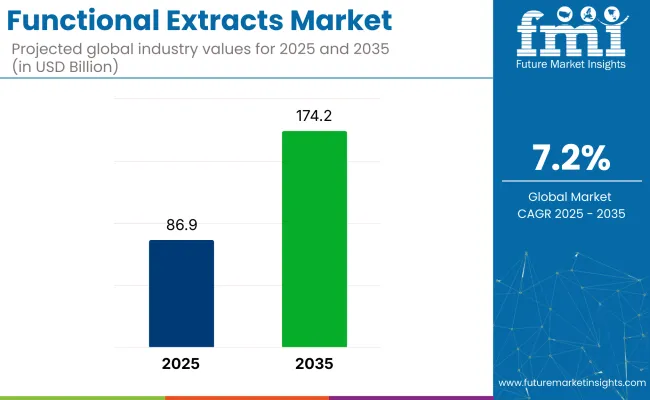

The functional extracts market is valued at USD 86.9 billion in 2025 and is projected to reach USD 174.2 billion by 2035. This market is expected to grow at a CAGR of 7.2% across the period.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 86.9 billion |

| Industry Value (2035) | USD 174.2 billion |

| CAGR (2025 to 2035) | 7.2% |

Growth has been observed within nutraceuticals, food and beverage formulations, personal care products, and veterinary nutrition, where botanical, animal, and microbial derivatives are being adopted for targeted physiological effects.

Global trade patterns, supply-chain integration, and contract extraction services have been reorganized to match expanding application sets and evolving regulatory oversight. Investment has been directed toward scalable bioprocessing and solvent-free techniques to meet rising safety and purity benchmarks.

The functional extracts market register 32% of the functional food ingredients market, 28% of the nutraceutical ingredients market, and 24% of the herbal and botanical extracts market in 2025. Within the pharmaceutical excipients segment, functional extracts held a smaller 11% share due to strict compliance demands. In the specialty chemicals category, it represented close to 6%, limited by its niche positioning relative to broader industrial applications.

This distribution reflects the convergence of products across multiple application domains, driven by rising demand for bioactive, natural, and health-targeted ingredients. As multifunctional roles of extracts expand in foods, supplements, and therapeutics, their cross-category presence is expected to strengthen, particularly in markets aligned with wellness, clean label preferences, and plant-derived formulations.

Biorefineries that once focused on oleoresin spice concentrates are now leasing night-shift capacity to cannabidiol processors, allowing the same supercritical CO₂ compressors to run close to 22-hour duty cycles.

This cross-category asset pooling has lifted utilization from 54% to 88% and cut per-kilogram extraction energy costs for curcumin, lutein, and rosmarinic-acid fractions by 17%. Spent hemp biomass left after cannabinoid stripping is being pyro-activated onsite and repurposed as a low-ash filtration aid that replaces imported diatomaceous earth in downstream clarifiers.

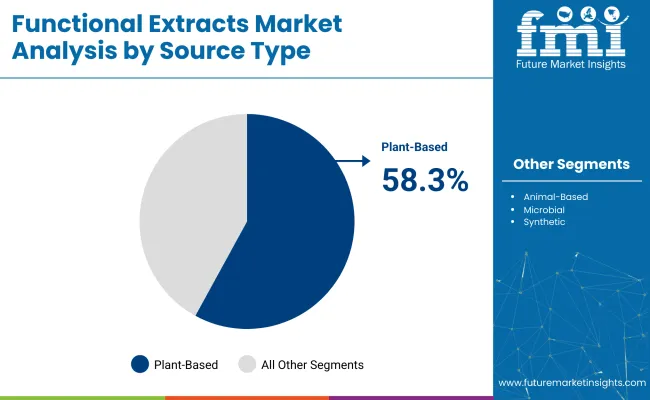

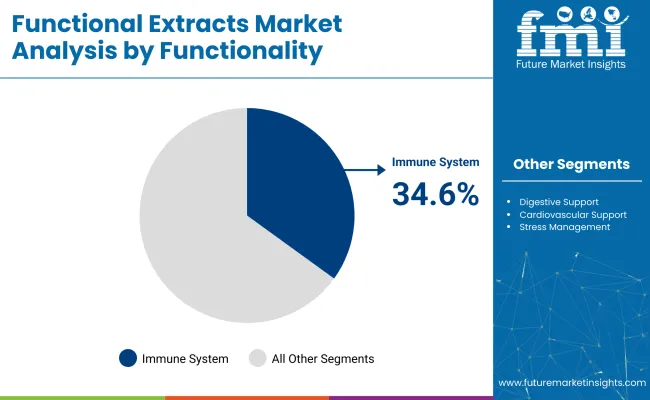

Plant-based extracts captured 58.3% of 2025 functional-extract sales, with immune-support formulations accounting for 34.6%. Solvent extraction supplied 41.2% of output, and food-and-beverage lines absorbed 36.8%, showing consumer preference for clean-label botanicals and the cost efficiency of established production methods.

Plant-based extracts accounted for 58.3% of the functional extracts market in 2025, driven by their alignment with evolving consumer expectations, flexible regulatory acceptance, and ease of integration across food, supplement, and personal care formulations.

Immune system support emerged as the leading functionality segment within the functional extracts market, holding a 34.6% share in 2025.

Solvent extraction held the leading position among extraction methods in the functional extracts market, accounting for 41.2% of total value. Its dominance stems from its long-standing industrial adoption, cost-efficiency, and compatibility with a wide range of plant, animal, and microbial sources.

The food and beverage segment led the functional extracts market with a 36.8% share, driven by expanding integration of natural bioactives into mainstream consumer diets.

Functional extracts are gaining momentum as validated health claims and clearer regulatory paths bring botanical ingredients into mainstream product lines. Improvements in extraction technologies are making supply more reliable by boosting yield and reducing cost, giving manufacturers better control over formulation inputs and output quality.

Botanical Ingredient Credibility Drives Consumer Uptake

Consumer confidence in botanical ingredients is rising, supported by peer-reviewed studies and growing regulatory approval. A 2024 study found that 300 mg of standardized ashwagandha reduced cortisol levels by 22% over eight weeks, reinforcing its use in stress management.

At the same time, GRAS approvals increased by 13% in 2025, helping ingredients like turmeric, elderberry, and ginseng move into global markets more easily. Large food and beverage companies have expanded their use of polyphenol-rich extracts, with product line extensions rising 19%. As a result, botanicals are now part of everyday functional foods, not just niche health items.

Extraction Method Shifts Reduce Production Volatility

Changes in extraction processes are making production more efficient and stable. In Vietnam, enzymatic methods recovered 16% more flavonoids from citrus peels and used 12% less energy than solvents. Cold-press hubs in Hungary cut processing time by 11% while improving oil quality.

BASF’s pilot using hybrid supercritical CO₂ showed a 23% increase in curcuminoid strength and cut post-processing needs by two-thirds. These advances are drawing interest from mid-size manufacturers looking to manage input costs and maintain consistent bioactive profiles without raising energy use.

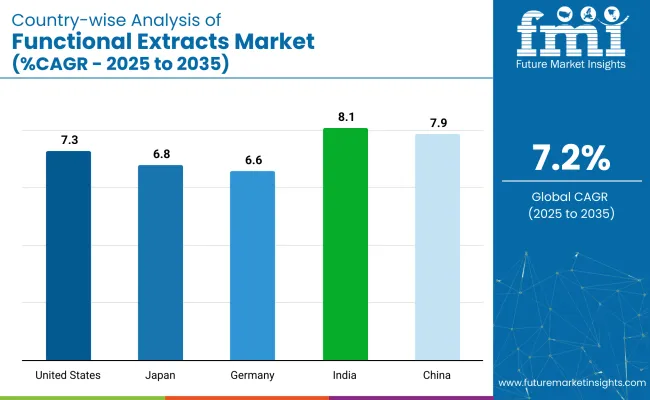

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.3% |

| China | 7.9% |

| Germany | 6.6% |

| Japan | 6.8% |

| India | 8.1% |

Functional extracts markets across key economies are advancing at varied paces, shaped by unique regulatory models, cultural frameworks, and consumer behaviors. India, recording the highest CAGR at 8.1%, is leveraging its deep-rooted Ayurvedic heritage, where traditional botanicals like tulsi and ashwagandha are being reformulated into modern delivery systems under government-supported GMP protocols, positioning the country as both a BRICS demand center and a global exporter.

China, also in the BRICS group, follows closely with 7.9% growth, fueled by the modernization of Traditional Chinese Medicine and strong integration of extracts into e-commerce and performance nutrition. In OECD economies, the USA market is expanding at 7.3%, where clinical validation and regulatory clarity under GRAS are allowing functional extracts to scale in beverages, snacks, and supplements.

Japan, growing at 6.8%, continues to rely on its FOSHU certification model, favoring high-bioavailability extracts in meal-integrated formats. Germany, with a 6.6% CAGR, is focusing on standardized botanical purity, where pharmacy-based distribution dominates and consumer trust hinges on risk-assessed claims aligned with EFSA oversight.

The USA functional extracts market is projected to expand at a CAGR of 7.3% from 2025 to 2035. This growth is being supported by a shift toward integrative health practices, where consumers increasingly seek natural alternatives to pharmaceuticals for chronic stress, fatigue, and immunity.

The USA Food and Drug Administration’s structured approach to GRAS certifications and dietary supplement regulation has made the country a reliable environment for clinical-grade botanical extract integration. Consumer awareness has also risen through direct-to-consumer brands leveraging transparent sourcing and formulation science. Functional extracts are now embedded in clean-label energy drinks, fortified snacks, and over-the-counter stress relief aids, creating volume across both mainstream retail and health-specialty outlets.

China’s functional extracts sector is forecast to grow at a CAGR of 7.9% through 2035. The surge is driven by a fusion of traditional Chinese medicine (TCM) principles with modern extraction science. Chinese consumers are increasingly demanding functional food formats featuring goji berry, ginseng, and cordyceps extracts, particularly for metabolic health, anti-fatigue, and circulation.

Government policies have promoted the standardization of herbal raw materials under the National Administration of Traditional Chinese Medicine, enabling stable output for both domestic and international consumption. Cross-border e-commerce platforms and health apps have further popularized evidence-based herbal formulations among younger consumers seeking non-pharmaceutical interventions for performance and vitality.

Germany’s functional extracts market is expected to register a CAGR of 6.6% during the analysis period. Local demand is rising from nutraceutical and personal care sectors that are increasingly using standardized botanical ingredients with proven health outcomes. Germany’s Federal Institute for Risk Assessment (BfR) and EFSA guidelines have prompted a shift toward clinically substantiated, pure-extract-based products, especially in sleep, digestion, and cognitive segments.

The domestic population is favoring preventive approaches to aging and chronic inflammation, driving incorporation of polyphenol-rich extracts in everyday foods and functional cosmetics. German pharmacies and apothecaries are key distribution points, offering capsules, tonics, and powders formulated with adaptogens, nootropics, and flavonoid complexes.

Japan’s functional extracts market is anticipated to rise at a CAGR of 6.8% through 2035. Growth is anchored by the nation’s structured Foods for Specified Health Use (FOSHU) system, which has cultivated consumer trust in functionally labeled products. Japanese companies have invested in precision extraction techniques such as enzymatic and supercritical methods to preserve the integrity of active ingredients like catechins, astaxanthin, and fucoidan.

Domestic consumers are highly receptive to plant-derived ingredients integrated into daily routines via fortified teas, soups, and wellness capsules. As lifestyle-related conditions such as fatigue, gut health, and stress remain top concerns, extract blends that promise multi-functional health outcomes are securing shelf space in convenience stores, pharmacies, and department stores.

India’s functional extracts industry is estimated to grow at a CAGR of 8.1% between 2025 and 2035. This momentum is driven by the integration of Ayurvedic formulations into mass-market food and health products.

Consumer acceptance of herbal remedies has long been entrenched, but the shift toward modernized formats, such as sachets, capsules, and flavored drinks, is expanding the use of extracts like tulsi, ashwagandha, and giloy.

Backed by the Ministry of AYUSH and industry players investing in standardized extraction protocols, India is now a major export hub for botanical actives. Domestic demand is also surging due to rising middle-class incomes and increasing use of preventive health regimens across urban centers.

Archer Daniels Midland Company (ADM), Cargill, Incorporated, Kerry Group, Ingredion Incorporated, Givaudan SA, Ashland Global Holdings Inc., BASF SE, Kemin Industries, Inc., Dupont de Nemours, Inc., Sensient Technologies Corporation, Novonesis, Synthite Industries Pvt Ltd, Corbion N.V., International Flavors & Fragrances (IFF), Lonza Group AG, and others.

ADM, Kerry Group, and Givaudan are among the leading players, leveraging vertical integration and advanced extraction capabilities to serve global nutraceutical, food, and personal care industries. These firms focus on standardized botanical compounds, regulatory-compliant formulations, and clinical substantiation to meet rising demand. In cold-pressed and supercritical CO₂ extraction, combined with strategic partnerships for clean-label product development, has enabled these companies to strengthen their foothold across both developed and emerging markets.

Recent Functional Extracts Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 86.9 billion |

| Projected Market Size (2035) | USD 174.2 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Source Type Analyzed (Segment 1) | Plant-Based, Animal-Based, Microbial, Synthetic |

| Functionality Analyzed (Segment 2) | Immune System Support, Digestive Support, Energy And Metabolism Support, Cardiovascular Support, Stress Management. |

| Extraction Method Analyzed (Segment 3) | Solvent Extraction, Supercritical Fluid Extraction, Steam Distillation, Cold Pressing, Enzymatic Extraction. |

| Application Analyzed (Segment 4) | Food and Beverage, Nutraceuticals, Pharmaceuticals, Cosmetics and Personal Care, Agriculture and Animal Feed. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Archer Daniels Midland Company (ADM), Cargill, Incorporated, Kerry Group, Ingredion Incorporated, Givaudan SA, Ashland Global Holdings Inc., BASF SE, Kemin Industries, Inc., Dupont de Nemours, Inc., Sensient Technologies Corporation, Novonesis, Synthite Industries Pvt Ltd, Corbion N.V., International Flavors & Fragrances (IFF), Lonza Group AG, and others. |

| Additional Attributes | Dollar sales, share by type and end user, rising demand in post-surgery recovery, growth in sports medicine and physiotherapy sectors, development of eco-friendly and biodegradable cold packs, regional usage variations |

The industry is segmented into plant-based, animal-based, microbial, and synthetic.

The industry is segmented into immune system support, digestive support, energy and metabolism support, cardiovascular support, and stress management.

The industry finds solvent extraction, supercritical fluid extraction, steam distillation, cold pressing, and enzymatic extraction.

The industry is segmented into food and beverage, nutraceuticals, pharmaceuticals, cosmetics and personal care, agriculture and animal feed.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 86.9 billion in 2025.

It is forecasted to reach USD 174.2 billion by 2035.

The industry is anticipated to grow at a CAGR of 7.2% during this period.

Plant-based are projected to lead the market with a 58.3% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 8.2%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA