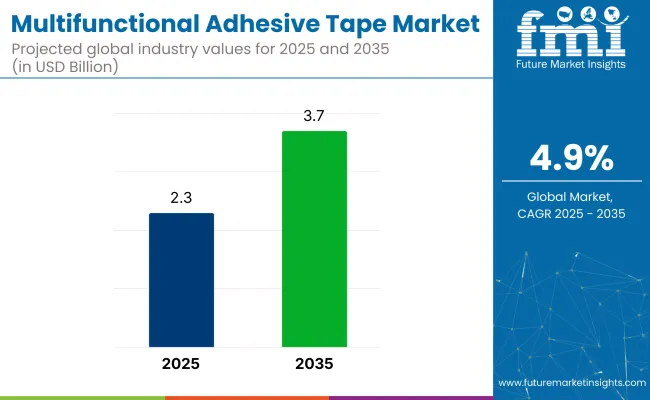

The multifunctional adhesive tape market is projected to grow from USD 2.3 billion in 2025 to USD 3.7 billion by 2035, registering a CAGR of 4.9%.

This growth is driven by the rising demand for adhesive solutions in industries such as electronics, automotive, and construction, with key trends including automation, electrification, and green architecture. Multifunctional adhesive tapes are used for a variety of applications due to their versatility, such as bonding, sealing, insulating, and protecting components. As industries focus on optimizing performance and reducing material use, adhesive tapes are increasingly seen as efficient, cost-effective solutions.

The industry holds varying shares within its parent markets. In the adhesives and sealants market, it accounts for approximately 3-5%, as adhesive tapes are just one type within the broader category of bonding agents. Within the packaging market, the share is higher at about 8-10%, driven by the extensive use of adhesive tapes for sealing, labeling, and protection.

In the construction and building materials market, multifunctional adhesive tapes represent around 2-3%, with applications in insulation, sealing, and temporary fixes. In the automotive market, its share is around 4-6%, used for assembly, sealing, and noise reduction. Within the consumer electronics market, multifunctional adhesive tapes hold about 3-4%, as they are critical for assembling and securing components in devices like smartphones and laptops.

In 2024, Mitch Butier, President and CEO of Avery Dennison, highlighted the company’s focus on eco-friendly packaging solutions, stating, “Sustainability is a core business driver, and advancing recyclable tape technology is essential to meet customer expectations.” This emphasis on sustainability reflects the increasing demand for eco-friendly materials in the multifunctional adhesive tape industry, with companies prioritizing recyclable technologies to align with customer expectations and environmental goals. The statement reinforces the industry's shift towards innovative solutions in adhesive tape applications.

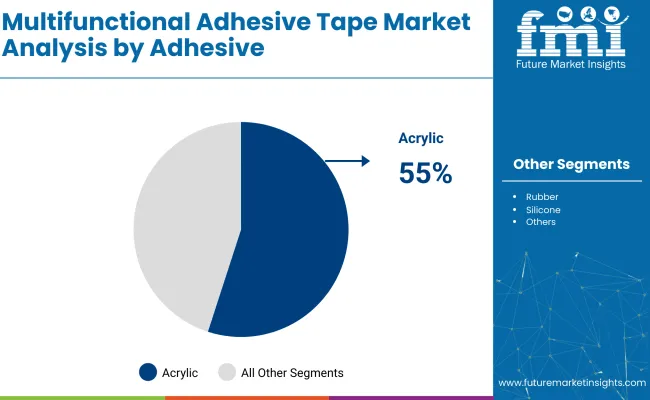

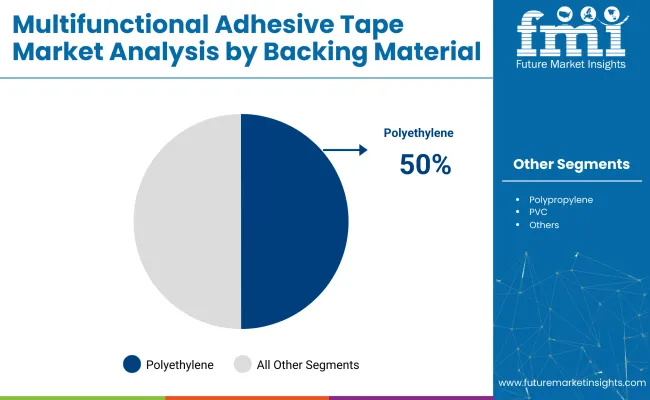

The multifunctional tape industry is experiencing strong investment in adhesives, backing materials, and end-use applications. With rising performance expectations in construction, electronics, and healthcare, manufacturers are focusing on acrylic adhesives, polyethylene backing materials, and electrical insulation tapes to meet evolving mechanical, thermal, and environmental demands.

Acrylic adhesives are projected to dominate the multifunctional tape industry, holding a 55% share in 2025. Their superior aging resistance, UV stability, and ability to bond with various surfaces make them the go-to choice for diverse applications. These adhesives are extensively used in automotive trim assembly, appliance bonding, and outdoor signage.

Companies like 3M and tesa SE are focusing on developing low-VOC, high-tack acrylic tapes designed for harsh environments. Compared to rubber and silicone adhesives, acrylics strike a better balance between strength and flexibility, making them ideal for high-speed manufacturing lines, cleanroom environments, and medical packaging.

Polyethylene (PE) is the dominant backing material in the multifunctional tape industry, projected to capture 50% of the industry in 2025. Its excellent flexibility, moisture resistance, and mechanical strength make it ideal for use in various applications like construction masking, cable insulation, and protective sealing in humid or corrosive environments.

Companies such as Berry Global, Intertape Polymer Group, and Lintec Corporation offer a wide range of PE-backed tapes for automotive painting, HVAC, and industrial applications. PE's recyclability and compatibility with water-based adhesives further enhance its position as an eco-friendly material.

The electrical insulation segment is set to dominate the multifunctional tape industry, accounting for 45% of the industry share in 2025. The rapid expansion of electric vehicles, renewable energy systems, and digital infrastructure is driving demand for heat-resistant, dielectric tapes.

Companies like Nitto Denko, Henkel, and Saint-Gobain manufacture multilayer insulation tapes that can endure high voltages, temperature extremes, and chemical exposure, replacing mechanical fasteners in wire harnessing and PCB assembly. Stringent regulations across Europe and the USA are also pushing OEMs to adopt high-spec adhesive tapes, ensuring consistent performance and durability in the energy and electronics sectors.

The industry is growing due to innovations in adhesive formulations, such as pressure-sensitive and UV-curable adhesives. However, challenges like raw material price fluctuations and environmental regulations are restraining growth, particularly for smaller companies adapting to eco-friendly solutions.

Technological Advancements in Adhesive Formulations Are Driving Market Growth

The industry is gaining momentum due to innovations in adhesive technologies, such as pressure-sensitive and UV-curable adhesives, enhancing bonding strength, surface adaptability, and resistance to temperature extremes. Companies like Avery Dennison and Henkel are focusing on developing low-VOC, solvent-free acrylic adhesives for industries like electronics, automotive, and healthcare.

The trend of miniaturization and automation in electronics is driving demand for thinner, multifunctional tapes, while smart tapes integrated with sensors or RFID tags are broadening the applications of tapes in logistics and healthcare.

Raw Material Price Fluctuations and Environmental Regulations Restrain Growth

The industry faces challenges due to raw material price fluctuations, especially for petroleum-based adhesives and synthetic films. Price volatility, driven by global crude oil trends, affects production costs and overall pricing strategies. Furthermore, increasing global pressure to reduce plastic waste and comply with circular economy goals is pushing manufacturers to find recyclable and biodegradable alternatives.

Many SMEs encounter challenges in adopting eco-friendly formulations without sacrificing performance. Regulatory frameworks, such as the EU Green Deal and the USA EPA guidelines, add additional pressure on manufacturers.

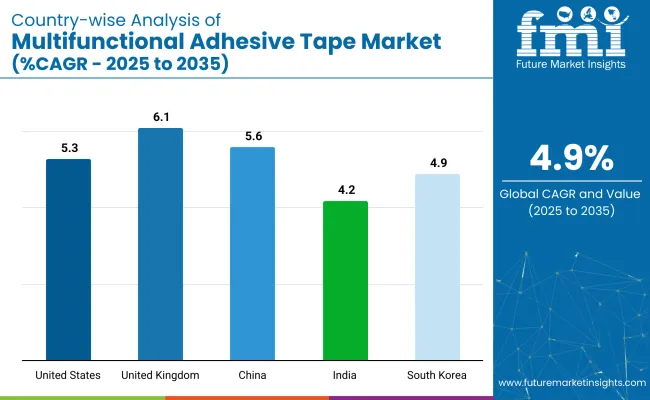

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

| United Kingdom | 6.1% |

| China | 5.6% |

| India | 4.2% |

| South Korea | 4.9% |

The global industry is projected to grow at a CAGR of 4.9% from 2025 to 2035. The United States, with a CAGR of 5.3%, shows steady growth, driven by increasing demand for adhesive tapes in various industries, including automotive, electronics, and construction. The United Kingdom, at 6.1%, demonstrates a slightly higher growth rate, supported by the growing use of multifunctional adhesive tapes in manufacturing, packaging, and consumer goods.

China, with a CAGR of 5.6%, reflects strong growth due to its expanding industrial base, increasing production activities, and rising demand for advanced materials in multiple sectors. India, with a CAGR of 4.2%, shows more moderate growth, influenced by the increasing adoption of adhesive tapes in the automotive and packaging industries.

South Korea, at 4.9%, experiences stable growth, with a focus on innovation and technological advancements in adhesive tape products. While OECD countries show moderate growth, China emerges as the fastest-growing industry, indicating that emerging economies are becoming key drivers of the global industry's expansion.

The report covers in-depth analysis of 40+ countries and the five top-performing OECD and BRICS countries are highlighted below.

The United States industry is set to grow at a 5.3% CAGR from 2025 to 2035. This growth is driven by increasing demand for advanced tapes in industries such as automotive, aerospace, and energy infrastructure.

Companies like 3M, Shurtape Technologies, and Saint-Gobain are leading the development of specialized tapes that offer heat resistance, electrical insulation, and structural performance. Additionally, low-VOC adhesives and recyclable backing materials are gaining traction, particularly in the healthcare and electronics sectors, reflecting a shift towards more eco-conscious materials.

The United Kingdom industry is projected to grow at a 6.1% CAGR from 2025 to 2035. Key drivers include the construction sector’s shift towards green and renewable energy solutions, as well as rising demand in medical device manufacturing.

Leading suppliers like Scapa Group PLC and tesa SE are advancing eco-friendly tapes using solvent-free adhesives and PE/paper-backed solutions. The growing focus on recyclable and biodegradable packaging materials, along with the expansion of electric vehicle production, is pushing innovation forward.

The China industry is expected to grow at a 5.6% CAGR from 2025 to 2035. As the largest global producer of low-cost adhesive tapes, China is expanding its manufacturing base to cater to both domestic and international demand in packaging, automotive, and consumer electronics.

Companies such as Cactus Tape and G-Tape are investing in PE and BOPP tapes while integrating acrylic and hot-melt adhesives. Automation in manufacturing and government-driven investments in infrastructure are fueling this industry, while environmental regulations are encouraging the use of water-based adhesives.

The industry in India is projected to grow at a 4.2% CAGR from 2025 to 2035. Growth is driven by rising demand in sectors such as construction, consumer goods, and healthcare packaging. Companies like Pro Tapes & Specialties, Bostik, and Henkel are expanding their local presence to offer cost-effective solutions.

Government initiatives, such as “Make in India”, are fostering domestic manufacturing. While challenges such as limited automation and the need for high-performance materials persist, the industry is expected to benefit from localized innovations and a growing export industry.

The industry in South Korea is expected to grow at a 4.9% CAGR from 2025 to 2035. Strong demand in the electronics, semiconductor, and battery sectors is driving industry growth. Companies like Nitto Denko and Lintec Corporation are supplying high-precision tapes for critical applications such as anti-static, EMI shielding, and thermal conductivity.

Additionally, government investments in clean energy and smart mobility technologies are contributing to growth. The increasing use of low-outgassing adhesives in cleanroom environments to meet environmental and health standards is further driving industry expansion.

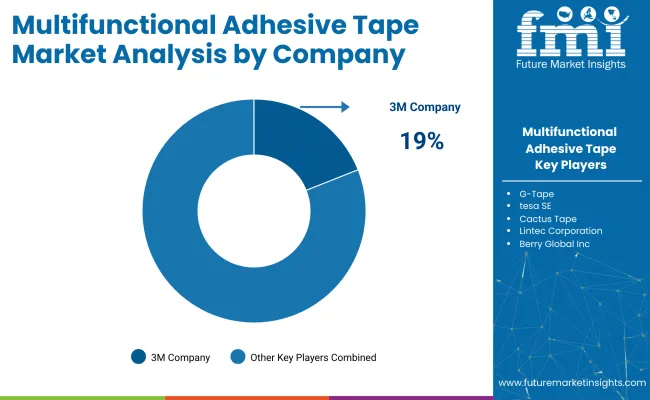

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as 3M Tapes, tesa SE, and Avery Dennison Performance Tapes lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across automotive, electronics, and industrial sectors. Key players including Lohmann Tape Group, VIBAC Group, and PR International Ltd. offer specialized solutions tailored to specific applications and regional industries.

Emerging players, such as JIANGYIN MEIYUAN INDUSTRIES CORPORATION, Wingtai (Zhongshan) Co., Ltd., and Flexibond Industries Pvt. Ltd., focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Multifunctional Adhesive Tape Industry News

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 2.3 billion |

| Projected Industry Size (2035) | USD 3.7 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square meters for volume |

| Adhesive Types Analyzed | Acrylic, Rubber, Silicone, Hot Melt, Others |

| Backing Material Types Analyzed | Polyethylene (PE), Polypropylene (PP), PVC (Polyvinyl Chloride), Paper, Fabric, Others |

| End-Use Segmentation | Electrical Insulation, Automotive, Packaging, Construction, Healthcare, Consumer Goods, Electronics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Leading Players in the Industry | 3M Tapes (USA), tesa SE (Germany), Avery Dennison Performance Tapes, Lohmann Tape Group (Germany), PAL Adhesive Products (United Kingdom), VIBAC Group, PR International Ltd., Jiangyin Meiyuan Industries Corporation, Wingtai (Zhongshan) Co., Ltd., and Flexibond Industries Pvt. Ltd. (India). |

| Additional Attributes | Dollar sales by adhesive type, backing material, and end-use, increasing demand for eco-friendly and engineered tapes, trends in industrial and automotive applications, regional variations in tape adoption, and innovations in specialty and high-performance tapes. |

By adhesive, the industry is segmented into acrylic, rubber, silicone, hot melt, and others.

By backing material, the industry includes polyethylene (PE), polypropylene (PP), PVC (Polyvinyl Chloride), paper, fabric, and others.

By end-use, industry is segmented into electrical insulation, automotive, packaging, construction, healthcare, consumer goods, electronics, and others.

The key regions analyzed in this industry include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Middle East and Africa (MEA).

The industry is expected to reach USD 3.7 billion by 2035.

The industry is projected to grow at a CAGR of 4.9%.

Acrylic adhesives lead with a 55% share in 2025 due to versatility and durability.

Electrical insulation is the leading end-use segment, contributing 45% of total demand.

The United Kingdom is projected to grow at the highest CAGR of 6.1% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape & Label Adhesives Market

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

Assessing Adhesive Transfer Tape Market Share & Industry Insights

Self-adhesive Tear Tape Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesive Tapes Market Size and Share Forecast Outlook 2025 to 2035

Cloth Self-adhesive Tapes Market

Multifunctional Loader Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Tester Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Multifunctional Household Robot Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Multifunctional Printer Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Modifier Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA