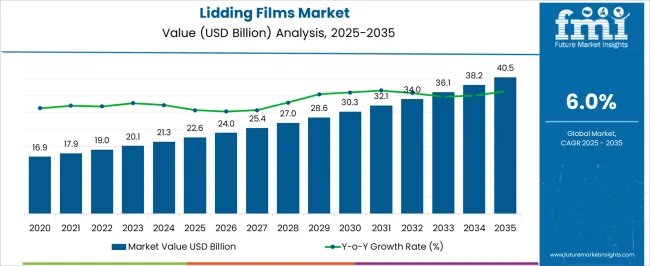

The Lidding Films Market is estimated to be valued at USD 22.6 billion in 2025 and is projected to reach USD 40.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Lidding Films Market Estimated Value in (2025E) | USD 22.6 billion |

| Lidding Films Market Forecast Value in (2035F) | USD 40.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The lidding films market is gaining considerable traction globally due to rising consumer preference for safe, durable, and convenient packaging solutions that align with modern retail and supply chain dynamics. These films are playing a pivotal role in preserving freshness, ensuring product visibility, and maintaining food integrity during transportation and storage. Increasing urbanization, growth in ready-to-eat meal consumption, and the expansion of organized retail are influencing the adoption of high-performance lidding films.

Industry efforts toward sustainability and material reduction have further accelerated the development of recyclable and biodegradable films, making the market increasingly innovation-driven. Strong regulatory emphasis on hygiene, food contact compliance, and tamper-evident packaging has also supported wider market penetration across diverse end-use sectors.

Technological advancements in multi-layer film extrusion and antimicrobial coatings are expected to enhance product functionality With growing investments in food processing, logistics, and cold chain networks, the lidding films market is positioned for sustained growth across both developed and emerging regions.

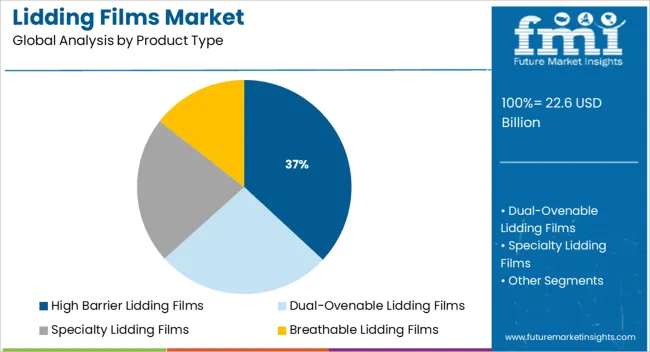

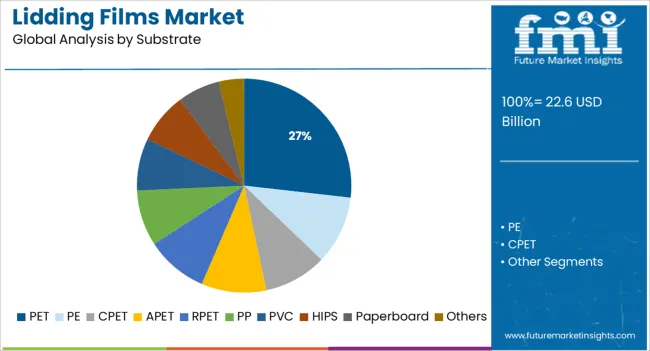

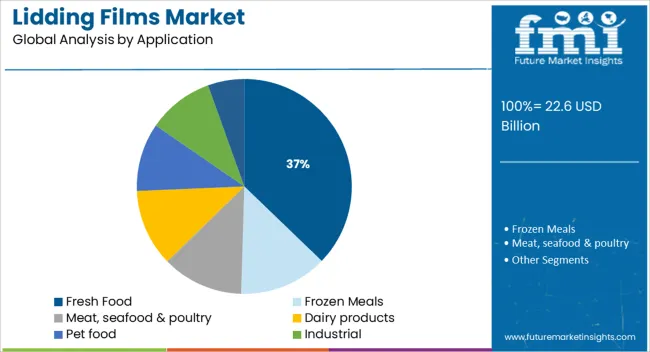

The market is segmented by Product Type, Substrate, Application, and End Use Industry and region. By Product Type, the market is divided into High Barrier Lidding Films, Dual-Ovenable Lidding Films, Specialty Lidding Films, and Breathable Lidding Films. In terms of Substrate, the market is classified into PET, PE, CPET, APET, RPET, PP, PVC, HIPS, Paperboard, and Others. Based on Application, the market is segmented into Fresh Food, Frozen Meals, Meat, seafood & poultry, Dairy products, Pet food, Industrial, and Others.

By End Use Industry, the market is divided into Packaging, Cosmetics & Personal Care, Pharmaceutical, Automobiles, Electrical & Electronics, Chemical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high barrier lidding films segment is projected to account for 36.9% of the total revenue share in the lidding films market in 2025, reflecting its dominance in packaging applications that require superior protection against oxygen, moisture, and other external contaminants. The preference for this segment is being driven by the growing need to extend shelf life and ensure the freshness of perishable products without compromising product visibility.

High barrier films have been adopted extensively in dairy, meat, and ready-to-eat food packaging, supported by their ability to maintain modified atmosphere packaging conditions and prevent spoilage. Enhanced sealing strength, puncture resistance, and heat stability have enabled these films to meet the stringent performance standards demanded by food manufacturers and retailers.

The segment's growth is further reinforced by the shift toward multi-layer flexible films that can be customized for diverse substrate combinations and packaging machinery Adoption is expected to continue rising due to the alignment of high barrier films with global food safety standards and consumer expectations for freshness.

The PET substrate segment is expected to represent 26.8% of the lidding films market’s revenue share in 2025, owing to its excellent optical clarity, mechanical strength, and compatibility with a wide range of sealing systems. PET films are being widely used as lidding materials due to their high-temperature tolerance, recyclability, and ability to act as a robust barrier against gas and vapor transmission.

Their suitability for both heat seal and cold seal applications has expanded their usage across frozen foods, dairy, and pharmaceutical packaging. The increasing focus on circular economy principles and sustainability has further positioned PET as a preferred substrate due to its recoverability and integration into closed-loop recycling systems.

Consistent surface performance and dimensional stability during high-speed packaging operations have enabled PET-based lidding films to meet the demands of automated filling lines The segment is anticipated to see continued expansion as industry stakeholders prioritize lightweight, durable, and eco-efficient packaging solutions.

The fresh food application segment is projected to account for 37.2% of the lidding films market revenue share in 2025, driven by rising demand for packaging solutions that preserve perishables while offering product visibility and convenience. The adoption of lidding films in this segment has been catalyzed by the growth in consumption of fresh produce, meats, and ready-to-cook meals, particularly in urban and health-conscious demographics.

Films used in fresh food applications are being designed to support modified atmosphere packaging, antimicrobial features, and tamper-evident closures to ensure safety, hygiene, and compliance with food regulations. The capability of lidding films to enhance shelf appeal through high gloss and transparency, while also reducing food waste through improved preservation, has further supported growth.

Increasing retail shelf turnover, expanded cold chain logistics, and greater consumer preference for resealable and easy-peel solutions have reinforced the need for flexible and advanced film structures This trend is expected to intensify as food producers seek to deliver freshness, safety, and sustainability in a single packaging format.

Recent years have seen a dynamic shift in the manufacturing of the product and its packaging. Lidding Films manufacturers are mainly focusing on upgrading new technology and implementing it in packaging materials. Lidding Films are usually used for covering trays, tubs, bowls, cups, etc. due to the strength it possesses such as high tensile, heat resistance and stability.

Lidding Films are also eco-friendly and are available in the biodegradable form which is helpful for protecting environmental. In addition, lidding films also increases the shelf life of the product due to its high barrier resistance. Lidding films are also useful in cargo packaging due to its high tensile strength. Lidding Films are also process optimized which helps in giving a cost effective due to the cheaper raw material.

Lidding Films hold escalation due to upsurge demand for food packaging and this resulted in the expansion of the sales for lidding films so that it can provide extended shelf life to the products and this trend is expected to grow over the forecast period 2020-2025. Lidding Films market have seen an increase in the penetration of retail outlets in Asia Pacific region which are driving the demand for lidding films market.

In addition, lidding films market is positively influenced by the change in lifestyle of developing countries across the globe and are fueling in demand. With the increasing population, the need for packaging of fresh food is increasing which has created a significant opportunity for lidding films.

However, lidding films are not able to protect the food products from physical and chemical damage externally which can create a restraint for its market. Furthermore, lidding films have concerns regarding the environmental effects of the use of plastic disposal from the government.

The global lidding films market can be divided into seven major regions which are as follows:

North America region is estimated to dominate the lidding film's market over the forecast period due to demand for packaged food. Europe region is also expected to witness a steady growth for lidding films market throughout the forecast period. In Asia Pacific region, lidding films market is expected to have the highest growth over the forecast period.

Furthermore, the market for lidding films in Asia Pacific region is mainly dominated by China and India due to its vast scope for rapid industrialization. Latin America and the Middle East & Africa region are expected to have a steady growth for lidding films market.

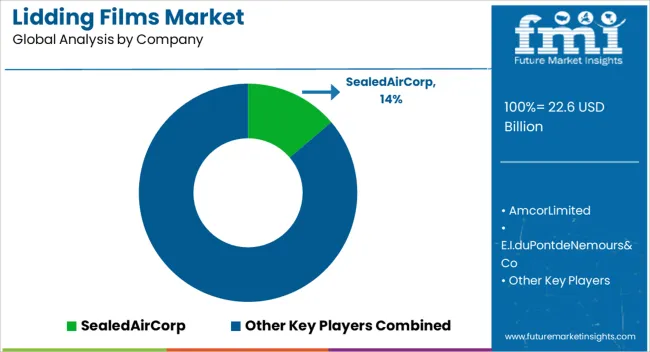

Few of the key players in lidding films are Sealed Air Corp, Amcor Limited, E.I. du Pont de Nemours & Co, Bemis Company, Inc., Berry Global, Inc., Winpak Ltd., Plastopil Hazorea Company Ltd, Danafilms Corp., Cosmo Films Ltd, Flexopack SA, Chaozhou Chaoan Keneng Print Co., Ltd., Jiangmen Pengjiang Hualong Packing Materials Co., Ltd, Shantou Weiyi Packaging Co., Ltd., Zhongsu New Materials Technology (Hangzhou) Co., Ltd., Dongying Jiachuan Commerce And Trade Co., Ltd., etc.

Amcor Limited launched a new innovative range of lidding films which are fully recyclable. Cosmo films launched a new range of universal lidding films which can be used for all types of thermoformed plastic containers.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, type of product and applications.

The lidding films can be segmented by the product type, substrate, by application, and by end use industry.

The global lidding films market is estimated to be valued at USD 22.6 billion in 2025.

The market size for the lidding films market is projected to reach USD 40.5 billion by 2035.

The lidding films market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in lidding films market are high barrier lidding films, dual-ovenable lidding films, specialty lidding films and breathable lidding films.

In terms of substrate, pet segment to command 26.8% share in the lidding films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peelable lidding films Market Size and Share Forecast Outlook 2025 to 2035

Specialty Lidding Films Market

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Market Share Breakdown of Dual Ovenable Lidding Films Manufacturers

Competitive Breakdown of Biodegradable Lidding Films Providers

Lidding Foil Market

Breathable Lidding Film Packaging Market by Material Type from 2025 to 2035

Competitive Overview of Breathable Lidding Film Packaging Companies

High Barrier Lidding Film Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the High Barrier Lidding Film Industry

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA