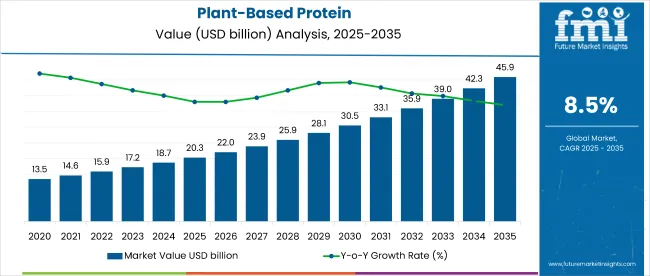

The global plant-based protein market is projected to grow from USD 20.3 billion in 2025 to USD 46 billion by 2035, registering a CAGR of 8.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 20.3 billion |

| Industry Value (2035F) | USD 46 billion |

| CAGR (2025 to 2035) | 8.5% |

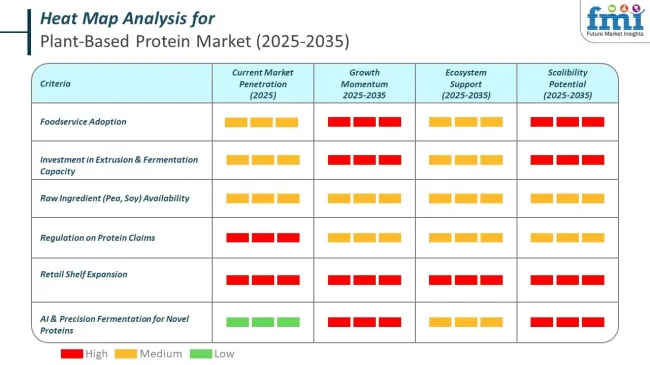

Growth in this market is being driven by the rising global shift toward sustainable, ethical, and clean-label dietary choices. Increasing awareness about environmental impact, animal welfare, and health benefits is accelerating the adoption of plant-based proteins across the food & beverage, sports nutrition, and convenience food sectors.

The market holds 1.9% of the global food & beverage market and around 23.4% of the protein ingredients market. It contributes nearly 11.8% to the functional food sector and accounts for 7.0% of the meat alternatives market. In the sports nutrition segment, its share stands at 9%, while it represents 6.3% of the global dietary supplements market. Within the vegan food category, it captures over 30%, owing to its essential role in core formulations. Despite being niche in the clean-label ingredients space, it holds a growing share of around 4.5%, fueled by clean, plant-forward product demand.

The market is strongly influenced by evolving regulatory standards favoring non-GMO, organic, and clean-label certifications. Governments in regions like the USA, EU, and India are actively encouraging plant-based food innovation through agricultural policies, sustainability initiatives, and health-forward food guidelines. At the same time, industry-wide alignment with ESG frameworks, transparent supply chains, and low-carbon processing is shaping product development and marketing strategies, further strengthening the credibility and appeal of plant-based proteins.

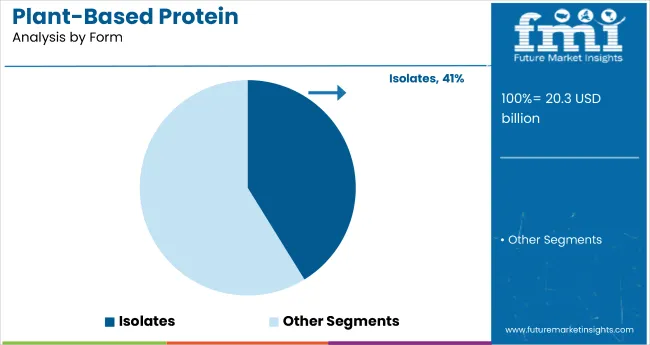

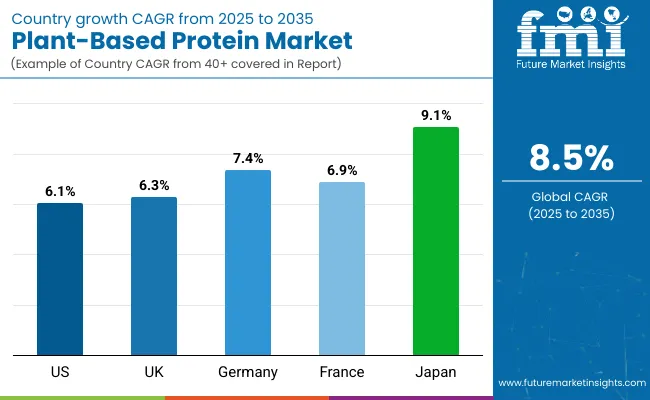

Japan is anticipated to be the fastest-growing market in the global plant-based protein industry, registering a CAGR of 9.1% from 2025 to 2035. Isolates will dominate the form segment, accounting for a 41.2% market share in 2025, while by, conventional plant-based proteins will lead the nature segment with a commanding 78.3% share. The USA and UK markets are also expected to witness steady growth, expected to expand at CAGRs of 6.1% and 6.3% respectively.

Per-capita consumption in the plant-based protein market varies across economic regions. In Canada and the Netherlands, consumers purchase larger quantities of isolate-based blends used in home and institutional cooking. Japan reports strong urban demand through soy and mung bean-based proteins. India shows moderate per-person usage, primarily in soy chunks, fortified wheat blends, and lentil formats distributed via retail and cooperative channels.

The plant-based protein market operates dual-format storage. Shelf-stable powders move through ambient silos. Chilled delivery is required for emulsified or rehydrated formats. Malaysia, Germany, and Brazil maintain mixed inventory systems. Distribution to foodservice partners runs through city hubs and regional freezer depots.

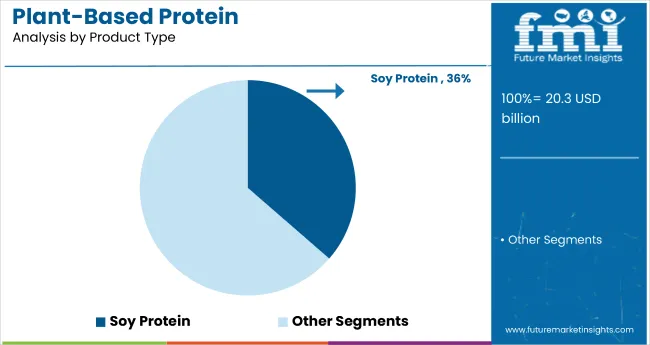

The market is segmented by product type, form, end use, nature, and region. By product type, the market includes soy protein, wheat protein, pea protein, and others (rice, hemp, chickpea, lentil). By form, the market is segmented into isolates, concentrates, and hydrolysates.

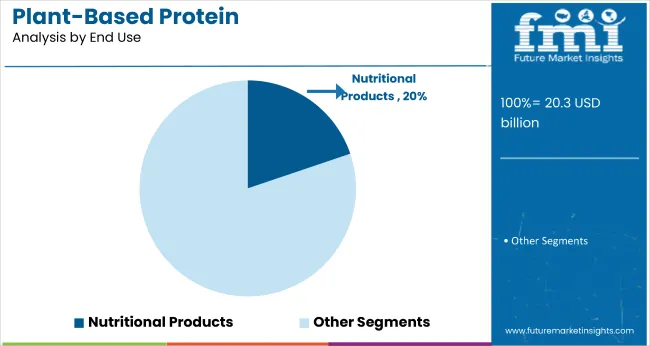

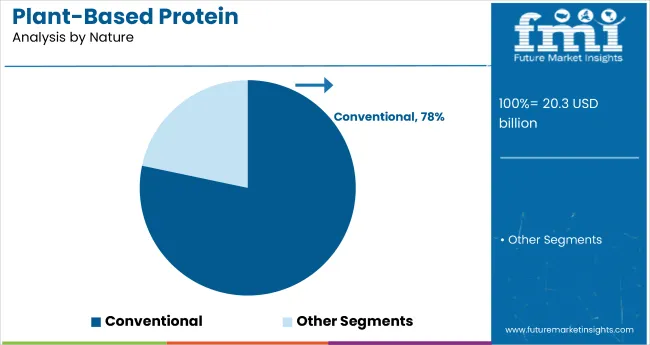

Based on end use, the market is divided into nutritional products, sports nutrition, medical nutrition, infant nutrition, bakery, ready-to-eat, snacks & cereals, dairy, confectionary and dessert, convenience food, beverages, animal feed, and others (meat substitutes, functional foods, soups & sauces, pet nutrition). By nature, the market divided into organic and conventional. By region, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Soy protein is expected to dominate the product type segment, accounting for 36.4% of the total market share in 2025. Its strong position is driven by widespread use in meat alternatives, dairy substitutes, and nutritional supplements.

Isolates are projected to hold a 41.2% share of the form segment in 2025, favored for their high protein concentration and broad functional versatility.

Nutritional products are projected to lead the end-use segment, capturing 19.8% of the global market share in 2025, reflecting strong demand from health-conscious consumers.

Conventional is forecast to dominate with a 78.3% market share in 2025 due to broader availability and lower cost compared to organic alternatives.

The global plant-based protein market is witnessing robust growth, driven by rising consumer awareness around health, sustainability, and ethical food choices. Increasing demand for clean-label and allergen-free alternatives is accelerating adoption across food, beverage, sports nutrition, and personal care sectors.

Recent Trends in the Plant-Based Protein Market

Challenges in the Plant-Based Protein Market

Among the top five countries, Japan is projected to witness the fastest growth in the market with a CAGR of 9.1% from 2025 to 2035, driven by technological innovation in food processing and increased consumer demand for functional foods. Germany and France follow with CAGRs of 7.4% and 6.9%, respectively, supported by clean-label demand and a strong vegetarian consumer base.

The UK is expected to grow at a CAGR of 6.3%, with growth fueled by flexitarian diets and sustainability awareness. The USA remains the largest contributor by value but will expand at a relatively steady CAGR of 6.1% over the forecast period.

The report offers a comprehensive analysis across 40+ countries; five top-performing OECD countries are highlighted below.

The USA plant-based protein market is projected to grow at a CAGR of 6.1% between 2025 and 2035, supported by strong consumer demand for clean-label, sustainable, and allergen-free food alternatives. Food and beverage giants are actively investing in plant-based innovation, particularly within ready-to-eat and nutritional products.

The plant-based protein market in the UK is expected to grow at a CAGR of 6.3% over the next decade. The country has a rising population of flexitarians and vegans, supported by government nutrition initiatives and climate change mitigation efforts.

The Germany plant-based protein revenue is forecasted to expand at a CAGR of 7.4% from 2025 to 2035. A strong base of vegetarian and environmentally conscious consumers is encouraging food producers to innovate across bakery, dairy alternatives, and snack categories.

The French plant-based protein market is projected to grow at a steady CAGR of 6.9% between 2025 and 2035. Local food heritage and increasing interest in health-centric diets are shifting demand toward plant proteins in bakery, dairy-free, and infant nutrition applications.

The Japan plant-based protein revenue is expected to register a robust CAGR of 9.1% during the forecast period. Innovation in fermented proteins, soy-based ingredients, and functional foods are driving adoption among health-conscious and aging consumers.

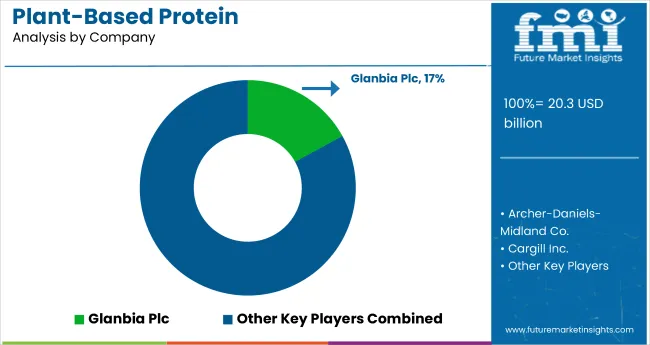

The market is moderately consolidated, with both global food ingredient giants and specialized protein innovators shaping competition. Leading suppliers such as Glanbia Plc, Archer-Daniels-Midland Co., Cargill Inc., and Kerry Inc. are driving market expansion through extensive product portfolios, strong distribution networks, and advanced R&D capabilities. These Tier-1 players are investing heavily in sustainable protein extraction technologies and offering customized formulations to serve the growing demand across functional foods, beverages, sports nutrition, and meat alternatives.

Strategic initiatives include the introduction of new plant sources (such as chickpea, lentil, and fava), clean-label formulations, and expansion in high-growth markets like Asia and Latin America. Burcon NutraScience Corporation and E.I. du Pont de Nemours & Co. are focusing on precision fermentation and protein texturization technologies to meet demand for meat and dairy alternatives.

Roquette Frères, Cosucra Groupe Warcoing, and Royal Avebe UA continue to dominate in Europe through locally sourced non-GMO proteins and clean processing standards. USA-based players like NOW Foods, Ingredion Inc., and CHS Inc. are enhancing their supply chain transparency and expanding retail presence via private label and direct-to-consumer platforms.

Recent Plant-Based Protein Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 20.3 billion |

| Projected Market Size (2035) | USD 46 billion |

| CAGR (2025 to 2035) | 8.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion / Volume in metric tons |

| By Product Type | Soy Protein, Wheat Protein, Pea Protein, and Others (Rice, Hemp, Chickpea, Lentil) |

| By Form | Isolates, Concentrates, and Hydrolysates |

| By End Use | Nutritional Products, Sports Nutrition, Medical Nutrition, Infant Nutrition, Bakery, Ready-to-Eat, Snacks & Cereals, Dairy, Confectionery and Dessert, Convenience Food, Beverages, Animal Feed, and Others (Meat Substitutes, Functional Foods, Soups & Sauces, Pet Nutrition) |

| By Nature | Organic and Conventional |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, India, Australia |

| Key Players | Glanbia Plc., Archer-Daniels-Midland Co., Cargill Inc., Kerry Inc., Burcon NutraScience Corporation, E.I. du Pont de Nemours & Co., Royal Avebe UA, Cosucra Groupe Warcoing, Ingredion Inc., Corbion, Tate & Lyle Plc., CHS Inc., Roquette Frères, AGT Food & Ingredients Inc., Now Food |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The industry analysis explored through product types like Soy Protein, Wheat Protein, Pea Protein, Others

Verities of forms like Isolates, Concentrates and Hydrolysates are included in the report

By nature segment industry has been categorised into Organic and Conventional

End use applications like Nutritional Products, Sports Nutrition, Medical Nutrition, Infant Nutrition, Bakery, Ready-to-eat, Snacks & Cereals, Dairy, Confectionary and Dessert, Convenience Food, Beverages, Animal Feed and Others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is valued at USD 20.3 billion in 2025.

The market is forecasted to reach USD 46 billion by 2035, reflecting a CAGR of 8.5%.

Isolates will lead the form segment with a 41.2% share in 2025.

Conventional will account for 78.3% of the global market share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 9.1% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Beverages Market Trends – Growth & Forecast 2025 to 2035

Demand for Plant-Based Protein Flavor Maskers and Enhancers in Latin America Size and Share Forecast Outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Pea Protein in Plant-Based Meat Analysis - Size Share and Forecast outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA