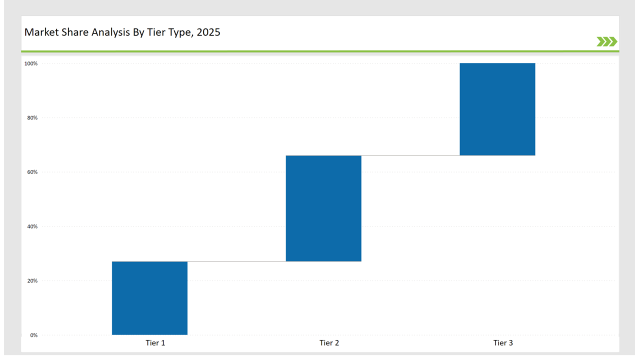

The self-adhesive films market is experiencing significant growth, driven by increasing demand across sectors such as packaging, automotive, and electronics. These films offer efficient bonding solutions, eliminating the need for additional adhesives and streamlining application processes. Companies in this market are categorized into Tier 1, Tier 2, and Tier 3 based on their market influence and strategic execution.

Leading companies, including 3M, LG Hausys, and Lintec, collectively hold a 27% portion of the market share. These Tier 1 companies leverage advanced manufacturing processes, innovative product development, and extensive distribution networks to maintain their dominance. They focus on developing sustainable and high-performance adhesive films to meet diverse industry requirements.

Tier 2 players, such as Hexis Graphics, Arlon Graphics, and Metamark, account for 39% share of the market. They emphasize cost-effective, customizable, and durable self-adhesive films tailored for mid-sized enterprises. Many of these companies are adopting eco-friendly materials to comply with environmental regulations and reduce carbon footprints.

Tier 3 consists of regional manufacturers, startups, and private labels, contributing to the 34% of market share. These companies prioritize agility and innovation, offering specialized self-adhesive films to meet niche demands and evolving industry standards. Additionally, they are exploring smart adhesive technologies to enhance performance and application efficiency.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, LG Hausys, Lintec) | 15% |

| Rest of Top 5 (Hexis Graphics, Arlon Graphics) | 7% |

| Next 5 of Top 10 (Metamark, FDC Graphics, KPMF, PVC Film Company, Vinyl Wrap Co.) | 5% |

| Market Concentration | Criteria | Current Market |

|---|---|---|

| High | Over 60% by leading players | No |

| Medium | 30-60% by top players | No |

| Low | Below 30% market share for leading players | Yes |

The Self-Adhesive Films Market serves multiple industries, including:

Companies offer a variety of solutions tailored to industry needs:

Throughout the year, leading companies innovated by developing sustainable materials, integrating advanced adhesive technologies, and enhancing product performance. Market leaders like 3M, LG Hausys, and Lintec spearheaded advancements in eco-friendly adhesives, high-performance bonding solutions, and application-specific films. The adoption of sustainable materials has optimized product offerings and reduced environmental impact. Additionally, companies have expanded their partnerships with end-user industries to develop customized solutions.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | AptarGroup, Albéa, Amcor |

| Tier 2 | Lumson, Vetroplas, Quadpack |

| Tier 3 | Silgan, Yonwoo, HCP Packaging, WWP Beauty |

| Manufacturer | Latest Developments |

|---|---|

| AptarGroup | Introduced refillable single-dose packaging (March 2024). |

| Albéa | Launched biodegradable sachets for cosmetics (April 2024). |

| Amcor | Developed recyclable mono-material cosmetic pouches (May 2024). |

| Lumson | Expanded airless packaging solutions (July 2024). |

| Vetroplas | Focused on eco-friendly dispensers for skincare (August 2024). |

| Quadpack | Developed compostable beauty pods (September 2024). |

| Silgan | Introduced luxury-focused single-dose packaging (October 2024). |

The self-adhesive films market is evolving rapidly with innovations in eco-friendly materials, advanced adhesive technologies, and performance enhancements. Companies are focusing on biodegradable adhesives, low-emission production methods, and smart adhesive films that adjust properties based on environmental conditions. The rise of nanotechnology and AI-assisted application processes is expected to enhance precision and efficiency. Additionally, regulations in Europe and North America are driving the adoption of sustainable and recyclable adhesives, positioning eco-conscious brands for long-term growth.

Leading manufacturers include 3M, LG Hausys, and Lintec.

The top 10 players hold approximately 27% of the global market.

Sustainability, smart adhesive technologies, and application-specific solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PCR Films Market Analysis by PET, PS, PVC Through 2035

Breaking Down PCR Films Market Share & Industry Positioning

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Retort Films Market

Market Share Breakdown of Edible Films and Coatings

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Protein Films Market from 2024 to 2034

PE Foam Films Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA