting of buildings, is driving modest but stable demand. Japanese market preferences are characterized by concern for high-quality surface finish, extended durability, and environmental compatibility.

Dominant players such as Nippon Paint Holdings and Kansai Paint are concentrating on the innovation of coatings with hydrophobic, reflective, and anti-pollution properties. Thin-film coating technology advancements and technology advancements in line with Japan's energy conservation activities are likely to propel market growth, particularly in urban development projects.

China is expected to grow at a high CAGR of 7.4% between the period 2025 to 2035. Rapid urbanization, industrial development, and increasing infrastructural spending are the main drivers of growth. The demand is highly driven by the construction of high-rise structures, public infrastructure, and energy-efficient factories that require heavy-duty coil coating applications.

Market leaders such as YiehPhui, Baosteel, and Shandong Kerui are rapidly expanding production capacity and mechanizing coating lines. Low-emission, anti-smog, and energy-saving coating technologies are being actively researched to respond to evolving regulatory demands and serve the nation's green development initiatives.

Australia is expected to register a CAGR of 5.3% during 2025 to 2035, spurred by construction activity, climate-resistant building material demand, and infrastructure replacement. Being exposed to coastlines and weather conditions results in corrosion-resistant and UV-stable coil coatings being a requirement for commercial and residential developments.

Multinational corporations' subsidiaries, such as Bluescope and Akzo Nobel, are local players that play a major role in providing functional coatings that suit Australia's environmental requirements. Innovation using coatings with thermal management and anti-fungal properties is expected to expand market use, particularly in roofing and external structures.

New Zealand is projected to grow at a rate of 4.9% over the forecast period due to a steady predisposition towards sustainable construction methods. The focus laid on architectural appearance, combined with the need for long service life and low-maintenance coatings, continues to drive demand for highly durable coil coatings.

Key industry participants are aiming for local demand through coatings that exhibit marine corrosion resistance, UV weathering resistance, and biological resistance. Emphasis on environmentally certified products and higher consumption of functional coatings in prefabricated building products will be relevant to the industry in the coming decade.

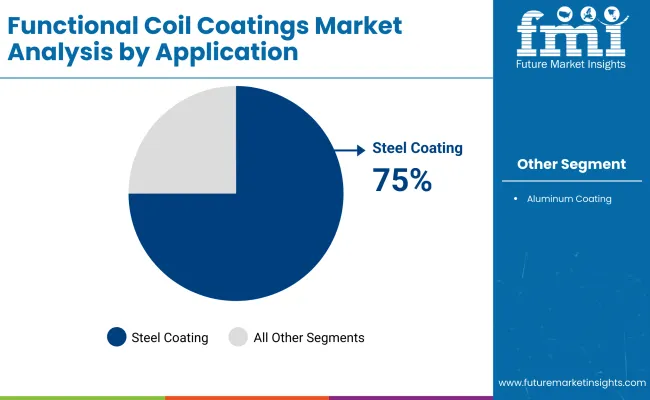

By application, steel coatings account for 75% of the share of the market, while aluminum coatings only account for the remaining 25%. Most of the applications for pre-coated steels are found in construction, appliances, automotive, and infrastructure buildings, where functional performance, durability, and aesthetics are very critical.

Major applications for steel coatings include roofing, wall cladding, garage doors, HVAC systems, and commercial buildings, and these hold demand for galvanized and color-coated steel from all corners of the globe. Functional coil coatings on steel substrates are designed for corrosion resistance, UV protection, chemical resistance, and better adhesion to result in a prolonged life of the steel structure. These coatings enhance energy efficiency and protect metals, containing some infrared-reflective pigments and self-cleaning technology.

Great functional coatings for applications in architectural and industrial areas for the steel coil have been produced by the leading manufacturers, AkzoNobel, PPG Industries, and Beckers Group. These coatings are, for example, anti-bacterial, anti-fingerprint, and anti-graffiti.

Meanwhile, aluminum coil coatings represent a robust 25% share of this market. They are typically used in applications that favor lightweight and corrosion-resistant materials, such as residential siding, transportation panels, and consumer electronics. Pre-coating is provided with functional coatings, such as fluoropolymer or polyester, that give a high weather ability and coloration retention properties to aluminum coils. Alchemco offers high-performance coatings, such as those of Valspar and Axalta Coating Systems, for aluminum substrates, but mainly for external building facades and components that require long-term durability and good appearance.

This difference in market share based on steel and aluminum applications can be said to be due to their differential utilities and the heavy reliance of industries on steel-based infrastructure, whereas new developments are seen in aluminum applications, mainly referring to lightweight designs and advanced surface protection.

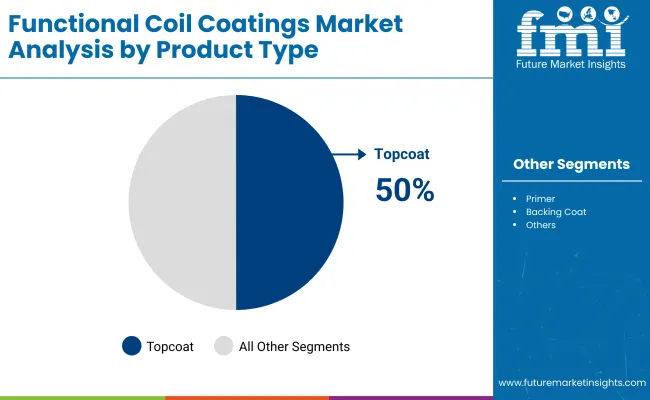

Based on product structures, functional coil coatings are divided into topcoat segments, with an estimated 50% share, and primers, with a significant share of nearly 30%. Primers are essential in imparting adhesion and corrosion protection in multilayer coil coating systems.

Topcoats are the outermost layer applied to coil-coated metal substrates, serving to provide decorative and protective purposes. These coatings are engineered for weather resistance, UV stability, abrasion protection, and chemical resistance. In the construction industry, topcoats are important for roofing and wall cladding and facades, where prolonged retention of color and gloss stability is required.

In appliances and automobile components, the topcoats give surface durability as well as aesthetics. Key players such as Beckers Group, AkzoNobel, and PPG Industries have presented advanced topcoat solutions with antimicrobial, anti-fingerprint, and solar-reflective properties for various industrial requirements.

Primers account for a share of 30%. They function as an intermediary bonding layer between the substrate and the topcoat. They are designed to improve adhesion, promote corrosion resistance, and enhance uniformity in the final coating system. Functional primers are fundamental for steel applications, considering that strong barrier performance is of utmost importance in marine or highly corrosive industrial environments.

Companies such as Axalta Coating Systems and Sherwin-Williams manufacture primer systems based on epoxy and polyester, which provide an even greater level of substrate protection and compatibility with a variety of topcoat systems, including PVDF, polyurethane, and silicone-modified polyester.

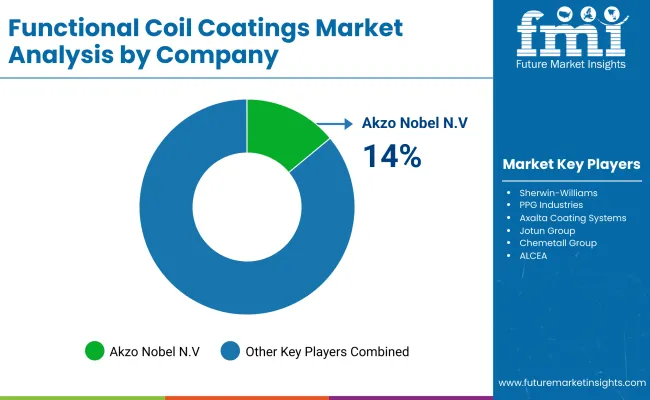

The industry has fierce competition from well-established coating manufacturers, regional players, and niche innovators. Akzo Nobel N.V., Sherwin-Williams, PPG Industries, and Axalta Coating Systems dominate with global distribution networks, stronger product formulations, and broader portfolios targeted for architectural uses, automotive, and industrial uses. The above companies utilize cutting-edge technological developments to improve high durability, corrosion resistance and self-healing coatings.

Mid-sized firms such as Jotun Group, Noroo Coil Coatings, and Titan Coatings Inc. manufacture specialty coatings with aesthetic-enhancing properties, thermal insulation, and antimicrobial features for niche segments in HVAC systems, appliances, and transportation. Here, performance and sustainability govern consumers when deciding between products. Customized coatings with low aggravation to VOC emissions and high energy efficiency have well-placed these players in regulatory-driven industries.

Regional companies like JK Coil Coating Pvt Ltd assume huge positions in Asia-Pacific, Latin America, or Europe based on localized production, competitive pricing, and direct customer relationships. Among the structures and consumer products, these firms primarily target the growing demand for paint that has improvement in adhesion, anti-fingerprint properties, and high brightness.

Innovation in nano-coating and fluoropolymer-based solutions and smart coatings seems to be trending with companies such as NANO-X GmbH, The Chemours Company, and OZKEM PTY LTD investing in next-generation coatings that promise outstanding resistance to UV light even while being energy-efficient and durable over time.

As those industries call for more sustainable and multifunction functionalities from their coatings, much of an industrial player’s emphasis is on bio-based formulations and circular economy initiatives bolstering their competitive advantage.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Akzo Nobel N.V. | 14-18% |

| Sherwin-Williams | 12-16% |

| PPG Industries | 10-14% |

| Axalta Coating Systems | 8-12% |

| Jotun Group | 6-10% |

| Others (combined) | 40-50% |

| Company Name | Key Offering and Activities |

|---|---|

| Akzo Nobel N.V. | High-performance coil coatings with corrosion resistance, weather durability, and sustainable formulations for industrial and architectural applications. |

| Sherwin-Williams | Advanced functional coil coatings with thermal management, antimicrobial, and eco-friendly properties for HVAC, appliances, and construction. |

| PPG Industries | Smart coatings featuring self-healing, anti-corrosion, and UV-resistant properties for industrial and automotive applications. |

| Axalta Coating Systems | High-durability coil coatings are designed for enhanced adhesion, chemical resistance, and energy-efficient surfaces. |

| Jotun Group | Specialty coil coatings with anti-fingerprint, anti-smudge, and high-reflectivity properties for consumer goods and electronic appliances. |

Key Company Insights

Akzo Nobel N.V. (14-18%)

Leading in durable and sustainable coil coatings, focusing on low-VOC formulations and advanced weather-resistant technologies.

Sherwin-Williams (12-16%)

Innovates in multifunctional coatings, integrating antimicrobial and energy-efficient properties for HVAC, construction, and industrial applications.

PPG Industries (10-14%)

Develops smart coatings with self-healing and nanotechnology-based enhancements to extend the lifespan of coated surfaces.

Axalta Coating Systems (8-12%)

It specializes in corrosion-resistant and chemically robust coil coatings that cater to industrial and commercial applications.

Jotun Group (6-10%)

It focuses on aesthetic and functional coatings with anti-smudge and high-reflectivity features for the consumer and electronics industries.

Other Key Players

The segmentation is into steel coatings and aluminum coatings.

The segmentation is into topcoat, primer, backing coat, and others.

The segmentation is into Anti-Graffiti Coating, Antimicrobial Coating, Solar Reflective Coating, Self-Cleaning Coating, Self-Healing Coating, Anti Dust Coating, Nox Reducing Coating, Photovoltaic Coating, Polychromic Coating, Laminating Film, Fire Resistant Coating, and Heat Saving Coating.

Key material types include Polyester, Epoxy, PVC/Vinyl, Plastisols, Acrylic, Polyurethane, PVDF, and Silicone.

The segmentation is into construction, transportation, consumer durable goods (including refrigerators, washing machines & dishwashers, ovens & toasters, and others), HVAC, metal furniture, and others,

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa, with regional differences influencing product demand and growth opportunities.

The valuation of the industry is estimated to be worth USD 576.6 million in 2025.

Sales are projected to reach USD 985.3 million by 2035, driven by growing demand for durable and protective coatings in the steel and metal industries.

China is expected to experience a CAGR of 7.4%, driven by its strong industrial base and rapid infrastructure development.

Steel coatings are leading due to their widespread use in construction, automotive, and home appliance applications.

Key players include Akzo Nobel N.V., JK Coil Coating Pvt Ltd, Jotun Group, Dura Coat Products, Inc., Noroo Coil Coatings, Titan Coatings Inc., Eastman Chemical Company, Modine Manufacturing Inc., Chemetall Group, ALCEA, Recubrimientos Plasticos SA, Italcoat Srl., Lord Corporation, Sherwin-Williams, PPG Industries, Axalta Coating Systems, The Chemours Company, NANO-X GmbH, OZKEM PTY LTD, and Blygold International BV.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: Global Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 22: North America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: North America Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 32: Latin America Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Latin America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: Latin America Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 42: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 44: Western Europe Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Western Europe Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Western Europe Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 52: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 56: Eastern Europe Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 58: Eastern Europe Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 60: Eastern Europe Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 80: East Asia Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 82: East Asia Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 84: East Asia Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Function Type, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Tons) Forecast by Function Type, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 20: Global Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 24: Global Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 28: Global Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 31: Global Market Attractiveness by Application, 2023 to 2033

Figure 32: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Function Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 35: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 48: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 52: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 56: North America Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 60: North America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 64: North America Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 67: North America Market Attractiveness by Application, 2023 to 2033

Figure 68: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Function Type, 2023 to 2033

Figure 70: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 71: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 88: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 92: Latin America Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 96: Latin America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 100: Latin America Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Function Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 120: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 124: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 128: Western Europe Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 132: Western Europe Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 136: Western Europe Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Function Type, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Function Type, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Function Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 228: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 232: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 236: East Asia Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 240: East Asia Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 244: East Asia Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Function Type, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 251: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Function Type, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Function Type, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Tons) Analysis by Function Type, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Function Type, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function Type, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Function Type, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA