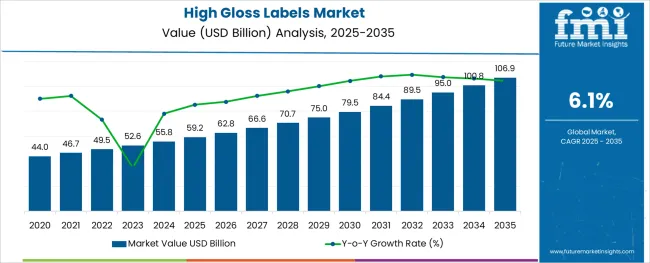

The High Gloss Labels Market is estimated to be valued at USD 59.2 billion in 2025 and is projected to reach USD 106.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The high gloss labels market is experiencing steady growth as manufacturers and brand owners increasingly prioritize visual appeal, durability, and branding consistency. High gloss finishes are gaining prominence for their ability to enhance shelf presence, resist smudging, and support high-resolution printing attributes critical in retail and packaging applications.

Industry adoption is being fueled by innovations in coating technologies, sustainable material options, and pressure-sensitive adhesives that improve label performance on various surfaces. As regulatory bodies enforce stricter labeling norms, particularly for safety and traceability, demand for reliable and durable labeling solutions has intensified. Growth is further supported by advancements in digital printing compatibility and rising investments in consumer packaging formats across e-commerce, personal care, and food sectors.

In the coming years, increased demand for tamper-evident, waterproof, and recyclable high-gloss labels is expected to offer new growth opportunities, especially as sustainability becomes central to packaging decisions.

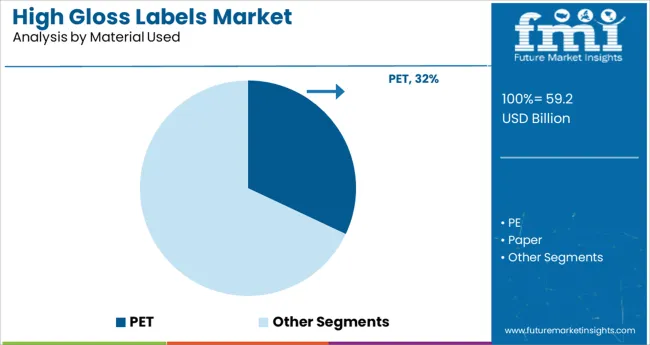

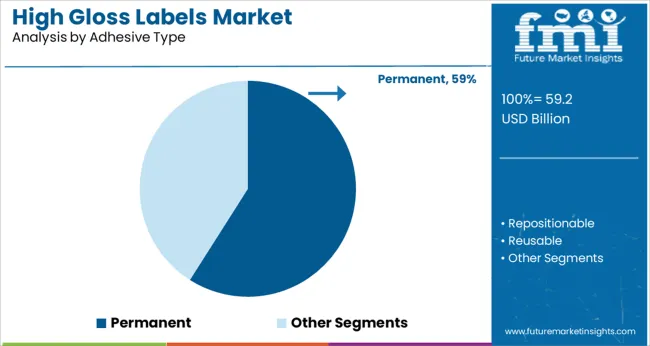

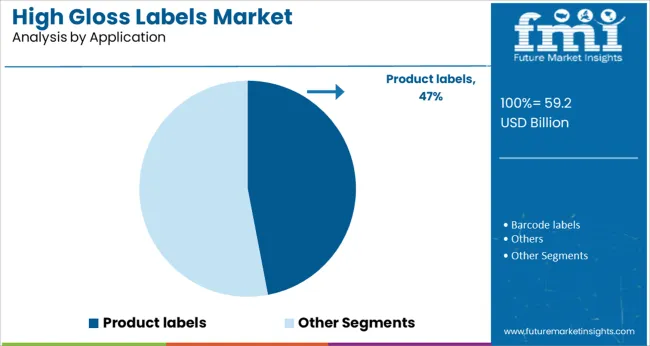

The market is segmented by Material Used, Adhesive Type, Application, and End Use Industry and region. By Material Used, the market is divided into PET, PE, Paper, PVC, and Others. In terms of Adhesive Type, the market is classified into Permanent, Repositionable, and Reusable. Based on Application, the market is segmented into Product labels, Barcode labels, and Others.

By End Use Industry, the market is divided into Food & beverage industry, Confectionary industry, Pharmaceutical industry, Cosmetic industry, Electronic industry, and Other industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene terephthalate (PET) is expected to account for 32.0% of the high gloss labels market revenue in 2025, establishing it as a leading material choice. This prominence is being driven by PET’s clarity, tensile strength, and excellent compatibility with high-speed printing processes.

Its dimensional stability and resistance to moisture and chemicals make it a preferred substrate for labeling products in demanding environments, including beverages, cosmetics, and industrial packaging. PET also supports recyclability and integrates well with both UV-curable and water-based inks, aligning with sustainability and compliance initiatives.

The material's ability to maintain gloss and print quality under various temperatures further strengthens its usage across both primary and secondary packaging formats. As brands continue to seek eco-efficient and visually superior labeling options, PET’s robust performance characteristics are expected to reinforce its dominance in the market.

Permanent adhesives are projected to hold 59.0% of total market revenue in 2025, making them the dominant adhesive type in the high gloss labels industry. This leadership is attributed to their strong bonding strength, longevity, and reliability across a wide range of substrates, including plastics, glass, and metals.

Permanent adhesives ensure that labels remain intact during the entire product lifecycle, even in environments involving friction, moisture, or temperature fluctuations. Their wide application in retail, logistics, and industrial labeling has solidified their position in packaging workflows that demand tamper-proof and traceable product identification. Moreover, compatibility with automatic labeling machinery and minimal adhesive bleed contribute to clean, high-performance finishes.

As regulatory requirements tighten around product traceability and labeling permanence, the demand for durable, pressure-sensitive adhesives continues to grow, reinforcing this segment’s market leadership.

Product labeling is projected to account for 47.0% of the high gloss labels market revenue in 2025, establishing it as the top application segment. Growth in this segment is being driven by the emphasis on shelf differentiation, branding consistency, and consumer engagement across packaged goods.

High gloss labels provide a premium visual finish that enhances perceived product quality and supports high-resolution imagery, which is critical for competitive positioning. Product categories ranging from cosmetics and food to personal care and beverages increasingly rely on these labels to convey information, maintain brand identity, and attract buyers in crowded retail settings.

The ability to combine gloss finishes with tactile and interactive elements, such as QR codes or augmented reality triggers, further adds value in this application. Additionally, evolving labeling standards and the need for multilingual content are prompting brands to invest in labels that are both functional and visually compelling, driving sustained demand in this segment.

Labels have become an important part of market today. They are not just used for storing information related to product but also attract customers and increase product appeal. It has been found that, it takes only seven seconds to create purchase or a drop. High gloss labels are a sub-class of coated labels. High gloss label is a type of label which is economical, and provides smooth and fine printing surface for branding and promotion.

Generally, inkjet and laser printers are used on high gloss labels for printing purposes. Here on high gloss labels, ultra violet coatings and gloss laminates together protect a label’s inks from spreading. Also, these high gloss labels are comparatively cheaper than film and possess equivalent print quality and durability, which increases their preference.

Materials which are used for the production of high gloss labels are polypropylene, paper, and others. High gloss labels adhere to multiple surfaces such as that of glass, metal, plastics and others. These labels provide good heat, moisture, and water resistance, which increases their durability. High gloss labels find a wide range of applications and are used as product labels, barcode labels and labels which are used on boxes, among others.

The global high gloss labels market growth is attributed to growing industries across the globe. Industries such as food & beverage, confectionary industry, electronics industry, chemical industry, and other such industries are using high gloss labels as a part of their packaging. This factor is expected to drive the global high gloss labels market growth over the forecast period.

Increasing use of barcodes in the packaging industry is expected to elevate the global high gloss labels market growth during the forecast period. These labels are available in various adhesive types such as repositionable, reusable or permanent. These high gloss labels provide excellent printability, which helps manufacturers to print product related information on the surface.

This factor is expected to drive global high gloss labels market growth over the forecast period. High gloss labels are abrasion resistant and water resistant. This increases their preference among the manufacturers, which in turn drives the growth of global high gloss labels market over the next decade.

The factors which might hamper the global gloss labels market growth is availability of rather cheaper alternatives such as matte labels and other such labels in the market.

North America and Western European region are expected to witness low growth in high gloss labels market over the next decade as these markets are already matured.

APEJ is the fastest growing market for high gloss labels during the forecast period, primarily driven by emerging economies such as India and China, where high gloss labels market is expected to grow due to growth in the consumer packaged goods industries and growing number of supermarkets in the region.

The Eastern Europe and Latin America high gloss labels markets are expected to witness average growth due to increase in manufacturing industries in the region, growing purchasing power, and changing lifestyle. MEA is expected to observe average growth during the next decade. Japan high gloss labels market is expected to witness average growth as the market is saturated and well established.

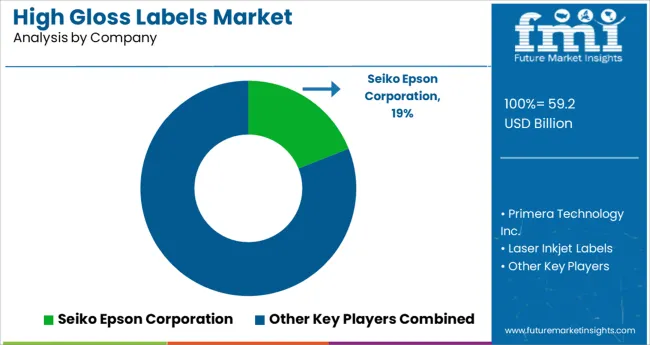

The key players operating in the global high gloss labels market are - Primera Technology Inc., Seiko Epson Corporation, Laser Inkjet Labels, AM Labels Ltd, Blanco Labels, Fast Labels, and others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global high gloss labels market is estimated to be valued at USD 59.2 billion in 2025.

It is projected to reach USD 106.9 billion by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are pet, pe, paper, pvc and others.

permanent segment is expected to dominate with a 59.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA