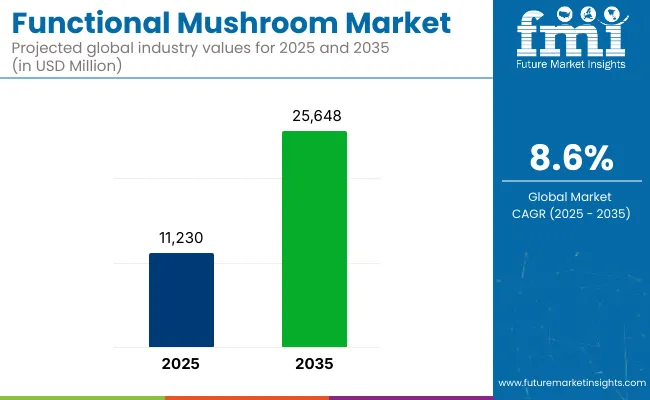

Between 2025 and 2035, the global market for functional mushrooms is expected to witness accelerated growth, increasing from USD 11,230 million to USD 25,648 million at a CAGR of 8.6%. This dynamic expansion is attributed to the rising demand for naturally sourced wellness ingredients that offer immune support, stress relief, and cognitive health benefits.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 11,230 million |

| Projected Market Value (2035F) | USD 25,648 million |

| Value-based CAGR (2025 to 2035) | 8.6% |

Functional mushrooms have steadily transitioned from niche applications to mainstream formulations across supplements, beverages, and snacks, driven by widespread consumer trust in their adaptogenic and anti-inflammatory potential.

Market expansion is being reinforced by an evolving landscape of health-conscious consumers who are increasingly seeking clean-label and plant-based solutions. Brands are responding by diversifying formulations with clinically supported mushroom species such as reishi, lion’s mane, and cordyceps.

Although regulatory ambiguities in some countries continue to pose challenges, product innovation across formats-from capsules and tinctures to functional teas and RTD drinks-is supporting market penetration. Key trends include the infusion of mushrooms in protein blends, beauty-from-within formats, and even pet supplements.

Manufacturers are scaling their extraction technologies and partnering with mycological experts to achieve standardization and quality assurance. However, fragmented supply chains and the need for consumer education around efficacy remain mild restraints.

Future growth will be guided by increased scientific validation and the incorporation of functional mushrooms into preventive health strategies. By 2025, supplements will continue to command the largest market share, but by 2035, fortified foods and beverages are projected to gain stronger ground due to convenience-driven consumption shifts.

Asia-Pacific and North America are forecast to remain dominant regions, supported by traditional usage patterns and rising nutraceutical investments. The market is poised to benefit from both biotech innovation and cross-industry collaborations aimed at improving ingredient delivery and functional benefits.

Animal health supplements account for an estimated 6.2% share of the global functional mushroom market in 2025. This segment is gaining traction as veterinary nutritionists and pet wellness brands turn to adaptogenic mushrooms to enhance immunity, cognitive function, and stress resilience in animals. Reishi and lion’s mane extracts are increasingly being used in canine and feline supplements targeting inflammation and cognitive aging, respectively.

Brands like Natural Pet Innovations and Nordic Naturals have incorporated mushroom-derived compounds into chewables and powdered formulations tailored for senior pets and anxious breeds. In the USA, regulatory guidance by the Association of American Feed Control Officials (AAFCO) has prompted clearer labeling practices and ingredient disclosures for such novel inclusions.

The segment’s growth is further supported by the rising trend in humanization of pets, where owners actively seek evidence-backed, holistic care. Despite regulatory fragmentation across markets and limited clinical trials in companion animals, the demand for functional mushroom-infused pet supplements is expanding.

Companies are expected to benefit by collaborating with veterinary professionals and adhering to local pet food standards such as those outlined by the European Pet Food Industry Federation (FEDIAF). Growth is anticipated to intensify in North America and Western Europe, where premium pet nutrition continues to command consumer attention.

Functional cosmetics containing mushroom extracts constitute approximately 5.1% of the total functional mushroom market in 2025. This subsegment is strategically positioned at the intersection of clean beauty, dermocosmetics, and nutricosmetics. Key mushroom species such as tremella, chaga, and reishi are leveraged for their high polysaccharide content, antioxidant capacity, and hydrating properties.

South Korea, France, and Japan lead product innovation in this space, with cosmetic giants like Shiseido, Innisfree, and L’Oréal launching serums, masks, and creams infused with fungal actives. The regulatory landscape remains favorable, particularly under the European Commission’s Cosmetics Regulation (EC No 1223/2009), which permits these mushrooms as cosmetic ingredients subject to safety assessments.

The rapid shift toward plant-derived skincare ingredients is accelerating formulation development, especially in anti-aging and anti-pollution skincare categories. Leading brands are investing in clinical validation to demonstrate skin barrier repair and UV-protection claims, particularly with β-glucan-rich extracts.

Cross-category innovation is also visible in ingestible beauty products where mushrooms serve dual roles in topical and oral regimens. While scalability of extraction and standardization remain challenges, companies are mitigating these through biotech partnerships and improved cultivation techniques. This segment is poised to expand significantly in East Asia and Western Europe through e-commerce and dermocosmetic retail channels.

Standardization and Quality Control

The functional mushroom industry is beset by the problem of standardization and quality control. In a food supplement vs. drug situation, different food supplements are never really under strict regulation, and differences in potency and purity are sure to happen. Unstandardized cultivation and harvest procedures can compromise such highly active constituents as triterpenoids and beta-glucans.

The challenge is addressed by the firms with research-proven investment, third-party labelling, and pre-emptive cultivation procedures to ensure product quality and consumer confidence.

Personalized Nutrition and Functional Drinks Growth

Functional growth provides enormous opportunities to the business. Mushroom tea, mushroom elixirs, and mushroom coffee are gaining popularity because people are willing to include health-supporting ingredients in their lives to save time. Food businesses prepare ready-to-eat packs with mushrooms blended with adaptogens such as Ginseng and Ashwagandha to provide resistance to stress and energy.

Apart from that, progress in personalized nutrition supported by DNA-mediated health testing is fueling targeted supplementation. Mushroom business companies are emerging on this tide by offering targeted mixes for targeted health needs such that increased and targeted benefit transfer prevails.

The United States has experienced growth in the functional mushroom sector as increasingly more consumers desire wellness and health. Functional mushrooms have been added to foods like supplements, tea, and coffee. Mushroom coffees, for example, where companies like Four Sigmatic have created coffees with regular coffee beans flavored with lion's mane and chaga extracts to offer consumers value in addition to caffeine.

The market will be expanding exponentially depending on the pace of the explosion of demand by consumers for functional food, as well as the explosion of demand for medicinal mushrooms in an attempt to play catch-up with their health effects from health-conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

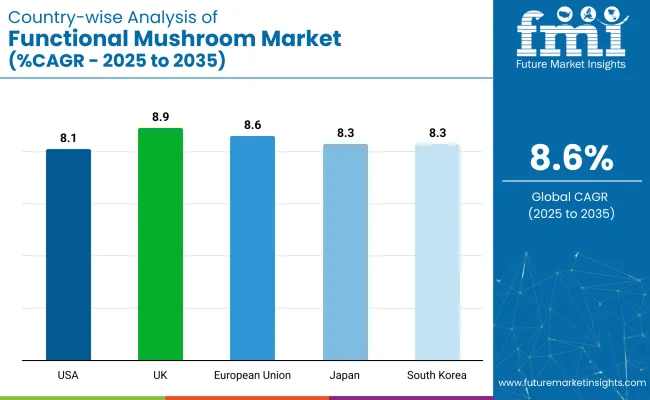

| USA | 8.1% |

In the United Kingdom, the functional mushroom market expanded as the newer generation of products emerged. Fungtn, for instance, launched a series of non-alcoholic craft beers that include functional mushrooms such as reishi, lion's mane, and chaga.

The beverages come with myco adaptogens that provide body, depth, and mouthfeel to the beer without the addition of additives, which is something not commonly seen in the non-alcoholic beer space. The United Kingdom non-alcoholic drinks market entry of functional mushrooms is anticipated to offer opportunities for market growth over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.9% |

The European Union saw the greater use of functional mushrooms in skincare. Mushrooms will be the top skincare product in 2024 because they can stimulate plumper and firmer skin.

There are some mushroom species like reishi, snow mushroom, chaga, songyi, shiitake, and cordyceps, and every kind of mushroom has different uses for skincare from anti-inflammatory effect, moisturizing, collagen stimulation, and antioxidant effect. This is credited to heightened scientific interest, cross-reactivity to well-being, and sustainability at the forefront.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.6% |

Functional mushrooms in Japan have never been more in demand as a source of ancient and modern diet and supplements. History-driven mushroom consumption has laid the ground for the consumption of functional mushroom food products.

Lion's mane supplement, for example, is one of the supplements that are highly demanded compared to others due to the potential impact of its activity on brain function in relation to the emphasis on brain health among Japanese citizens. Functional mushroom business also has high demand in specialty chemicals business, where it is utilized as a lead catalyst in chemical and polymer synthesis.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.3% |

South Korea's functional mushroom market has expanded with mushroom use in beauty and skincare. Mushrooms are also 2024 skincare essentials because they stimulate plumper, firmer skin. Mushrooms are of varied species, such as reishi, snow mushroom, chaga, songyi, shiitake, and cordyceps, with varied skin benefits such as anti-inflammatory, moisturizing, collagen stimulation, and antioxidant.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.3% |

The functional mushroom industry is a competitive industry with industry-leading players and local producers based on industry growth. Industry leaders occupy premium market share positions based on innovation in extraction technology, formulation, and sustainable sourcing.

The industry is focusing on the growing demand for functional mushrooms from the nutraceuticals, food and beverages, and cosmetics sectors. The industry has mature and new players that dominate industry trends by undertaking research, technology, and market development activities.

The overall market size for functional mushroom market was USD 11,230 million in 2025.

The functional mushroom market is expected to reach USD 25,648 million in 2035.

The increasing consumer awareness regarding health benefits, rising demand for functional foods and dietary supplements, and growing applications in pharmaceuticals fuel the functional mushroom market during the forecast period.

The top 5 countries which drive the development of functional mushroom market are USA, China, Japan, Germany, and South Korea.

On the basis of type, Reishi mushrooms are expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA