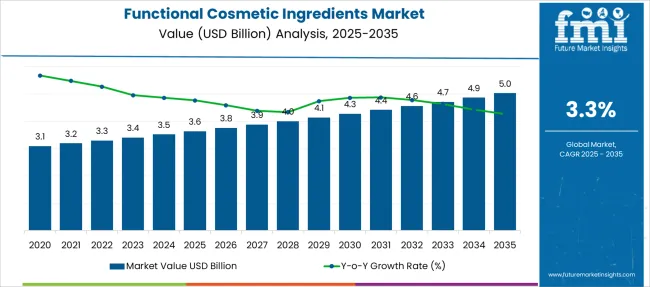

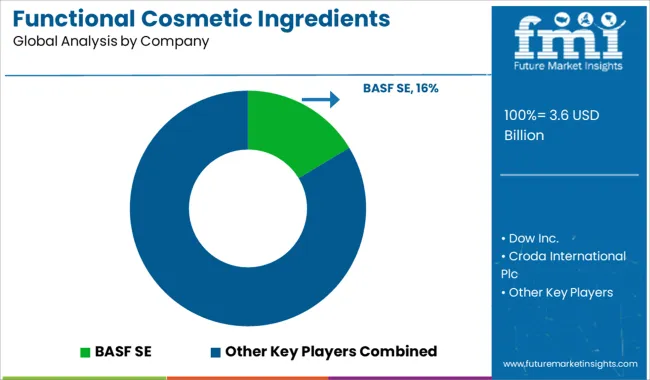

The Functional Cosmetic Ingredients Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Functional Cosmetic Ingredients Market Estimated Value in (2025 E) | USD 3.6 billion |

| Functional Cosmetic Ingredients Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The functional cosmetic ingredients market is expanding steadily as consumer preferences shift toward performance-driven beauty and personal care products. Rising awareness regarding skin health, aging concerns, and demand for targeted functionality has pushed manufacturers to formulate advanced products with active ingredients that deliver visible results.

Skin care remains the primary application area, driven by trends such as preventive care, clean beauty, and dermo-cosmetics. The market outlook remains favorable due to technological innovations in ingredient delivery systems, biocompatible compounds, and plant-based alternatives.

Regulatory focus on ingredient safety and efficacy continues to steer product development, while premiumization trends are driving the inclusion of multifunctional ingredients in mainstream formulations. As brands emphasize transparency and science-backed claims, the role of functional ingredients in ensuring formulation integrity and performance will remain vital across cosmetic categories.

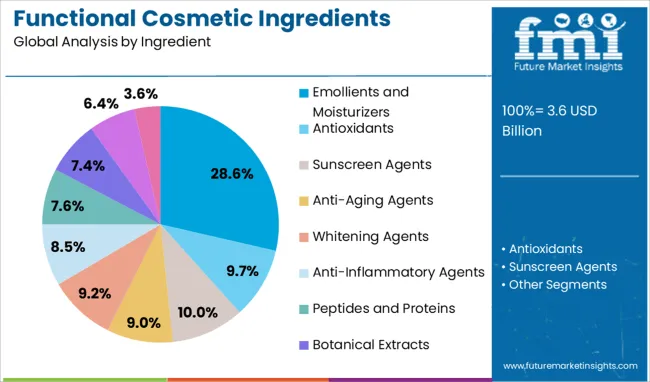

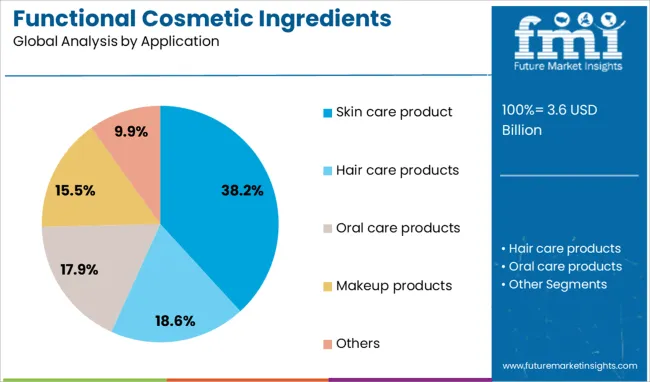

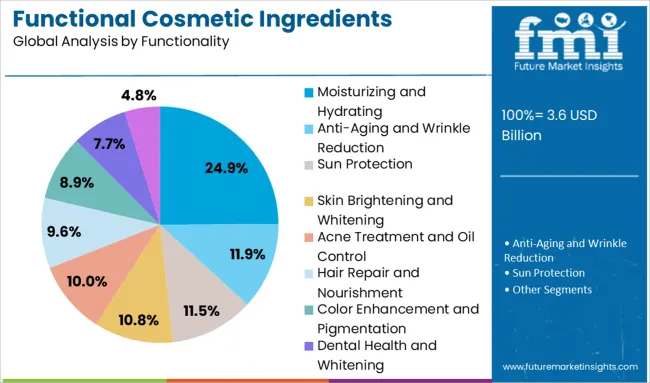

The functional cosmetic ingredients market is segmented by ingredient, application, functionality, and geographic regions. By ingredient of the functional cosmetic ingredients market is divided into Emollients and Moisturizers, Antioxidants, Sunscreen Agents, Anti-Aging Agents, Whitening Agents, Anti-Inflammatory Agents, Peptides and Proteins, Botanical Extracts, Vitamins and Minerals, and Others. In terms of application, the functional cosmetic ingredients market is classified into Skin care products, hair care products, oral care products, Makeup products, and Others. Based on functionality of the functional cosmetic ingredients market is segmented into Moisturizing and Hydrating, Anti-Aging and Wrinkle Reduction, Sun Protection, Skin Brightening and Whitening, Acne Treatment and Oil Control, Hair Repair and Nourishment, Color Enhancement and Pigmentation, Dental Health and Whitening, and Others. Regionally, the functional cosmetic ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The emollients and moisturizers segment dominates the ingredient category with a 28.6% market share, reflecting its indispensable role in restoring skin barrier function and maintaining hydration. These ingredients are widely used across formulations for dry, sensitive, and aging skin, addressing consumer demand for immediate and long-term moisturizing benefits.

The segment’s growth is supported by increased awareness of skin barrier health and the rising prevalence of climate-induced dryness and irritation. Advancements in emollient chemistry, including bio-based and non-comedogenic formulations, are enabling manufacturers to cater to specific skin types and claims such as “non-greasy” or “fast-absorbing.” Furthermore, the integration of these ingredients into hybrid products such as tinted moisturizers and sun care formulations is expanding their market footprint.

As hydration remains a foundational skin care benefit, this segment is expected to retain its market leadership across both mass and premium product lines.

The skin care product application segment holds a commanding 38.2% market share in the functional cosmetic ingredients market, driven by rising consumer investment in preventive and therapeutic skin care. Increasing concerns over environmental aggressors, early aging, and lifestyle-related skin conditions have amplified demand for active-rich skin care solutions.

This has spurred the incorporation of functional ingredients that deliver hydration, protection, brightening, and repair benefits into daily-use products. The growing popularity of step-based routines and multifunctional skin care formats such as serums, essences, and overnight masks further propels the segment’s expansion.

Continuous product launches by global brands and indie labels alike are sustaining high ingredient turnover and innovation. As consumers become more ingredient-aware and product claims become more scrutinized, the demand for functional components in skin care formulations is expected to remain strong and central to market evolution.

The moisturizing and hydrating functionality segment leads with a 24.9% share, highlighting its essential role in consumer skin care preferences across age groups and skin types. This segment benefits from the universal appeal of hydration as a primary need, making it a cornerstone of most cosmetic formulations.

Increasing exposure to digital pollution, harsh climates, and indoor environmental stressors has made hydration-centric products more relevant, supporting demand for functional ingredients that offer immediate and sustained moisture retention. Ingredient innovation focusing on humectants, occlusives, and emollients with enhanced skin penetration and minimal irritation profiles is driving differentiation.

Consumer interest in hydration-boosting botanical extracts and biotech-derived actives is contributing to portfolio expansion. As hydration becomes interlinked with anti-aging, soothing, and barrier-repair claims, the segment is expected to maintain its leadership due to its relevance in both foundational and advanced skin care offerings.

The functional cosmetic ingredients market is driven by demand for clinically proven, multifunctional, and natural formulations, supported by strict regulatory compliance and growing premiumization trends that emphasize transparency, safety, and performance-driven skincare solutions.

The functional cosmetic ingredients market is witnessing strong demand due to growing consumer interest in products that offer visible and clinically validated results. Formulations enriched with humectants, emollients, and actives such as peptides and antioxidants are gaining prominence for their ability to improve skin hydration, elasticity, and barrier function. Anti-aging and skin-brightening benefits are key factors influencing purchasing decisions, especially among middle-aged consumers. Additionally, dermatologically tested and non-irritant ingredients are being prioritized to address sensitivity concerns. Brands are leveraging ingredient-backed claims to build trust, reinforcing the importance of transparency in formulations. This shift toward performance-driven skincare significantly elevates the role of functional ingredients in cosmetic product development.

The demand for multifunctional cosmetic products is creating new opportunities for ingredient suppliers. Consumers are increasingly opting for hybrid formulations that combine hydration, sun protection, and anti-aging benefits in a single application. This trend has resulted in higher adoption of UV filters, emulsifiers, and bioactive complexes in formulations like BB creams, serums, and tinted moisturizers. Premium skincare and cosmetic segments are focusing on advanced ingredient systems that deliver targeted benefits, improving perceived value among consumers. Customization and personalized beauty solutions are driving the need for ingredients that ensure compatibility across various skin types and product categories, reinforcing their strategic importance.

Functional cosmetic ingredient suppliers are responding to rising demand for nature-inspired solutions by incorporating plant-derived oils, botanical extracts, and marine actives into formulations. These ingredients appeal to consumers who value purity, minimal processing, and skin-friendly properties. The preference for clean-label and naturally sourced components has pushed manufacturers to reformulate products while maintaining efficacy and stability. Suppliers are investing in extraction techniques and ingredient standardization to ensure consistent performance across diverse applications. This trend not only enhances brand credibility but also provides opportunities for premium positioning, especially in markets where ingredient authenticity strongly influences purchase behavior.

Strict regulatory frameworks governing cosmetic ingredients play a significant role in shaping the market landscape. Compliance with regional standards such as EU Cosmetics Regulation and FDA guidelines influences ingredient selection and formulation strategies. Suppliers are required to provide detailed safety data, allergen profiles, and clinical validation to meet quality benchmarks. This has driven investments in R&D to develop ingredients that meet evolving safety and performance standards without compromising sensory attributes. Regulatory compliance also impacts speed-to-market for new product launches, making partnerships with certified suppliers a strategic priority for brands aiming to maintain a competitive edge in the industry.

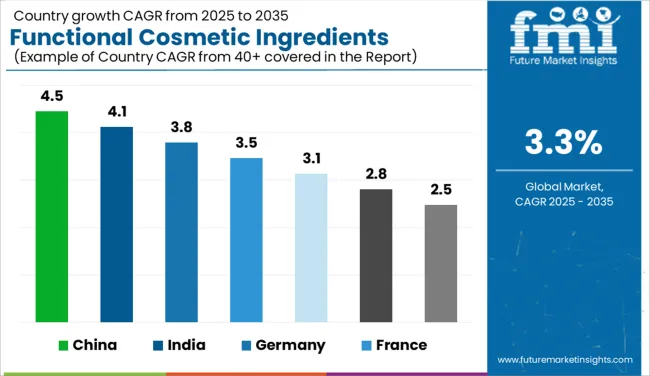

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The functional cosmetic ingredients market, projected to grow globally at a CAGR of 3.3% from 2025 to 2035, is showing varied regional trends. China leads with a CAGR of 4.5%, supported by rapid growth in skincare and premium beauty products integrating bioactive compounds. India follows at 4.1%, benefiting from the increasing demand for herbal and natural cosmetics combined with rising disposable incomes and expanding e-commerce penetration. France reports 3.5% CAGR, leveraging its dominance in luxury beauty with a focus on multifunctional and plant-based formulations, while the United Kingdom stands at 3.1%, driven by personalized beauty and clean-label innovations. The United States, with a CAGR of 2.8%, remains a mature market where innovation in multifunctional formulations and natural ingredient adoption sustains moderate growth. These dynamics confirm that Asia-Pacific is steering market acceleration, while Europe and North America maintain stability through premiumization and safety-driven consumer trends. The report provides a comprehensive review of 40+ countries, highlighting these five as key benchmarks for market strategies and growth opportunities globally.

The CAGR of the functional cosmetic ingredients market in the United Kingdom increased from nearly 2.5% during 2020-2024 to 3.1% for 2025-2035, supported by rising demand for clean-label formulations and multifunctional products. A strong preference for anti-aging creams and sun-care solutions has driven higher integration of UV filters, humectants, and plant-based actives. E-commerce platforms played a pivotal role in promoting ingredient transparency, influencing consumers to opt for premium and clinically validated products. Brands in the UK are investing in R&D to meet allergen-free and vegan-certified product trends while enhancing compatibility with various skin types. This transition toward natural, sustainable ingredient sourcing combined with advanced delivery systems is expected to remain a critical growth factor.

The CAGR in France moved from 2.9% in 2020-2024 to 3.5% during 2025-2035, driven by the premium skincare sector's emphasis on luxury formulations incorporating bioactive complexes. High consumer interest in anti-aging and skin-brightening products boosted demand for peptides and botanical extracts. French cosmetic brands have focused on multifunctional formulations such as BB creams and serums that deliver hydration, UV protection, and antioxidant benefits simultaneously. Regulatory alignment with EU standards has further pushed the adoption of clinically backed ingredients for sensitive skin. Growing consumer trust in French-origin products, along with strong export potential for premium skincare, positions France as a global leader in functional ingredient application trends.

China’s functional cosmetic ingredients market expanded from a CAGR of 3.7% during 2020-2024 to 4.5% in the 2025-2035 period, propelled by a surge in premium skincare demand and growing e-commerce penetration. Rising interest in anti-aging, whitening, and hydration products has led to increased adoption of peptides, ceramides, and natural botanical actives. Domestic brands are focusing on developing multifunctional products for both skincare and color cosmetics, creating a significant opportunity for ingredient suppliers. Government initiatives to strengthen local ingredient production and a shift toward clinically validated components have accelerated market maturity. Online beauty platforms continue to educate consumers on functional benefits, boosting ingredient transparency trends.

The CAGR in India rose from 3.4% in 2020-2024 to 4.1% during 2025-2035, supported by growing demand for herbal and natural beauty formulations. Increased consumer preference for Ayurvedic-inspired ingredients and premium clean-label products has transformed the functional ingredient landscape. Brands are introducing hybrid products combining hydration, anti-aging, and SPF protection in one application, creating opportunities for emulsifiers and humectants. Expansion of digital platforms and influencer-driven marketing has boosted awareness of product safety and efficacy, leading to higher adoption of dermatologically tested actives. Domestic manufacturers are investing in modern processing to meet rising demand for premium-grade ingredients.

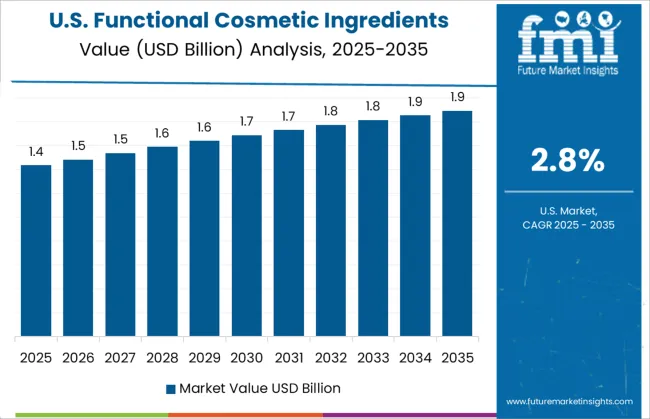

The CAGR of the USA functional cosmetic ingredients market climbed from 2.1% in 2020-2024 to 2.8% during 2025-2035, fueled by innovation in multifunctional products and clean-label formulations. Consumers increasingly favor actives like antioxidants, peptides, and ceramides for anti-aging and hydration benefits. Brands are prioritizing ingredient transparency, which has reinforced consumer trust in dermatology-backed products. Growth in premium and clinical skincare lines continues to shape demand for bioactive complexes and advanced emulsifiers. E-commerce platforms dominate distribution, supported by strong adoption of personalized beauty products and subscription models that integrate functional ingredients into everyday routines.

In the functional cosmetic ingredients sector, global leaders are focusing on advanced ingredient innovation, bio-based formulations, and performance-driven solutions to cater to premium skincare, personal care, and multifunctional product segments. BASF SE, Dow Inc., and Croda International Plc dominate through investments in specialty actives and emulsifiers, emphasizing skin hydration, barrier protection, and anti-aging properties. Ashland Global Holdings Inc. and Clariant International Ltd. are leveraging clean-label trends with botanical extracts and biodegradable solutions. Evonik Industries AG and Givaudan SA are strengthening portfolios with sensorial actives and green chemistry processes, while Lonza Group Ltd. and DSM Nutritional Products AG lead in biotech-driven peptides and vitamins for clinical-grade skincare. Solvay SA and Lubrizol Corporation focus on multifunctional surfactants and rheology modifiers for stability and texture enhancement. Innospec Inc. and Eastman Chemical Company target safe and high-performance conditioning agents, while Wacker Chemie AG develops silicone-based solutions for sensory appeal. Seppic SA drives innovation in marine-derived actives and multifunctional emulsifiers, supporting the growing demand for luxury and dermocosmetic applications. These companies prioritize R&D, regulatory compliance, and strategic partnerships to maintain leadership in a market driven by ingredient efficacy, consumer transparency, and evolving clean beauty standards.

In April 2025, BASF launched three new natural-based ingredients, Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA, under its Longevity Ecosystem at in‑cosmetics Global.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Ingredient | Emollients and Moisturizers, Antioxidants, Sunscreen Agents, Anti-Aging Agents, Whitening Agents, Anti-Inflammatory Agents, Peptides and Proteins, Botanical Extracts, Vitamins and Minerals, and Others |

| Application | Skin care product, Hair care products, Oral care products, Makeup products, and Others |

| Functionality | Moisturizing and Hydrating, Anti-Aging and Wrinkle Reduction, Sun Protection, Skin Brightening and Whitening, Acne Treatment and Oil Control, Hair Repair and Nourishment, Color Enhancement and Pigmentation, Dental Health and Whitening, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Dow Inc., Croda International Plc, Ashland Global Holdings Inc., Clariant International Ltd., Evonik Industries AG, Givaudan SA, Lonza Group Ltd., DSM Nutritional Products AG, Solvay SA, Lubrizol Corporation, Innospec Inc., Eastman Chemical Company, Wacker Chemie AG, and Seppic SA |

| Additional Attributes | Dollar sales, share by region and application, demand by ingredient type, competitive positioning, pricing trends, regulatory frameworks, consumer preferences for bio-based actives, and innovation-driven growth opportunities. |

The global functional cosmetic ingredients market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the functional cosmetic ingredients market is projected to reach USD 5.0 billion by 2035.

The functional cosmetic ingredients market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in functional cosmetic ingredients market are emollients and moisturizers, antioxidants, sunscreen agents, anti-aging agents, whitening agents, anti-inflammatory agents, peptides and proteins, botanical extracts, vitamins and minerals and others.

In terms of application, skin care product segment to command 38.2% share in the functional cosmetic ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Functional Films Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA