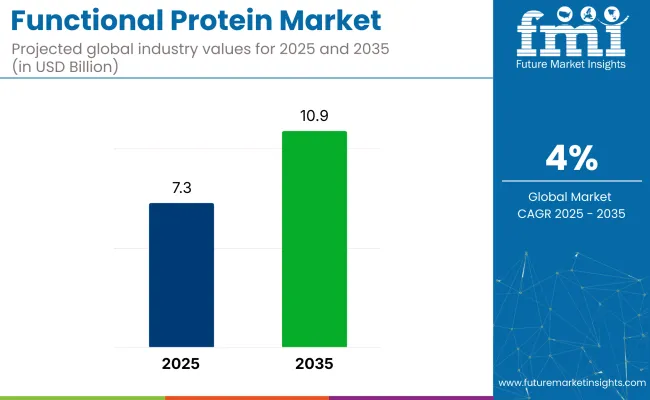

The global functional protein market is projected to grow from USD 7.3 billion in 2025 to USD 10.9 billion by 2035, registering a CAGR of 4%. Market expansion is being fueled by rising consumer awareness of nutrition, growing demand for performance-enhancing ingredients in food, and the shift toward plant-based and clean-label dietary solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.3 billion |

| Industry Value (2035F) | USD 10.9 billion |

| CAGR (2025 to 2035) | 4% |

Functional proteins are gaining traction across sports nutrition, dietary supplements, and functional food segments as consumers seek products supporting muscle health, immunity, satiety, and gut well-being.

The market holds approximately 18% share in the global protein ingredients market, driven by rising demand for targeted health benefits. Within the functional food and beverage market, it accounts for around 2%, as a key contributor to wellness formulations. In the nutraceuticals market, functional proteins represent about 6%, supported by their use in supplements.

The market captures nearly 4% of the sports nutrition market, where high-performance products are in demand. Its share in the broader health and wellness market is modest, at under 1%, but growing due to increased interest in clean-label and personalized nutrition solutions.

Government regulations impacting the market focus on product safety, clean labeling, and health claims verification. The Food Safety and Standards Authority of India (FSSAI) regulates the labeling and nutrient content of protein supplements under the Food for Special Dietary Use (FSDU) guidelines.

Internationally, the EFSA (European Food Safety Authority) and US FDA enforce strict norms on allergen declarations, protein source traceability, and permissible health claims. These frameworks drive the adoption of standardized, high-quality functional protein formulations that comply with labeling, sustainability, and safety standards, thereby boosting market credibility and consumer trust.

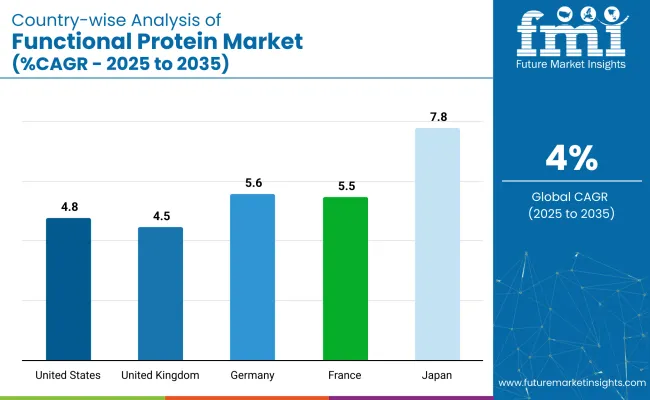

Japan is projected to be the fastest-growing market, expanding at a CAGR of 7.8% from 2025 to 2035. Dry segment will lead the form categorywith a 67% share, while dietary supplements will dominate the application segment with a 38% share. The USA and Germanmarkets are also expected to grow steadily at CAGRs of 4.8% and 5.6%, respectively.

The functional protein market is segmented by product type, form, source, application, distribution channel, and region. By product type, the market is categorized into hydrolysates, whey protein concentrates, whey protein isolates, casein and caseinates, soy protein, and others (microparticulated proteins, modified starches, fiber-based replacers, and cellulose derivatives). Based on form, the market is bifurcatedinto dry and liquid. By source, the market is divided into animal (dairy, egg, gelatin) and plant (soy, wheat, vegetable).

In terms of applications, the market is classified into food, beverages, dietary supplements, and animal nutrition. Based on distribution channel, the market is segmented into direct and retail (pharmacy stores, e-retailers, specialty stores, and supermarkets). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia &Pacific, East Asia, and Middle East &Africa.

Hydrolysates are projected to lead the product type segment, capturing 26% of the market share by 2025.

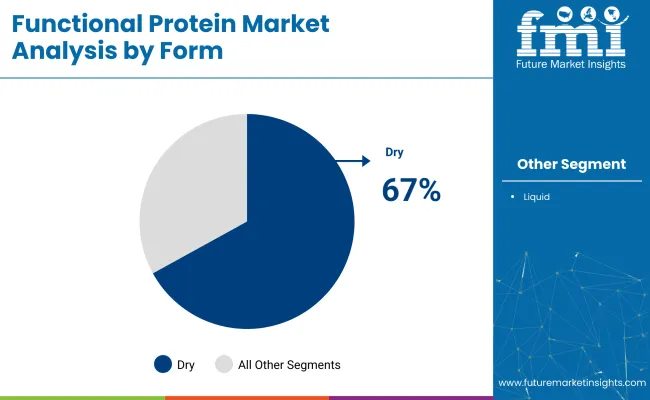

Dry formare expected to dominate the form segment, accounting for 67% of the market share in 2025.

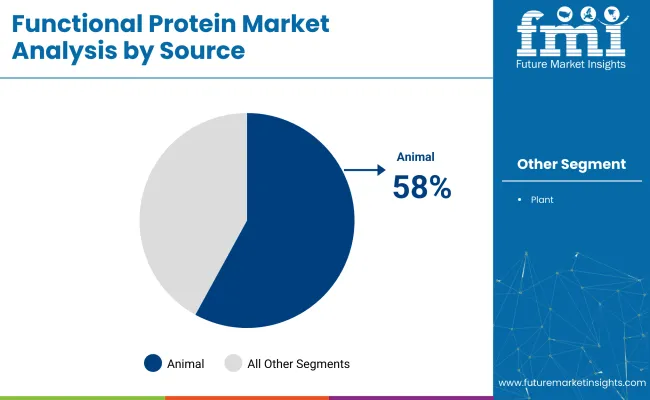

Animal-based proteins are set to dominate the source segment with 58% share in 2025.

Dietary supplements are expected to dominate the application segment, capturing 38% of the global share in 2025.

E-retailers are projected to lead the retail distribution segment, holding 85% of the market share in 2025.

The global functional protein market is growing steadily, fueled by rising demand for health-focused nutrition that supports immunity, muscle development, weight control, and personalized wellness across preventive dietary applications.

Recent Trends in the Functional Protein Market

Challenges in the Functional Protein Market

Japan functional protein market momentum is anchored in holistic health trends, functional beverages, and regulatory alignment with clean-label nutrition standards. Germany and France maintain consistent demand driven by EU nutritional labeling laws and funding for plant-based innovation under the Green Deal. In contrast, developed economies such as the USA(4.8% CAGR), UK (4.5%), and Japan (7.8%) are expanding at a steady 1.13 to 1.95 times the global growth rate.

Japan leads with the highest growth rate at 7.8% CAGR, driven by innovations in gut health and clean-label formulations. Germany and France follow closely with 5.6% and 5.5% CAGR respectively, propelled by EU health regulations and plant-based demand. The USA shows a steady 4.8% CAGR, supported by personalized nutrition and sports applications.

Meanwhile, the UK registers a 4.5% CAGR, slightly above the global average, fueled by vegan trends and age-targeted products. Overall, East Asia, led by Japan, outpaces Western markets, while Europe remains regulation-driven and innovation-focused.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan functional protein revenue is growing at a CAGR of 7.8% from 2025 to 2035. Growth is driven by demand for ultra-functional, gut-friendly, and low-allergen formulations in protein beverages and dietary supplements. As a technology-oriented economy, Japan prioritizes precision in nutrition and embraces proteins with added cognitive, metabolic, and immune support.

The sales of functional protein in Germany are expanding at 5.6% CAGR during the forecast period, surpassing the global average and being strongly policy-led. EU mandates on health claims, consumer transparency, and plant-based food development are driving robust product innovation. Key applications include plant-based drinks, dairy alternatives, and high-protein bakery items.

The France functional protein market is projected to grow at a 5.5% CAGR during the forecast period, slightly above the global average. Demand is driven by national health strategies, flexitarian lifestyles, and funding for sustainable agri-food innovation.

Sectors such as sports nutrition, women’s health, and weight management dominate protein consumption. Modular product formats, such as ready-mix powders and shelf-stable drinks, are favored in urban and mid-sized markets.

The USA functional protein market is projected to grow at 4.8% CAGR from 2025 to 2035, translating to 1.2 times the global rate. Unlike emerging economies focused on accessibility, USA demand is driven by high-value segments such as sports recovery, immune health, and digital nutrition platforms. Protein usage is shifting toward personalized subscription-based supplements and fortified snacks.

The UK functional protein revenue is projected to grow at a CAGR of 4.5% from 2025 to 2035, slightly above global pace at 1.13 times the growth rate. Demand is led by aging populations, vegan lifestyle trends, and increased focus on women’s health.

The market is moderately consolidated, with leading players like InVivo, Cargill, Roquette Frères, Omega Protein Corporation, and DowDuPont dominating the industry. These companies offer a diverse range of high-quality functional proteins designed for applications in sports nutrition, dietary supplements, food, and beverage formulations. InVivo focuses on sustainable sourcing and plant-based protein development, while Cargill is recognized for its vertically integrated production and broad portfolio of animal and plant protein solutions.

Roquette Frères specializes in high-purity plant-based proteins, particularly from pea and rice sources. Omega Protein Corporation delivers marine-based functional proteins with bioactive health properties. DowDuPont emphasizes innovation in protein isolates and concentrates for clinical nutrition and specialized health applications.

Other key players like Amway, AMCO Proteins, and Herbalife International Inc. contribute by offering branded, performance-driven products across multiple consumer segments, supported by extensive retail and direct-to-consumer networks.

Recent Functional Protein Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 7.3 billion |

| Projected Market Size (2035) | USD 10.9 billion |

| CAGR (2025 to 2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Type Analyzed | Hydrolysates, Whey Protein Concentrates, Whey Protein Isolates, Casein and Caseinates, Soy Protein, and Others (Microparticulated Proteins, Modified Starches, Fiber -Based Replacers, and Cellulose Derivatives) |

| Form Analyzed | Dry and Liquid |

| Source Analyzed | Animal (Dairy, Egg, Gelatin), and Plant (Soy, Wheat, Vegetable) |

| Application Analyzed | Food, Beverages, Dietary Supplements, and Animal Nutrition |

| Distribution Channel Analyzed | Direct and Retail (Pharmacy Stores, E-retailers, Specialty Stores, Supermarkets) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | InVivo, Cargill, Roquette Frères, Omega Protein Corporation, DowDuPont, Amway, AMCO Proteins, Herbalife International Inc. |

| Additional Attributes | Dollar sales by equipment type, share by power, regional demand growth, policy influence, automation trends, competitive benchmarking |

The market is valued at USD 7.3 billion in 2025.

The market is forecasted to reach USD 10.9 billion by 2035, reflecting a CAGR of 4%.

Dry functional proteins will lead the form segment, accounting for 67% of the global market share in 2025.

Dietary supplements will dominate the application segment with a 38% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 7.8% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA