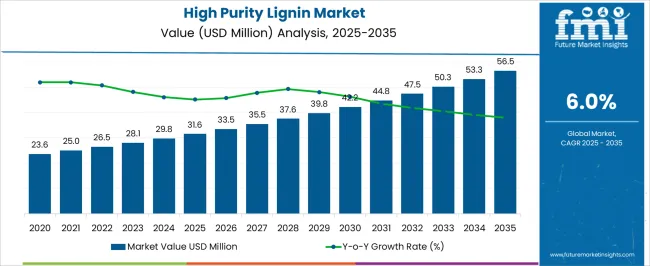

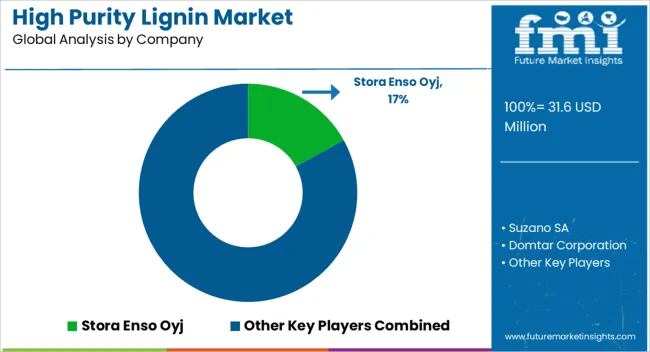

The high purity lignin market is estimated to be valued at USD 31.6 million in 2025 and is projected to reach USD 56.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A half-decade weighted growth analysis shows consistent expansion, with early-phase growth driven by rising demand for renewable materials and sustainable alternatives in various industries, including bioplastics, construction, and pharmaceuticals.

Between 2025 and 2030, the market grows from USD 31.6 million to USD 42.2 million, contributing USD 10.6 million in growth, with a CAGR of 7.3%. This early-phase acceleration is fueled by increasing environmental awareness and the growing adoption of lignin-based products due to their biodegradability, renewability, and low environmental impact. Additionally, technological advancements in lignin extraction methods further support market expansion. From 2030 to 2035, the market continues to expand from USD 42.2 million to USD 56.5 million, adding USD 14.3 million in growth, with a slightly lower CAGR of 5.7%. This phase reflects a more stable growth trajectory as the market matures, with widespread adoption of high purity lignin in established industries. Despite a deceleration in growth rate, demand remains strong due to innovations in lignin-based applications and ongoing emphasis on sustainable, eco-friendly materials. The half-decade weighted growth analysis indicates robust early-phase growth followed by steady, sustained expansion as the market reaches maturity.

| Metric | Value |

|---|---|

| High Purity Lignin Market Estimated Value in (2025 E) | USD 31.6 million |

| High Purity Lignin Market Forecast Value in (2035 F) | USD 56.5 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The current growth trajectory is being shaped by increasing demand for eco-friendly raw materials and the need to reduce reliance on fossil-based chemicals. Advancements in lignin purification technologies and expanded applications in high-value industries are enhancing the market potential.

Industry-focused updates and corporate sustainability reports have highlighted growing use of lignin in energy storage, polymers, and construction sectors, where renewable content is prioritized. The market is also benefiting from supportive government policies promoting green chemistry and circular economy principles.

Strategic investments by companies in biorefinery capacities and partnerships for value chain integration are also enabling wider commercialization of high-purity lignin products. Growth is expected to be driven by further innovation in product standardization, as well as the ability of manufacturers to scale and meet consistent quality requirements demanded by high-performance industrial users.

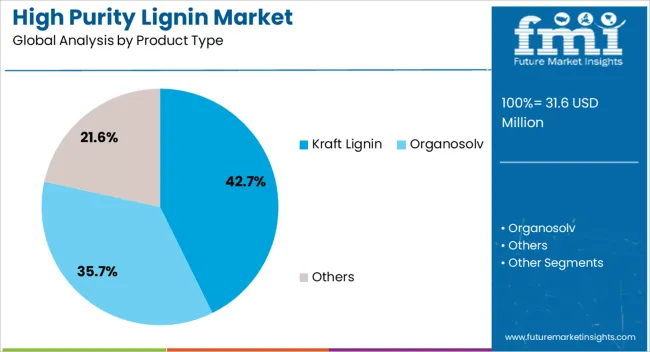

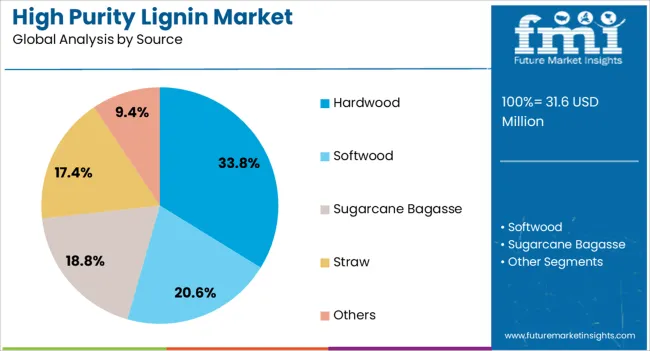

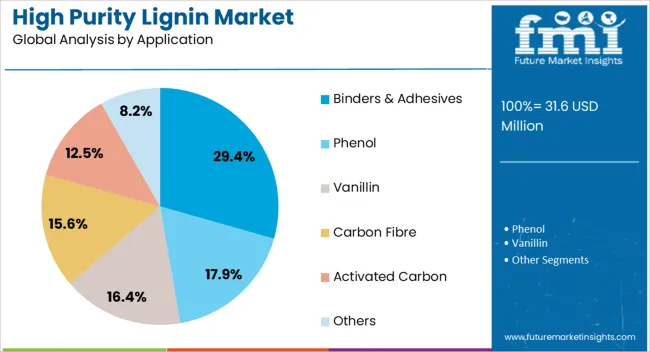

The high purity lignin market is segmented by product type, source, application, and geographic regions. By product type, the high purity lignin market is divided into Kraft Lignin, Organosolv, and Others. In terms of source, the high purity lignin market is classified into Hardwood, Softwood, Sugarcane Bagasse, Straw, and Others. Based on application, the high purity lignin market is segmented into Binders & Adhesives, Phenol, Vanillin, Carbon Fibre, Activated Carbon, and Others.

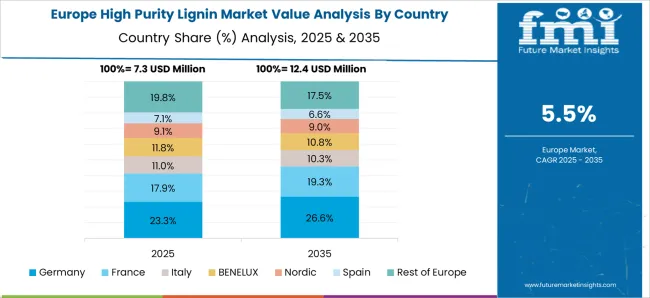

Regionally, the high purity lignin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Kraft Lignin segment is expected to account for 42.7% of the High Purity Lignin market revenue share in 2025, positioning it as the leading product type segment. This dominance is being driven by the established availability of Kraft Lignin from pulp and paper operations and its compatibility with purification processes required for high-value end uses.

It has been widely adopted due to its well-characterized structure and consistent supply chains, which make it attractive for downstream industries seeking sustainable inputs. Technical advantages such as higher thermal stability and improved reactivity compared to other lignin types have supported broader application in advanced materials.

Additionally, strong R&D focus by key producers and collaborations with specialty chemical manufacturers have further expanded its utilization. The segment’s leading position is being maintained by the ability to meet performance specifications across applications such as binders, adhesives, carbon fibers, and dispersants, reinforcing its relevance in the global lignin value chain.

The Hardwood source segment is projected to contribute 33.8% of the High Purity Lignin market revenue share in 2025, making it a key segment in raw material sourcing. This share is being supported by the favorable chemical composition of hardwood-derived lignin, which typically results in lower molecular weight and higher uniformity, properties preferred in high-performance formulations.

Hardwood sources have gained traction due to their suitability for producing lignin with improved processability and ease of modification. The increased availability of hardwood feedstock in both developed and emerging regions has also facilitated reliable production volumes.

Industry insights indicate that advancements in selective extraction and purification techniques have made hardwood lignin more viable for consistent industrial use. The segment has continued to grow due to demand from applications that require predictable molecular structures and better solubility, aligning with the requirements of manufacturers in performance-based chemical markets.

The Binders and Adhesives segment is projected to lead the application category with a 29.4% revenue share in the High Purity Lignin market in 2025. Its dominance is being attributed to the increasing use of lignin as a bio-based alternative to synthetic binders derived from petroleum. The natural adhesive properties of lignin have been optimized through purification, enabling its use in wood panel products, insulation materials, and industrial adhesives.

Adoption has been driven by regulations favoring formaldehyde-free and low-emission solutions in construction and consumer goods manufacturing. Furthermore, growing awareness of indoor air quality and sustainable sourcing has reinforced demand for bio-based binders.

Companies are investing in R&D to improve the compatibility of lignin with various polymer systems, enhancing performance while lowering environmental impact. These dynamics are positioning this segment as a central area of growth in lignin applications, especially as industries continue to prioritize renewable content in their product lines.

The high purity lignin market is experiencing growth as industries seek alternative, renewable materials for use in various applications. Derived from biomass sources like wood and agricultural residues, high purity lignin is used in a range of industries, including bioplastics, pharmaceuticals, and chemicals. With an increasing focus on reducing reliance on fossil-based resources, high purity lignin is being explored as a versatile raw material that can replace petroleum-derived substances in multiple processes. The market is expected to expand as demand for alternative materials and cleaner production methods rises.

The key driver for the high purity lignin market is the rising demand for alternative raw materials across various industries. Lignin, a naturally occurring polymer, provides a renewable and cost-effective alternative to petroleum-based chemicals and products. Industries such as packaging, automotive, and textiles are increasingly looking to lignin to replace conventional materials due to its potential to reduce dependency on non-renewable resources. As the need to develop more efficient and eco-friendly manufacturing processes becomes more pressing, high purity lignin offers an attractive solution. Additionally, advancements in extraction technologies are improving the yield and quality of lignin, contributing to its growing adoption in various sectors.

While the high purity lignin market presents several opportunities, challenges remain in scaling production and raising awareness of its potential. A significant challenge is the high production cost associated with extracting high purity lignin from biomass. The process requires advanced technologies and substantial energy input, which makes the end product more expensive compared to traditional materials. Additionally, the lack of widespread understanding and awareness of lignin’s benefits in industries beyond paper and pulp can hinder its adoption. Many industries are hesitant to invest in new materials without fully understanding their potential. As a result, improving education and increasing research into lignin’s diverse applications is essential to overcoming these challenges.

The high purity lignin market offers significant growth opportunities, particularly in the bioplastics and advanced materials sectors. As the demand for bioplastics continues to grow, lignin presents a valuable resource due to its availability and versatile properties. It can be used in various applications such as packaging materials, coatings, and adhesives, providing an alternative to conventional petroleum-based plastics. Furthermore, there are emerging opportunities in the automotive and construction industries, where lignin can be used in the production of composites and lightweight materials. With innovations in lignin-based materials, such as advanced carbon fibers and biofuels, the market is poised for expansion. Additionally, increased collaboration between industries and improved extraction technologies will further unlock the potential of high purity lignin across multiple sectors.

The high purity lignin market is evolving with several key trends, particularly in the development of new lignin-based products and applications. Innovations in lignin extraction processes are making it easier to produce high-quality lignin, opening up new opportunities for its use in various industries. One major trend is the growing adoption of lignin in the bioplastics industry, where it is being used to replace traditional materials in packaging, automotive parts, and coatings. Additionally, the development of lignin-based chemicals and composites for industrial applications is gaining momentum. Lignin is also being explored for its use in advanced energy systems and as a precursor for carbon fiber production. These trends highlight the increasing versatility of lignin as a material, suggesting a future where it plays a more prominent role in replacing conventional resources across various industries.

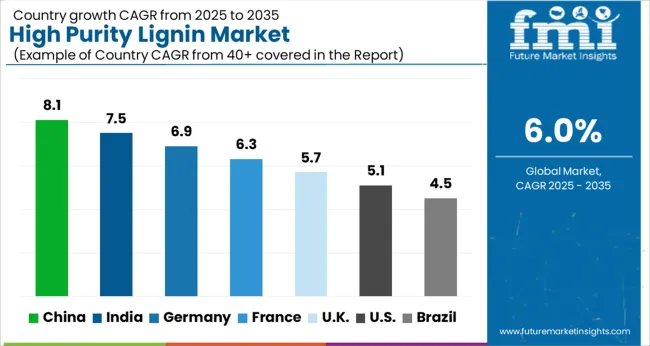

The high purity lignin market is projected to grow at a global CAGR of 6.0% from 2025 to 2035. China leads the market with 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom is expected to grow at 5.7%, while the United States shows a growth rate of 5.1%. The increasing use of lignin in various industries such as biofuels, chemicals, and materials is driving the market. Emerging economies like China and India are investing in the development of lignin-based products, while mature markets such as the UK and the USA show steady growth, supported by demand in the renewable energy and chemical sectors. The analysis spans over 40 countries, with the top markets shown below.

China is projected to grow at a CAGR of 8.1% through 2035, driven by its expanding demand for bio-based chemicals and materials. The country's efforts to shift towards more sustainable industrial processes have increased the adoption of lignin as a renewable resource in various applications, particularly in biofuels and bioplastics. China's large-scale production capabilities and investments in lignin-based technologies further support its market leadership. Government initiatives to reduce carbon emissions and enhance the circular economy are expected to fuel demand for high purity lignin.

India is expected to grow at a CAGR of 7.5% through 2035, with significant demand arising from the growing biofuel industry and the need for renewable materials. As the country focuses on energy efficiency and reducing environmental impacts, high purity lignin has gained popularity in chemical manufacturing, energy production, and bio-based alternatives to conventional materials. With increasing investments in green technologies, India is on track to become a key player in the high purity lignin market.

Germany is projected to grow at a CAGR of 6.9% through 2035, driven by strong demand in the chemical industry, biofuels, and advanced materials. Germany’s well-established renewable energy sector and sustainable industrial practices make it a leader in lignin-based innovations. The country’s efforts to reduce dependence on fossil fuels and improve environmental efficiency in manufacturing will continue to drive the market. Lignin is also gaining traction as a raw material for bioplastics and other bio-based products, with major players investing in lignin-based technology development.

The UK high purity lignin market is expected to grow at a 5.7% CAGR through 2035. As the UK continues to invest in green and renewable energy technologies, the demand for high purity lignin is rising. The adoption of lignin in the production of bio-based chemicals, including plastics and polymers, is increasing as part of the push for more environmentally friendly manufacturing processes. Furthermore, the UK’s expanding biofuel and waste-to-energy sectors contribute to the market’s growth, along with the increasing interest in sustainable packaging and material alternatives

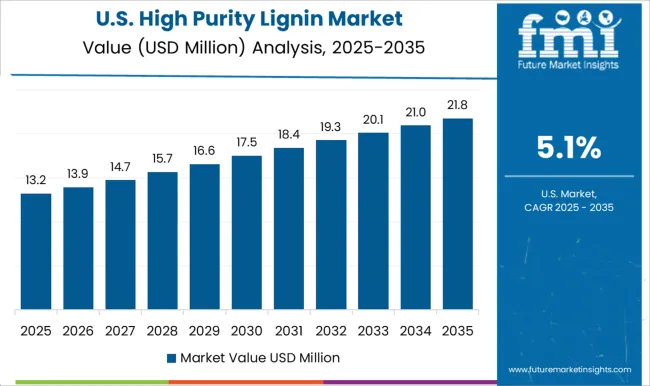

Demand for high purity lignin in the USA is projected to grow at a 5.1% CAGR through 2035. The USA is adopting high purity lignin in various industries, particularly in bio-based chemicals and biofuels. The market growth is driven by the increasing use of lignin in sustainable product development, such as biodegradable plastics and eco-friendly materials in automotive and packaging industries. Additionally, the USA government’s investments in clean energy projects and the increasing demand for alternative raw materials in the manufacturing sector further support the market for high purity lignin.

The high purity lignin market is driven by several key players focusing on the extraction, development, and commercialization of high-purity lignin for various applications, including biofuels, biochemicals, and materials. Companies in this market are increasingly investing in the advancement of lignin-based solutions to meet the growing demand for renewable and sustainable raw materials.

Stora Enso Oyj is a prominent leader in the high purity lignin market, offering innovative lignin-based products that support a range of sustainable applications. Suzano SA is another significant player, leveraging its position in the pulp and paper industry to develop and scale lignin-based products for biofuel and bioplastics applications. Domtar Corporation is focused on developing high-purity lignin for use in the production of sustainable chemicals and renewable energy sources. West Fraser offers lignin solutions derived from sustainable forest management practices, contributing to the development of high-purity lignin for bioenergy and carbon-neutral solutions.

Liquid Lignin Company specializes in the extraction and commercialization of high-purity lignin, positioning itself as a key player in the growing renewable materials market. Metsa Group is involved in the production of lignin-based materials, focusing on high-purity lignin for use in various bio-based applications, including chemicals and adhesives. Sigma Aldrich provides high-purity lignin products for research and industrial applications, enabling the development of new materials and bio-based chemicals. Alberta Pacific is an emerging player in the lignin market, focusing on the sustainable production of high-purity lignin derived from its forestry operations. Green Value S.A. offers lignin-based products for biofuels and bioplastics applications, contributing to the transition toward a more sustainable economy.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.6 Million |

| Product Type | Kraft Lignin, Organosolv, and Others |

| Source | Hardwood, Softwood, Sugarcane Bagasse, Straw, and Others |

| Application | Binders & Adhesives, Phenol, Vanillin, Carbon Fibre, Activated Carbon, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stora Enso Oyj, Suzano SA, Domtar Corporation, West Fraser, Liquid Lignin Company, Metsa Group, Sigma Aldrich, Alberta Pacific, Green Value S.A., and Ingevity Corporation |

| Additional Attributes | Dollar sales by product type (bio-based chemicals, biofuels, adhesives) and end-use segments (energy, chemicals, materials). Demand dynamics are influenced by the growing adoption of lignin-based products for sustainable applications, such as biofuels, bioplastics, and renewable chemicals. Regional trends show strong growth in North America and Europe, driven by sustainability initiatives and demand for renewable materials, while Asia-Pacific is expanding due to rising investments in bioeconomy and renewable energy sectors. Innovation trends focus on enhancing lignin extraction processes, improving product purity, and expanding applications across industrial sectors. Environmental considerations are pushing the development of lignin-based solutions to replace fossil fuel-derived materials and reduce carbon footprints. |

The global high purity lignin market is estimated to be valued at USD 31.6 million in 2025.

The market size for the high purity lignin market is projected to reach USD 56.5 million by 2035.

The high purity lignin market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in high purity lignin market are kraft lignin, organosolv and others.

In terms of source, hardwood segment to command 33.8% share in the high purity lignin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA