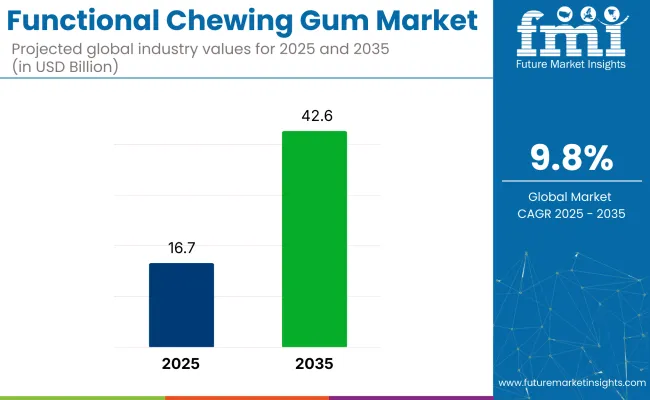

The functional chewing gum market is anticipated to rise from USD 16.7 billion in 2025 to USD 42.6 billion by 2035, reflecting a 9.8% CAGR. Growth is being shaped by time-constrained consumers seeking fast, discreet wellness delivery that bypasses pills, water, and calorie intake.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 16.7 billion |

| Industry Value (2035) | USD 42.6 billion |

| CAGR (2025 to 2035) | 9.8% |

Regulatory clearance for actives like nicotine, caffeine, and vitamins has added legitimacy, while endorsements from dental and sports bodies have expanded its acceptance. These shifts have positioned functional gum between impulse and planned routines, with presence growing across pharmacies, gyms, c-stores, and D2C platforms. The format now serves both snack aisles and supplement categories, offering formulation flexibility, habitual repeat usage, and cross-category visibility-core features fueling its future scale.

The industry holds for a projected 11-13% share of the global nutraceuticals market, 4-6% within dietary supplements, and roughly 2-3% of the wider functional foods and beverages category. In the oral care products market, its presence is still nascent at under 2%, though growing through anti-cavity and whitening gums.

Within the broader confectionery space, it represents 6-8%, driven by a shift from sugar-based indulgence to health-positioned formulations. Its cross-category appeal allows it to draw revenue from adjacent sectors without fully displacing traditional delivery systems.

This hybrid identity has created marketing flexibility, enabling brands to position gums as both wellness aids and snack alternatives. That overlap is fueling its inclusion across pharmacy, fitness, and grocery aisles.

Production in the functional chewing gum market is being transformed by repurposing equipment from the pharmaceutical sector. Facilities that once made transdermal patches are now being used to produce thin films, which are cut into small, porous gum pellets.

This change lowers capital costs by about 38% compared to installing traditional gum extrusion lines. It also makes it easier to include heat-sensitive ingredients like probiotics and saffron-based actives with consistent dosing.

Early studies from Nordic clinics show that vitamin B12 delivered through gum can result in 15% higher absorption in the body compared to lozenges with the same dose. This gives brands more room to make health claims while using less of the ingredients.

These upgraded production lines also use laser scoring, which lets manufacturers switch between different product types-like caffeine and melatonin gums-in under 45 minutes. As a result, companies can quickly produce custom batches. This type of backend efficiency is becoming a key driver of profit margins and speed to market.

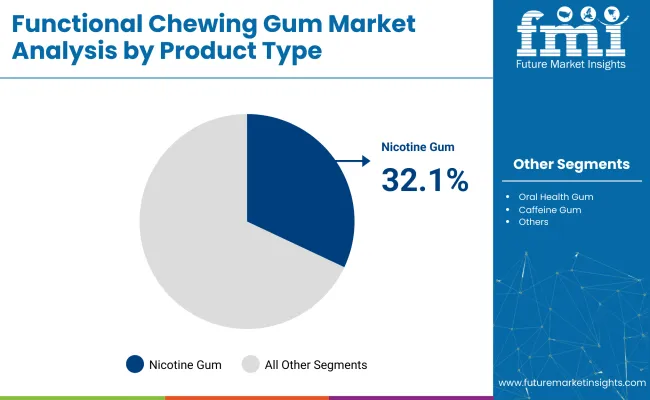

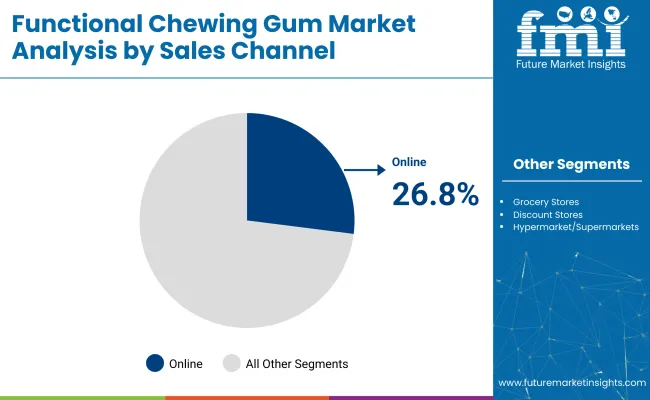

Nicotine gum has emerged as the leading product type, driven by its clinical credibility, regulatory backing, and growing use in smoking cessation programs. Online channels dominate sales due to their accessibility, personalization, and ability to directly connect consumers with specialized functional gum offerings.

Nicotine gum is expected to hold 32.1% of functional chewing gum revenue in 2025, driven by its well-established use in smoking cessation. Approval from regulatory bodies like the FDA and EMA has positioned it as a medically recognized product, giving it access to pharmacy shelves and even insurance coverage in some markets.

Online platforms are forecasted to account for 26.8% of total sales in 2025, reflecting a change in how consumers prefer to access wellness products. Buyers are moving away from in-store purchases and toward websites that offer clear ingredient information, detailed product comparisons, and targeted claims.

Functional chewing gum is gaining traction as a credible therapeutic format, supported by regulatory approvals and controlled-release delivery systems. Direct-to-consumer channels and low-touch logistics are accelerating growth through personalized access, efficient fulfillment, and subscription-driven engagement.

Therapeutic Format Gains Credibility Through Clinical and Regulatory Endorsement

Functional chewing gum is evolving into a recognized therapeutic format, supported by clinical data and regulatory approvals. With nicotine and caffeine already approved for gum-based delivery by agencies like the FDA and EMA, the format has moved beyond novelty and into the healthcare space.

This endorsement has enabled wider pharmacy distribution and made reimbursement possible in some markets. As more actives such as melatonin, CBD, and probiotics are formulated into gum, investor focus has shifted from flavor development to science-backed claims. Compliance is being reinforced through controlled-release systems and accurate dosing, validated in absorption studies, which improves user trust and repeat use.

Supply Chain Shift Favors DTC and Low-Touch Digital Distribution

The supply chain for functional chewing gum is adapting to direct-to-consumer demand. Shoppers increasingly want targeted wellness products without going through retail stores. Online platforms enable fast feedback, faster reformulations, and better targeting for goals like focus, stress relief, or sleep.

Brands are using subscription models to drive regular use, and the money saved by skipping retail margins is being redirected into higher-quality ingredients. Lightweight, shelf-stable gum formats offer a lower shipping cost per unit compared to pills or drinks. SEO and influencer-driven marketing are reducing barriers to trial and helping brands scale efficiently online.

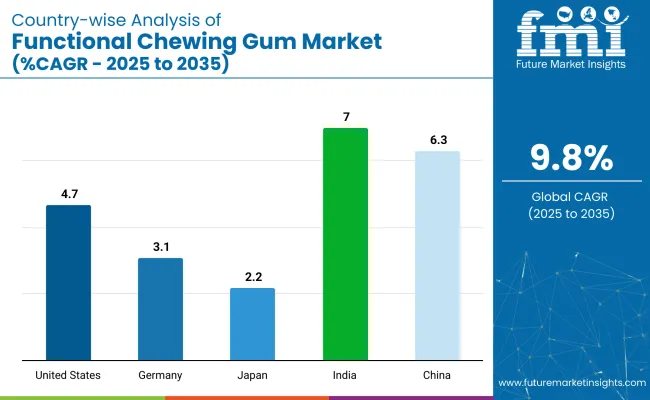

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

| Germany | 3.1% |

| Japan | 2.2% |

| China | 6.3% |

| India | 7.0% |

The functional chewing gum industry, forecast to grow globally at a CAGR of 9.8% between 2025 and 2035, is showing divergent growth trajectories across major economies. The United States, an OECD member, is expected to expand at 4.7%, supported by regulatory-backed nicotine gums and growing demand for stress and energy variants across pharmacy, retail, and e-commerce formats.

Germany and Japan, both part of the OECD, are set to grow at 3.1% and 2.2% respectively. In Germany, clean-label and sugar-free formats are gaining traction through trusted pharmacy channels, while Japan is seeing gradual uptake in oral care and memory-support gums among its aging population.

Faster growth is projected in BRICS economies, with China forecast at 6.3% and India at 7.0%. China’s growth stems from digital-first wellness behaviors, where beauty, detox, and cognitive gum formulations are flourishing on platforms like Tmall and JD.com. India’s expansion is fueled by rising demand for Ayurvedic and nicotine-based gums, growing retail reach, and mobile-driven consumer engagement.

The USA functional chewing gum market is estimated to grow at 4.7% CAGR during the forecast period. Expansion in the USA has been attributed to behavioral health trends, clinical integration of nicotine-replacement therapy, and wide availability through omnichannel retail formats.

Consumers are increasingly choosing gums for energy, stress relief, and immunity boosts in place of traditional supplements. Pharmaceutical chains and health-focused convenience outlets have broadened shelf space for caffeine and melatonin-based gums.

National advertising campaigns have normalized functional gums in fitness, travel, and workplace settings, particularly with discrete and zero-calorie formats. FDA approval of specific actives for chewing gum has legitimized health claims, while post-COVID wellness priorities have reshaped consumer loyalty.

Germany’s functional chewing gum industry is expected to register a 3.1% CAGR from 2025 to 2035.Germany’s progress in this segment stems from its dense pharmacy network, public trust in science-backed health products, and strong dental association advocacy for sugar-free formats.

Functional gums that support oral health, vitamin intake, or nicotine withdrawal are positioned as compliant with national health guidelines. Reformhaus and apothecary channels promote gums with botanicals, probiotics, or vegan actives, while local private-label lines have gained traction due to traceability claims and clean-label credentials.

Gum formats have appealed to German consumers seeking alternatives to tablets and lozenges, especially among older demographics wary of swallowing pills. Marketing has leaned on bio availability and low sugar content, aligning with Germany’s preventive-health narrative.

China’s functional chewing gum market is forecast to expand at a CAGR of 6.3% between 2025 and 2035, rising health awareness among young professionals, coupled with a cultural preference for functional formats in portable packaging, is driving gum uptake. Local e-commerce platforms such as Tmall and JD.com feature a growing range of imported and domestic functional gums for beauty, cognitive enhancement, and weight control.

Collagen-boosting gums and detox blends appeal to urban wellness-conscious consumers, while nicotine gums are gaining traction as smoking rates remain high among men. Regulatory easing for functional ingredients in gum form has encouraged cross-border brand entries, especially from Japan and South Korea. Integration with health-tracking apps and WeChat-based wellness programs has accelerated repeat purchase behavior

Japan is projected to see its functional chewing gum market increase at 2.2% CAGR through 2035.Japan’s conservative pace reflects saturation in traditional confectionery and limited consumer exposure to therapeutic gum formats.

However, functional gums are gradually being adopted as a wellness tool among aging populations, particularly for oral care, memory support, and sleep enhancement. Japanese manufacturers are emphasizing dental function, anti-bacterial claims, and probiotic content to align with national dental-care policies.

The country’s high compliance with daily routines has created opportunity for timed gum regimens, morning energy, midday focus, and nighttime relaxation. Distribution has been concentrated in convenience stores, drugstores, and commuter kiosks, with QR-linked traceability gaining attention. Refinement in chewing experience and flavor modulation is expected to shape premium segments.

India’s functional chewing gum industry is projected to grow at a CAGR of 7.0% during the forecast timeline.India’s growth trajectory stems from increased awareness of functional nutrition, a rise in digital wellness content, and the availability of gums as affordable alternatives to capsules or beverages. Youth-focused formulations, such as caffeine, ginseng, and mood-regulating botanicals, are gaining popularity, particularly in metros and Tier-2 cities.

The country’s high smoking prevalence has also fueled nicotine gum demand, supported by government cessation campaigns and broader pharmacy penetration. Local brands and D2C startups are leveraging Instagram and WhatsApp commerce to engage younger buyers, especially with Ayurvedic and vegan ingredients that align with cultural dietary preferences. Functional gums are also being integrated into fitness centers and workplace wellness kits.

The functional chewing gum sector is shaped by global confectionery giants and specialized innovators targeting therapeutic formats, wellness delivery, and nicotine replacement. Companies like Mars, Incorporated, Mondelez International, and Lotte have expanded beyond traditional gum to launch function-specific SKUs for energy, immunity, and oral care.

Perfetti Van Melle and Cloetta leverage extensive retail networks to distribute botanical and vitamin-infused gums across Europe and Asia. Medical-focused brands such as GSK (Nicotinell) and Hager & Werken focus on smoking cessation and dental applications with clinically validated formulations.

Niche entrants like Military Energy Gum, ZOFT Gum, and Lemon Pharma are gaining momentum by offering caffeine-based, CBD-infused, and natural ingredient formats through direct-to-consumer platforms, appealing to younger, health-conscious consumers across North America and Europe.

Recent Functional Chewing Gum Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 16.7 billion |

| Projected Market Size (2035) | USD 42.6 billion |

| CAGR (2025 to 2035) | 9.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Type Analyzed (Segment 1) | Oral Health Gum, Nicotine Gum, Caffeine Gum, Weight Management Gum, CBD-Infused Gum, Functional Ingredients Gum, Sugar-Free Gum, Memory and Focus Gum. |

| Sales Channel Analyzed (Segment 2) | Hypermarket/Supermarkets, Grocery Stores, Discount Stores, Online Sales. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Mars, Incorporated, Mondelez International, Lotte, Perfetti Van Melle, Cloetta, Hager & Werken, GSK ( Nicotinell ), Military Energy Gum, ZOFT Gum, Lemon Pharma. |

| Additional Attributes | Dollar sales, share by product type, ingredient trends, top-performing regions, consumer demographics, regulatory shifts, sales channel performance, and competitive positioning across formats. |

The industry is segmented into oral health gum, nicotine gum, caffeine gum, weight management gum, CBD-infused gum, functional ingredients gum, sugar-free gum, memory and focus gum.

The industry is segmented into hypermarket/supermarkets, grocery stores, discount stores, online sales.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 16.7 billion in 2025.

It is forecasted to reach USD 42.6 billion by 2035.

The industry is anticipated to grow at a CAGR of 9.8% during this period.

Nicotine gum are projected to lead the market with a 32.1% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 7.0%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA