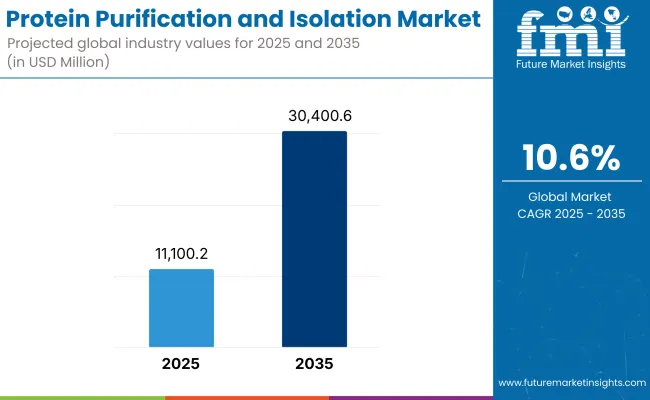

The global protein purification and isolation market is estimated to be valued at USD 11,100.20 million in 2025 and is projected to reach USD 30,400.6 million by 2035, registering a CAGR of 10.6% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 11,100.20 million |

| Market Value (2035F) | USD 30,400.6 million |

| CAGR (2025 to 2035) | 10.6% |

The protein purification and isolation market has been growing steadily as biopharmaceutical development, proteomics research, and academic studies place increasing emphasis on high-quality protein characterization. Continuous advancements in chromatography resins, magnetic beads, and membrane-based techniques have enhanced reproducibility and yield, supporting broader adoption across research and manufacturing settings.

Pharmaceutical companies have invested heavily in expanding capacity for monoclonal antibody and recombinant protein manufacturing, driving procurement of high-performance isolation tools. Academic institutions have also prioritized proteomics studies to support biomarker discovery and functional genomics initiatives. These developments are anticipated to improve workflow efficiency and maintain high standards of purity, thereby sustaining strong market momentum globally.

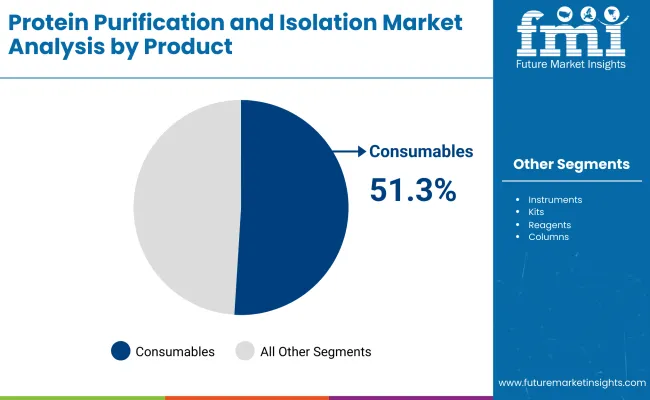

In 2025, Consumables segment is holding a revenue share of 51.3% which has been attributed to consumables, underscoring their essential role in protein purification workflows across research and production. Utilization has been driven by the recurring need for resins, columns, magnetic beads, and membranes that support consistent yields and purity.

Advances in chromatography media and affinity ligands have further improved selectivity and binding capacity, strengthening user confidence in product performance. Academic and Contract Research Laboratories have prioritized consumables for their flexibility in small-scale applications and compatibility with automated platforms. Supplier investments in robust supply chains and technical support have ensured reliability, which has been critical for scaling complex purification protocols.

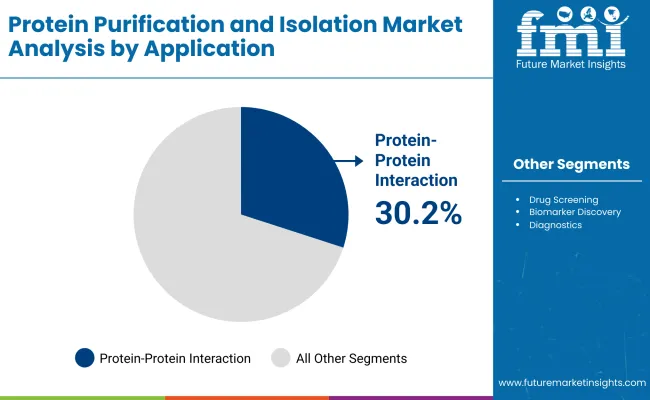

Protein-Protein Interaction leads the segment with a revenue share of 30.2% in the global protein purification and isolation market which has been attributed to protein-protein interaction studies, reflecting their importance in understanding biological pathways and disease mechanisms. Utilization has been supported by the expansion of proteomics and drug discovery programs seeking to elucidate complex molecular interactions.

Pharmaceutical companies and academic research institutes have prioritized these studies to identify novel therapeutic targets and validate biomarker candidates. Advances in affinity purification and co-immunoprecipitation techniques have improved the efficiency and reproducibility of protein complex isolation, enabling higher throughput analysis.

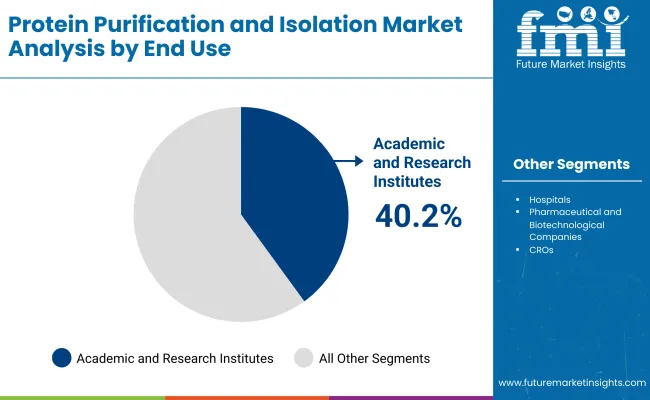

Academic and research institutes have accounted for 40.2% of market revenue, driven by the sustained focus on basic and translational studies exploring protein function and structure. Adoption of protein purification solutions has been reinforced by significant public and private funding directed toward disease research, functional genomics, and biomarker discovery. Institutes have invested in high-throughput platforms and advanced consumables to enable reproducible isolation and characterization across diverse applications.

Procurement policies favoring reliable consumables and equipment have contributed to consistent purchasing volumes. These factors contribute collectively in positioning academic and research institutes as the leading end user segment, with sustained growth anticipated as proteomics and structural biology remain research priorities.

High Cost of Equipment and Reagents

Despite the growing interest and potential of protein purification and isolation, the market is challenged by the high costs of advanced purification techniques, specialized reagents, and high-performance chromatography systems.

Accuracy and rapidity in capturing the protein of interest need pricey equipment and can be beyond reach for small research labs and biotech companies. Moreover, the financial strain is aggravated by maintenance and operational expenses that limit the widespread utilization of this technology in emerging economies.

Advancements in Automated and High-Throughput Purification Systems

Technological innovations about automation and high-throughput purification systems are some of the factors that can drive the growth of the market. This automation establishes reproducible purification processes that minimize manual errors and improve scalability for larger production.

Furthermore, growing investigation efforts in biologics, including monoclonal antibodies and recombinant proteins fuels the need for better isolation with consequent innovations in technologies such as affinity chromatography, magnetic bead-based purification and membrane filtration.

The USA is one of the prominent market protein purification and isolation, due to the robust biotechnology and pharmaceutical sector. The availability of many leading research institutes and biopharmaceutical companies drives innovation in the area of protein purification technology.

The USA government also spends vast amounts of money on proteomics research, enabling developments in drug discovery and disease diagnostics. The higher prevalence of chronic diseases which include cancer and autoimmune diseases also drives the need of high purity proteins. In addition, strategic collaboration between the academic and industry players bolsters research capabilities, fuelling a rapid market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

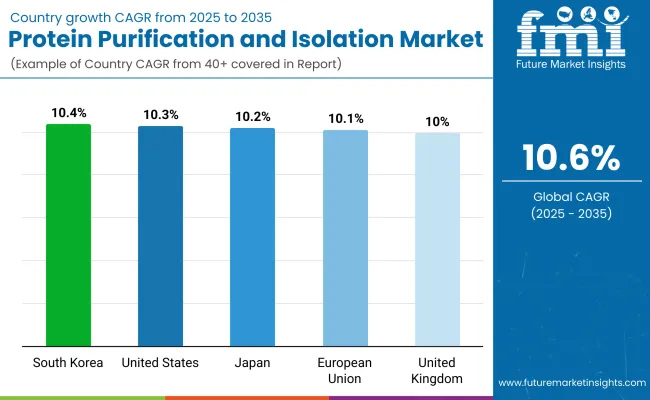

| United States | 10.3% |

The United Kingdom protein purification & isolation market is growing owing to a heightened focus on precision medicine and biopharmaceutical development. The significant government funding of life sciences research in the country helps advance proteomics and molecular diagnostics in particular.

In addition to this, the drive for higher quality protein isolation techniques continues with the ever-increasing interest in personalized treatment etc. by the NHS. In addition, the presence of various major biotech companies and academic institutions involved in protein analysis research is anticipated to facilitate market growth over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.0% |

Germany, France, and Italy top the protein purification and isolation market in the European Union market and are key countries in research and biotechnology production. As such, the quality and efficiency of protein-based therapeutics are subject to demanding regulatory frameworks under the European Medicines Agency (EMA).

Moreover, rapid and strong investment in biotechnology and life sciences from public and private sector contributes to the growth of the market. The growing investment in proteomics research and the increasing focus on recombinant protein therapeutics are further solidifying the market demand across the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.1% |

Japan remains a leader in biopharmaceutical research and cutting-edge life sciences technologies, driving steady growth in the country's protein purification and isolation market. The existing number of pharmaceutical companies and research institutions contributes to the advancement of protein extraction and separation methods.

Moreover, demand for targeted protein-based therapies has been driven by growth in Japan’s ageing population healthcare solutions. The growth of the market is also highly driven by government initiatives supporting proteomics research and development of advanced diagnostic tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

The growth of the peptide and protein purification and isolation market in South Korea can be attributed to the growing biotechnology sector in the country and the increasing investments in life sciences research. The country’s system of government is supportive of pharmaceutical and biotech innovation, particularly in biopharmaceutical production and diagnostic technologies.

The demand for chromatography and electrophoresis-based purification techniques is also fuelling the growth of the market. Moreover, South Korean entities are targeting on automation and AI-driven proteomics for improved efficacy in protein isolation processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.4% |

The competitive landscape has been shaped by companies investing in innovative chromatography resins, affinity ligands, and automation-ready consumables to strengthen differentiation. Leading suppliers have expanded portfolios with single-use systems and customizable kits to address evolving workflow needs.

Strategic collaborations with biopharmaceutical firms and research organization have been established to validate performance and build credibility. Geographic expansion initiatives have focused on emerging markets with growing biologics pipelines and academic funding. These activities are expected to drive innovation and sustain competition as demand for advanced purification technologies increases.

Key Development

In 2024, Repligen Corporation announced the launch of AVIPure® dsRNA Clear OPUS® columns, a groundbreaking solution designed to simplify and enhance the production of mRNA therapeutics and vaccines..

In 2024, JSR Life Sciences, announced the launch of its next generation protein A chromatography resin, Amsphere™ A+. The AVIPure dsRNA Clear resin offers superior performance in the removal of double-stranded RNA (dsRNA) impurities from transcribed RNA.

The market was valued at USD 11,100.20 million in 2025.

The market is projected to reach USD 30,400.6 million by 2035.

The market growth is driven by advancements in biotechnology, pharmaceutical research, and proteomics, along with the increasing demand for high-purity proteins in drug discovery and development.

North America is expected to dominate due to strong research infrastructure, significant investments in biotechnology, and the presence of key pharmaceutical companies.

Consumables and chromatography techniques is the leading segment due to the rising need for purified proteins in pharmaceutical research and therapeutic applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Protein Water Market Analysis by Product Type, Flavour, Packaging Type, Source and Distribution Channel Through 2035

Protein Expression Technology Analysis by Product Type by Indication and by End User through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA