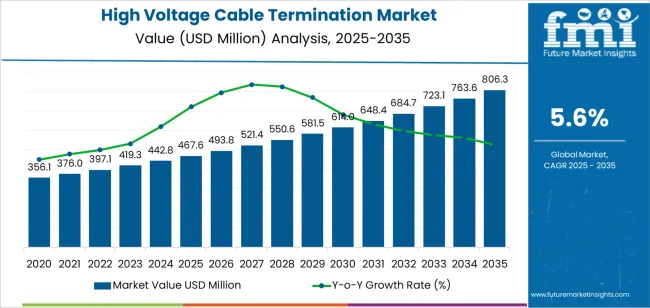

The global high voltage cable termination market is expected to grow from USD 467.6 million in 2025 to approximately USD 806.3 million by 2035, recording an absolute increase of USD 338.7 million over the forecast period. This translates into a total growth of 72.4%, with the market forecast to expand at a CAGR of 5.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing electricity transmission infrastructure investments globally, growing adoption of renewable energy integration technologies, and rising demand for grid modernization projects across developed and emerging power markets.

The market's expansion reflects the fundamental shift in electrical infrastructure toward enhanced transmission capacity and improved grid reliability standards. Power utilities in North America and Europe continue to invest in high voltage cable termination systems that meet stringent safety requirements while supporting increased power transmission efficiency. Asia Pacific markets demonstrate accelerating adoption as power grid construction expands and renewable energy infrastructure matures. The growing emphasis on underground cable deployment and grid interconnection drives demand for termination solutions that can support high voltage applications while maintaining operational reliability across diverse environmental conditions.

Technical advancements in termination technologies and insulation systems enable more sophisticated power transmission protocols that support diverse voltage levels and extended operational requirements. Major utility companies increasingly prioritize solutions that offer consistent performance across different installation scenarios while meeting stringent electrical and mechanical standards. The market benefits from established engineering standards supporting cable termination applications combined with ongoing innovation in materials science and installation methodologies. Supply chain considerations favor systems that provide reliable performance and simplified installation protocols for utility contractors operating under demanding project timelines and technical specifications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 467.6 million |

| Market Forecast Value (2035) | USD 806.3 million |

| Forecast CAGR (2025-2035) | 5.6% |

| POWER INFRASTRUCTURE EXPANSION | GRID MODERNIZATION REQUIREMENTS | REGULATORY & SAFETY STANDARDS |

|---|---|---|

| Global Transmission Infrastructure Growth Continuous expansion of high voltage transmission networks and underground cable deployment across established and emerging markets driving demand for reliable termination systems. Renewable Energy Integration Growing emphasis on renewable power plant connections and offshore wind farm infrastructure creating demand for specialized termination technologies. Grid Investment Focus Increasing utility investments in transmission capacity expansion and grid reliability programs supporting adoption of high-performance cable termination solutions. |

Sophisticated Technical Requirements Modern power transmission requires termination systems delivering precise voltage control and enhanced electrical performance capabilities. Reliability Demands Utility companies investing in termination solutions offering consistent operational performance while maintaining safety standards under extreme conditions. Quality and Performance Standards Power utilities requiring certified systems with proven track records for critical transmission infrastructure applications. |

Electrical Safety Standards Regulatory requirements establishing performance benchmarks favoring engineered cable termination systems. Installation Protocol Standards Quality standards requiring superior insulation properties and resistance to electrical stresses in high voltage environments. Utility Compliance Requirements Diverse regulatory requirements and technical standards driving need for sophisticated cable termination solutions. |

| Category | Segments Covered |

|---|---|

| By Installation Environment | Indoor Termination, Outdoor Termination, Industrial Settings |

| By Application | Power Transmission and Distribution, Renewable Energy, Telecommunications, Electric Utilities |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

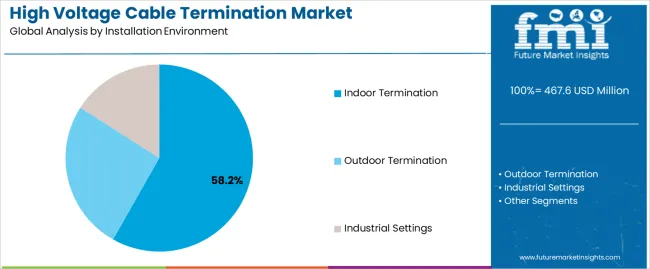

| Indoor Termination | Leader in 2025 with 58.2% market share expected to maintain dominance through 2035. Optimal configuration for substations, switchgear facilities, and enclosed distribution centers with controlled environmental conditions. Momentum: steady-to-strong driven by substation construction and urban underground cable deployment. Watchouts: space constraints in retrofit applications and ventilation requirements in compact installations. |

| Outdoor Termination | Secondary format serving exposed installation environments including overhead-to-underground transitions, pole-mounted applications, and outdoor switchyards. Growing adoption in utility networks prioritizing weather-resistant solutions and simplified maintenance access. Momentum: moderate growth in transmission grid expansion and renewable energy interconnection projects. Watchouts: environmental stress factors and extended maintenance cycles compared to indoor installations. |

| Industrial Settings | Serves specialized manufacturing facilities, mining operations, and heavy industrial power distribution requiring ruggedized termination solutions. Limited adoption due to specific application requirements and customized engineering needs. Momentum: selective growth in industrial electrification projects and heavy manufacturing expansions. Watchouts: higher customization costs and facility-specific technical specifications. |

| Segment | 2025 to 2035 Outlook |

|---|---|

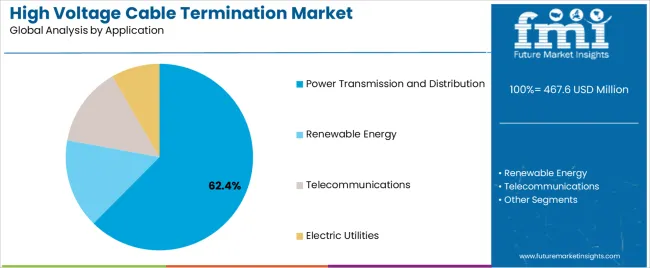

| Power Transmission and Distribution | Dominant segment at 62.4% market share in 2025 representing primary deployment environment across utility networks. Comprehensive grid infrastructure requirements spanning transmission substations, distribution systems, and interconnection facilities. Momentum: steady growth driven by grid modernization and transmission capacity expansion initiatives. Watchouts: utility budget cycles and regulatory approval timelines for infrastructure projects. |

| Renewable Energy | Fastest-growing segment focused on wind farm connections, solar power plant integration, and renewable energy transmission infrastructure. Supporting grid connection requirements for distributed generation and offshore power transmission. Momentum: strong growth driven by renewable energy capacity additions and green energy transition programs. Watchouts: project development cycles and grid interconnection queue constraints. |

| Telecommunications | Growing segment supporting fiber optic network power infrastructure, data center connections, and telecommunications facility power distribution. Enabling reliable power delivery for critical communications infrastructure. Momentum: moderate expansion as telecommunications networks densify and data center construction accelerates. Watchouts: cost sensitivity in telecommunications infrastructure investments and technology evolution impacts. |

| Electric Utilities | Includes municipal utilities, cooperative power systems, and regional transmission organizations requiring standardized termination solutions. Supporting diverse utility infrastructure needs across residential, commercial, and industrial service territories. Momentum: steady growth as utility infrastructure ages and replacement cycles drive equipment upgrades. Watchouts: utility rate constraints and public utility commission approval requirements affecting capital expenditure timing. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Grid Modernization Programs Continuing emphasis on transmission infrastructure upgrades and grid reliability improvements across power systems driving demand for advanced termination solutions. Underground Cable Deployment Increasing adoption of underground transmission cables for aesthetic reasons and reliability enhancement creating demand for specialized termination technologies. Renewable Energy Expansion Growing investments in wind and solar power infrastructure supporting demand for cable termination systems enabling renewable energy grid integration. |

High Installation Costs Specialized installation requirements and skilled labor needs affecting project economics and deployment timelines. Technical Complexity Engineering specifications and quality control requirements demanding expertise and comprehensive testing protocols. Long Project Cycles Utility infrastructure project timelines and regulatory approval processes affecting market growth rates and revenue recognition. |

Advanced Insulation Materials Integration of silicone rubber compounds, cross-linked polyethylene systems, and composite materials enabling superior electrical performance and extended service life. Prefabricated Solutions Development of factory-assembled terminations, quality-tested components, and standardized installation kits supporting installation efficiency. Smart Monitoring Integration Enhanced sensor technologies providing real-time condition monitoring, partial discharge detection, and predictive maintenance capabilities compared to conventional systems. Modular Design Innovation Integration of interchangeable components and scalable voltage ratings supporting diverse application requirements and simplified inventory management. |

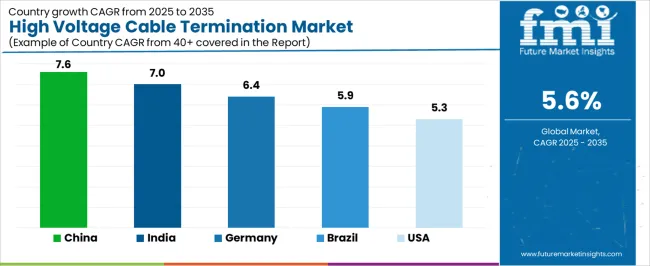

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

| United States | 5.3% |

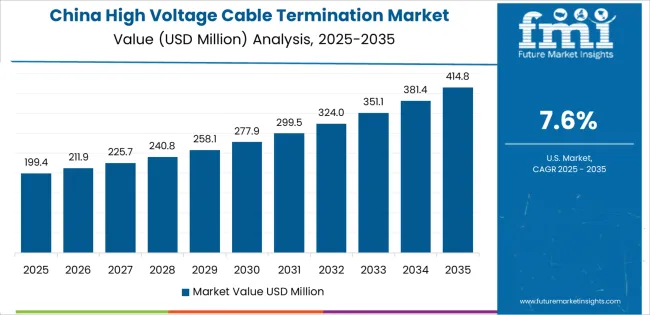

Revenue from high voltage cable terminations in China is expected to grow at a strong 7.6% CAGR, reaching significant market value by 2035, driven by expanding ultra-high voltage transmission projects and comprehensive grid modernization programs. This creates substantial opportunities for termination system providers across major power corridors, urban substations, and renewable energy interconnection facilities. The country's massive power infrastructure development and growing electricity demand are creating significant demand for high-performance cable termination systems. Major utility companies and grid operators are establishing comprehensive transmission protocols to support large-scale power delivery operations and meet the growing demand for reliable electricity transmission.

Revenue from high voltage cable terminations in India is anticipated to grow at a 7.0% CAGR, reaching significant levels by 2035, supported by power sector expansion and comprehensive transmission infrastructure development. This is creating sustained demand for cable termination systems across diverse utility networks and emerging grid corridors. The country's growing electrification programs and expanding renewable energy capacity are driving demand for systems that provide consistent technical performance while supporting cost-effective procurement requirements. Utility companies and transmission operators are investing in grid infrastructure technologies to support growing power demand and quality improvement initiatives.

Demand for high voltage cable terminations in Germany is projected to grow at a 6.4% CAGR, reaching substantial levels by 2035, supported by the country's leadership in power system engineering and advanced grid management protocols. This requires sophisticated cable termination systems for diverse voltage levels and complex network configurations. German utility companies are implementing high-quality termination systems that support engineering best practices, operational efficiency, and comprehensive safety standards. The market is characterized by focus on technical excellence, regulatory compliance, and adherence to stringent electrical equipment and grid safety standards.

Revenue from high voltage cable terminations in Brazil is forecasted to grow at a 5.9% CAGR, reaching significant levels by 2035, driven by power sector modernization programs and increasing transmission infrastructure development. This creates sustained opportunities for system providers serving both federal utility companies and regional transmission operators. The country's expanding electricity infrastructure and growing power equipment market are creating demand for cable termination systems that support diverse technical requirements while maintaining safety standards. Utility companies and transmission contractors are developing procurement strategies to support operational efficiency and technical specification compliance.

Demand for high voltage cable terminations in the United States is projected to expand at a CAGR of 5.3%, driven by grid reliability excellence and established transmission infrastructure supporting advanced cable deployment protocols and comprehensive utility management systems. The country's mature power grid and stringent regulatory environment are creating demand for cable termination systems that support technical performance and safety compliance standards. Utility companies and transmission operators are maintaining comprehensive engineering protocols to support diverse grid infrastructure requirements.

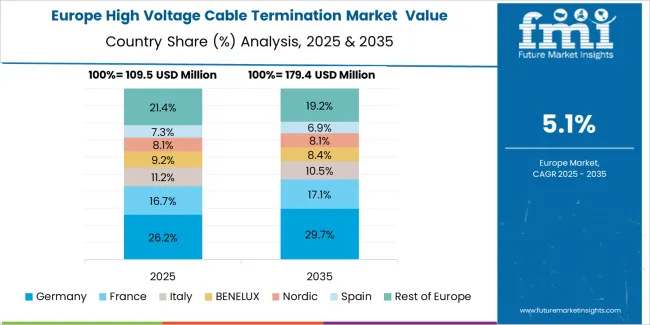

The high voltage cable termination market in Europe is projected to grow from USD 142.8 million in 2025 to USD 229.4 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.6% by 2035, supported by its advanced power transmission infrastructure and major grid operators including TenneT and Amprion.

France follows with a 23.4% share in 2025, projected to reach 24.0% by 2035, driven by comprehensive grid modernization programs and nuclear power plant infrastructure. The United Kingdom holds a 19.8% share in 2025, expected to maintain stability at 19.6% by 2035 with continued National Grid transmission investment. Italy commands a 14.7% share, while Spain accounts for 10.9% in 2025. The Rest of Europe region is anticipated to maintain its collective share at approximately 11% through 2035, with increasing adoption in Nordic countries and Eastern European power systems implementing transmission capacity expansion programs.

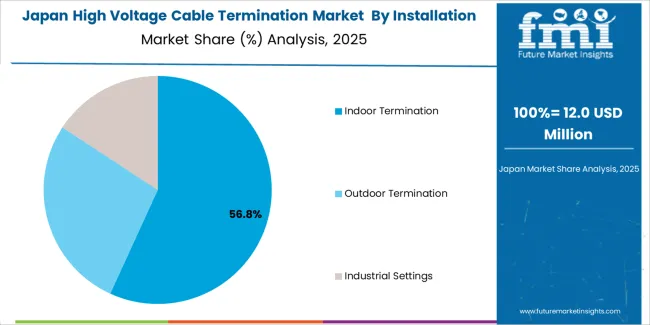

Japanese high voltage cable termination operations reflect the country's exacting technical standards and sophisticated power system protocols. Major utility companies including Tokyo Electric Power and Kansai Electric Power maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, performance validation, and system testing that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports optimal grid reliability outcomes.

The Japanese market demonstrates unique technical requirements, with significant emphasis on seismic-resistant designs and precise voltage control specifications tailored to established utility engineering standards. Regulatory oversight through the Ministry of Economy, Trade and Industry emphasizes comprehensive safety management and performance verification requirements that surpass most international standards.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese utility companies typically maintain long-term supplier relationships spanning decades, with contract negotiations emphasizing technical consistency and engineering support over price competition.

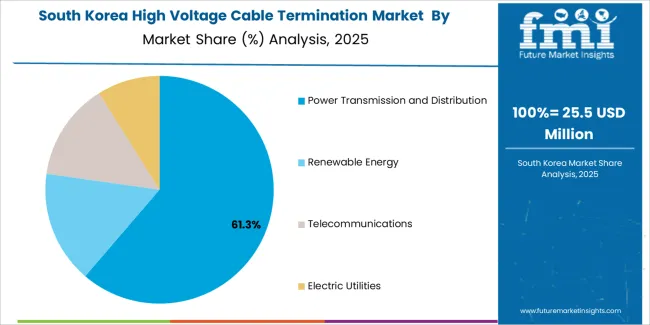

South Korean high voltage cable termination operations reflect the country's advanced power infrastructure and technology-oriented utility management approach. Major power companies including Korea Electric Power Corporation drive sophisticated termination system procurement strategies, establishing relationships with international suppliers to secure consistent quality and technical compliance for transmission infrastructure.

The Korean market demonstrates particular strength in integrating cable termination systems with smart grid technologies, with utilities combining termination installations with advanced monitoring systems and automated fault detection protocols. Regulatory frameworks emphasize electrical safety and system reliability, with Ministry of Trade, Industry and Energy requirements for comprehensive documentation and quality assurance.

Supply chain efficiency remains critical given Korea's mix of domestic manufacturing and international equipment procurement. Utility companies increasingly pursue long-term contracts with both local and international manufacturers to ensure reliable access while managing technical specification requirements.

Profit pools concentrate in engineered termination system development and certified utility-grade solutions where technical validation, regulatory compliance, and utility relationships command sustained margins. Value migrates from commodity cable accessories to application-specific termination systems with documented electrical performance and comprehensive testing certifications. Several competitive archetypes define market dynamics: established power equipment manufacturers leveraging utility relationships and engineering expertise; specialized cable accessory developers with proprietary termination technologies and material science capabilities; electrical equipment conglomerates expanding transmission product portfolios; and regional distributors serving utility networks with established supplier partnerships. Switching costs remain substantial given utility qualification requirements, engineering specification integration, and contractor training needs, stabilizing supplier relationships for proven systems. Market entry barriers include utility approval timelines, technical certification requirements, and established procurement relationships within transmission infrastructure networks. Consolidation occurs selectively as larger electrical equipment companies acquire specialized cable termination technology platforms to expand utility product offerings. Digital procurement influences commodity accessory purchasing while engineered termination systems remain relationship-driven given technical performance criticality. Strategic imperatives include securing utility partnerships with comprehensive technical support, establishing multi-regional certifications and performance approvals, and developing voltage-specific systems addressing transmission needs across diverse utility applications and environmental conditions.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established power equipment manufacturers | Engineering expertise, utility relationships | Multi-product portfolios, testing infrastructure, global service networks |

| Specialized cable accessory developers | Proprietary termination technologies, material science capabilities | Novel insulation development, utility collaborations, targeted performance testing |

| Electrical equipment conglomerates | System integration capabilities, manufacturing scale | Product portfolio breadth, installed base leverage, utility account management |

| Regional distributors | Local market access, utility network knowledge | Multi-supplier partnerships, utility relationships, technical support capabilities |

| Items | Values |

|---|---|

| Quantitative Units | USD 467.6 million |

| Product | Indoor Termination, Outdoor Termination, Industrial Settings |

| Application | Power Transmission and Distribution, Renewable Energy, Telecommunications, Electric Utilities |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, China, Brazil, India, and other 40+ countries |

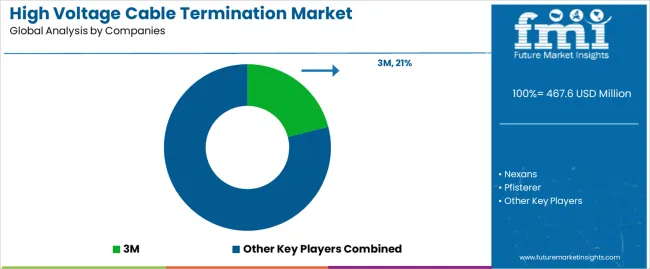

| Key Companies Profiled | 3M, Nexans, Pfisterer, Prysmian, ABB, Siemens, Elastimold, Shrink Polymer Systems, Raychem |

| Additional Attributes | Dollar sales by installation environment/application, regional demand (NA, EU, APAC), competitive landscape, utility vs. industrial adoption, insulation technology innovation, and smart monitoring integration driving grid reliability improvement, transmission efficiency, and electrical safety standards |

By Installation Environment

The global high voltage cable termination market is estimated to be valued at USD 467.6 million in 2025.

The market size for the high voltage cable termination market is projected to reach USD 806.3 million by 2035.

The high voltage cable termination market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in high voltage cable termination market are indoor termination, outdoor termination and industrial settings.

In terms of application, power transmission and distribution segment to command 62.4% share in the high voltage cable termination market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA