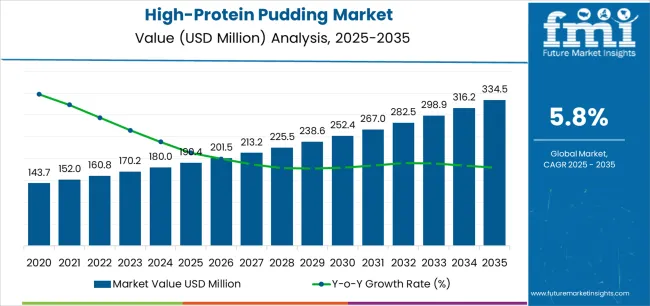

The High-Protein Pudding Market is estimated to be valued at USD 190.4 million in 2025 and is projected to reach USD 334.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The High-Protein Pudding market is witnessing significant growth due to increasing consumer focus on health, wellness, and functional nutrition. The future outlook for this market is driven by rising demand for convenient protein-enriched foods that support muscle recovery, weight management, and overall wellness. Consumer awareness about balanced diets and protein intake has been increasing globally, particularly among active adults, athletes, and fitness enthusiasts.

The market is further fueled by the growing trend of on-the-go snacking, which positions high-protein puddings as a convenient alternative to traditional protein sources. Additionally, manufacturers are focusing on innovation in flavors, nutritional claims, and protein sources to attract a wider consumer base.

The availability of clean-label, allergen-friendly, and high-quality protein formulations supports adoption in both developed and emerging markets As demand for functional and fortified foods rises, high-protein puddings are expected to capture a larger share of the refrigerated and shelf-stable dessert segment, offering significant growth opportunities in retail and e-commerce channels.

| Metric | Value |

|---|---|

| High-Protein Pudding Market Estimated Value in (2025 E) | USD 190.4 million |

| High-Protein Pudding Market Forecast Value in (2035 F) | USD 334.5 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

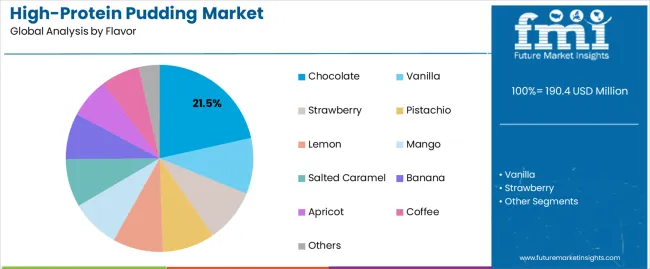

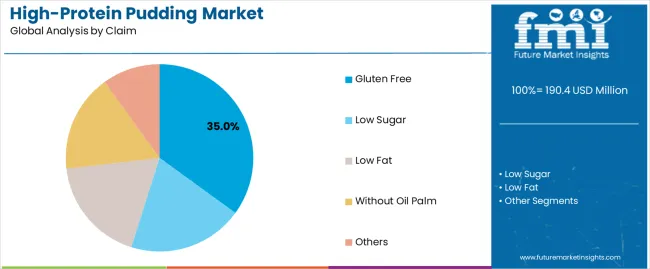

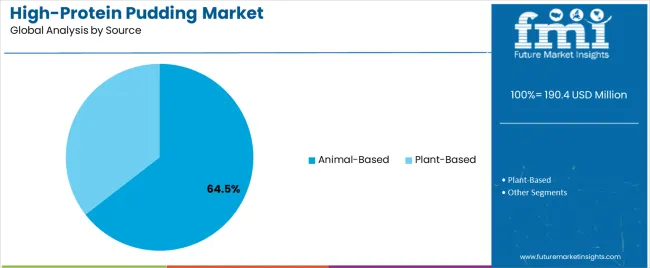

The market is segmented by Flavor, Claim, Source, Mode Of Delivery, and Sales Channel and region. By Flavor, the market is divided into Chocolate, Vanilla, Strawberry, Pistachio, Lemon, Mango, Salted Caramel, Banana, Apricot, Coffee, and Others. In terms of Claim, the market is classified into Gluten Free, Low Sugar, Low Fat, Without Oil Palm, and Others. Based on Source, the market is segmented into Animal-Based and Plant-Based. By Mode Of Delivery, the market is divided into Oral, Enteral, and Parenteral. By Sales Channel, the market is segmented into Store-Based Retailing and Online Retailing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chocolate flavor segment is projected to hold 21.5% of the High-Protein Pudding market revenue share in 2025, making it the leading flavor segment. The popularity of chocolate is driven by its widespread consumer preference and its ability to combine indulgence with functional benefits.

Chocolate-flavored puddings provide a familiar and appealing taste while delivering high protein content, which supports daily nutritional goals. Product innovation, such as reduced sugar or fortified chocolate puddings, has enhanced consumer acceptance and contributed to market growth.

Additionally, the versatility of chocolate allows it to be paired with various nutritional claims and protein sources, further increasing its appeal among health-conscious consumers The segment benefits from strong retail visibility and marketing campaigns emphasizing both taste and health benefits, reinforcing its dominant position in the market.

The gluten free claim segment is expected to capture 35.0% of the High-Protein Pudding market revenue share in 2025, positioning it as the leading claim segment. Growth in this segment is driven by increasing consumer awareness of gluten-related sensitivities and lifestyle choices favoring gluten-free diets.

High-protein puddings with gluten-free labeling cater to health-conscious individuals seeking functional foods without compromising on taste or nutrition. The availability of certified gluten-free products enhances consumer trust and encourages repeat purchases.

Furthermore, rising adoption of clean-label and allergen-friendly products in retail and online channels has contributed to the growth of this segment The combination of health benefits, convenience, and compliance with dietary requirements has reinforced the dominance of gluten-free high-protein puddings in the market.

The animal-based source segment is anticipated to account for 64.5% of the High-Protein Pudding market revenue in 2025, establishing it as the leading protein source segment. This growth is fueled by the high biological value and superior digestibility of animal-derived proteins such as whey and milk protein, which support muscle development and recovery.

Consumers increasingly seek high-quality protein sources that offer effective nutritional benefits, making animal-based puddings a preferred choice. The segment has benefited from advancements in formulation technologies, allowing the creation of smooth, palatable, and protein-dense products.

Additionally, the perception of reliability and efficacy associated with animal proteins has further reinforced their market share The widespread availability of these products in retail and fitness-focused outlets, coupled with growing health and fitness awareness, continues to drive the dominance of animal-based high-protein puddings.

Increasing spending power on fitness and well-being is likely to create lucrative opportunities for the market

Increasing consumer spending power on fitness and well-being is growing to create big opportunities for the high-protein pudding market. As consumers become more conscious about their protein intake and seek convenient, protein-rich snacks to support their active lifestyles, the demand for high-protein puddings is likely to surge.

Manufacturers are more interested in investing in fitness products including high-protein puddings For example, in Sweden and Germany, protein puddings have gained immense popularity in recent years. Brands like Njie in Sweden and Ehrmann in Germany have exploited on this, offering a variety of high-protein pudding flavors to provide to health-conscious consumers

Fitness and gym enthusiasts are increasing the adoption of high-protein pudding

In recent years, the fitness community has seen a rising interest in the adoption of high-protein pudding as a favored nutritional choice. The several factors influencing consumer behavior and preferences. High-protein diets have increased wide popularity among fitness enthusiasts and athletes due to their apparent benefits in muscle recovery and satisfaction.

High-protein pudding offers a convenient mode to meet protein intake goals without resorting to traditional, less palatable protein sources like shakes and bars.

An example of a brand that has capitalized on this is Protein Pudding Co. which offers a range of flavors and formulations custom-made to different fitness goals and dietary preferences. Their products not only provide high protein products but also often boast additional health benefits such as low sugar, gluten-free, and lactose-free options, interesting to a larger audience concerned with overall wellness.

Increasing use of innovative ingredients like lactose-free milk protein concentrate to create high-protein puddings

The high-protein pudding market is witnessing a prominent including innovative ingredients such as lactose-free milk protein concentrate to enhance nutritional value and appeal to health-conscious consumers. Growing consumer preferences for products that not only deliver high-protein pudding but also align with dietary restrictions and preferences, such as lactose intolerance.

Lactose-free milk protein concentrate provides a key ingredient in these puddings, offering a rich source of high-quality protein without the digestive discomfort associated with lactose.

For instance, Brands like Fit & Fresh, have introduced lactose-free variants of their protein puddings, catering to a wider customer looking for clean-label products with minimal additives and allergens. By leveraging such ingredients, manufacturers are not only meeting the demand for functional foods but also addressing specific dietary needs, so putting high-protein puddings as a versatile and appealing choice in the competitive health food market.

Global High-Protein Pudding increased at a CAGR of 5.6% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on high-protein pudding will rise at 6.1% CAGR

From 2020 to 2025, the global high-protein pudding market experienced steady growth, driven by a rising preference for convenient, protein-rich snacks. During this period, sales were bolstered by the introduction of innovative products incorporating high-protein ingredients like milk protein concentrates and plant-based proteins, catering to diverse dietary preferences and requirements.

From 2025 through 2035 demand for high-protein puddings is expected to continue its upward trajectory, albeit with notable shifts in consumer behavior and market dynamics. One significant trend anticipated is the expansion of product lines to include more specialized and functional offerings. For example, companies introduce high-protein puddings fortified with vitamins, minerals, and adaptogens to appeal to consumers seeking holistic health benefits.

Brands that prioritize transparency in sourcing and production methods, such as using organic ingredients and eco-friendly packaging, are expected to gain power. For instance, "GreenProtein Pudding" leverage sustainable packaging and responsibly sourced ingredients to attract environmentally conscious consumers.

In Asia-Pacific and Latin America presenting significant growth opportunities. Increased disposable incomes and a burgeoning fitness culture in these regions are expected to drive demand for high-protein snacks, including puddings.

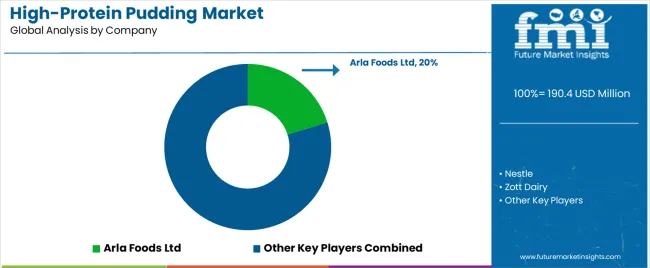

The global high-protein pudding industry is dominated by many big players, including Arla Foods Ltd, Nestle, Zott Dairy, Pereira's Nutrition, Bariatric Europe, Milbona, Lidl, Dolcela, WonderSlim, and many more. These business leaders constitute a significant value share.

These brands have extensive good manufacturing practices and distinguish themselves from the competitors through an elaborate distribution network and regional presence and also launch new products with new flavors. Their products are widely present at retail stores present worldwide.

They offer a wide product portfolio accompanied by modern packaging formats. They concentrate on meeting the regulatory standards to garner more consumer trust and build brand loyalty.

Regional brands have a distinct advantage in their ability to cater to local consumers' specific needs and preferences. While they lack the resources for extensive research and development compared to national brands, regional players make up for it with their deep understanding of the local market and strong connections with their target consumers.

Regional brands adapt quickly to changing market conditions and consumer trends due to their agility and proximity to the local market.

The table below highlights revenue from product sales in key countries. The United States and Germany are predicted to remain top consumers, with estimated valuations of USD 334.5 Million and USD 39 Million, respectively, by 2035.

| Countries | Value (2035) |

|---|---|

| United States | USD 70.8 Million |

| Germany | USD 39.0 Million |

| Japan | USD 22.0 Million |

| China | USD 47.7 Million |

| India | USD 36.1 Million |

The following table shows the estimated growth rates of the top three industries. China and India are set to exhibit High-Protein Pudding consumption, recording CAGRs of 9.3% and 9.8%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.8% |

| Germany | 5.3% |

| Japan | 7.8% |

| China | 9.3% |

| India | 9.8% |

The sale of high-protein pudding in the United States is projected to exhibit a CAGR of 4.8% during the assessment period by 2035, and revenue from the sales of High-Protein Pudding in the country is expected to reach USD 70.8 million

In the United States, there is a growing consumer demand for convenient, protein-rich snacks and desserts that provide to active lifestyles and fitness goals driven by several factors influencing consumer behavior, including increasing health consciousness, a rise in fitness activities, and busy schedules that prioritize convenience without compromising on nutrition.

Products like high-protein puddings have developed as popular choices among consumers looking for tasty yet health-conscious options that support their dietary and fitness objectives

For example, brands like MuscleMunch Pudding have capitalized on this trend by offering ready-to-eat protein puddings that provide a protein boost per serving, making them ideal for pre- and post-workout consumption. These puddings are convenient to eat and satisfy hungers for a dessert-like treat without guilt, attractive to a wide demographic of fitness enthusiasts, athletes, and health-conscious individuals.

High-protein pudding demand in Germany is expected to rise at a value CAGR of 5.3% during the forecast period 2025 to 2035. By 2035, Germany is expected value share to account for 21.5% of high-protein pudding sales in Europe.

Increasing adoption of plant-based protein sources. Consumers are increasingly looking for alternatives to animal-derived proteins, driven by concerns about personal health benefits associated with plant-based eating. The availability and variety of plant-based protein puddings in Germany have expanded with supermarkets, health food stores, and online retailers stocking a wide range of options to meet diverse consumer preferences.

An example showing this trend is the introduction of plant-based protein puddings by brands like VeggiePro Pudding. These puddings are formulated using protein-rich plant sources such as pea protein, soy protein, and hemp protein, offering a comparable protein content to traditional animal-based products but with added benefits like lower saturated fat content and higher fiber content.

Such products appeal not only to vegetarians and vegans but also to a growing segment of flexitarians and health-conscious individuals looking to reduce their meat consumption while maintaining adequate protein intake.

Consumption of High-Protein Pudding in India is expected to increase at a value CAGR of 9.8% over the next ten years. By 2035, the sale size is forecasted to reach USD 4,381.7 Million, with India expected to account for a market share of 28.1% in South Asia.

In India, there is a noticeable surge in the popularity of high-protein diets driven by changing lifestyles, increased health awareness, and a growing emphasis on fitness. Hectic schedules and rising disposable incomes have spurred interest in nutritious, protein-packed foods that support active lifestyles.

Growing recognition of protein's role in muscle building, weight management, and overall health. As more Indians become health-conscious and engage in fitness activities such as gym workouts, yoga, and sports, there is an awareness of the importance of suitable protein intake to support all these activities.

| Segment | Chocolate (Flavor) |

|---|---|

| Value Share (2025) | 21.5% |

Sales of chocolate flavor are projected to register a CAGR of 6.7% from 2025 to 2035.

Chocolate has universal appeal, likable to a wide range of consumers who enjoy desserts and snacks that offer a satisfying and comforting experience. This flavor's popularity is rooted in its ability to remind feelings of pleasure and indulgence without compromising on nutritional goals.

For example, brands like Protein Delights have capitalized on the popularity of chocolate by offering a variety of high-protein puddings in flavors like chocolate fudge, chocolate hazelnut, and double chocolate. These products not only cater to consumers' cravings for chocolate but also provide a substantial protein boost, making them ideal for individuals looking to maintain a balanced diet while satisfying their sweet tooth

| Segment | Animal-based (Source) |

|---|---|

| Value Share (2025) | 64.5% |

The rapidly growing popularity of the Animal-based segment is anticipated to advance at 9.5% CAGR during the projection period.

High-protein puddings formulated with animal-based sources are often marketed for their superior muscle-building benefits such as whey protein and casein, and are considered complete proteins because they contain all essential amino acids required by the body. This quality makes them highly efficient in muscle repair and growth, and attractive to athletes and fitness enthusiasts.

Animal-based proteins often contribute to a creamy and satisfying texture in puddings, enhancing the overall eating experience. This texture mimics traditional dairy desserts, which consumers find appealing and familiar. Brands like Protein Power Pudding leverage animal-based proteins to dominate the high-protein pudding market. Their products boast high protein content from sources like milk protein concentrate and whey isolate, appealing to consumers seeking effective protein supplementation.

| Segment | Store Base (Sales Channel) |

|---|---|

| Value Share (2025) | 66.7% |

Sales of high-protein pudding store-based sales channels are projected to register a CAGR of 7.3% from 2025 to 2035.

Store-based channels, including hypermarkets & supermarkets, convenience stores, drug stores & pharmacies, specialty stores, and other retailers, play a key role in the sales and distribution of high-protein pudding products. These channels offer significant advantages in terms of visibility, accessibility, and consumer trust, contributing to their popularity among manufacturers and consumers.

For example, Hypermarkets & supermarkets serve as key outlets for high-protein puddings due to their extensive shelf space and ability to stock a wide range of brands and flavors. Brands such as "FitFuel Pudding" capitalize on these channels by ensuring prominent placement in aisles dedicated to health foods and protein supplements. This exposure helps attract health-conscious consumers who prioritize convenience and variety while shopping for their dietary needs.

There are various key players in the industry such as Arla Foods Ltd, Nestle, Zott Dairy, Pereira's Nutrition, Bariatrix Europe, Milbona, Lidl, Dolcela, WonderSlimas, and others these key players mainly focus on launching new products and product developments such as introducing new flavors

For example:

In 2025, the Lidli brand of high-protein pudding launched new flavors such as Double Choc Pudding, and Rice Pudding with 20 g protein per pot.

In 2025, Danone UK & Ireland launched GetPRO, a range of high-protein dairy snacks including high-protein pudding Produced for people who want to get more out of their workouts and enjoy a great-tasting, healthy snack. In high-protein pudding 18g of protein per pot

By Flavor, the segment has been categorized into Vanilla, Strawberry, Chocolate, Pistachio, Lemon, Mango, Salted Caramel, Banana, Apricot, Coffee, and Others.

Different Claims include Gluten Free, Low Sugar, Low Fat, Without Oil palm, and others

High protein pudding produced with Plant-based and Animal-based source

The modes of delivery include Oral, Enteral, and Parenteral

Different Sales channels include Store-based Retailing, (Hypermarkets & Supermarkets, Convenience Store, Drug Stores & Pharmacies, Specialty Stores, and Other Retailers) and Online Retailing

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global high-protein pudding market is estimated to be valued at USD 190.4 million in 2025.

The market size for the high-protein pudding market is projected to reach USD 334.5 million by 2035.

The high-protein pudding market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in high-protein pudding market are chocolate, vanilla, strawberry, pistachio, lemon, mango, salted caramel, banana, apricot, coffee and others.

In terms of claim, gluten free segment to command 35.0% share in the high-protein pudding market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA