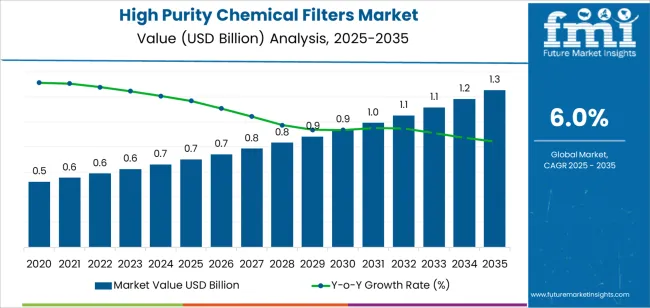

The global high purity chemical filters market is valued at USD 0.7 billion in 2025. It is slated to reach USD 1.2 billion by 2035, recording an absolute increase of USD 0.5 billion over the forecast period. This translates into a total growth of 79.1%, with the market forecast to expand at a CAGR of 6.0% between 2025 and 2035. The market size is expected to grow by nearly 1.79 times during the same period, supported by increasing demand for ultrapure chemical filtration, growing adoption of contamination control in semiconductor manufacturing, and rising focus on process purity across pharmaceutical production, chemical processing, and advanced materials fabrication facilities.

Between 2025 and 2030, the market is projected to expand from USD 0.7 billion to USD 1.0 billion, resulting in a value increase of USD 0.3 billion, which represents 52.9% of the total forecast growth for the decade. This phase of development will be shaped by accelerating semiconductor manufacturing capacity expansion and advanced node technology adoption, rising pharmaceutical biologics production requiring stringent contamination control, and growing demand for specialty chemical purity in electronics and materials applications. Semiconductor fabs and pharmaceutical manufacturers are expanding their filtration capabilities to address the growing demand for contamination-free processing that ensures product quality and yield optimization in critical manufacturing operations.

From 2030 to 2035, the market is forecast to grow from USD 1.0 billion to USD 1.2 billion, adding another USD 0.2 billion, which constitutes 47.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of next-generation semiconductor nodes and extreme ultraviolet lithography adoption, the development of advanced filtration materials with enhanced particle retention capabilities, and the growth of gene therapy and cell therapy manufacturing requiring ultra-high purity standards. The growing adoption of continuous manufacturing processes and single-use systems will drive demand for high purity filters with validated performance and comprehensive contamination control documentation.

Between 2020 and 2025, the market experienced steady growth, driven by increasing semiconductor manufacturing complexity and growing recognition of ultrapure filtration as an essential requirement for preventing defects, ensuring process reliability, and supporting yield targets in semiconductor, pharmaceutical, and specialty chemical production. The market developed as process engineers and quality managers recognized the potential for high purity filtration technology to eliminate contamination sources, prevent particle-induced defects, and support stringent purity objectives while meeting industry qualification standards. Technological advancement in filter membrane materials and housing designs began focusing the critical importance of maintaining extractable levels and particle retention efficiency in ultrapure process environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 0.7 billion |

| Forecast Value in (2035F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

Market expansion is being supported by the increasing global demand for contamination-free processing driven by semiconductor manufacturing advancement and pharmaceutical production standards, alongside the corresponding need for ultrapure filtration systems that can remove submicron particles, prevent chemical extractables, and maintain process integrity across semiconductor fabs, pharmaceutical facilities, and specialty chemical plants. Modern process engineers and manufacturing managers are increasingly focused on implementing high purity filtration solutions that can eliminate defect sources, enhance product quality, and provide consistent performance in demanding cleanroom environments.

The growing focus on yield optimization and contamination control is driving demand for high purity filters that can support advanced node semiconductor production, enable biologics manufacturing purity, and ensure comprehensive particle removal performance. Manufacturing operators' preference for filtration technologies that combine submicron retention with low extractables and validated performance is creating opportunities for innovative filter implementations. The rising influence of semiconductor node shrinkage and pharmaceutical single-use systems is also contributing to increased adoption of filters that can provide superior purity levels without compromising process flow or introducing contamination.

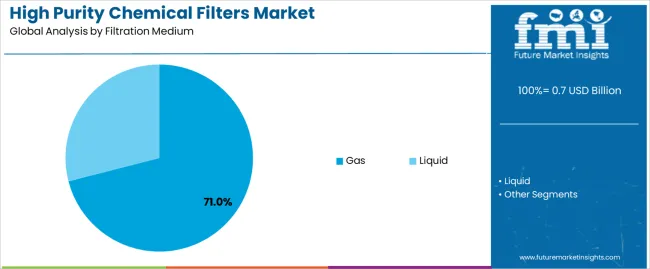

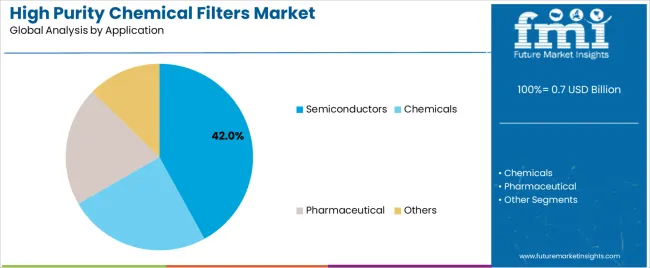

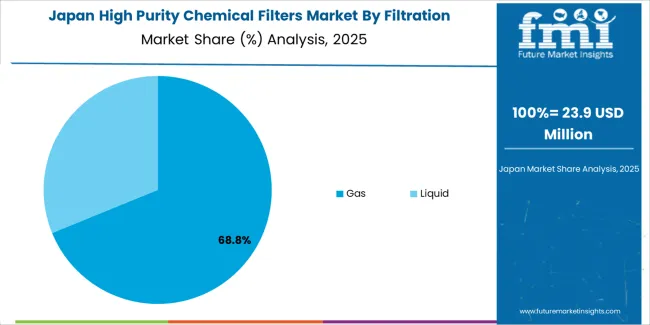

The market is segmented by filtration medium, application, and region. By filtration medium, the market is divided into gas and liquid. Based on application, the market is categorized into semiconductors, chemicals, pharmaceutical, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The gas segment is projected to maintain its leading position in the market with 71.0% market share in 2025 with a substantial market share, reaffirming its role as the preferred filtration medium for critical process gas purification and cleanroom air treatment applications. Semiconductor manufacturers and pharmaceutical producers increasingly utilize gas filtration systems for their essential contamination control characteristics, submicron particle removal capabilities, and proven effectiveness in maintaining ultrapure processing environments while supporting cleanroom classification requirements. Gas filtration technology's proven effectiveness and application criticality directly address industry requirements for particle-free atmospheres and established performance record across diverse cleanroom classes and process gas applications.

This filtration medium forms the foundation of modern contamination control systems, as it represents the application with the greatest impact on defect prevention and established reliability record across multiple semiconductor fabrication processes and pharmaceutical production operations. Industry investments in advanced manufacturing technologies continue to strengthen adoption among semiconductor fabs and pharmaceutical facilities. With quality pressures requiring improved particle control and cleanroom performance, gas filtration systems align with both contamination objectives and cleanroom standards, making them the central component of comprehensive contamination control strategies.

The semiconductors application segment is projected to represent the 42.0% market share of high purity chemical filters demand in 2025, highlighting its critical role as the primary driver for filter adoption across wafer fabrication facilities, photolithography processes, and chemical delivery systems serving integrated circuit manufacturing operations. Semiconductor manufacturers prefer high purity filters for process applications due to their exceptional particle retention capabilities, low extractables characteristics, and ability to prevent defect generation while supporting advanced node production requirements and yield optimization targets. Positioned as essential components for modern semiconductor manufacturing, high purity filters offer both quality advantages and process reliability benefits.

The segment is supported by continuous advancement in semiconductor technology nodes and the growing deployment of extreme ultraviolet lithography systems that enable smaller feature sizes with enhanced contamination sensitivity and reduced defect tolerance. Semiconductor manufacturers are investing in comprehensive contamination control programs to support increasingly stringent particle specifications and yield requirements for advanced logic and memory devices. As semiconductor technology complexity accelerates and node dimensions shrink, the semiconductors application will continue to dominate the market while supporting advanced filtration integration and contamination control optimization strategies.

The high purity chemical filters market is advancing steadily due to increasing demand for contamination control solutions driven by semiconductor manufacturing complexity and growing adoption of advanced pharmaceutical production that requires ultrapure filtration systems providing exceptional particle removal and extractables control benefits across semiconductor fabrication, pharmaceutical manufacturing, and specialty chemical processing operations. The market faces challenges, including high product costs and qualification requirements, competition from alternative purification technologies and integrated systems, and validation constraints related to material compatibility testing and extractables characterization. Innovation in membrane material development and filter integrity monitoring continues to influence product development and market expansion patterns.

The growing deployment of advanced semiconductor manufacturing technologies is driving demand for specialized filtration solutions that address unique process requirements including sub-10nm feature protection, extreme ultraviolet resist purity, and chemical mechanical planarization slurry filtration for next-generation integrated circuits. Advanced node applications require high purity filters that deliver superior particle retention across critical size ranges while maintaining chemical compatibility and cost-effectiveness. Semiconductor manufacturers are increasingly recognizing the competitive advantages of advanced filtration integration for yield enhancement and defect reduction, creating opportunities for innovative filter designs specifically engineered for leading-edge semiconductor production technologies.

Modern pharmaceutical and biopharmaceutical manufacturing facilities are incorporating single-use filtration systems and disposable technologies to enhance operational flexibility, reduce contamination risks, and support comprehensive cleanability objectives through elimination of cleaning validation and cross-contamination concerns. Leading pharmaceutical companies are developing integrated single-use assemblies, implementing disposable filter cartridges, and advancing technologies that enable rapid changeover and minimize validation requirements. These technologies improve manufacturing agility while enabling new operational capabilities, including multi-product facilities, campaign-based production, and accelerated process development timelines. Advanced single-use integration also allows manufacturers to support comprehensive quality objectives and operational efficiency beyond traditional reusable system attributes.

The expansion of specialty chemical production, high-purity reagent manufacturing, and advanced materials processing is driving demand for filtration membranes with optimized pore structures and enhanced chemical resistance characteristics. These demanding applications require specialized filter materials with precise particle retention that exceed conventional membrane capabilities, creating premium market segments with differentiated value propositions. Manufacturers are investing in membrane material innovation and performance validation to serve emerging high-purity chemical segments while supporting innovation in semiconductor photoresists, pharmaceutical excipients, and electronic materials production.

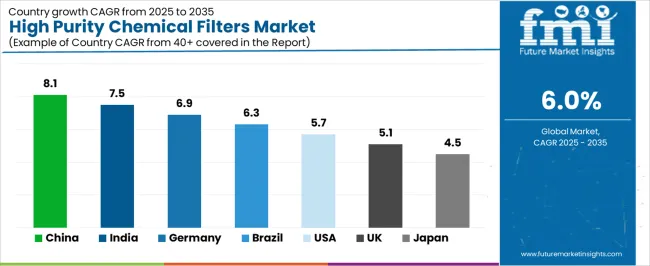

| Country | CAGR (2025-2035) |

|---|---|

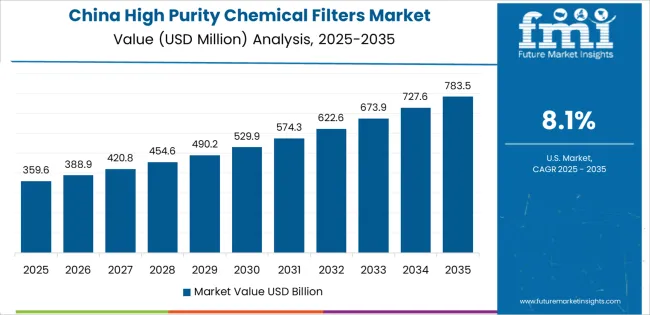

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| Brazil | 6.3% |

| United States | 5.7% |

| United Kingdom | 5.1% |

| Japan | 4.5% |

The market is experiencing solid growth globally, with China leading at an 8.1% CAGR through 2035, driven by massive semiconductor manufacturing capacity expansion, growing pharmaceutical production infrastructure, and increasing investment in domestic high-purity chemical production. India follows at 7.5%, supported by expanding semiconductor fabrication facilities, growing pharmaceutical manufacturing sector, and increasing adoption of contamination control technologies. Germany shows growth at 6.9%, focusing pharmaceutical excellence, semiconductor equipment manufacturing, and precision filtration technology development. Brazil demonstrates 6.3% growth, supported by pharmaceutical industry expansion, growing specialty chemical production, and increasing manufacturing quality standards. The United States records 5.7%, focusing on advanced semiconductor manufacturing, biopharmaceutical production leadership, and high-purity chemical processing. The United Kingdom exhibits 5.1% growth, focusing pharmaceutical manufacturing and specialty chemical production. Japan shows 4.5% growth, supported by semiconductor equipment leadership and pharmaceutical manufacturing precision.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 8.1% through 2035, driven by massive semiconductor manufacturing capacity expansion and rapidly growing pharmaceutical production infrastructure supported by government initiatives for semiconductor self-sufficiency and advanced manufacturing development programs. The country's comprehensive fabrication facility construction and increasing focus on contamination control are creating substantial demand for high purity filter solutions. Major semiconductor manufacturers and pharmaceutical companies are establishing comprehensive filtration capabilities to serve both domestic markets and global technology supply chains.

India is expanding at a CAGR of 7.5%, supported by expanding semiconductor fabrication facilities, growing pharmaceutical manufacturing sector, and increasing adoption of contamination control technologies driven by manufacturing modernization and quality standard advancement. The country's comprehensive industrial development and technology adoption are driving sophisticated filtration capabilities throughout manufacturing sectors. Leading semiconductor companies and pharmaceutical manufacturers are establishing advanced filtration infrastructure to address growing production requirements.

Germany is expanding at a CAGR of 6.9%, supported by the country's pharmaceutical industry excellence, semiconductor equipment manufacturing leadership, and strong focus on precision filtration technology development and contamination control standards. The nation's manufacturing sophistication and quality consciousness are driving advanced filtration capabilities throughout industrial sectors. Leading pharmaceutical companies and semiconductor equipment manufacturers are investing extensively in filtration technology innovation and application development.

Brazil is expanding at a CAGR of 6.3%, supported by the country's pharmaceutical industry expansion, growing specialty chemical production, and increasing manufacturing quality standards requiring advanced contamination control. The nation's pharmaceutical growth and chemical industry development are driving demand for high purity filtration solutions. Pharmaceutical manufacturers and chemical processors are investing in filtration capabilities to support production requirements.

The United States is expanding at a CAGR of 5.7%, supported by the country's advanced semiconductor manufacturing, biopharmaceutical production leadership, and strong focus on high-purity chemical processing for technology and healthcare applications. The nation's comprehensive technology infrastructure and pharmaceutical excellence are driving demand for sophisticated filtration solutions. Semiconductor manufacturers and pharmaceutical companies are investing in advanced filtration capabilities to serve innovation requirements.

The United Kingdom is expanding at a CAGR of 5.1%, driven by the country's pharmaceutical manufacturing presence, specialty chemical production capabilities, and focus on quality standards and contamination control in regulated manufacturing environments. UK's pharmaceutical sector strength and chemical industry expertise are driving demand for high purity filtration solutions. Pharmaceutical manufacturers and chemical producers are establishing advanced filtration programs for quality assurance.

Japan is expanding at a CAGR of 4.5%, supported by the country's semiconductor equipment manufacturing leadership, pharmaceutical production precision, and strong focus on contamination control standards and filtration technology innovation. Japan's technological sophistication and quality focus are driving demand for high-specification filter products. Leading manufacturers are investing in advanced filtration capabilities for precision-critical applications.

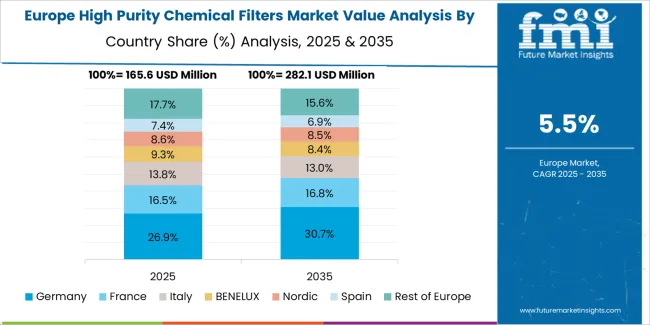

What is the market split by country in Europe?

The high purity chemical filters market in Europe is projected to grow from USD 235.0 million in 2025 to USD 390.8 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain leadership with a 32.6% market share in 2025, moderating to 32.1% by 2035, supported by pharmaceutical industry excellence, semiconductor equipment leadership, and precision filtration technology innovation.

The United Kingdom follows with 19.4% in 2025, projected at 19.1% by 2035, driven by pharmaceutical manufacturing, specialty chemical production, and quality standards enforcement. France holds 16.8% in 2025, reaching 17.2% by 2035 on the back of pharmaceutical industry strength and specialty chemical manufacturing. Italy commands 12.7% in 2025, rising slightly to 13.0% by 2035, while Spain accounts for 9.2% in 2025, reaching 9.5% by 2035 aided by pharmaceutical sector growth and chemical industry development. Switzerland maintains 5.1% in 2025, up to 5.3% by 2035 due to pharmaceutical manufacturing excellence and high-purity chemical production. The Rest of Europe region, including Nordic countries, Central & Eastern Europe, and other markets, is anticipated to hold 4.2% in 2025 and 3.8% by 2035, reflecting steady development in pharmaceutical manufacturing and contamination control adoption.

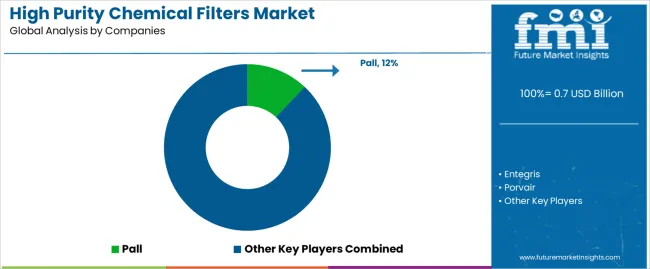

The market is characterized by competition among established filtration technology companies, specialized cleanroom equipment manufacturers, and diversified process equipment suppliers. Companies are investing in membrane material innovation, extractables reduction development, validation support services, and application-specific filter design to deliver high-performance, reliable, and compliant high purity filtration solutions. Innovation in nanofiber membranes, integrity testing technologies, and single-use filter assemblies is central to strengthening market position and competitive advantage.

Pall leads with comprehensive high purity filtration solutions focused on semiconductor and pharmaceutical applications, validation support services, and extensive product portfolio across diverse contamination control requirements. Entegris provides advanced materials and contamination control solutions with focus on semiconductor manufacturing and specialty chemical handling. Porvair offers precision filtration products with focus on semiconductor and pharmaceutical purity applications. Cobetter Filtration Group delivers high purity filter systems with comprehensive validation documentation.

Critical Process Filtration specializes in ultrapure filtration solutions for semiconductor and pharmaceutical critical processes. Advantec Group provides filtration technologies for laboratory and industrial high-purity applications serving diverse market requirements.

High purity chemical filters represent a specialized contamination control segment within semiconductor, pharmaceutical, and chemical processing applications, projected to grow from USD 0.7 billion in 2025 to USD 1.2 billion by 2035 at a 6.0% CAGR. These ultrapure filtration systems, primarily gas and liquid filtration configurations for multiple applications, serve as critical contamination control equipment in semiconductor fabrication, pharmaceutical production, and specialty chemical manufacturing where submicron particle removal, chemical purity, and extractables control are essential. Market expansion is driven by increasing semiconductor manufacturing complexity, growing pharmaceutical quality standards, expanding contamination control requirements, and rising demand for validated filtration solutions across diverse high-purity manufacturing and critical process operations.

How Industry Standards Organizations Could Strengthen Performance Requirements and Validation Protocols?

How Industry Associations Could Advance Technology Standards and Contamination Control Knowledge?

How High Purity Filter Manufacturers Could Drive Innovation and Market Leadership?

How Semiconductor and Pharmaceutical Manufacturers Could Optimize Filtration Performance?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 0.7 billion |

| Filtration Medium | Gas, Liquid |

| Application | Semiconductors, Chemicals, Pharmaceutical, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Pall, Entegris, Porvair, Cobetter Filtration Group, Critical Process Filtration |

| Additional Attributes | Dollar sales by filtration medium and application category, regional demand trends, competitive landscape, technological advancements in membrane materials, extractables reduction development, single-use system integration, and contamination control optimization |

The global high purity chemical filters market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the high purity chemical filters market is projected to reach USD 1.3 billion by 2035.

The high purity chemical filters market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in high purity chemical filters market are gas and liquid.

In terms of application, semiconductors segment to command 42.0% share in the high purity chemical filters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA