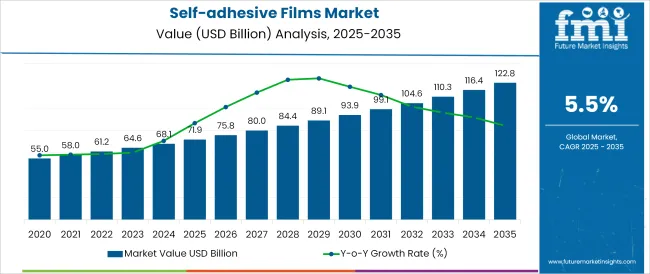

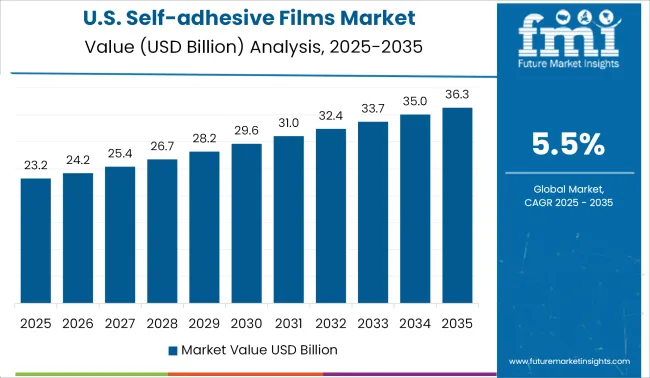

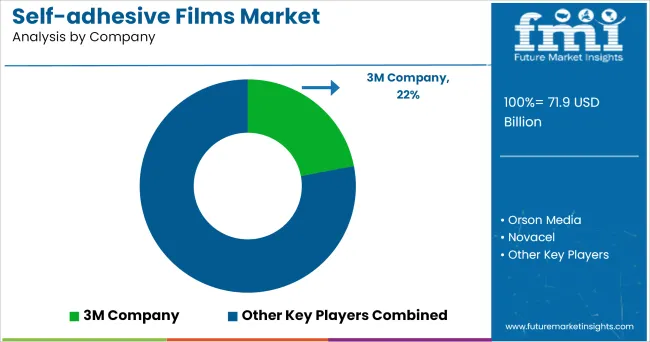

The Self-adhesive Films Market is estimated to be valued at USD 71.9 billion in 2025 and is projected to reach USD 122.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The self-adhesive films market is expanding steadily, propelled by advancements in surface coating technologies, the shift toward sustainable substrates, and rising cross-sectoral application demand. Industries are increasingly prioritizing materials that offer flexibility, durability, and strong bonding performance across diverse surfaces and environmental conditions.

Manufacturers are developing films with enhanced chemical resistance, UV stability, and printability to cater to packaging, labelling, and decorative applications. Additionally, regulatory pressure around recyclability and carbon footprint is driving innovation in eco-friendly formulations, including solvent-free adhesives and biodegradable backings.

The proliferation of e-commerce, personalized branding, and lightweight vehicle components has further intensified the need for cost-effective and visually appealing film solutions. As smart labelling, anti-counterfeit technology, and product traceability become mainstream, the demand for self-adhesive films with embedded intelligence and precise functional control is expected to rise, positioning the market for sustained multi-industry growth.

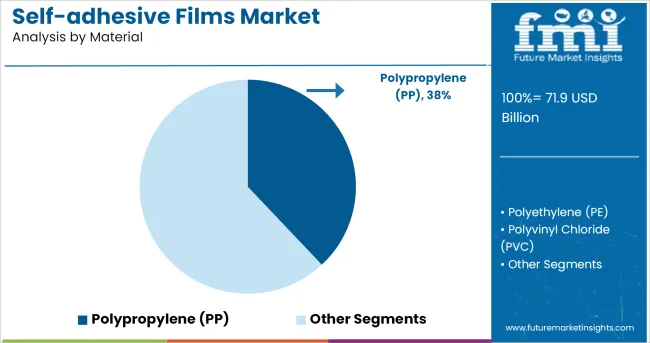

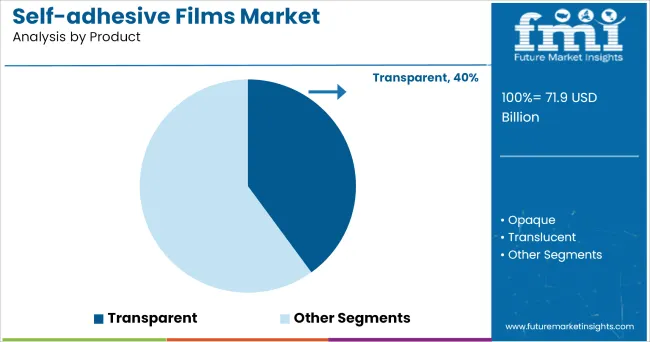

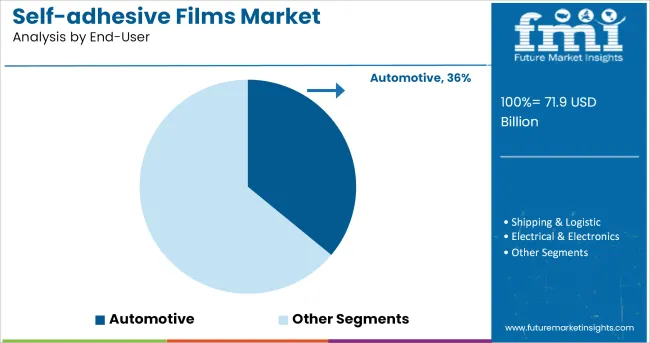

The market is segmented by Material, Product, and End-User and region. By Material, the market is divided into Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), and Others (PET, PU, PA). In terms of Product, the market is classified into Transparent, Opaque, and Translucent. Based on End-User, the market is segmented into Automotive, Shipping & Logistic, Electrical & Electronics, and Aerospace. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polypropylene (PP) segment is projected to hold 38.0% of total market revenue by 2025 under the material category, marking it as the dominant substrate. Its leadership is attributed to a strong balance between mechanical strength, cost efficiency, and chemical resistance, making it ideal for labelling and packaging across food, consumer goods, and industrial sectors.

PP films offer excellent clarity, moisture resistance, and print compatibility, enhancing product shelf appeal while maintaining structural performance. Additionally, PP's adaptability to various adhesive types including water based and hot-melt formulations has supported widespread adoption in both permanent and removable applications

The growing focus on mono-material packaging and recyclability has also positioned PP as a preferred choice over PVC and other composites, reinforcing its leading market share.

Transparent self-adhesive films are expected to contribute 40.0% of the market’s revenue by 2025, positioning them as the leading product type. This dominance stems from their wide utility in display protection, branding overlays, surface lamination, and packaging windows.

The demand for visually clean, high-clarity substrates that preserve brand aesthetics and allow product visibility has driven adoption across consumer electronics, food packaging, and retail branding. Transparent films are often engineered with anti-scratch, anti-UV, and low-reflective coatings to suit demanding applications while maintaining optical performance.

The rising trend of minimalist packaging, coupled with the need for protective yet non-intrusive overlays, has elevated transparent films as the go-to product type for a wide range of commercial uses.

The automotive segment is anticipated to account for 36.0% of total market revenue in 2025 among end-user industries, securing its position as the largest contributor. This growth has been supported by rising demand for vehicle wraps, paint protection films, branding decals, and interior trim enhancements all of which rely heavily on high-performance self-adhesive films.

Light weighting initiatives and the shift to electric vehicles have reinforced the adoption of advanced films that offer both aesthetic flexibility and functional protection. Automotive manufacturers and aftermarket providers are increasingly using films for surface customization, noise dampening, and corrosion resistance. Additionally, the industry’s demand for UV-stable, weather-resistant, and easy to install solutions has driven innovation in adhesive chemistry and film engineering.

These factors, coupled with global expansion of automotive production and personalization trends, are expected to sustain the automotive sector’s lead in the self-adhesive films market.

Self-adhesive films are used in a variety of ways and are simple to utilise. To attach two surfaces, self-adhesive films are used. These films are catalysed adhesives that come in the shape of a film and contain compounds like phenolic and epoxy. On one side these films have pressure-sensitive adhesives. Self-adhesive films are major of two types as printable and non-printable.

Based on formulating technology, self-adhesive films can be made by calendaring or casting and these technologies are gaining popularity among manufactures and favouring the growth of the self-adhesive films market.

Additionally, these films are widely used in the packaging, automotive, construction and advertising sectors. The global market for self-adhesive films is expected to remain positive throughout the forecast period.

In automotive industry, the demand for self-adhesive films are increasing due to its extensive use for door hinge washers, reinforcement plates, and bracket attachments which is expected to fuels the market growth.

These films are quick to attach as they are self-adhesive, inexpensive and can be easily changed. Furthermore, significant growth in various industries is projected to propel the growth of the self-adhesive films market.

Across the globe, in shipping & logistics sector, the demand for self-adhesive films is consistently increasing as it offers high adhesive strength, durability, and elasticity enable them to be used in a variety of applications.

Therefore, due to the increasing usage of corrugated packaging by manufacturers in the shipping & logistics sector is projected to bolster the sales of self-adhesive films.

The top global manufacturers in the market are introducing antimicrobial films along with customization which is favouring the demand of the product. Self-adhesive antimicrobial films will safeguard the product and increase the consumption among consumers.

However, these trend adopted by self-adhesive films manufacturers is expected to propel the growth of the market in the forecast period.

Polypropylene, polyvinyl chloride and other plastic materials are the raw materials which are used for self-adhesive films. It has observed that the prices of these raw materials has a higher initial cost which is restraining the growth of the self-adhesive films market.

In the North American region, USA is the fastest growing country in the industrial sectors and accounted for the prominent share of the self-adhesive films market. The growth of the market is recognised by the substantial demand for self-adhesive films from the chemical and building & construction industry in the country and is expected to propel the growth of the target market.

Global players

Asia Pacific players

The key players adopt various strategies such as product launch, merger & acquisition, innovation and others to survive the competition in the market.

The global self-adhesive films market is estimated to be valued at USD 71.9 billion in 2025.

The market size for the self-adhesive films market is projected to reach USD 122.8 billion by 2035.

The self-adhesive films market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in self-adhesive films market are polypropylene (pp), polyethylene (pe), polyvinyl chloride (pvc) and others (pet, pu, pa).

In terms of product, transparent segment to command 40.0% share in the self-adhesive films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Self-Adhesive Films Market Share

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Protein Films Market from 2024 to 2034

PE Foam Films Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA