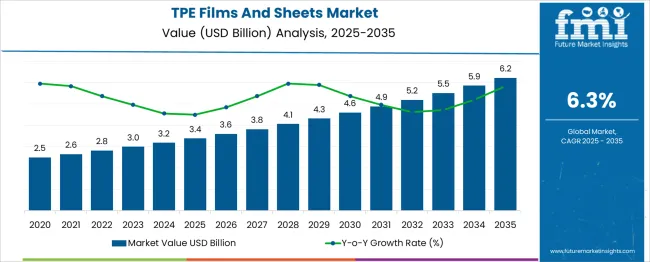

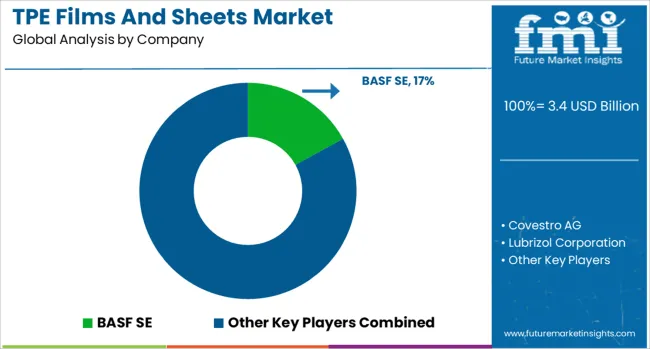

The global TPE films and sheets market is forecasted to increase from USD 3.4 billion in 2025 to approximately USD 6.22 billion by 2035, recording an absolute increase of USD 2.84 billion over the forecast period. This translates into a total growth of 84.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.84X during the same period, supported by the rising adoption of thermoplastic elastomers in various industries and increasing demand for flexible, recyclable polymer solutions in packaging and medical applications.

Between 2025 and 2030, the TPE Films and Sheets market is projected to expand from USD 3.4 billion to USD 4.56 billion, resulting in a value increase of USD 1.18 billion, which represents 41.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of TPE materials in medical device manufacturing, increasing demand for eco-friendly packaging solutions, and growing awareness among manufacturers about the recyclability advantages of thermoplastic elastomers. Material processors are expanding their production capabilities to address the growing complexity of application requirements across different industries.

From 2030 to 2035, the market is forecast to grow from USD 4.56 billion to USD 6.22 billion, adding another USD 1.66 billion, which constitutes 58.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of bio-based TPE materials, integration of advanced compounding technologies, and development of specialized grades for emerging applications. The growing adoption of TPE films in electric vehicle components and renewable energy applications will drive demand for more sophisticated material formulations and processing expertise.

Between 2020 and 2025, the TPE Films and Sheets market experienced steady expansion, driven by increasing adoption rates in healthcare applications and growing awareness of material advantages over traditional rubber and PVC solutions. The market developed as manufacturers recognized the processing advantages and design flexibility offered by thermoplastic elastomers. End-use industries began emphasizing material recyclability and environmental compliance to meet environmental goals and regulatory requirements.

| Metric | Value |

|---|---|

| TPE Films and Sheets Market Value (2025) | USD 3.4 billion |

| TPE Films and Sheets Market Forecast Value (2035) | USD 6.2 billion |

| TPE Films and Sheets Market Forecast CAGR | 6.3% |

Market expansion is being supported by the rapid increase in demand for flexible, durable materials across healthcare, automotive, and consumer goods industries worldwide. Modern manufacturing processes rely on materials that combine elastomeric properties with thermoplastic processability to ensure efficient production and product performance. The versatility of TPE materials enables manufacturers to achieve complex designs and specifications while maintaining cost-effectiveness and environmental compliance.

The growing complexity of application requirements and increasing regulatory pressures are driving demand for specialized TPE formulations with certified material properties and processing characteristics. Healthcare manufacturers are increasingly requiring biocompatible TPE materials with documented safety profiles for medical device applications. Regulatory requirements and industry specifications are establishing standardized material grades that require specialized compounding expertise and quality control systems.

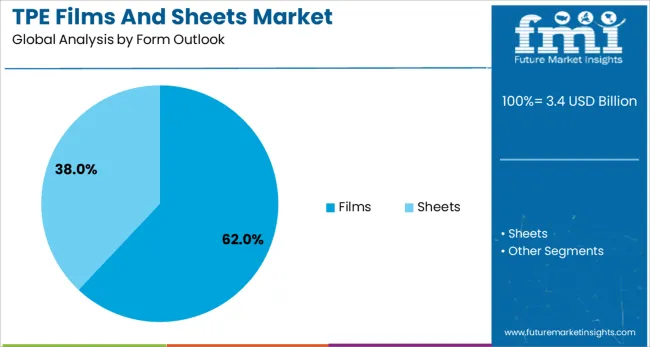

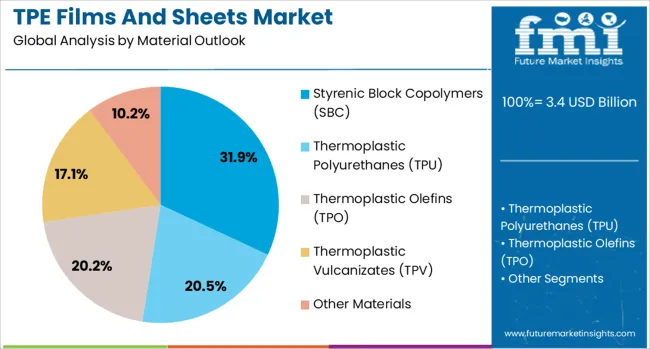

The market is segmented by material outlook, form outlook, application outlook, and region. By material outlook, the market is divided into styrenic block copolymers (SBC), thermoplastic polyurethanes (TPU), thermoplastic olefins (TPO), thermoplastic vulcanizates (TPV), and other materials. Based on form outlook, the market is categorized into films and sheets. In terms of application outlook, the market is segmented into medical & healthcare, automotive, consumer goods, packaging, construction & infrastructure, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Films are projected to account for 62.0% of the TPE Films and Sheets market in 2025. This leading share is supported by the widespread adoption of TPE films in medical packaging, automotive interiors, and consumer product applications. TPE films provide excellent flexibility, transparency options, and barrier properties, making them the preferred choice for applications requiring thin-gauge materials with consistent performance. The segment benefits from established processing technologies and comprehensive material availability from multiple suppliers.

Medical & healthcare applications are expected to represent 25.1% of TPE films and sheets demand in 2025. This significant share reflects the high penetration of TPE materials in medical device manufacturing and pharmaceutical packaging applications. Modern healthcare products increasingly feature TPE components that require biocompatibility, sterilization resistance, and regulatory compliance. The segment benefits from growing healthcare infrastructure development and increasing demand for advanced medical devices and disposable medical products.

Styrenic block copolymers are projected to contribute 31.9% of the market in 2025, representing the largest material category in TPE films and sheets production. These materials offer excellent processability, elasticity, and compatibility with various additives and fillers. SBC-based TPEs typically serve multiple industries with requirements for soft-touch surfaces, flexible films, and impact-resistant sheets. The segment is supported by growing demand for versatile materials and established supply chain infrastructure.

The TPE films and sheets market is advancing steadily due to increasing material adoption and growing recognition of processing advantages. However, the market faces challenges including raw material price volatility, competition from traditional materials, and varying performance requirements across different applications. Standardization efforts and material certification programs continue to influence product development and market adoption patterns.

The growing deployment of bio-based TPE materials is enabling manufacturers to meet environmental goals while maintaining product performance and processing efficiency. Material suppliers are developing formulations incorporating renewable feedstocks and recyclable components that provide environmental benefits without compromising mechanical properties. These developments are particularly valuable for brand owners and OEMs that require eco-friendly material solutions for consumer-facing applications.

Modern TPE manufacturers are incorporating advanced compounding equipment and process control systems that improve material consistency and reduce production costs. Integration of real-time monitoring systems and automated quality control enables more precise material formulations and comprehensive batch documentation. Advanced processing also supports development of specialized TPE grades with enhanced properties including improved heat resistance, chemical compatibility, and surface characteristics.

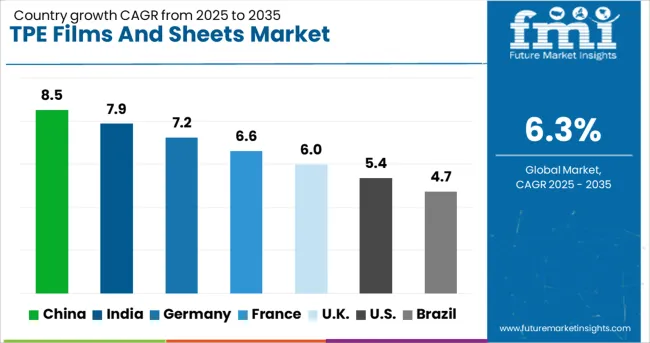

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| United Kingdom | 6.0% |

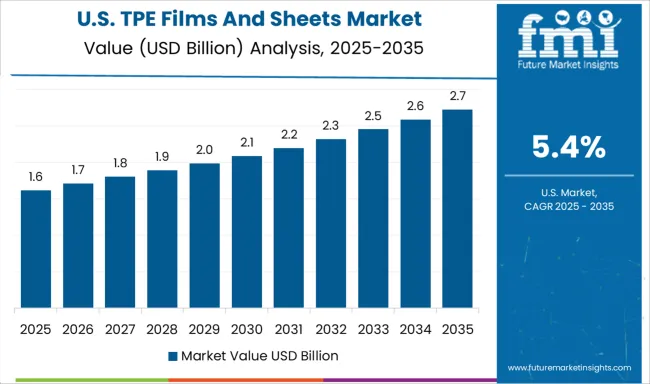

| United States | 5.4% |

| Brazil | 4.7% |

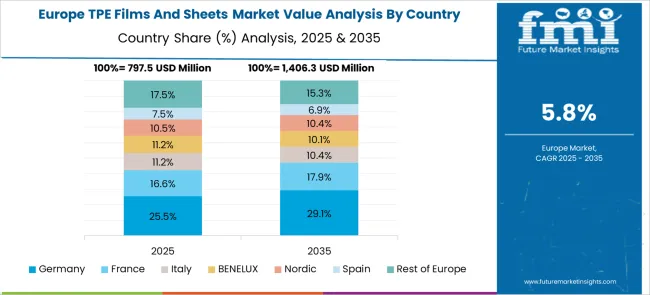

The TPE films and sheets market is growing rapidly, with China leading at an 8.5% CAGR through 2035, driven by manufacturing expansion and increasing industrial applications. India follows at 7.9%, supported by growing industrialization and healthcare sector development. Germany grows at 7.2%, emphasizing technical excellence and innovation. France records 6.6%, the United Kingdom shows 6 %, and the United States demonstrates 5.4% growth, focusing on specialized applications. Brazil shows steady growth at 4.7%, integrating TPE materials into established processing infrastructure. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from TPE films and sheets in China is projected to exhibit the highest growth rate with a CAGR of 8.5% through 2035, driven by rapid expansion of manufacturing capabilities and increasing domestic demand for advanced polymer materials. The country's expanding industrial base and growing end-use sectors are creating significant demand for TPE films and sheets. Major material processors and converters are establishing comprehensive production networks to support growing requirements across diverse applications.

Revenue from TPE films and sheets in India is expanding at a CAGR of 7.9%, supported by increasing industrial development and growing awareness of advanced material benefits. The country's expanding manufacturing sector and rising consumer goods production are driving demand for high-quality TPE materials. Processing facilities and material converters are establishing capabilities to serve growing requirements of diverse end-use industries.

Demand for TPE films and sheets in Germany is projected to grow at a CAGR of 7.2%, supported by the country's emphasis on material innovation and precision manufacturing. German processors are implementing comprehensive quality systems that meet stringent industry standards and customer specifications. The market is characterized by focus on technical excellence, advanced material development, and compliance with regulatory requirements.

Revenue from TPE films and sheets in France is growing at a CAGR of 6.6%, driven by increasing adoption across packaging, healthcare, and consumer goods applications. The country's established plastics processing industry is integrating advanced TPE materials to serve modern product requirements. Manufacturing facilities and material converters are investing in processing capabilities to address growing market demand.

Demand for TPE films and sheets in the United Kingdom is expanding at a CAGR of 6 %, driven by increasing focus on specialized applications and material innovation. British processors and converters are establishing comprehensive capabilities to serve diverse customer needs across medical, automotive, and consumer sectors. The market benefits from strong technical infrastructure and collaborative development initiatives.

Revenue from TPE films and sheets in the United States is projected to grow at a CAGR of 5.4%, supported by emphasis on advanced applications and material innovation. American processors are implementing sophisticated compounding and processing technologies that enable specialized material solutions. The market is characterized by focus on high-performance applications and comprehensive quality systems.

Demand for TPE films and sheets in Brazil is growing at a CAGR of 4.7%, driven by increasing industrial adoption and growing recognition of material advantages. The country's established plastics processing industry is integrating TPE materials to serve evolving market requirements. Processing facilities are developing capabilities to address diverse application needs across multiple sectors.

The TPE Films and Sheets market in Europe shows diversified material adoption patterns across different segments. Styrenic block copolymers maintain the largest share, followed by thermoplastic polyurethanes which serve specialized applications requiring higher performance characteristics. The strong presence of medical device manufacturers and automotive suppliers drives demand for specialized TPE grades with certified properties. Thermoplastic olefins serve primarily automotive and construction applications where cost-effectiveness and weatherability are key requirements. Thermoplastic vulcanizates address applications requiring enhanced chemical resistance and compression set properties. Germany leads regional demand due to its extensive automotive and medical technology sectors, while France shows growing adoption in packaging and consumer goods applications. The United Kingdom maintains focus on medical and pharmaceutical packaging applications requiring stringent regulatory compliance.

The TPE films and sheets market is defined by competition among material suppliers, compound manufacturers, and specialized processors. Companies are investing in advanced compounding technologies, application development, material innovation, and technical support to deliver high-performance, and cost-effective material solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

BASF SE offers comprehensive TPE solutions with focus on innovation and technical excellence across diverse applications. Covestro AG provides advanced TPU-based films and sheets with emphasis on performance, durability, and environmental compatibility. Lubrizol Corporation delivers specialized TPE materials with comprehensive technical support and application development expertise. Kraton Corporation emphasizes SBC-based solutions with focus on processing efficiency and performance optimization.

Teknor Apex Company offers customized TPE compounds and solutions for specific application requirements. American Polyfilm, Inc. provides specialized film conversion and processing capabilities. 3M delivers innovative TPE-based products with focus on advanced applications. Huntsman Corporation offers TPU materials with emphasis on performance. RTP Company provides specialized compounds and technical solutions. PERMALI offers specialized TPE sheets and technical materials for industrial applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.4 billion |

| Material Outlook | Styrenic Block Copolymers (SBC), Thermoplastic Polyurethanes (TPU), Thermoplastic Olefins (TPO), Thermoplastic Vulcanizates (TPV), Other Materials |

| Form Outlook | Films, Sheets |

| Application Outlook | Medical & Healthcare, Automotive, Consumer Goods, Packaging, Construction & Infrastructure, Other Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France, and 40+ countries |

| Key Companies Profiled | BASF SE; Covestro AG; Lubrizol Corporation; Kraton Corporation; Teknor Apex Company; American Polyfilm, Inc.; 3M; Huntsman Corporation; RTP Company; PERMALI |

| Additional Attributes | Dollar sales by material type, form, and application, regional demand trends across Asia Pacific, Europe, and North America, competitive landscape with established players and emerging processors, buyer preferences for sustainable versus traditional materials, integration with advanced compounding and processing technologies, innovations in bio-based TPE materials and recyclable formulations, and adoption of specialized grades for medical, automotive, and packaging applications requiring certified properties and regulatory compliance. |

The global TPE films and sheets market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the TPE films and sheets market is projected to reach USD 6.2 billion by 2035.

The TPE films and sheets market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in TPE films and sheets market are styrenic block copolymers (SBC), thermoplastic polyurethanes (TPU), thermoplastic olefins (TPO), thermoplastic vulcanizates (TPV), and other materials.

In terms of form outlook, films segment to command 62.0% share in the TPE films and sheets market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA