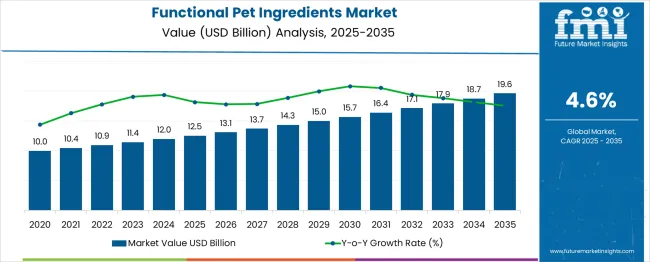

The functional pet ingredients market is projected to grow from USD 12.5 billion in 2025 to USD 19.6 billion by 2035, expanding at a CAGR of 4.6% over the assessment period. Annual growth rises steadily from USD 0.58 billion in 2026 to USD 0.86 billion by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.5 billion |

| Industry Value (2035F) | USD 19.6 billion |

| CAGR (2025 to 2035) | 4.6% |

This positive trend reflects rising consumer focus on preventative pet health and tailored nutrition. The market benefits from increasing inclusion of ingredients that support joint health, digestive function, skin and coat condition, and cognitive well-being in both food and supplements.

After 2030, growth is further supported by expanding product innovation, particularly in probiotic, plant-based, and omega-rich formulations. With pet owners treating animals more like family members, demand for functional nutrition is expected to continue expanding across premium and mass-market tiers.

The functional pet ingredients segment holds a unique position within several converging industries. Within the global pet care market valued at USD 280 billion, functional nutrition makes up 6-8%, supported by rising demand for targeted health solutions.

In the USD 140 billion pet food space, 12-15% of new product development focuses on functional additives like probiotics, omega-3s, and joint-support compounds. Veterinary-backed supplements contribute nearly 10% of the USD 40 billion pet supplement industry, signaling clinical alignment. Premium brands allocate 8-12% of formulation costs to health-focused ingredients to differentiate offerings.

Even in the natural pet products segment, valued at USD 50 billion, around 7-9% is driven by clean-label functional inputs that reflect human wellness trends being mirrored in companion animal care.

Sales of functional pet ingredients are being led by probiotics, soft chews, and digestive health claims. Dogs remain the dominant pet type, with strong retail traction in specialty stores and growing demand for plant-based, clean-label ingredient formulations.

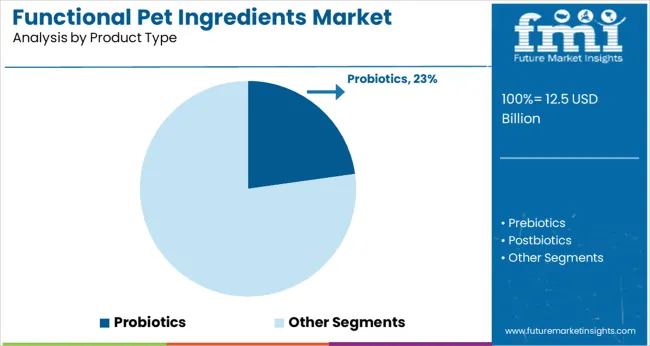

Probiotics are expected to capture 23% of the market by product type in 2025. Demand for functional pet ingredients with gut-supportive benefits is rising as awareness of microbiome health expands among pet owners. Probiotic strains help balance intestinal flora, boost immunity, and improve nutrient absorption. Manufacturers are introducing species-specific formulations tailored for dogs and cats.

Digestive health is forecast to account for 24.1% of the market by health claim in 2025. Functional pet ingredients targeting gastrointestinal wellness are resonating with owners focused on preventive care. Digestive aids like enzymes, fibers, and prebiotics are increasingly integrated into treats, toppers, and complete diets. Veterinary trends show strong alignment between gut health and overall vitality.

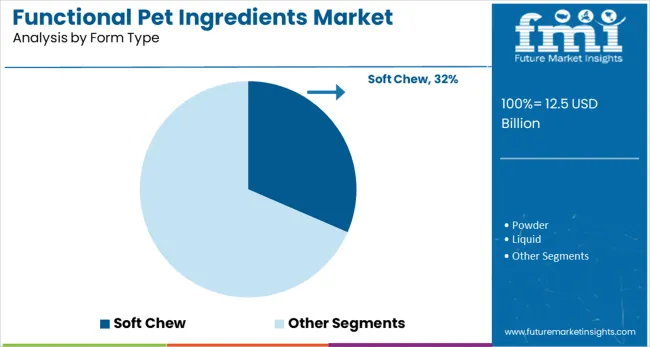

Soft chew formats are projected to hold a 32% share by form type in 2025. Sales of functional pet ingredients in soft chew delivery are increasing due to ease of administration and palatability. These treats double as supplements, eliminating the need for pills or powders. Senior pets and picky eaters particularly benefit from this form.

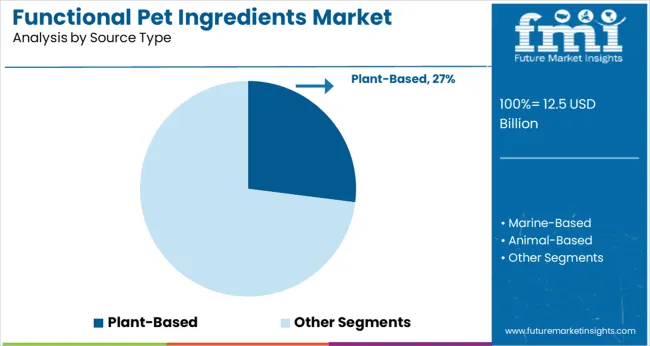

Plant-based ingredients are expected to contribute 27% of market share by source type in 2025. Demand for functional pet ingredients derived from natural botanicals is rising due to sustainability and perceived safety. Pea protein, turmeric, flaxseed, and ashwagandha are among the top-performing sources.

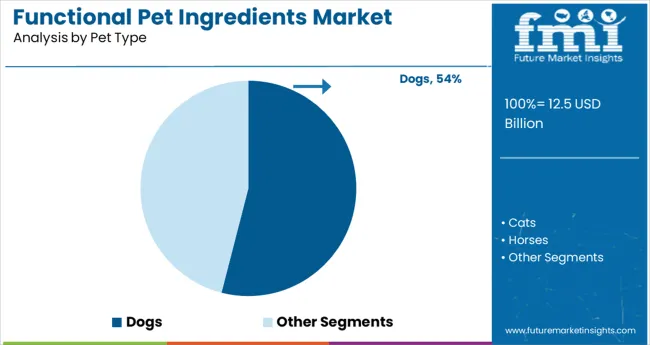

Dogs are expected to dominate with a 54% market share by pet type in 2025. Functional pet ingredient manufacturers are focusing heavily on canine-targeted SKUs, especially in large breeds and seniors. Dog owners actively seek solutions for joint, skin, gut, and cognitive health.

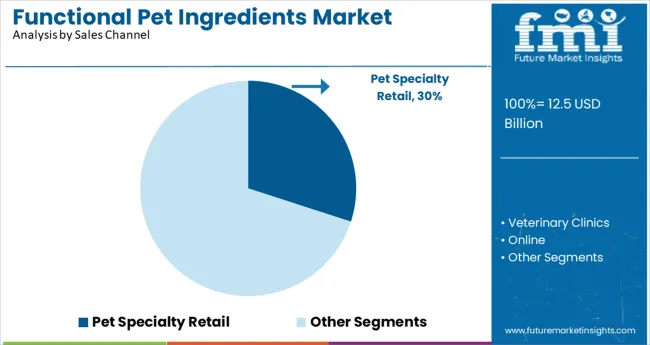

Pet specialty retail stores are projected to account for 30% of the market by sales channel in 2025. These outlets are preferred for their curated selections and staff expertise. Sales of functional pet ingredients through this channel benefit from premium positioning and brand storytelling.

The industry is accelerating as owners seek condition-specific formulations targeting immunity, digestion, mobility, and coat health. Ingredient innovations like postbiotics, adaptogens, and collagen peptides are driving premiumization. Growth is strongest in vet-recommended SKUs, senior pet nutrition, and gut-health-focused supplements across both canine and feline categories.

Postbiotics and Prebiotics Expand Gut-Health Segment

Postbiotic inclusion in dog and cat foods surged 41% in 2025, addressing microbiome balance and stool quality in high-sensitivity breeds. Brands using heat-treated Lactobacillus and yeast fermentates saw a 23% improvement in digestibility metrics. Functional treats with FOS and inulin grew 36%, especially in senior dog SKUs.

Subscription-based pet food services reported a 19% increase in repeat orders for gut-health lines featuring synbiotic blends. Veterinary channel formulations incorporating prebiotic fibers achieved 27% higher conversion in first-time customers. The combination of shelf-stable postbiotics with soluble fibers is reshaping product development in digestive care and establishing a new premium tier in functional formulations.

Joint Health SKUs Drive Collagen and Omega Inclusion

Pet food and supplements with collagen peptides and omega-3s saw a 38% YoY increase, driven by mobility support claims. Cold-pressed treats with type II collagen gained traction in aging dogs, with a 31% rise in reorder rates for SKUs targeting large-breed stiffness. EPA-DHA-rich algae oils replaced fish oil in 22% of new soft chew launches, offering better taste and shelf stability.

Veterinary-prescribed joint formulas grew 28%, with green-lipped mussel and MSM combinations gaining credibility in clinical trials. The convergence of clean-label mobility support and plant-sourced omegas is opening up cross-category innovations in functional jerky, toppers, and condition-specific wet diets.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.3% |

| Australia | 3.3% |

| United States | 2.3% |

| Japan | 1.6% |

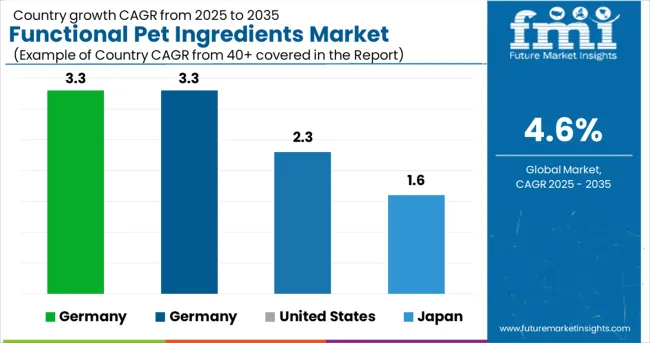

The global market is anticipated to expand at a CAGR of 4.6% from 2025 to 2035. This growth is largely fueled by shifting consumer attitudes toward pet wellness, particularly in emerging economies. Some OECD countries are seeing more subdued growth. The United States, for instance, is expected to register a CAGR of just 2.3% as the market reaches maturity and innovation plateaus in established pet food categories.

Similarly, Japan is forecast to grow at only 1.6%, reflecting an aging pet population and lower new product demand. In contrast, Germany and Australia are projected to grow at 3.3%, supported by evolving preferences for fortified pet food and premium dietary supplements.

While the global average remains robust, momentum is increasingly driven by emerging markets in Asia and Latin America rather than legacy economies. Strategic investments are shifting accordingly to capitalize on demand for functional formulations.

The report provides insights across 40+ countries. The four below are highlighted for their strategic influence and growth trajectory.

Germany is forecasted to grow at a CAGR of 3.3% by 2035. During the 2020-2024 period, interest in natural supplements and herbal additives spurred demand for Functional Pet Ingredients. Moving forward, sales will benefit from increased awareness around pet obesity, digestive care, and age-related conditions.

The market in Australia is set to grow at a CAGR of 3.3% through 2035. Over 2020-2024, the market expanded through direct-to-consumer channels and pet wellness startups. From 2025 onward, demand for Functional Pet Ingredients is expected to accelerate in natural kibble, grain-alternative diets, and holistic supplements.

The USA market is poised to grow at a CAGR of 2.3% through 2035. Between 2020 and 2024, the primary momentum came from premium pet food brands incorporating ingredients like omega-3s, probiotics, and antioxidants. Looking ahead, demand for Functional Pet Ingredients is expected to shift toward condition-specific formulations such as those targeting gut health and joint support.

Japan is expected to see a modest CAGR of 1.6% through 2035. Between 2020 and 2024, Functional Pet Ingredients were primarily adopted in limited-edition wellness pet food products. Going forward, an aging pet population will shape future demand for Functional Pet Ingredients that support mobility, vision, and immune health.

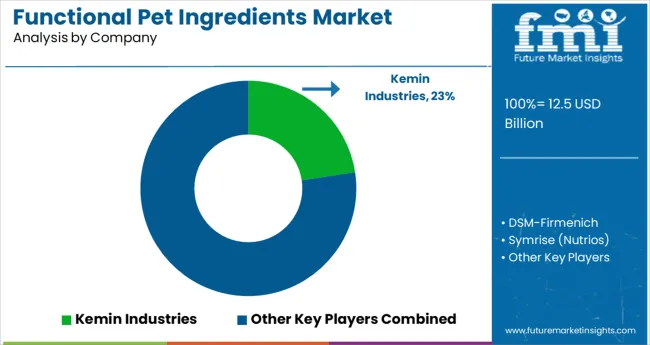

The market is witnessing intense competition, shaped by advancements in gut health, cognitive support, and mobility-enhancing solutions. Kemin Industries leads with a 22.6% share, driven by its patented postbiotics and natural antioxidant systems. DSM-Firmenich closely follows at 18.3%, leveraging innovations in algae-based omega-3s and immune-supporting nutrients.

ADM controls 16.1% of the market, with a stronghold in plant-based proteins and digestive prebiotics. Symrise, through its Nutrios division, commands 14.8%, particularly in palatability enhancers. Nestlé Health Science (Purina) contributes 12.4%, supported by clinical research and expanding functional portfolios.

Growth in the sector is projected at a 7.9% CAGR through 2035, with consumer demand favoring brands that combine science-backed efficacy with clean-label ingredient transparency.

Recent Functional Pet Ingredients Industry News

Report Coverage and Scope Summary

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 12.5 billion |

| Projected Industry Size (2035) | USD 19.6 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Prebiotics (Inulin, FOS, MOS), Probiotics, Postbiotics, Digestive Enzymes, Omega Fatty Acids (EPA, DHA, ALA), Collagen & Gelatin, Botanicals (Chamomile, Valerian Root, Turmeric, Green Tea, Milk Thistle), Functional Fibers (Pumpkin, Beet Pulp), Vitamins (C, E, D, B-complex), Minerals (Zinc, Magnesium, Selenium), Amino Acids, Antioxidants |

| Health Benefit Areas Analyzed (Segment 2) | Digestive Health, Immune Support, Joint & Mobility, Skin & Coat Health, Cognitive & Brain Health, Stress & Anxiety Relief, Cardiovascular Health, Weight Management & Metabolism, Urinary Tract Support, Dental & Oral Care, Vision Health, Liver Support |

| Form Types Analyzed (Segment 3) | Powder, Liquid, Soft Chew, Capsule/Tablet, Gel/Paste, Premix/Blend, Spray, Infused Treat, Functional Kibble Coating |

| Source Types Analyzed (Segment 4) | Plant-Based, Marine-Based (Fish Oil, Algae), Animal-Based (Collagen, Organ Extracts), Fermentation-Derived (Probiotics, Enzymes, Postbiotics), Synthetic/Isolated Nutrients |

| Pet Types Analyzed (Segment 5) | Dogs, Cats, Horses, Small Mammals (Rabbits, Guinea Pigs), Birds, Reptiles, Aquatic Pets (Fish) |

| Sales Channels Analyzed (Segment 6) | Pet Specialty Retail, Veterinary Clinics, Online (DTC e-Commerce, Amazon, Brand Stores), Mass Merchandisers (Walmart, Target), Grocery Retail, Subscription Box/Auto-Ship Services, B2B/Ingredient Supply |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Kemin Industries, DSM- Firmenich, Symrise ( Nutrios ), ADM (Pet Solutions), Nestlé Health Science (Purina) |

| Additional Attributes | Dollar sales, share by ingredient category and health benefit, rising demand for natural and functional supplements in pet nutrition, wide adoption in canine and feline diets, regional variation in formulation trends |

Includes prebiotics (Inulin, FOS, MOS), probiotics, postbiotics, digestive enzymes, omega fatty acids (EPA, DHA, ALA), collagen & gelatin, botanicals (Chamomile, Valerian Root, Turmeric, Green Tea, Milk Thistle), functional fibers (Pumpkin, Beet Pulp), vitamins (C, E, D, B-complex), minerals (Zinc, Magnesium, Selenium), amino acids, and antioxidants.

Covers digestive health, immune support, joint & mobility, skin & coat health, cognitive & brain health, stress & anxiety relief, cardiovascular health, weight management & metabolism, urinary tract support, dental & oral care, vision health, and liver support.

Available formats include powder, liquid, soft chew, capsule/tablet, gel/paste, premix/blend, spray, infused treat, and functional kibble coating.

Derived from plant-based, marine-based (Fish Oil, Algae), animal-based (Collagen, Organ Extracts), fermentation-derived (Probiotics, Enzymes, Postbiotics), and synthetic/isolated nutrients.

Target animals include dogs, cats, horses, small mammals (rabbits, guinea pigs), birds, reptiles, and aquatic pets (fish).

Distributed via pet specialty retail, veterinary clinics, online (DTC e-commerce, Amazon, brand stores), mass merchandisers (Walmart, Target), grocery retail, subscription box/auto-ship services, and B2B/ingredient supply.

Covers North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, and Western Europe.

The market is valued at USD 12.5 billion in 2025.

The market is forecasted to reach USD 19.6 billion by 2035, reflecting a CAGR of 4.6%.

Probiotics will lead the product type segment, accounting for 23% of the global market share in 2025.

Digestive health will dominate the benefit area with a 24.1% share in 2025.

Germany and Australia are projected to grow at the fastest rate, with a CAGR of 3.3% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Functional Films Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA