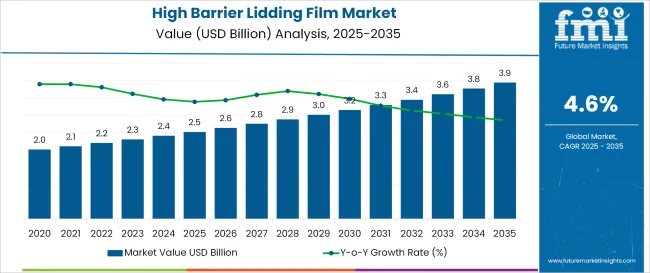

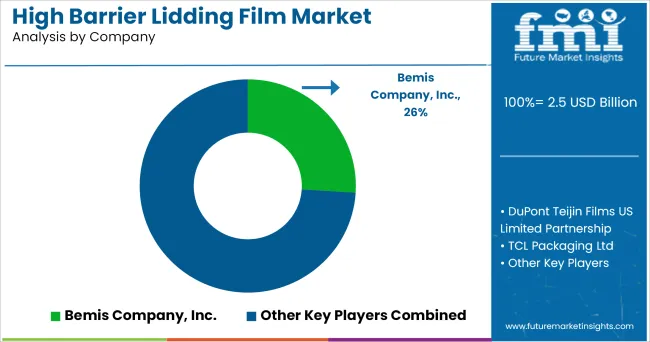

The global high barrier lidding film market is valued at USD 2.5 billion in 2025 and is expected to reach USD 3.9 billion by 2035, registering a CAGR of 4.6%. Market expansion is driven by rising consumer demand for extended shelf-life products, increasing adoption of sustainable packaging solutions, and growth in convenience food consumption.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 2.5 billion |

| Projected Value (2035F) | USD 3.9 billion |

| CAGR (2025 to 2035) | 4.6% |

Technological innovations in multi-layer film structures and enhanced barrier capabilities against oxygen and moisture are also major contributing factors. The high barrier lidding film market accounts for approximately 4.5% of the overall flexible packaging industry, supported by growth in ready-to-eat meals and single-serve product formats.

In dairy packaging, it contributes around 7.1%, reflecting its widespread usage in yogurt cups, cheese trays, and cream tubs. Within the pharmaceutical packaging sector, it comprises about 3.2%, spurred by its increasing use in medical device packaging and sterile barrier applications.

In fresh produce packaging, high barrier lidding films command nearly 6% of the market, reflecting their essential role in extending shelf life and maintaining product freshness. In frozen food packaging and convenience meal markets, barrier films constitute around 5.5% to 6.2%, highlighting their function as protective barriers against moisture and oxygen in temperature-sensitive applications.

Government regulations impacting the market focus on regulatory efforts to minimize plastic waste and encourage recyclable barrier films, which have influenced product development trends. Recent innovations include biodegradable barrier coatings, laser perforation for breathability, and peelable seal films with enhanced recyclability.

Government-supported initiatives across Europe and North America promoting circular economy packaging strategies are also expected to spur market growth. Continuous advancements in packaging technology and sustainable materials will further unlock value across the high barrier lidding film supply chain. Additionally, strategic collaborations between film manufacturers and end-use industries are likely to accelerate customized product development and market penetration.

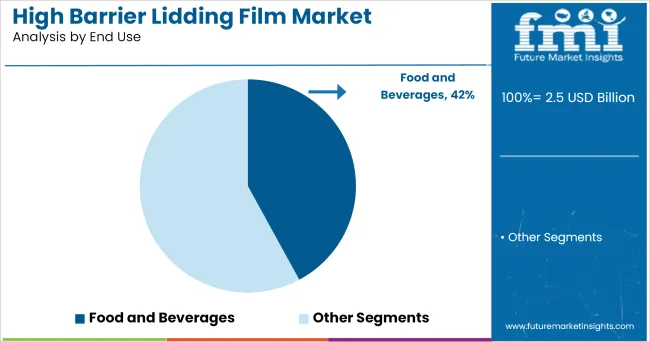

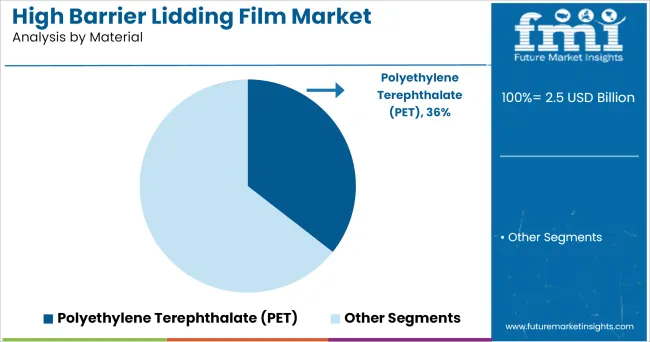

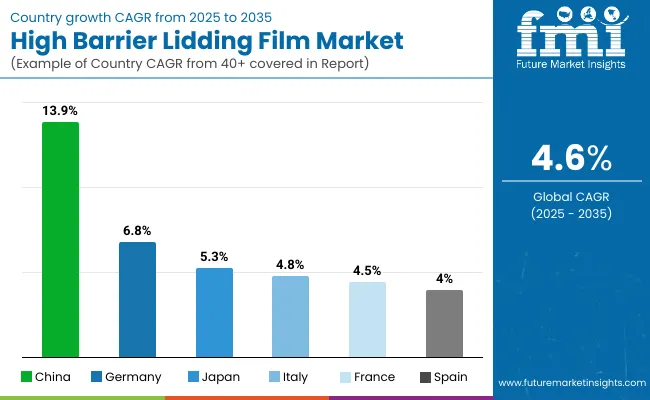

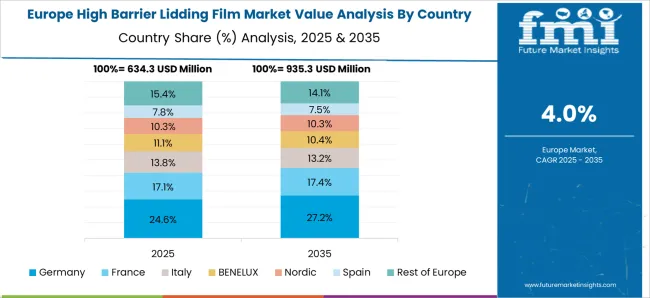

China is projected to be the fastest-growing market, expanding at a CAGR of 13.9% from 2025 to 2035. PET will lead the material segment with a 36% share, while Food packaging will dominate the application segment with a 42% market share in 2025. Germany and Japan will also see steady growth at CAGRs of 5.3% and 4.9%, respectively.

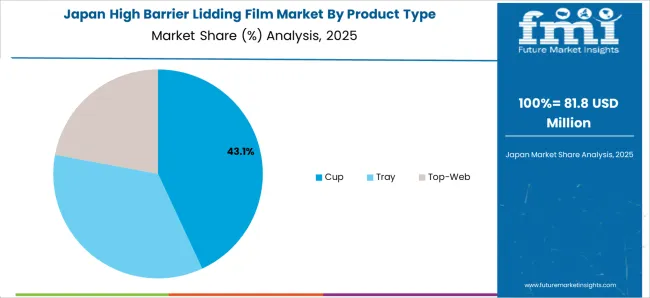

The high barrier lidding film market is segmented by material, application, and region. By material used, the market includes PET, polyethylene (PE), polypropylene (PP), and PVC. By product type, the market includes cup, tray, and top-web.

Based on application, the market is categorized into food & beverages, pharmaceuticals, cosmetics, and consumer goods. Regionally, the market is classified into North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Food & beverages are projected to dominate the end-use segment, accounting for 42% of the global high barrier lidding film market share. Their critical role in extending shelf life, maintaining product freshness, and providing superior barrier protection against oxygen, moisture, and contaminants establishes them as the primary driver for manufacturers.

The versatility of high barrier lidding films supports their widespread use in ready-to-eat meals, dairy products, processed meats, snacks, and beverage packaging, making them the preferred solution for maintaining food quality and safety.

Polyethylene Terephthalate (PET) is projected to dominate the material segment, accounting for 36% of the global market share. Its superior clarity, excellent barrier properties, and chemical resistance make it the preferred material across food, pharmaceutical, and consumer goods applications. Manufacturers value PET's ability to maintain product visibility while providing robust protection against environmental factors without compromising package integrity.

The global high barrier lidding film market has been experiencing steady growth, driven by increasing demand for extended shelf life, food safety, and sustainable packaging solutions. As consumers prioritize convenience and freshness, these films are becoming essential in ready-to-eat meals, dairy products, and pharmaceutical packaging.

Their superior moisture, oxygen, and contamination barrier properties align with evolving industry needs for hygiene, product integrity, and regulatory compliance. Additionally, the push toward recyclable and mono-material barrier films is driving innovation, as manufacturers respond to environmental concerns and circular economy goals.

China leads the high barrier lidding film market due to rising demand for packaged foods, frozen meals, and pharmaceutical packaging solutions. Innovation in peel-and-reseal films and investments in sustainable materials are key growth drivers. Germany and Japan are also major contributors, benefiting from strong food processing and healthcare industries.

France and China are emerging as manufacturing hubs, supported by technological upgrades in film extrusion, lamination, and eco-friendly coatings. The Asia Pacific region is seeing rapid adoption across urban centers due to the rise of organized retail and growing middle-class demand for convenience food products.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

The China high barrier lidding film market is projected to grow at a CAGR of 13.9% from 2025 to 2035. Growth is driven by rapid industrialization, expanding food processing capabilities, and increasing consumer demand for packaged goods. China's massive manufacturing base and growing middle class are creating unprecedented demand for high-quality packaging solutions across multiple industries.

The Italy high barrier lidding film market is growing at a CAGR of 5.3% from 2025 to 2035. Growth is driven by the country's strong food and beverage industry, particularly in premium and artisanal products. Italy's established pharmaceutical and cosmetics sectors also significantly contribute to demand, with barrier films used in luxury packaging and medical applications.

The demand for high barrier lidding films in Germany is projected to grow at a CAGR of 6.8% from 2025 to 2035. Growth is driven by increasing use of barrier films in German food processing, automotive, and pharmaceutical packaging applications. As one of the leading markets in Europe, Germany benefits from a mature packaging industry and stringent quality standards. The country's pharmaceutical and medical device industries also leverage barrier films in specialized packaging requirements.

The France high barrier lidding film market is projected to grow at a CAGR of 4.8% from 2025 to 2035. Growth is driven by thriving food and beverage sectors, where barrier films are extensively used for gourmet and artisanal products. France has also embraced barrier films in cosmetics packaging, luxury goods, and organic food products. Regulatory alignment with sustainable packaging and recyclability trends has boosted barrier film adoption.

The Japan high barrier lidding film market is expected to grow at a CAGR of 4.5% from 2025 to 2035. Growth in the Japan market is supported by strong technological innovation, traditional precision in packaging, and continued applications in electronics and semiconductor industries.

The country has a long-standing tradition of advanced packaging technology, with barrier films used in food, electronics, and industrial applications. Japan's advanced manufacturing sector continues to utilize barrier films in precision packaging and contamination-sensitive applications.

The Spain high barrier lidding film market is expected to grow at a CAGR of 4.0% from 2025 to 2035. Growth in the Spanish market is supported by expanding food processing industries, tourism-driven hospitality sector, and growing export markets for Spanish agricultural products. The country's olive oil, wine, and processed food industries rely heavily on barrier films for product protection and shelf life extension.

The high barrier lidding film market is moderately consolidated with major players focusing on sustainable material innovations and strategic expansions. Companies like Winpak Ltd., Bischof & Klein SE & Co., DuPont Teijin Films USA Limited Partnership, Golden Eagle Extrusions Inc., Toray Plastics (America) Inc., Multi-Pastics Inc., Clifton Packaging Group Ltd., Bemis Company Inc., and TCL Packaging Ltd., dominate the industry through R&D, supply chain integration, and partnership with food and pharma brands.

Top companies in the high barrier High Barrier Lidding Films market are actively focusing on material innovation, regional expansion, and sustainability-driven product development to meet rising demand across food, pharmaceutical, and cosmetic applications. Key players such as Amcor, Bemis (now part of Amcor), Sealed Air, and Mondi are enhancing their portfolios with recyclable, mono-material, and resealable solutions.

Strategic collaborations with food manufacturers and pharmaceutical packaging firms are also being prioritized to develop tailored barrier film solutions. Regulatory compliance, extended shelf life performance, and compatibility with a wide range of sealing technologies continue to be critical areas of competitive advantage within the industry.

Recent High Barrier Lidding Film Market News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 3.9 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in kilo tons |

| By Product Type | Cup, Tray, Top-Web |

| By Material Used | PET, PE, PP, and PVC |

| By Application | Food & Beverages, Pharmaceuticals, Cosmetics, and Consumer Goods |

| Regions Covered | North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Winpak Ltd., Bischof & Klein SE & Co., DuPont Teijin Films USA Limited Partnership, Golden Eagle Extrusions Inc., Toray Plastics (America) Inc., Multi-Pastics Inc., Clifton Packaging Group Ltd., Bemis Company Inc., and TCL Packaging Ltd. |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global high barrier lidding film market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the high barrier lidding film market is projected to reach USD 3.8 billion by 2035.

The high barrier lidding film market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in high barrier lidding film market are cup, tray and top-web.

In terms of material, polyethylene terephthalate (pet) segment to command 38.6% share in the high barrier lidding film market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the High Barrier Lidding Film Industry

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of High Barrier Packaging Films for Pharmaceuticals

Market Share Breakdown of High Barrier Packaging Films Suppliers

High Performance Barrier Films Market Size, Growth, and Forecast 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

Electron High Barrier Packaging Film Market Growth - Forecast 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Barrier Film Market Trends & Industry Growth Forecast 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Friction Films Market Size and Share Forecast Outlook 2025 to 2035

Vapor Barrier Films Market Analysis by Material, Thickness, End-Use Industry, and Region through 2035

Clear Barrier Films Market

Oxygen Barrier Films And Coatings For Dry Food Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Barrier Films Market

Peelable lidding films Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

High Density Polyethylene Film Market

Super Barrier Coated Film Market Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA